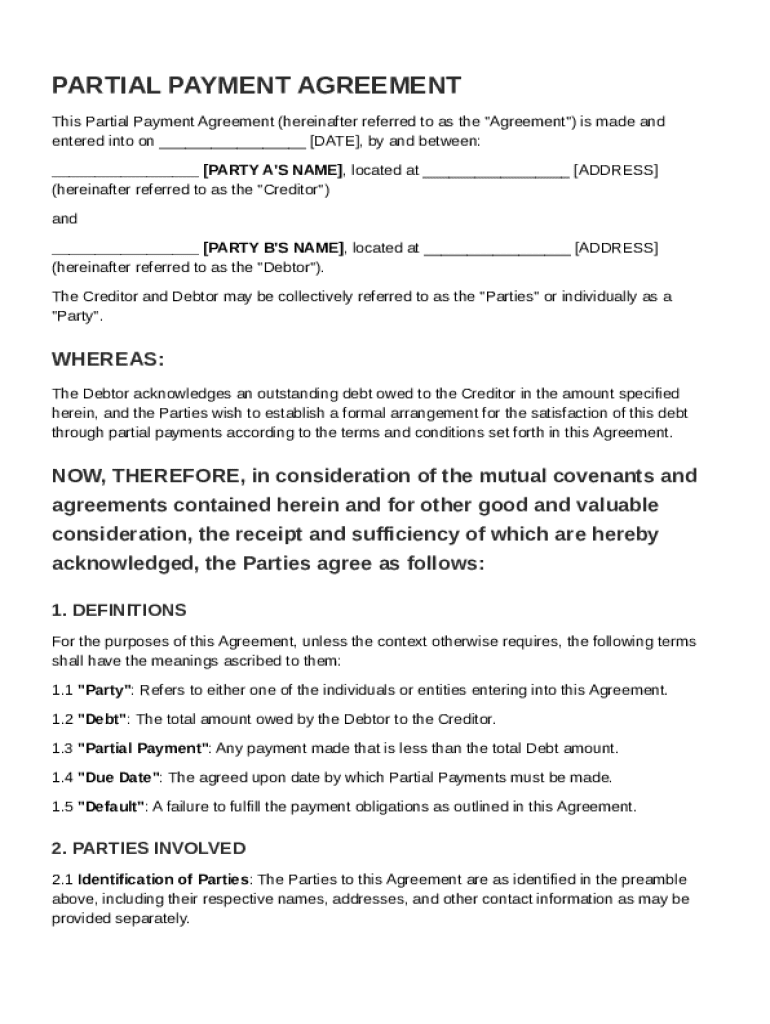

Partial Payment Agreement Template free printable template

Show details

This document outlines the terms and conditions for a partial payment arrangement between a creditor and debtor, including definitions, payment schedules, default conditions, and legal obligations.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Partial Payment Agreement Template

A Partial Payment Agreement Template is a legal document that outlines the terms under which a debtor agrees to pay a portion of a debt over time.

pdfFiller scores top ratings on review platforms

This application has everything I…

This application has everything I needed even before I knew I needed it!

This website is very reliable and is…

This website is very reliable and is great in assisting in everything that I need help with.

VALUE FOR DOLLAR IS GOOD

helpful

This program was very helpful. I will use it again.

This is a great way to upload and…

This is a great way to upload and submit pdf forms. I will continue to use this as needed and I do recommend!

great

great service

Who needs Partial Payment Agreement Template?

Explore how professionals across industries use pdfFiller.

How to fill out a Partial Payment Agreement Template form

Understanding Partial Payment Agreements

A Partial Payment Agreement is a legal document that outlines the terms and conditions under which a debtor agrees to pay a creditor in installments rather than a lump sum. Having a formal agreement is crucial as it clarifies each party's obligations and prevents misunderstandings. Partial Payment Agreements are often used in scenarios like debt repayment plans, installment contracts, or when a borrower is unable to fulfill an immediate cash payment.

Who are the key parties in the agreement?

In every Partial Payment Agreement, there are two key parties: the creditor, or the party to whom money is owed, and the debtor, the individual or entity that owes the debt. Each party has distinct roles; the creditor provides the loan or service, while the debtor agrees to repay the borrowed amount under specific terms.

-

The creditor's role is to extend credit or loan, detailing how much is owed and when payments are expected.

-

The debtor's obligation is to repay the loan based on the agreed schedule, which may include interest or additional fees.

What are the essential elements of the agreement?

A well-structured Partial Payment Agreement should include key elements such as the total debt amount, a clear payment schedule, and acceptable payment methods. The total debt amount must be accurately represented to avoid future disputes. The payment schedule will outline how and when payments should occur, ensuring that financial expectations are met.

-

Clearly state the total amount owed; erroneous figures can lead to complications in repayment.

-

Detail how often payments are to be made, including payment dates, frequencies, and total number of payments.

-

Outline acceptable forms of payment, such as bank transfers, checks, or online payment systems.

How should you draft your Partial Payment Agreement?

Drafting your Partial Payment Agreement begins with selecting a user-friendly template that you can easily customize. It is essential to follow a step-by-step guide to ensure that all necessary components are included. Watch out for common pitfalls, such as omitting crucial information or using unclear language, which can lead to misunderstandings.

-

Select a Partial Payment Agreement Template that suits your needs, ensuring it covers all critical areas.

-

Accurately enter the debtor and creditor names, debt amount, payment schedule, and any additional terms.

-

Leverage pdfFiller’s editing and signing functionalities to refine your document, making it both professional and legally binding.

What are default and acceleration clauses?

Understanding default and acceleration clauses is vital when drafting your agreement. A default occurs when the debtor fails to meet the payment obligations outlined in the agreement. Having a clear acceleration clause is important as it allows the creditor to demand the entire remaining balance upon default, enhancing recovery options.

-

A default occurs when the debtor fails to make a payment as per the schedule.

-

If a debtor defaults, the creditor may seek repayment of the entire amount owed and any additional fees.

-

This clause helps creditors ensure they can recover their debt quickly, thereby protecting their financial interests.

How does indemnification and subsequent claims work?

Indemnification in a Partial Payment Agreement refers to protection against past claims related to the debt being paid. Including clauses that release prior claims can prevent disputes, especially in complex transactions. It is beneficial to include clear examples of indemnification clauses in your agreement to ensure comprehensive coverage.

-

Indemnification protects either party from potential losses arising from claims related to the debt.

-

Releasing prior claims helps both parties move forward without lingering disputes that could complicate repayment.

-

An example would include a statement that specifies the release of any claims arising from previous debt agreements.

What are the final steps in finalizing and signing your agreement?

Before signing the agreement, a thorough review ensures that all details are accurate and clearly understood by both parties. Utilizing digital signatures through platforms like pdfFiller simplifies the signing process, making it more efficient. Once signed, it is essential to store the agreement securely for future reference.

-

Go through the whole document to ensure all details are correct before finalizing it.

-

Employ pdfFiller's eSign functionalities to save time and streamline the signing process.

-

Store the finalized agreement in a secure location, whether digitally or physically, for easy access.

How to fill out the Partial Payment Agreement Template

-

1.Download the Partial Payment Agreement Template from pdfFiller.

-

2.Open the document in the pdfFiller editor.

-

3.Begin by entering the date at the top of the agreement.

-

4.Fill in the names and addresses of both the debtor and creditor.

-

5.Specify the total amount owed by the debtor.

-

6.Outline the payment terms, including the partial payment amount, due dates, and frequency of payments.

-

7.Include any interest rates or fees applicable to the payment plan.

-

8.Detail any consequences for missed payments, if applicable.

-

9.Both parties should sign and date the document to make it legally binding.

-

10.Make sure to save and download the completed agreement for records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.