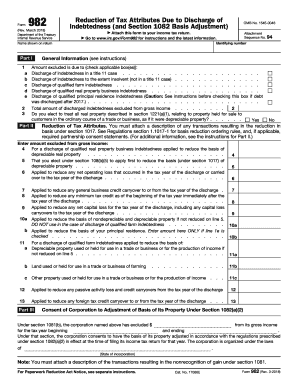

IRS 982 2016 free printable template

Instructions and Help about IRS 982

How to edit IRS 982

How to fill out IRS 982

About IRS previous version

What is IRS 982?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 982

How do I make edits in [SKS] without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing [SKS] and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I sign the [SKS] electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your [SKS] and you'll be done in minutes.

How do I edit [SKS] on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign [SKS] right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is IRS 982?

IRS Form 982 is a tax form used to report the discharge of indebtedness and to apply the exclusion from gross income for debt canceled in a Title 11 bankruptcy case or certain other situations. It enables taxpayers to adjust their tax attributes after a cancellation of debt.

Who is required to file IRS 982?

Taxpayers who have had their debts forgiven, canceled, or discharged, particularly in bankruptcy or insolvency situations, are required to file IRS Form 982 to report these changes and adjust their taxable income accordingly.

How to fill out IRS 982?

To fill out IRS Form 982, taxpayers need to provide personal information such as their name and Social Security number, indicate the type of transaction that resulted in debt cancellation, and calculate the adjustments to be made to their tax attributes for the tax year.

What is the purpose of IRS 982?

The purpose of IRS Form 982 is to allow taxpayers to exclude canceled debt from their gross income under certain conditions and to make corresponding adjustments to their tax attributes.

What information must be reported on IRS 982?

Taxpayers must report details regarding the cancellation of debt, including the amount of discharged debt, the circumstances surrounding the cancellation, and any tax attributes that need adjustment, such as net operating loss or credit carryovers.