People Loan Agreement Template free printable template

Show details

Este documento establece los trminos y condiciones bajo los cuales el prestamista proporcionar un prstamo al prestatario, asegurando una comprensin clara y un acuerdo mutuo sobre el reembolso del

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is People Loan Agreement Template

A People Loan Agreement Template is a legal document outlining the terms and conditions of a loan between individuals.

pdfFiller scores top ratings on review platforms

So simple to use. Excellent editing and form filling.

I found it easy to use.

great tool

It was Great to work

nice

Very easy and intuitive

Very easy and intuitive. You get 5 free documents per year. Great product that offers excellent value.

Who needs People Loan Agreement Template?

Explore how professionals across industries use pdfFiller.

How to fill out a People Loan Agreement Template form

What is a People Loan Agreement Template?

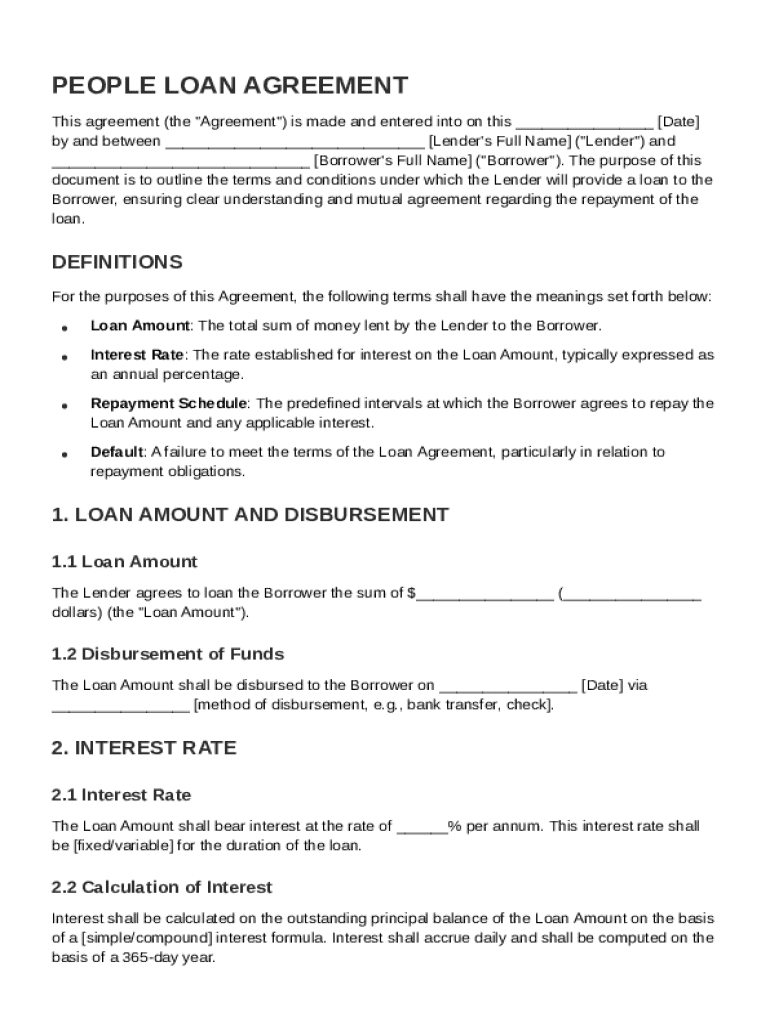

A People Loan Agreement Template serves as a formalized document outlining the terms of a loan arrangement between individuals. This template is crucial to ensure that both the lender and borrower have a clear understanding of their obligations and rights. By utilizing such a template, you establish a legally enforceable contract which can prevent misunderstandings and conflicts.

Why is having a written agreement important?

Having a written agreement is fundamental when it comes to loan transactions. It provides legal protection for both parties and serves as a reference point in case disputes arise. Additionally, it enhances transparency, ensuring all agreed-upon terms and conditions are documented and cannot be easily disputed.

What are the key components of a loan agreement?

-

Clearly define the loan amount and its significance in the agreement.

-

Specify the type of interest rate and its calculation method.

-

Outline the repayment schedule including frequency and total duration.

-

Include provisions detailing penalties or actions in case of default.

How do you fill out the template?

Completing the People Loan Agreement Template is straightforward if you follow a systematic approach. First, gather all necessary information regarding the loan amount, interest rate, and repayment terms. Next, progress through the template step-by-step, ensuring each section is filled out accurately to avoid mistakes. Pay special attention to legal language and terms to ensure clarity.

What to consider when determining interest rates?

-

Understand the difference between fixed rates that remain constant and variable rates that fluctuate over time.

-

Familiarize yourself with simple versus compound interest calculations for effective budgeting.

-

Use practical examples to see how different interest rates impact overall loan costs.

What should you know about repayment terms?

Repayment terms outline how, when, and in what amounts the borrower will repay the loan. It's essential to set a repayment schedule that fits the borrower’s financial capabilities to prevent defaults. Understanding different frequencies and scenarios for prepayment can help both parties plan accordingly.

How can you modify the People Loan Agreement Template?

Modifying the People Loan Agreement Template using pdfFiller is simple and efficient. The platform offers user-friendly tools that allow for easy edits, ensuring that both parties can agree to any changes without starting from scratch. Save and manage different versions to maintain a clear history of amendments.

How does this compare to other loan documents?

-

Understand the differences, mainly in terms of enforceability and terms outlined.

-

Explore various loan agreement nuances and their relevance based on situation.

What is the conclusion about proper documentation?

In conclusion, having a comprehensive People Loan Agreement Template is pivotal for both lenders and borrowers. It not only ensures legal protection but also fosters clarity and trust throughout the lending process. Utilizing tools like pdfFiller can significantly streamline document management, making the entire process more efficient and secure.

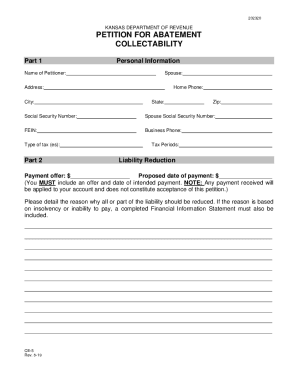

How to fill out the People Loan Agreement Template

-

1.Open the People Loan Agreement Template on pdfFiller.

-

2.Enter the date of the agreement at the top of the document.

-

3.Fill in the names and contact information for both the borrower and the lender.

-

4.Specify the loan amount clearly in the designated field.

-

5.Detail the interest rate, if applicable, along with the repayment schedule.

-

6.Include any collateral specifics, if required for the loan.

-

7.List any additional terms or conditions that both parties agree upon.

-

8.Review the document for accuracy and completeness.

-

9.Save the filled-out template and consider printing it for signatures.

-

10.Have both parties sign and date the agreement to validate it.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.