Money Lending Agreement Template free printable template

Show details

This document is a Money Lending Agreement outlining the terms and conditions under which a lender provides a loan to a borrower.

We are not affiliated with any brand or entity on this form

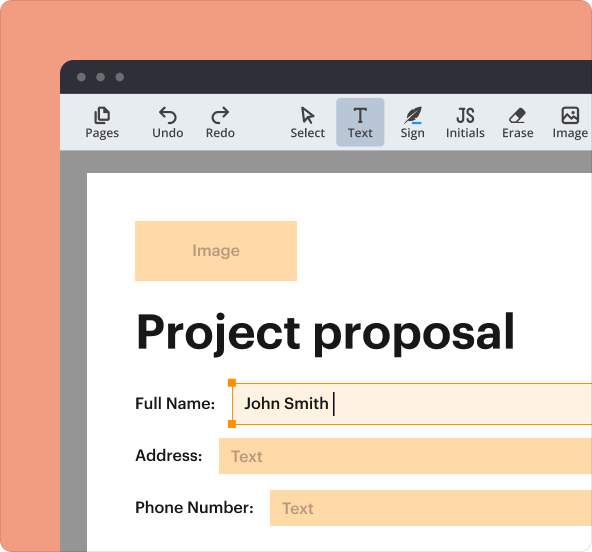

Why pdfFiller is the best tool for managing contracts

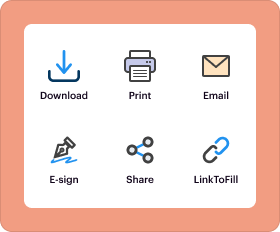

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Money Lending Agreement Template

A Money Lending Agreement Template is a legal document outlining the terms and conditions under which money is borrowed and repaid between a lender and a borrower.

pdfFiller scores top ratings on review platforms

I'm just glad that I am now able to edit things in PDF form! YAY

Easy to use. Makes my work neat and tidy. I love it!

Don't recall having used any program so simple to use and self-explanatory. Plan on keeping a subscription for future use.

Very easy to use and grea support. I highly recommend PDFfiller!

Lovely customer service, quick and effective! I like the simple layout of the program that makes this PDF converter easy to use. No complicated stuff, upload, edit and done!

I needed this program badly, just in the time for distance learning because of the Corona Virus. It was easy to navigate through and use. My only wish is that I would have found this program years earlier! I will update my rating to include the student (recipient) experience of pdfFiller after they return their first homework assignment.

Who needs Money Lending Agreement Template?

Explore how professionals across industries use pdfFiller.

A Comprehensive Guide to Crafting Your Money Lending Agreement

How does a money lending agreement work?

A Money Lending Agreement serves as a formal contract between a lender and a borrower, outlining terms of funds transfer and repayment. It is crucial for establishing clear expectations and protecting the interests of both parties involved. Without a formal agreement, misunderstandings can arise, leading to disputes.

Understanding the money lending agreement

-

A written document that specifies the terms and conditions under which money is loaned and the expectations for repayment.

-

It clarifies responsibilities and reduces the potential for conflicts or misinterpretations in the lending process.

-

Lenders provide the funds while borrowers commit to repay them under agreed conditions. Both parties must understand their roles.

What are the essential components of a money lending agreement?

-

The introduction outlines the purpose of the agreement along with the date it becomes effective.

-

Essential terms should be clearly defined to avoid confusion in the agreement.

-

The document should specify whether the funds will be transferred via direct bank deposit, check, or another method.

How to specify loan amount and disbursement details?

-

Clearly specify the loan amount in both numerical and written form to avoid misinterpretation.

-

Discuss the options available such as bank transfers or checks, and ensure every method is acknowledged in the agreement.

-

The date on which the agreement becomes valid must be mentioned explicitly.

What should you know about determining interest rates?

-

This is the percentage charged on the loan amount, which can be either fixed or variable.

-

Borrowers should understand how the interest is calculated, as it affects total repayment costs.

-

The agreement should specify when the first payment is due and provide a payment schedule for subsequent payments.

How to outline repayment terms and conditions?

-

It is essential to outline when payments are due and the frequency of these payments, such as monthly or quarterly.

-

The agreement should clarify what happens if the borrower fails to make payments on time.

-

Both parties should discuss strategies for managing payments. Setting reminders or automatic payments can support timely repayment.

What are common queries regarding money lending agreements?

-

Understanding your rights and obligations is crucial when entering a lending agreement to protect yourself legally.

-

Both parties should feel comfortable discussing and negotiating terms to ensure fair conditions.

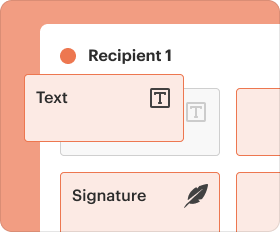

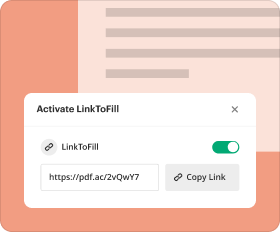

How to utilize pdfFiller for managing money lending agreements?

-

pdfFiller allows users to create editable PDF versions of their agreements that can be easily customized.

-

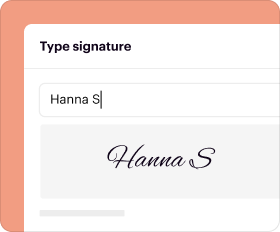

The platform provides a secure way to eSign documents, simplifying the approval process.

-

Users can collaborate with other parties involved using pdfFiller’s cloud-based platform, ensuring all stakeholders have access to necessary documents.

What are alternatives to money lending agreements?

-

These platforms allow individuals to borrow money directly from other individuals, offering a different experience from traditional loans.

-

It’s essential to know when to consider alternatives like peer-to-peer lending or bank loans for funding needs.

-

Evaluate when you might want to look into alternatives based on your specific financial needs and circumstances.

How to fill out the Money Lending Agreement Template

-

1.Open the Money Lending Agreement Template on pdfFiller.

-

2.Begin by entering the names and contact information of both the lender and the borrower at the top of the document.

-

3.Specify the loan amount in the designated section.

-

4.Indicate the interest rate and explain how it will be calculated (fixed or variable).

-

5.Set the repayment terms, including the payment schedule (weekly, monthly, etc.) and the due date for the entire loan.

-

6.Include any additional terms or conditions that are relevant to the loan agreement, such as collateral or late fees.

-

7.Review the document for accuracy and completeness, ensuring all necessary information is included.

-

8.Finalize the agreement by adding signatures from both the lender and the borrower, and include the date of signing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.