MD Realtors Conventional Financing Addendum 2015 free printable template

Show details

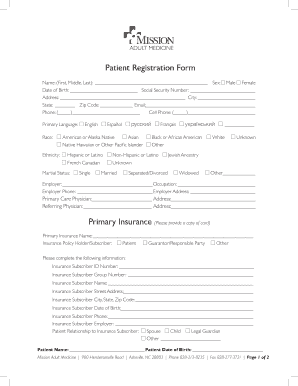

CONVENTIONAL FINANCING ADDENDUMADDENDUM #dated to Contract of Sale between Buyer

and Seller

for Property known as. The Contract is contingent upon Buyer obtaining a conventional loan secured by the

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MD Realtors Conventional Financing Addendum

Edit your MD Realtors Conventional Financing Addendum form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MD Realtors Conventional Financing Addendum form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MD Realtors Conventional Financing Addendum online

In order to make advantage of the professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit MD Realtors Conventional Financing Addendum. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MD Realtors Conventional Financing Addendum Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MD Realtors Conventional Financing Addendum

How to fill out MD Realtors Conventional Financing Addendum

01

Obtain the MD Realtors Conventional Financing Addendum from your real estate agent or the official website.

02

Fill in the buyer's name and the property address at the top of the document.

03

Specify the loan type in the appropriate section (e.g., fixed-rate mortgage, adjustable-rate mortgage).

04

Enter the loan amount and terms of the financing clearly.

05

Detail any contingencies related to financing, such as loan approval timelines and appraisal requirements.

06

Include information about the lender, if applicable, such as name and contact details.

07

Review the addendum for any additional clauses relevant to the transaction.

08

Sign and date the document along with any necessary co-signers.

09

Submit the completed addendum to all relevant parties involved in the transaction.

Who needs MD Realtors Conventional Financing Addendum?

01

The MD Realtors Conventional Financing Addendum is needed by buyers purchasing residential properties using conventional financing, real estate agents assisting those buyers, and sellers to ensure clarity on financing terms.

Fill

form

: Try Risk Free

People Also Ask about

Why would a seller want to waive the appraisal?

Without the appraisal contingency, there are fewer opportunities for the deal to fall through, which is always good news to the seller. If you're certain the value of the home is at or above your purchase price, it might be beneficial to waive the contingency to beat the competition.

What is appraisal addendum?

What is an appraisal contingency addendum? An addendum is a separate form that, once signed by the buyer and seller, becomes part of the sales contract. Appraisal contingency addendums are state-specific and allow buyers to move forward with their purchase under certain agreed-upon conditions.

Are appraisal contingencies normal?

Appraisal contingencies are almost always included in contracts for buyers who are using a mortgage to finance their home purchase. Like most contingencies in a home purchase agreement, the appraisal contingency protects the buyer from getting trapped in a bad or unfair deal.

How do you write a seller financed contract?

What do I need to include in an owner-finance contract? The names of the buyer and seller. A description of the property being sold. The purchase price. The down payment amount. The interest rate. The repayment schedule. The start and end dates of the loan. Closing costs.

What is addendum to closing disclosure?

The document will include any additional information or requests that the buyer did not put into the original purchase and sale agreement.

What is an appraisal gap addendum?

“An appraisal gap coverage clause is custom wording in the purchase contract that says you will pay the difference between the appraised value and the contract price, up to a certain amount.”

Should I waive the appraisal contingency?

While an appraisal contingency is not required, waiving the clause can make things extremely difficult for you if the home appraisal is low. You could be at risk of breaking the contract and losing your deposit, at the very least.

What is conventional financing addendum?

What is a conventional financing addendum? A third (3rd) party financing addendum is attached to a sales contract that outlines the terms of a loan (e.g., conventional, FHA, VA) that is agreeable to the buyer in order to close on the property.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete MD Realtors Conventional Financing Addendum online?

Completing and signing MD Realtors Conventional Financing Addendum online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I fill out the MD Realtors Conventional Financing Addendum form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign MD Realtors Conventional Financing Addendum and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I complete MD Realtors Conventional Financing Addendum on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your MD Realtors Conventional Financing Addendum, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is MD Realtors Conventional Financing Addendum?

The MD Realtors Conventional Financing Addendum is a document used in real estate transactions in Maryland that outlines the specific terms and conditions related to conventional financing agreements between the buyer and seller.

Who is required to file MD Realtors Conventional Financing Addendum?

The MD Realtors Conventional Financing Addendum must be filed by the buyer and seller when the buyer intends to finance the purchase of the property using a conventional loan.

How to fill out MD Realtors Conventional Financing Addendum?

To fill out the MD Realtors Conventional Financing Addendum, the buyer and seller should provide necessary details such as the loan amount, interest rate, type of financing, and any specific contingencies or requirements related to the loan.

What is the purpose of MD Realtors Conventional Financing Addendum?

The purpose of the MD Realtors Conventional Financing Addendum is to clearly define the terms of the financing arrangement and ensure both parties understand their obligations regarding the financing of the real estate transaction.

What information must be reported on MD Realtors Conventional Financing Addendum?

Information that must be reported on the MD Realtors Conventional Financing Addendum includes the names of the parties involved, loan amount, type of loan, interest rate, contingencies if any, and deadlines for financing approval.

Fill out your MD Realtors Conventional Financing Addendum online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MD Realtors Conventional Financing Addendum is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.