Loan Repayment Agreement Template free printable template

Show details

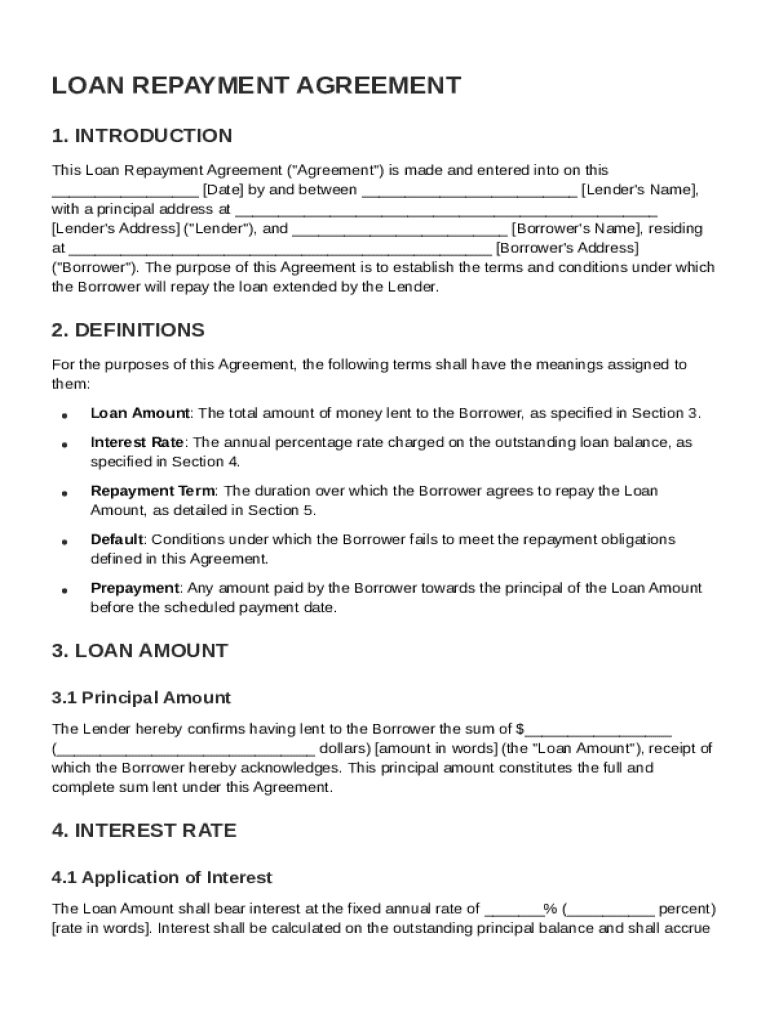

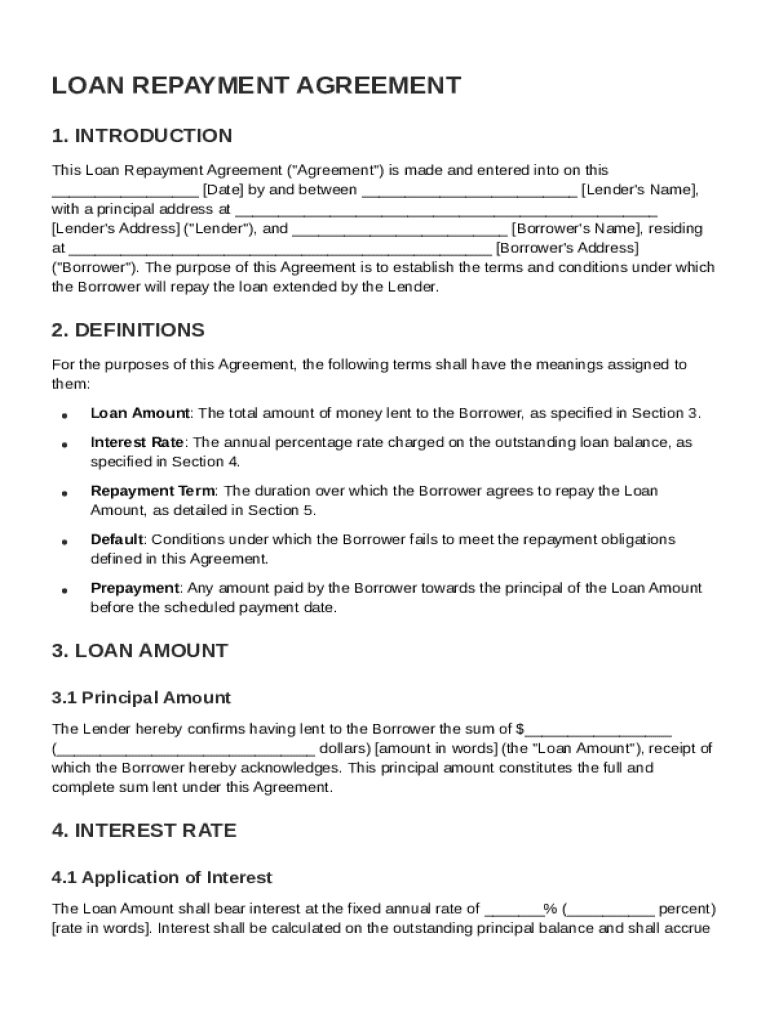

This document establishes the terms and conditions under which the borrower agrees to repay the loan extended by the lender, including definitions, repayment terms, and remedies for default.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Loan Repayment Agreement Template

A Loan Repayment Agreement Template is a legal document outlining the terms and conditions for repaying a loan between a borrower and lender.

pdfFiller scores top ratings on review platforms

I like the ability of filing almost any form online.

This is an easy way to resolve all the problems that I used to have when we have to fill a pdf document. For me is the best.

Very easy to use. Great for completing Government forms. Minor mistakes easily corrected and the end result is much neater and legible. Saves time and paper by not having to print forms, complete them manually then scan the completed form.

Only had if for a week but so far it has worked well and done exactly as it claims. I asked for support once and it was quick and useful

Handy for quick completion of important forms.

I like all of the features. It is saving me lots of time. well worth the investment.

All of the above

Who needs Loan Repayment Agreement Template?

Explore how professionals across industries use pdfFiller.

Your Comprehensive Guide to the Loan Repayment Agreement Template on pdfFiller

How to fill out a Loan Repayment Agreement Template form

Filling out a Loan Repayment Agreement Template form involves a systematic approach, starting with defining the key terms, identifying the parties involved, and detailing loan specifics like amount and repayment schedule. Utilizing pdfFiller enhances the experience by offering user-friendly features for editing, signing, and storing your document securely online.

What is a Loan Repayment Agreement?

A Loan Repayment Agreement is a formalized contract between a borrower and a lender that outlines the terms of a loan. Its importance lies in clarifying expectations and obligations between both parties, which can prevent misunderstandings and disputes later on.

-

A loan repayment agreement articulates the borrowing terms, including repayment amount, schedule, and interest rates.

-

Typically, the primary parties are the borrower and the lender, but co-signers may also be involved depending on the loan type.

-

Using a formal agreement adds a layer of security, protects rights, and clarifies responsibilities, making it crucial in managing financial relationships.

What are the essential components of the Loan Repayment Agreement?

For clarity and legal validity, every Loan Repayment Agreement should contain specific components that detail the transaction between the borrower and lender.

-

Clearly state the total amount borrowed, ensuring both parties understand the figure.

-

Specify the interest rate along with how it is calculated, as this significantly impacts the repayment sum.

-

Define the length of time the borrower has to repay the loan and the schedule for payments, whether monthly or otherwise.

-

Outline what constitutes a default and the consequences thereof to protect both parties.

-

Indicate whether the borrower can pay off the loan early and any terms associated with it.

How do you fill out the Loan Repayment Agreement form?

When completing the Loan Repayment Agreement form on pdfFiller, an intuitive interface assists users in entering accurate data effectively.

-

Follow step-by-step guidance provided on pdfFiller to ensure the form is filled out correctly.

-

Make sure to enter correct borrower and lender information such as names and addresses to avoid future disputes.

-

Document the amount clearly, providing any necessary explanations for any fluctuations in amount.

-

Ensure the interest rate is clearly recorded, with calculations laid out so both parties can understand how it accrues.

-

Specify how often payments are due, detailing the timeline and amounts carefully.

What are the best practices for managing your loan agreement?

Maintaining an effective communication line with your lender can greatly improve the management of your loan.

-

Regular updates and dialogues with the lender can help resolve issues before they become serious.

-

Use calendars and reminders to keep track of payment due dates and amounts to ensure consistent payment.

-

Understand what steps to take if you find yourself unable to meet payments, such as negotiating for extensions.

-

If early repayment is allowed, strategize how the implications might affect your finances.

How can pdfFiller assist with your loan documentation?

pdfFiller provides a multitude of interactive tools to assist in the editing, signing, and storing of your loan agreements.

-

Utilize pdfFiller’s features to easily modify and personalize your loan documents.

-

Teams can work together on loan agreements, sharing and collaborating in real time.

-

Benefit from the cloud storage options to keep your documents accessible from anywhere, ensuring ease of management.

-

Learn how to save and retrieve documents efficiently within pdfFiller, enhancing workflow.

Can you provide practical examples and scenarios?

Real-life examples help understand how Loan Repayment Agreements function in different contexts.

-

Analyze a sample loan repayment agreement, walking through each section to understand its essence.

-

Review instances where having a formal agreement has saved borrowers and lenders from disputes.

-

Explore how different types of loans—personal, mortgage, and auto—each manifest unique elements in their agreements.

What challenges might you face in Loan Repayment Agreements?

Borrowers frequently encounter various challenges that can complicate the repayment process.

-

Understand common borrower difficulties, such as unexpected financial challenges or misunderstandings about terms.

-

Learn about the potential legal consequences of loan defaults, including repercussions on credit scores.

-

Discover strategies for altering agreement terms proactively to avoid future repayment issues.

How to fill out the Loan Repayment Agreement Template

-

1.Download the Loan Repayment Agreement Template from pdfFiller.

-

2.Open the template using pdfFiller to access editing tools.

-

3.Begin by entering the date at the top of the document.

-

4.Fill in the names and addresses of both the borrower and lender.

-

5.Specify the loan amount in clearly stated numbers and words.

-

6.Outline the repayment schedule, including payment amounts and due dates.

-

7.Detail any interest rates applicable to the loan.

-

8.Include terms regarding late payments and any associated fees.

-

9.Sign the document electronically, ensuring both parties complete their signatures.

-

10.Review all entries for accuracy, and then save the finalized agreement.

-

11.Print copies for both the borrower and lender for their records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.