MD Realtors Conventional Financing Addendum 2023-2026 free printable template

Show details

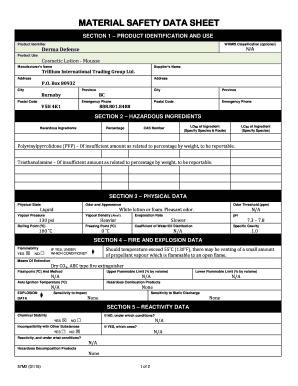

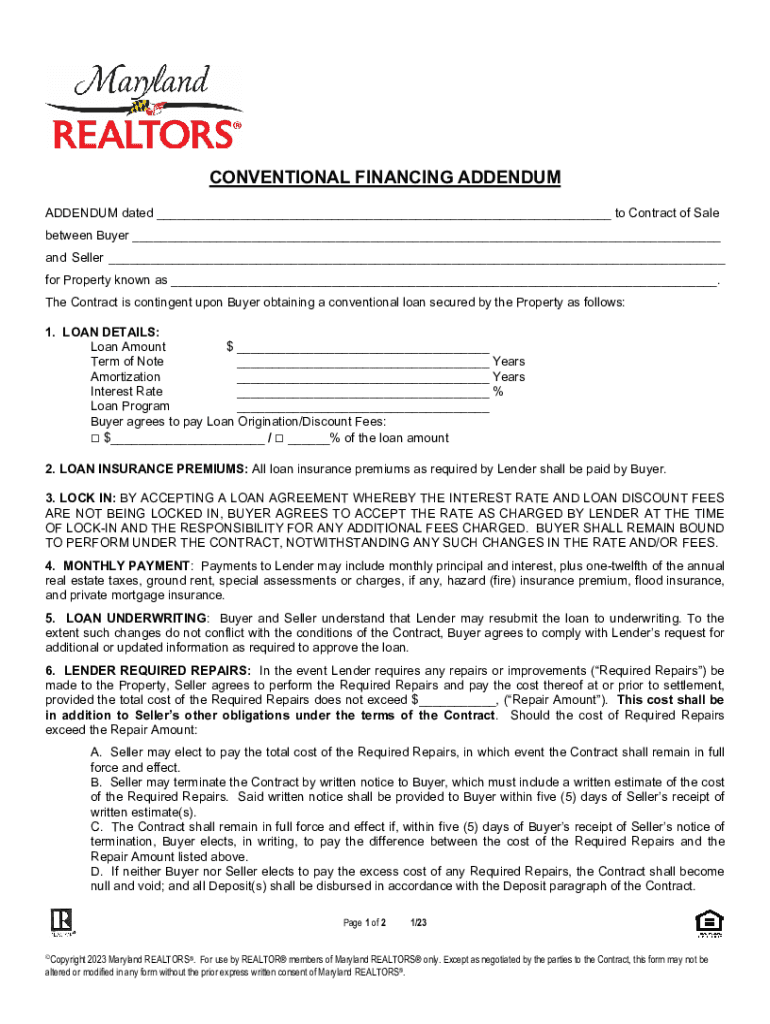

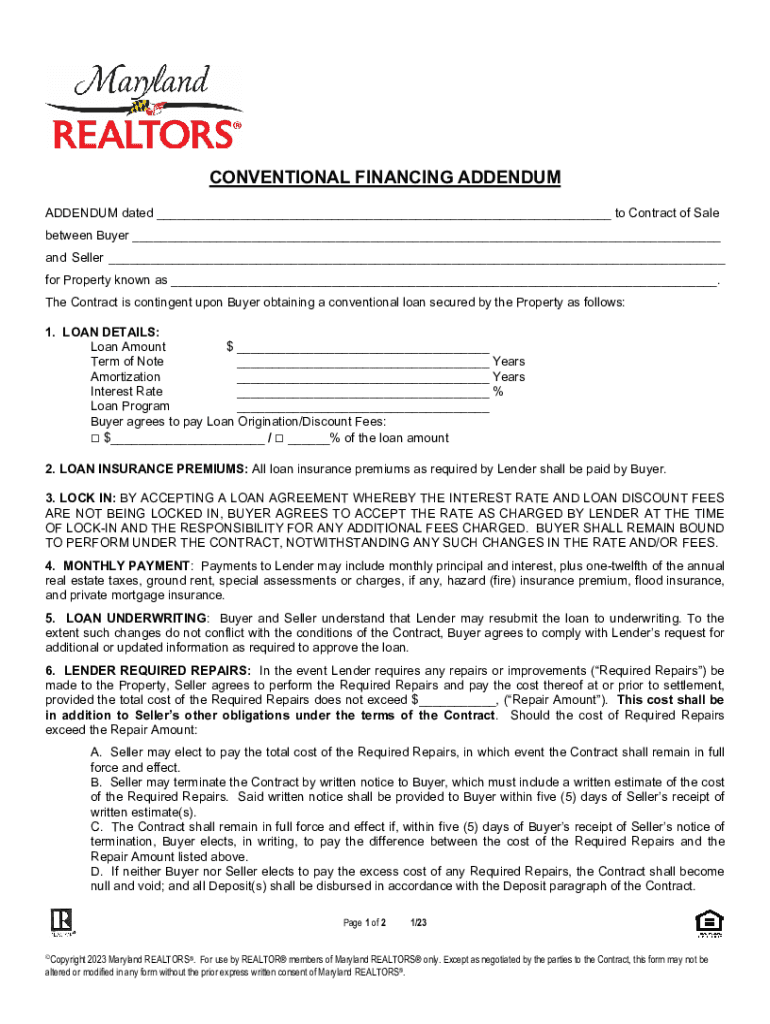

CONVENTIONAL FINANCING ADDENDUM dated ___ to Contract of Sale between Buyer ___ and Seller ___ for Property known as ___. The Contract is contingent upon Buyer obtaining a conventional loan secured

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MD Realtors Conventional Financing Addendum

Edit your MD Realtors Conventional Financing Addendum form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MD Realtors Conventional Financing Addendum form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MD Realtors Conventional Financing Addendum online

Follow the steps below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit MD Realtors Conventional Financing Addendum. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MD Realtors Conventional Financing Addendum Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MD Realtors Conventional Financing Addendum

How to fill out MD Realtors Conventional Financing Addendum

01

Obtain the MD Realtors Conventional Financing Addendum form.

02

Fill in the buyer's name and contact information at the top of the form.

03

Specify the property address being purchased.

04

Indicate the purchase price of the property.

05

State the amount of the loan being applied for.

06

Fill in the type of mortgage loan (e.g., conventional, FHA, VA).

07

Provide details about the lender, including their name and contact information.

08

Clarify the financing terms, including interest rate and loan duration.

09

Sign and date the addendum to confirm the agreement.

Who needs MD Realtors Conventional Financing Addendum?

01

Homebuyers seeking conventional financing to purchase a property.

02

Real estate agents representing buyers who are using conventional loans.

03

Sellers who require a financing addendum as part of a sales contract.

Fill

form

: Try Risk Free

People Also Ask about

Why would a seller want to waive the appraisal?

Without the appraisal contingency, there are fewer opportunities for the deal to fall through, which is always good news to the seller. If you're certain the value of the home is at or above your purchase price, it might be beneficial to waive the contingency to beat the competition.

What is appraisal addendum?

What is an appraisal contingency addendum? An addendum is a separate form that, once signed by the buyer and seller, becomes part of the sales contract. Appraisal contingency addendums are state-specific and allow buyers to move forward with their purchase under certain agreed-upon conditions.

Are appraisal contingencies normal?

Appraisal contingencies are almost always included in contracts for buyers who are using a mortgage to finance their home purchase. Like most contingencies in a home purchase agreement, the appraisal contingency protects the buyer from getting trapped in a bad or unfair deal.

How do you write a seller financed contract?

What do I need to include in an owner-finance contract? The names of the buyer and seller. A description of the property being sold. The purchase price. The down payment amount. The interest rate. The repayment schedule. The start and end dates of the loan. Closing costs.

What is addendum to closing disclosure?

The document will include any additional information or requests that the buyer did not put into the original purchase and sale agreement.

What is an appraisal gap addendum?

“An appraisal gap coverage clause is custom wording in the purchase contract that says you will pay the difference between the appraised value and the contract price, up to a certain amount.”

Should I waive the appraisal contingency?

While an appraisal contingency is not required, waiving the clause can make things extremely difficult for you if the home appraisal is low. You could be at risk of breaking the contract and losing your deposit, at the very least.

What is conventional financing addendum?

What is a conventional financing addendum? A third (3rd) party financing addendum is attached to a sales contract that outlines the terms of a loan (e.g., conventional, FHA, VA) that is agreeable to the buyer in order to close on the property.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get MD Realtors Conventional Financing Addendum?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the MD Realtors Conventional Financing Addendum in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I create an electronic signature for the MD Realtors Conventional Financing Addendum in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your MD Realtors Conventional Financing Addendum.

How can I edit MD Realtors Conventional Financing Addendum on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing MD Realtors Conventional Financing Addendum, you need to install and log in to the app.

What is MD Realtors Conventional Financing Addendum?

The MD Realtors Conventional Financing Addendum is a document used in real estate transactions in Maryland, outlining the terms and conditions of conventional financing for purchasing a property.

Who is required to file MD Realtors Conventional Financing Addendum?

The sellers and buyers involved in a real estate transaction that is contingent upon obtaining conventional financing are required to fill out and file the MD Realtors Conventional Financing Addendum.

How to fill out MD Realtors Conventional Financing Addendum?

To fill out the MD Realtors Conventional Financing Addendum, parties should provide necessary information such as loan type, lender details, financing terms, and any contingencies or conditions related to the financing.

What is the purpose of MD Realtors Conventional Financing Addendum?

The purpose of the MD Realtors Conventional Financing Addendum is to provide detailed information about the financing arrangements in a real estate transaction, ensuring both parties understand the terms and conditions of the financing.

What information must be reported on MD Realtors Conventional Financing Addendum?

The MD Realtors Conventional Financing Addendum must report information such as the type of loan, amount of financing, lender's information, interest rate, terms of financing, and any specific contingencies related to obtaining the loan.

Fill out your MD Realtors Conventional Financing Addendum online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MD Realtors Conventional Financing Addendum is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.