Partner Buyout Agreement Template free printable template

Show details

This document outlines the terms and conditions under which one partner buys out the ownership interest of another partner in a business partnership.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Partner Buyout Agreement Template

A Partner Buyout Agreement Template is a legal document used to outline the terms under which one partner buys out the share of another partner in a business.

pdfFiller scores top ratings on review platforms

I'm still in the learning process of features, etc. Having some difficulty with getting my signature on file the way I'd like it.

I like to use PDF filler.com because I can fill the entire form on the computer, except the places where I need to sign it. Also, it has an option to fill the form on the computer or print it out with blank spaces which I can fill it out manually with a pen. Finally, I only pay for the program as long as my subscription is active.

It helped me to apply fror a V.A. buri8al plot.

I was sort of forced into using this form to fill out VA documents, it is so easy, however, I look forward to using it again.

The program is very user friendly. Would like the opportunity to test more documents before sending to clients, so I can see what they are seeing when they receive notification to sign.

I am very happy with results so far. I've had it less than 24 hours though. Please ask again in a month. I'm sure I will continue subscribing.

Who needs Partner Buyout Agreement Template?

Explore how professionals across industries use pdfFiller.

Understanding the Partner Buyout Agreement Template

What is a Partner Buyout Agreement?

A Partner Buyout Agreement is a legally binding document facilitating the transfer of a partner's ownership interest in a business to remaining partners or external buyers. This agreement is crucial for ensuring smooth transitions in ownership and preserving business stability. It details essential elements like the buyout procedure, payment terms, and the valuation of the partnership interest.

-

The agreement protects both parties' rights and obligations during ownership transitions.

-

Typically includes buyout price, payment terms, and legal compliance essentials.

What key terms are defined in the agreement?

Understanding key terms is vital when negotiating a Partner Buyout Agreement. Common terms include ownership transfer processes, rights and stakes of partners, and the valuation of the partnership interest. Defining these terms helps avoid disputes and ensures all parties are on the same page.

-

The formal steps taken for ownership transfer.

-

The specific rights and financial stakes each partner holds.

-

The agreed-upon value of the partnership interest based on market principles.

-

Clarification of responsibilities for both the Buying and Selling Partners.

When should a Partner Buyout Agreement be utilized?

A Partner Buyout Agreement should be employed during critical transition periods in a partnership. These include scenarios where a partner decides to retire, wishes to leave the business, or in the event of a partner's death. Recognizing the right moments to utilize this agreement can prevent misunderstandings and legal complications.

-

When partners wish to exit the partnership, a buyout agreement outlines the terms.

-

Changes in partnership dynamics that could warrant a buyout agreement.

-

Signs that a partner is leaning toward exiting the partnership.

How to draft your Partner Buyout Agreement?

Drafting your agreement begins by gathering essential information about each partner, including names and addresses. Next, establish clear terms regarding ownership interests, including how to determine buyout prices and payment structures. Utilizing pdfFiller allows you to efficiently fill, edit, and review the document to meet your partnership needs.

-

Names, addresses, and details of the partnership must be collected.

-

Clearly define ownership interests and the structure of payments.

-

Set a fair and agreed-upon price for the partner's interest.

-

Coordinate editing and signing using our platform for convenience.

What are the payment structures and buyout price determination methods?

Determining the buyout price is pivotal for both the Buying and Selling partner. Various methods can be employed, including mutual agreements, third-party evaluations, or established formulas within the partnership agreement. Understanding payment structures—like full payments, down payments, or installment plans—is just as crucial.

-

Establishing a fair price reflective of the partnership's valuation.

-

Using agreed formats like valuation methods or negotiation.

-

Choose between full payments, partial payouts, or installment-based payments.

What legal considerations and compliance issues arise?

Every buyout agreement must adhere to local regulations to ensure its legality. Familiarizing yourself with regional-specific requirements helps mitigate common pitfalls. Ensuring your agreement's validity and compliance not only protects your partnership but also enhances its enforceability.

-

Be aware of specific laws regulating partner buyouts in your region.

-

Know frequently encountered issues in buyout agreements to avoid mistakes.

-

Adopt effective strategies to ensure enforceability and legal soundness.

How to manage your agreement seamlessly with pdfFiller?

With pdfFiller, managing your Partner Buyout Agreement is straightforward. The platform enables electronic signing and cloud storage, giving you access from anywhere. Additionally, collaborative features allow partners to comment, share, and track changes effortlessly, further enhancing the document management experience.

-

Using pdfFiller for quick and legally-binding digital signatures.

-

Enable team collaboration through comments, document sharing, and revision tracking.

-

Manage and store your documents online for added flexibility.

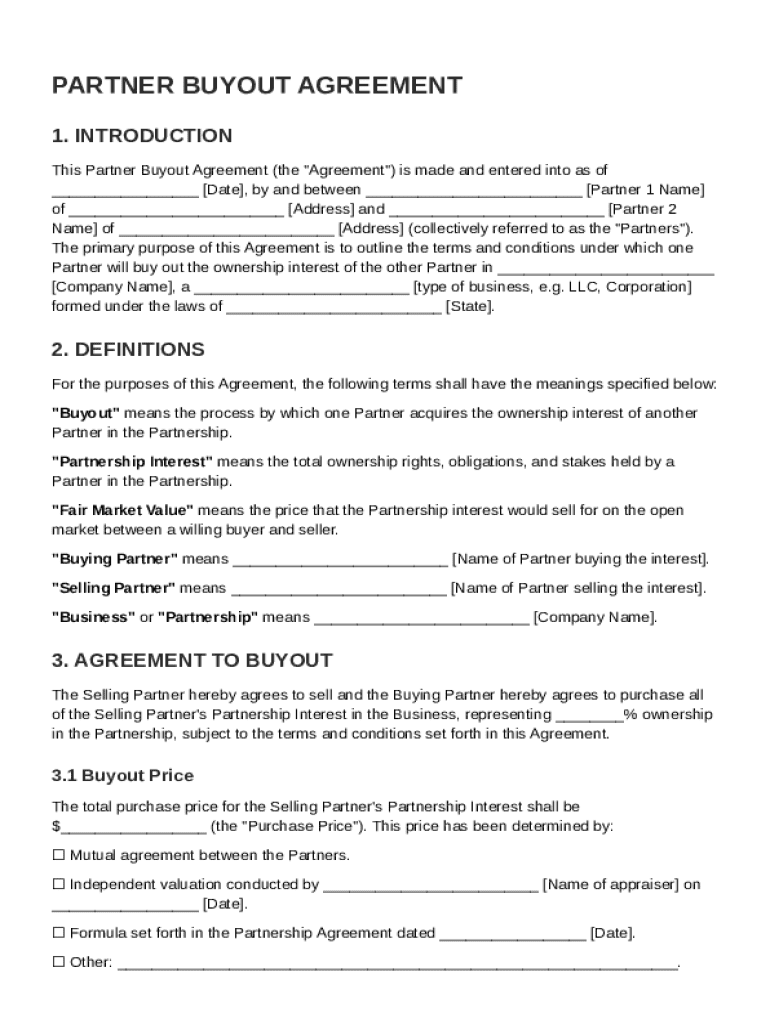

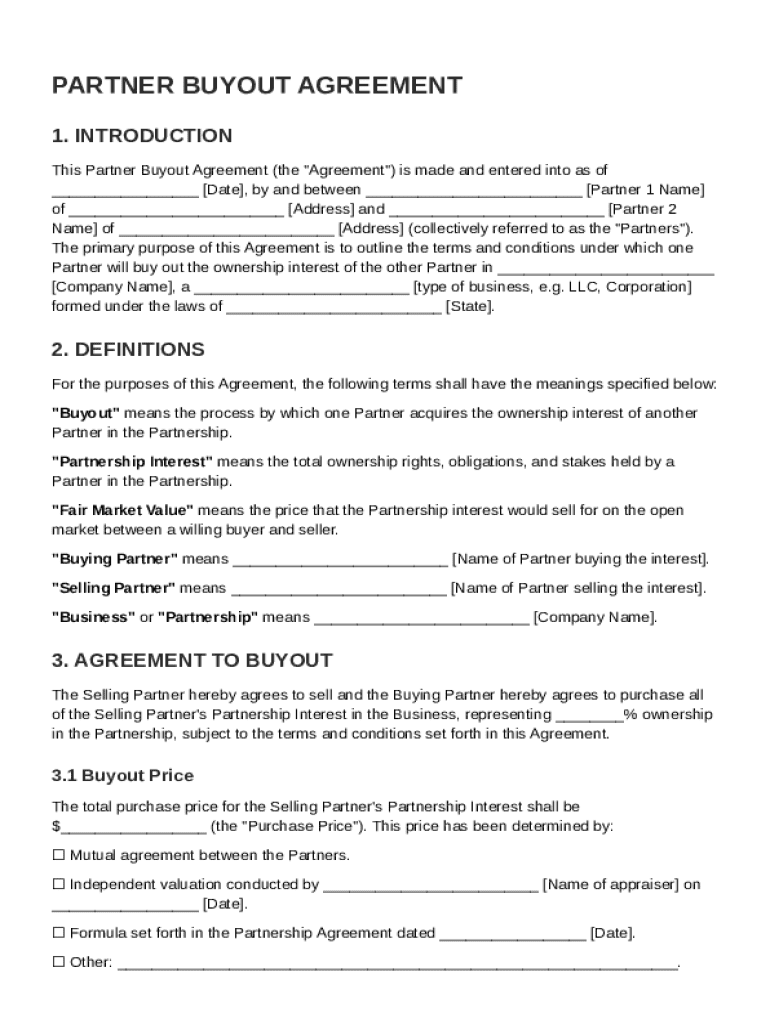

What does a sample Partner Buyout Agreement look like?

Familiarizing yourself with a sample agreement can provide guidance in creating your own. A walkthrough of a template depicts real-life scenarios, offering insight into how to fill out the necessary fields accurately. Customizing the template to fit specific partnership needs is crucial for ensuring all relevant aspects are covered.

-

Review common scenarios depicted in sample agreements.

-

Attention to detail when filling out template fields ensures accuracy.

-

Adapting the template to suit your partnership's unique requirements.

How to fill out the Partner Buyout Agreement Template

-

1.Download the Partner Buyout Agreement Template from pdfFiller.

-

2.Open the template in the pdfFiller editor.

-

3.Begin by entering the names of the partners involved in the buyout at the top of the document.

-

4.Specify the date of the agreement in the designated field.

-

5.Clearly outline the buyout price or formula to calculate the buyout amount in the appropriate section.

-

6.Include details about the payment terms, such as lump sum or installments, and the due date for payments.

-

7.Mention any conditions or contingencies that apply to the buyout.

-

8.Review the terms to ensure clarity and mutual understanding between the partners.

-

9.Add a section for signatures, ensuring all parties sign and date the document for validity.

-

10.Save and print the completed agreement for distribution to all parties involved.

What is a partner buyout?

A Partnership Buyout Agreement is an agreement signed by all partners stipulating the circumstances in which one partner may buy out another partner's business shares. (Corps. C. § 16701.5.) Ideally, these agreements are drafted at the start of a partnership and articulate the terms of sale and a set sale price.

How to calculate a partner buyout?

The standard partnership buyout formula will help you and your attorney determine the fair value of your partner's equity stake in the company. The formula takes the appraised value of the business and multiplies that number by the percentage of ownership your partner has in the company.

How to negotiate a business partner buyout?

Clearly articulate your objectives and goals for the buyout. Define what you want to achieve and how it aligns with your partner's expectations. Ask your partner to express their objectives and goals. This will help you both stay focused during negotiations and find common ground.

How to write a buyout proposal?

Identify who is buying and who is being bought out. Outline who has authority to make decisions and sign the agreement. Make sure all parties are legally able to enter into the agreement. List all interested parties, such as creditors, shareholders, and other potential beneficiaries of the buyout.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.