Husband and Wife LLC Operating Agreement free printable template

Show details

This document outlines the rights, duties, and obligations of the husband and wife members of a limited liability company, including management structure, profit allocation, and dissolution procedures.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

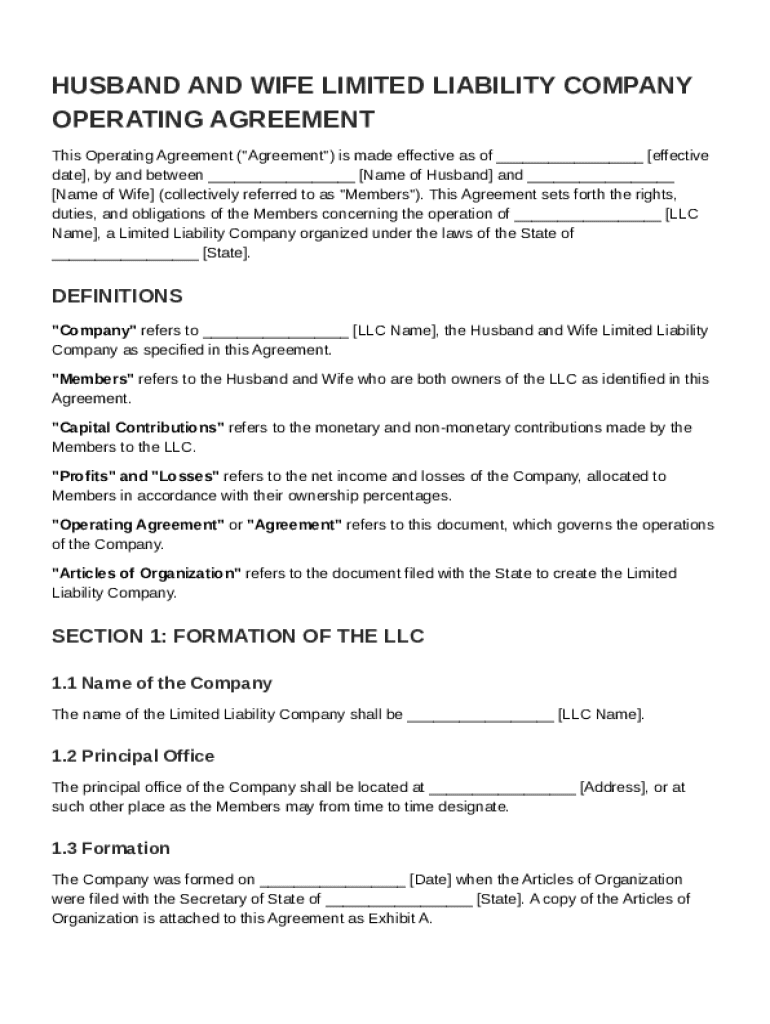

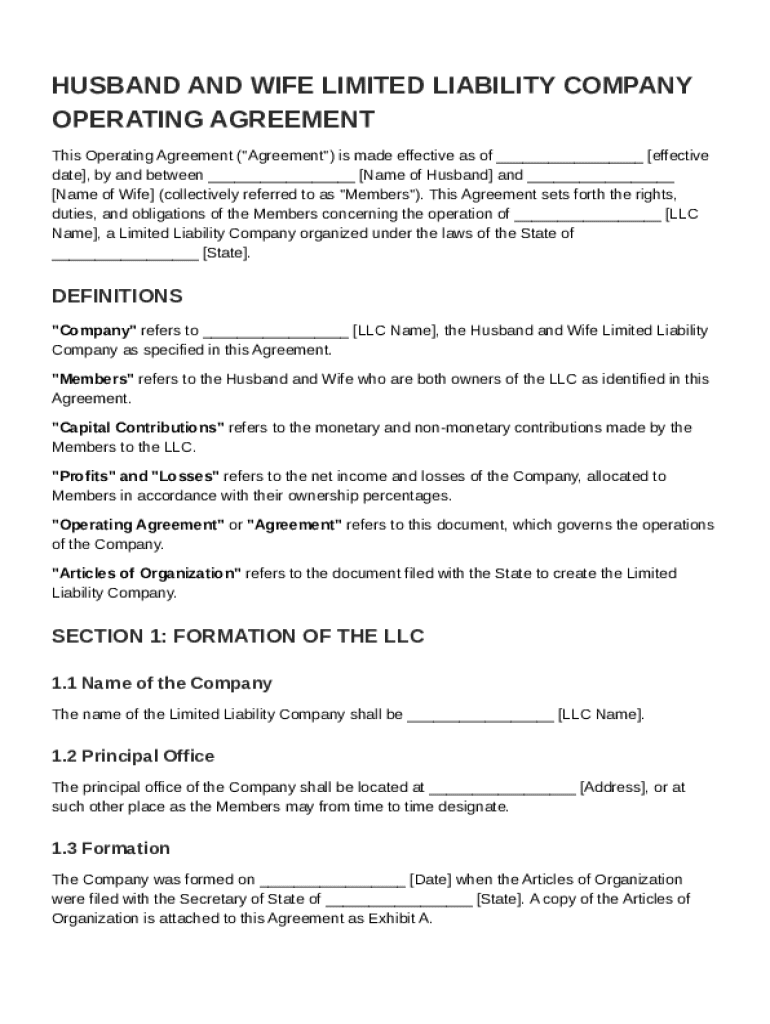

What is Husband and Wife LLC Operating Agreement

A Husband and Wife LLC Operating Agreement is a legal document that outlines the management structure and operational procedures of a limited liability company formed by a married couple.

pdfFiller scores top ratings on review platforms

This app is great, Does exactly what it is designed to do and easy to use

very intuituve. quick and easy to learn. i operate mobily so i like the fact that i can use it on any of my 4 computers any where in the world. Very easy to drop text in. I like the erase and highlight feature. I tried at least 6 other platfroms and they were too dificult to use.

PDFfiller has allowed me access to several important work documents that I would otherwise not know how to edit. So far, great program!

If you need to type on a PDF this is the tool to use. Makes it very easy, worth the price.

AN ECELLENT SERVICE, FORMS & CLEARED INSTRUCTIONS.. THANK YOU ..

easy to follow, encode details & print. User friendly

Who needs Husband and Wife LLC Operating Agreement?

Explore how professionals across industries use pdfFiller.

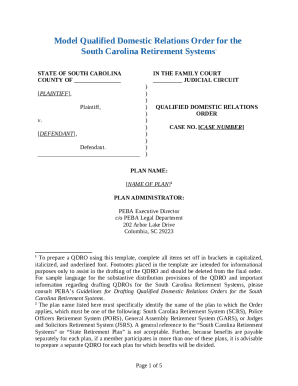

Husband and wife operating agreement guide

How do you define a Husband and Wife Operating Agreement?

A Husband and Wife LLC Operating Agreement is a legal document that outlines the rules and regulations under which a limited liability company (LLC) operated by a married couple will function. This document is crucial because it defines the roles and responsibilities of each spouse as members of the LLC, while also establishing the operational framework that protects both parties’ interests. Without a formal agreement, issues related to the business's ownership, profits, and liabilities can lead to misunderstandings and legal complications.

-

It serves as the foundational document that governs the LLC's operations, ensuring clarity in management and ownership.

-

A formal agreement helps minimize conflicts and provides a clear path for resolution, especially important in family dynamics.

-

Operating without an agreement can lead to default state laws applying to your LLC, which may not align with your intentions.

What are the key components of the Operating Agreement?

A comprehensive Operating Agreement should cover various essential components to ensure clarity and compliance. Primary sections typically include identification of the members (the husband and wife), their roles, and the structure of the business, detailing everything from capital contributions to profit distribution.

-

The agreement must specify the legal names and roles each spouse plays in the LLC, crucial for outlining authority and responsibility.

-

Terms like 'Company,' 'Members,' 'Capital Contributions,' and 'Profits and Losses' must be defined to prevent ambiguity in the agreement.

-

This includes the name of the LLC, principal office location, and the articles of organization to be filed with the state.

What are the steps to complete the form?

Filling out the Husband and Wife LLC Operating Agreement form can seem complex, but it can be streamlined into manageable steps. It’s essential to follow these instructions carefully to ensure accuracy and compliance with state laws.

-

Ensure that both members' names are correctly spelled, and include the effective date of the agreement.

-

Clearly state the physical address of the LLC, as this is required for state registrations and communications.

-

Outline all intended business activities and the dates relevant to the formation to ensure clarity and transparency.

What common mistakes should you avoid?

When drafting a Husband and Wife LLC Operating Agreement, it is crucial to be meticulous to avoid common pitfalls that can create future headaches or legal issues.

-

Overlooking this can lead to disputes over decision-making and accountability.

-

Not clearly stating the business purpose can result in operational misunderstandings and conflict.

-

Mistakes here can delay the LLC’s formation and lead to legal complications.

What legal considerations and compliance issues should you know?

Legal compliance is critical for maintaining the LLC's status. Different states have varying requirements for LLC formation, and being aware of these can save you time and trouble.

-

These can include fees, necessary disclosures, and ongoing annual reporting obligations.

-

Legal advice ensures that your agreement meets all statutory requirements and adequately protects your interests.

-

The agreement should include provisions for amendments, allowing you to adapt to changes in business circumstances or plans.

How do you manage your post-formation?

Once your Husband and Wife LLC is formed, managing it effectively involves ongoing responsibilities and compliance with state laws. Proper management ensures the longevity of your business and adheres to the legal obligations.

-

Members must stay informed about the LLC operations and fulfill their duties, including financial obligations.

-

Clearly outlined processes for distributing profits and losses help mitigate potential disputes.

-

Ensure timely filings, renewals, and adherence to any changes in state regulations to maintain good standing.

How can you utilize pdfFiller for your Operating Agreement?

pdfFiller provides an excellent platform for creating, editing, and managing your Husband and Wife LLC Operating Agreement. Utilizing its features can enhance collaboration and efficiency in document management.

-

Easily upload your existing document or create a new one from scratch, ensuring it’s tailored to your needs.

-

With pdfFiller, you can sign the document electronically, speeding up the process of finalizing agreements.

-

Utilize tools that allow multiple members to review and contribute to the agreement, fostering better communication.

In conclusion, creating a comprehensive Husband and Wife LLC Operating Agreement is essential for clarifying responsibilities, protecting assets, and ensuring smooth operations of your business. By following the outlined steps, leveraging available tools like pdfFiller, and avoiding common mistakes, you can set a solid foundation for your LLC. This agreement not only safeguards your interests but also promotes a professional approach to running a family-owned LLC.

How to fill out the Husband and Wife LLC Operating Agreement

-

1.Download the Husband and Wife LLC Operating Agreement template from pdfFiller.

-

2.Open the template in pdfFiller and review the introductory section for guidance on the agreement's purpose.

-

3.Fill in the names and addresses of both spouses at the top of the document.

-

4.Specify the LLC name and the date of formation in the designated section.

-

5.Outline the management structure, indicating whether both spouses will manage the LLC or if one will be the designated manager.

-

6.Add details about capital contributions from each spouse, including initial investments and ongoing financial commitments.

-

7.Include provisions for profit-sharing, specifying how profits and losses will be distributed between spouses.

-

8.Define the duration of the LLC and any conditions for dissolution in case the couple decides to terminate the business.

-

9.Review the agreement for accuracy and completeness, making any necessary adjustments before finalization.

-

10.Save the filled document and consider having both parties sign in the presence of a notary public for added legal protection.

How do I make a simple operating agreement for an LLC?

How to create an LLC operating agreement in 9 steps Decide between a template or an attorney. Include your business information. List your LLC's members. Choose a management structure. Outline ownership transfers and dissolution. Determine tax structure. Gather LLC members to sign the agreement. Distribute copies.

Does Washington state require an operating agreement for LLC?

No. The state of Washington does not require businesses to file their LLC operating agreements with the state. However, it's a good idea to have a completed operating agreement on hand for other institutions who may request one.

Do you need an operating agreement for a partnership?

Operating agreement: Required for LLCs in many jurisdictions but not always legally mandated. Partnership agreement: Not always required by law, but it's highly recommended to have a written agreement to clarify the terms among partners.

What is the operating agreement for an LLC in Texas?

The Operating Agreement Is a Contract In Texas, an Operating Agreement is not just a formality; it is a contract between the owners (members) of a Limited Liability Company (LLC). It governs the company's internal operations and the relationships among its members.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.