UK Scottish Widows 12260 2015 free printable template

Show details

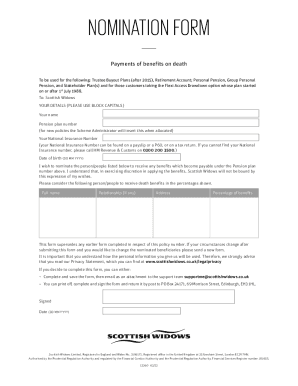

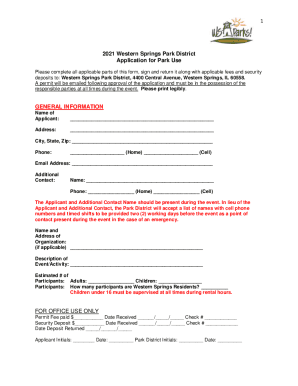

Document Info Form Job?ID PERSONAL PENSION AND STAKEHOLDER PENSION 48355 Size A4 Pages 1 Color Black Version N 12260 APRIL 2014 Operator Info 1 ALI 15/04/14 2 3 4 5 6 7 NOMINATION FORM 8 9 10 11 To:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign UK Scottish Widows 12260

Edit your UK Scottish Widows 12260 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK Scottish Widows 12260 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UK Scottish Widows 12260 online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit UK Scottish Widows 12260. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK Scottish Widows 12260 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK Scottish Widows 12260

How to fill out UK Scottish Widows 12260

01

Gather necessary personal information including your National Insurance number, address details, and relevant dates.

02

Ensure you have details of your employment history and pension contributions.

03

Start filling out the form from the top, following the instructions on the form carefully.

04

For each section, provide accurate and specific information as required.

05

Double-check all entered information for accuracy before submitting.

06

Attach any necessary supporting documents as indicated on the form.

07

Sign and date the form where required before sending it to the appropriate address.

Who needs UK Scottish Widows 12260?

01

Individuals who are looking to claim their pension from Scottish Widows.

02

People who have past contributions with Scottish Widows and need to consolidate their pensions.

03

Anyone needing to update their personal details or circumstances related to their pension plans with Scottish Widows.

Fill

form

: Try Risk Free

People Also Ask about

Can I claim my dead ex husband's pension UK?

Pension benefits technically fall outside a person's estate, so are not covered by a will. Savers who want to name a beneficiary of their pension pot must therefore complete an 'expression of wish' or 'nomination of beneficiaries' form when enrolling on a workplace pension or private pension scheme.

How do I claim my ex husband's pension after divorce?

In order to gain access to a percentage of your pension, your spouse would have to specifically ask for their share at the time of the divorce – not at the time of your retirement. This is done via a court order called a qualified domestic relations order (QDRO).

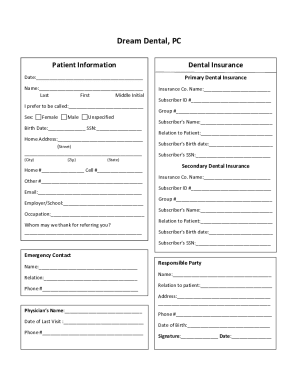

How do I add a beneficiary to my Scottish Widows pension?

We'll send you an expression of wish form so you can nominate a beneficiary, and if you want to make changes we can send you a new one. It is important to note that in exercising discretion in applying the benefits, Scottish Widows will not be bound by this expression of wish. Remember to update your will too.

What happens to pension after death?

When a participant in a retirement plan dies, benefits the participant would have been entitled to are usually paid to the participant's designated beneficiary in a form provided by the terms of the plan (lump-sum distribution or an annuity).

Can I still get my ex husband's pension?

Generally, your former spouse's community property interest may be up to 50 percent of your pension benefit. We won't release pension benefits to you or your former spouse until the community property claim is resolved. For retirees: One-half of your monthly allowance is held until the claim is resolved.

What happens to my ex husband's pension if he dies UK?

Pension benefits technically fall outside a person's estate, so are not covered by a will. Savers who want to name a beneficiary of their pension pot must therefore complete an 'expression of wish' or 'nomination of beneficiaries' form when enrolling on a workplace pension or private pension scheme.

What happens to my ex husband's pension when he dies?

It depends on the dissolution decree. As with other divided property, the ex-spouse's share of the pension remains his/her property. Without an agreement to return your ex-spouse's share to you, the law provides for the ex-spouse's share to be passed on to the beneficiary of the ex-spouse, or his/her estate.

Where do I send my Scottish widow nomination form?

If your circumstances change after submitting this form and you would like to change the nominated beneficiaries please send a new form. Signed Date (DD MM YYYY) If you decide to complete this form, please return it to Scottish Widows, 15 Dalkeith Road, Edinburgh, EH16 5BU.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my UK Scottish Widows 12260 in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your UK Scottish Widows 12260 and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I edit UK Scottish Widows 12260 from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your UK Scottish Widows 12260 into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I edit UK Scottish Widows 12260 on an iOS device?

You certainly can. You can quickly edit, distribute, and sign UK Scottish Widows 12260 on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is UK Scottish Widows 12260?

UK Scottish Widows 12260 refers to a specific tax document used in the United Kingdom for reporting pension contributions and tax relief claim.

Who is required to file UK Scottish Widows 12260?

Individuals who have made pension contributions to Scottish Widows and wish to claim tax relief must file UK Scottish Widows 12260.

How to fill out UK Scottish Widows 12260?

To fill out UK Scottish Widows 12260, provide your personal details, contribution amounts, and relevant tax information as requested in the form.

What is the purpose of UK Scottish Widows 12260?

The purpose of UK Scottish Widows 12260 is to facilitate the reporting and claiming of tax relief on pension contributions made by individuals.

What information must be reported on UK Scottish Widows 12260?

The information that must be reported includes personal details, the amount of pension contributions made, and any other relevant tax information applicable for relief.

Fill out your UK Scottish Widows 12260 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK Scottish Widows 12260 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.