Investment Advisory Agreement Template free printable template

Show details

This document outlines the terms and conditions under which an advisory firm will provide investment advisory services to a client, detailing the responsibilities of both parties, fee structures,

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Investment Advisory Agreement Template

An Investment Advisory Agreement Template is a standardized document used to outline the terms and conditions under which an investment advisor will manage a client's investment portfolio.

pdfFiller scores top ratings on review platforms

I am a lawyer and it allows me to edit pdf and other documents. Love it. Thank you

Terrific product, but not very intuitive.

love it but can not afford the monthly fee so please cancel my trial offer. thank you

PDFfiller does everything I need. There is definitely a learning curve to use, but through experience it is amazing to have an app that does it all.

Gostei muito e tem sido muito útil para o que desejo.

Very good. Took a little getting used to but, I think I did it.

Who needs Investment Advisory Agreement Template?

Explore how professionals across industries use pdfFiller.

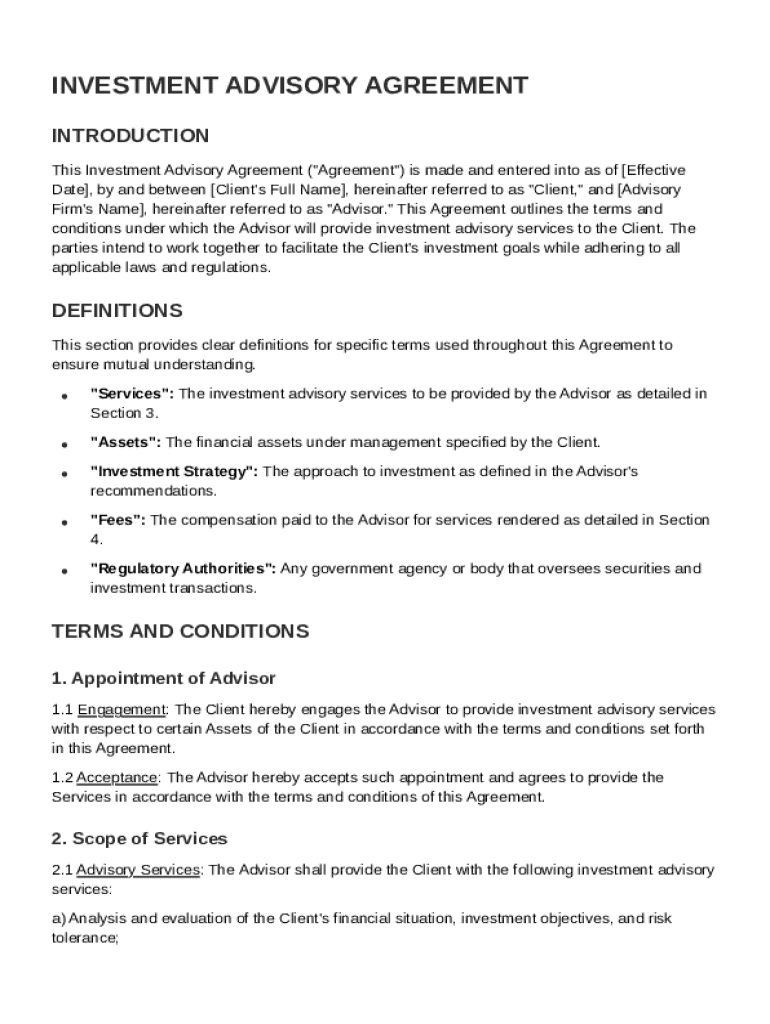

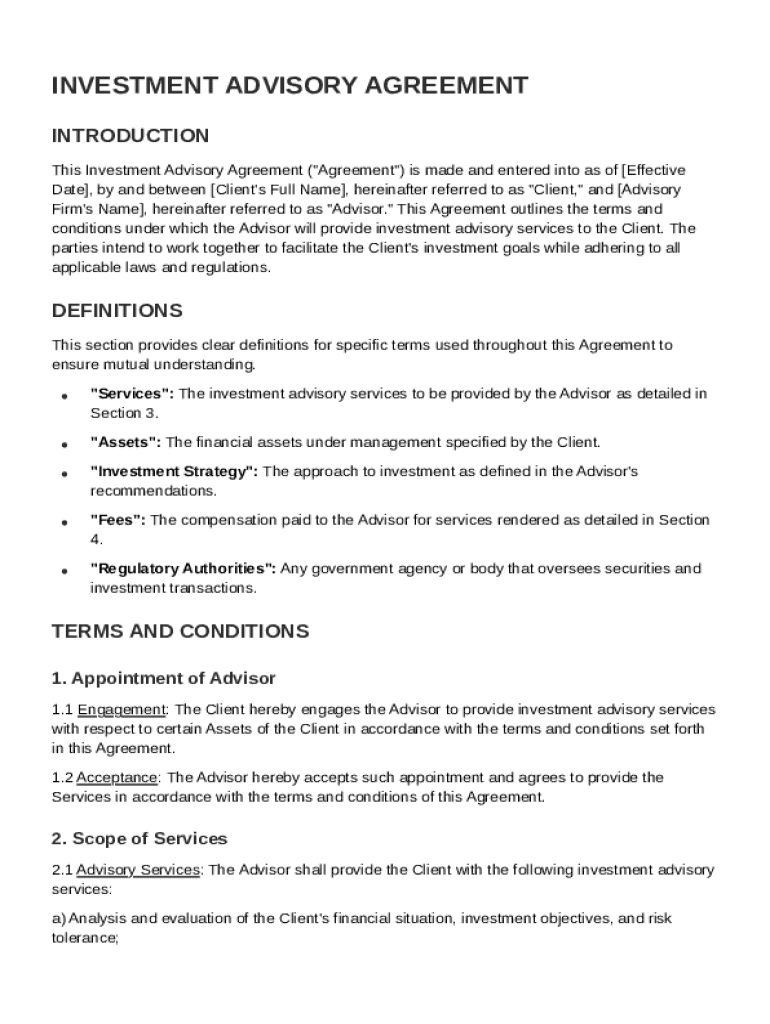

A comprehensive guide to the Investment Advisory Agreement

How do fill out an investment advisory agreement form?

To fill out an Investment Advisory Agreement form, begin by providing your personal information and investment objectives. Follow with details about your financial situation, including assets and liabilities. Specify the services you require from the advisor and review the fee structure ensuring clarity and transparency. Finally, make sure to read through the terms and sign the agreement.

Comprehensive overview of the investment advisory agreement

An Investment Advisory Agreement is a formal contract between a client and a financial advisor that outlines the services to be provided, investment goals, and the terms of engagement. This agreement is crucial as it establishes the mutual understanding necessary for achieving successful investment outcomes. Additionally, it ensures compliance with all relevant laws and regulations, safeguarding both parties' interests.

-

It serves as a legal document that defines the relationship between the advisor and client, detailing their respective responsibilities.

-

Clarifies how the advisory services align with the client's financial objectives.

-

Ensures that both the advisor and client adhere to necessary regulatory standards, protecting against legal issues.

What are the key terminologies in investment advisory?

Understanding the terminology used in investment advisory agreements is essential for both clients and advisors to ensure clear communication. The key terms include 'Services,' which refer to the specific financial advice and management offered, 'Assets,' which indicate what property or funds are under management, 'Investment Strategy,' and 'Fees,' which cover the costs associated with the advisory services. Regulatory authorities play a crucial role in overseeing these agreements, emphasizing the significance of a mutual understanding of these terms.

-

These are the advisory tasks performed by the advisor, ranging from investment recommendations to portfolio management.

-

Refers to the monetary and property resources that the advisor manages or recommends investments for.

-

The plan created by the advisor that details how the client’s investment goals will be achieved.

-

The compensation structure for the advisor, which can include flat fees or a percentage based on assets managed.

What is the engagement process for an investment advisor?

The engagement process is critical for forming a strong relationship with your investment advisor. This involves a series of steps beginning with an introductory meeting to discuss the services offered. Both the client and advisor must be clear about their roles and responsibilities to ensure a smooth collaboration. A formal acceptance of the agreement finalizes the relationship and establishes a foundation for future interactions.

-

A meeting to discuss your investment needs and to learn about the advisor’s services.

-

Reviewing specific terms of the Investment Advisory Agreement that both parties need to understand.

-

Signing the agreement to confirm mutual consent and understanding of the terms.

What is the scope of services provided by the advisor?

The scope of services offered by an investment advisor may vary widely, but it primarily includes a comprehensive analysis of the client’s financial situation to self-identify investment goals. Advisors then develop personalized investment strategies tailored to these objectives, including specific asset allocations. Services might also encompass ongoing monitoring of the investment portfolio and adjustments based on market fluctuations or changes in the client’s financial status.

-

A comprehensive review of the client’s financial status to inform investment strategy.

-

Creating a custom investment plan that aligns with the client’s goals and risk tolerance.

-

Regular portfolio reviews and adjustments to the investment strategy as needed.

How is the compensation structure defined?

Understanding the compensation structure of your investment advisory agreement is vital for financial planning. Advisors may charge flat fees, fees based on a percentage of assets under management, or a commission on transactions. It is important for clients to be aware of all associated costs to ensure transparency and make informed decisions about their investment methods. Any potential additional costs should also be discussed to avoid unexpected expenses.

-

A specific charge for services rendered, typically paid annually or quarterly.

-

A fee based on the total amount of assets under management, which incentivizes advisors to grow your investments.

-

Charges per trade or investment product sold, which may vary by service agreement.

What is the role of compliance and regulatory frameworks?

Compliance with regulatory requirements is a fundamental aspect of investment advisory services. Investment advisors must adhere to guidelines set by regulatory authorities, ensuring that their practices align with legal standards. This oversight protects clients and promotes transparency within the investment management industry. Understanding these regulations helps clients make informed decisions about their investment strategies and the advisors they engage.

-

Advisors must comply with all legal and ethical standards in their investment practices.

-

Regulatory guidelines can influence the types of investments recommended and the overall advisory approach.

What interactive tools are available for document management?

pdfFiller provides users with powerful interactive tools designed for effective document management. These functionalities enable the editing, signing, and sharing of Investment Advisory Agreements seamlessly. Users can customize their agreements according to their needs, ensuring a personalized touch. Furthermore, pdfFiller's collaborative features facilitate teamwork, allowing multiple users to contribute to and manage documents efficiently.

-

Allow users to make adjustments to their agreements directly within the platform.

-

Enable clients and advisors to sign documents securely and quickly.

-

Support joint document management, making it easier for teams to work together.

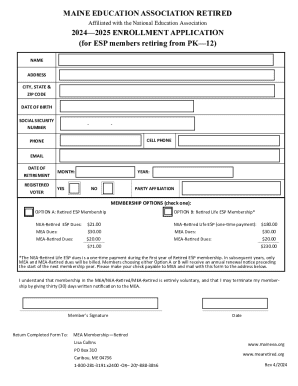

How to fill out the Investment Advisory Agreement Template

-

1.Download the Investment Advisory Agreement Template from pdfFiller.

-

2.Open the document in pdfFiller to access editing tools.

-

3.Start by filling in your personal information including name, address, and contact details.

-

4.Next, enter the investment advisor's details such as name and company information.

-

5.Specify the scope of services to be provided by the advisor in the designated section.

-

6.Clearly outline the fee structure, including any management fees or commissions.

-

7.Include a section on investment objectives and risk tolerance, ensuring both parties understand the goals.

-

8.Review the Term and Termination clauses to set the duration of the agreement and conditions for cancellation.

-

9.Make sure to include any specific provisions or preferences based on your requirements.

-

10.Finally, both parties should sign and date the agreement, ensuring it is complete and valid.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.