Key Man Insurance Agreement Template free printable template

Show details

This document outlines the terms and conditions for securing a life insurance policy for a key individual whose loss could impact the financial stability of a company.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

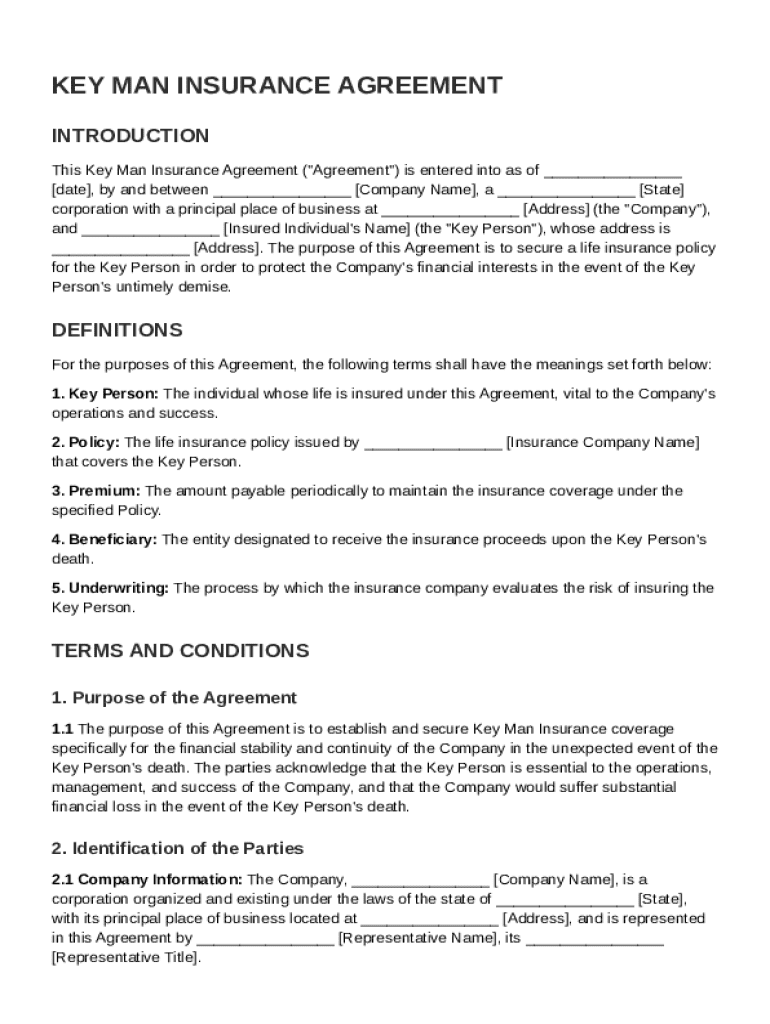

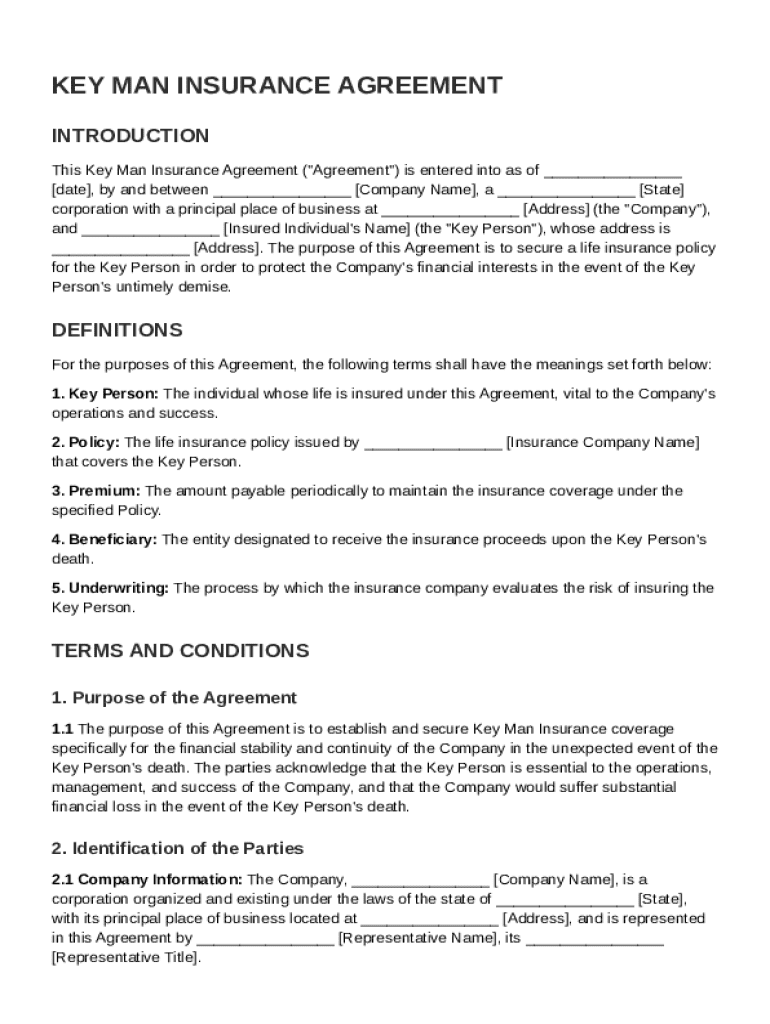

What is Key Man Insurance Agreement Template

A Key Man Insurance Agreement Template is a legal document that establishes an insurance policy taken out on the life or health of an essential employee, designed to protect a business against financial loss in the event of that person's untimely death or disability.

pdfFiller scores top ratings on review platforms

Easy to use and through.

WAs easy to start without much knowledge of the product, but I'm sure there is much more to learn.

Easy to use.

Really easy to use and very affordable compared to mainstream options

it is cool as far as i know how it orks

Mostly all forms I search is here

Who needs Key Man Insurance Agreement Template?

Explore how professionals across industries use pdfFiller.

How to fill out a Key Man Insurance Agreement Template form

Key Man Insurance is a vital component for many businesses, ensuring protection against the loss of critical personnel. To fill out a Key Man Insurance Agreement Template form, start by understanding the key components required and the specific needs of your organization.

Understanding Key Man Insurance Agreements

Key Man Insurance refers to a policy that a company takes out on the life of an essential employee, known as a 'Key Person.' This insurance protects the business from financial loss if that individual passes away or becomes unable to perform their duties.

-

Key Man Insurance helps cover lost revenue, costs of recruitment, and training expenses for replacement employees, preserving business stability.

-

Examples include small businesses relying on a founder, or companies dependent on a high-value salesperson or expert.

Components of a Key Man Insurance Agreement

A Key Man Insurance Agreement includes several critical components that ensure clarity and legal compliance.

-

Understand terms like 'Key Person' (the insured), 'Policy' (the insurance contract), 'Premium' (amount payable), 'Beneficiary' (who receives the payout), and 'Underwriting' (the risk assessment process).

-

Typically consists of sections covering definitions, coverage amounts, payment terms, and the responsibilities of each party.

-

Customizations may be necessary to reflect the unique circumstances of various businesses, considering size, structure, and personnel.

Filling Out Your Key Man Insurance Agreement

Filling out the Key Man Insurance Agreement requires accurate inputs to avoid future liabilities and ensure compliance with local laws.

-

Start by gathering relevant data on the Key Person, including full name, position, and financial contributions to assess coverage needs.

-

Double-check all figures and spellings, and consult a legal professional or insurance broker for guidance.

-

Leverage pdfFiller's tools for seamless editing, signing, and collaborative document management.

The Role of the Key Person in the Agreement

The Key Person's role is critical in a Key Man Insurance Agreement, influencing both the policy's structure and its necessity.

-

Consider individuals whose skills and expertise are essential to the operational success of the business.

-

The loss of a Key Person can severely disrupt business activities, making this insurance crucial.

-

Ensure compliance with any regulations that govern the designation of Key Persons in your industry.

Understanding Premiums and Policy Types

Different types of policies are available within Key Man Insurance, influencing both coverage and premium costs.

-

Options include term life insurance, whole life policies, and universal life insurance, each with distinct benefits and coverage durations.

-

Consider health status, age of the Key Person, coverage amount, and type of coverage selected.

-

Investigate eligibility for group insurance or bundling policies to lower overall costs.

Managing Your Key Man Insurance Over Time

After securing a Key Man Insurance Agreement, ongoing management is essential to ensure it remains effective.

-

Regularly reassess coverage to match any changes in business structure or Key Person roles.

-

Conduct annual reviews to ensure the policy aligns with business continuity plans.

-

Utilize pdfFiller to keep all documentation organized and accessible for updates and collaboration.

Ensuring Compliance and Legal Considerations

Compliance is a critical aspect of establishing and maintaining a Key Man Insurance Agreement.

-

Research local laws and industry regulations that govern insurance agreements to ensure compliance.

-

Engage with legal experts to navigate complex legal landscapes and safeguard your business interests.

-

Keep records of the agreement, policy updates, and any compliance certifications handy for legal scrutiny.

Conclusion and Next Steps

In summary, the Key Man Insurance Agreement Template form is vital for businesses aiming to protect themselves against the loss of key personnel. By understanding its components and managing it effectively, businesses can ensure continuity and stability.

As you proceed, use pdfFiller to streamline document handling, allowing for easy updates and compliance management.

How to fill out the Key Man Insurance Agreement Template

-

1.Download the Key Man Insurance Agreement Template from a reputable source.

-

2.Open the PDF in pdfFiller.

-

3.Begin by entering the name of your business on the first line.

-

4.Next, specify the key person's full name and relationship to the business.

-

5.Input the insurance policy details, including coverage amount and terms.

-

6.Fill in the start date of the agreement and duration of the coverage.

-

7.Include any necessary provisions for policy changes or renewals as needed.

-

8.Review the template for any required signatures from authorized parties.

-

9.Save the filled document and consider printing it for physical records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.