KS DoR ST-8B 2021 free printable template

Show details

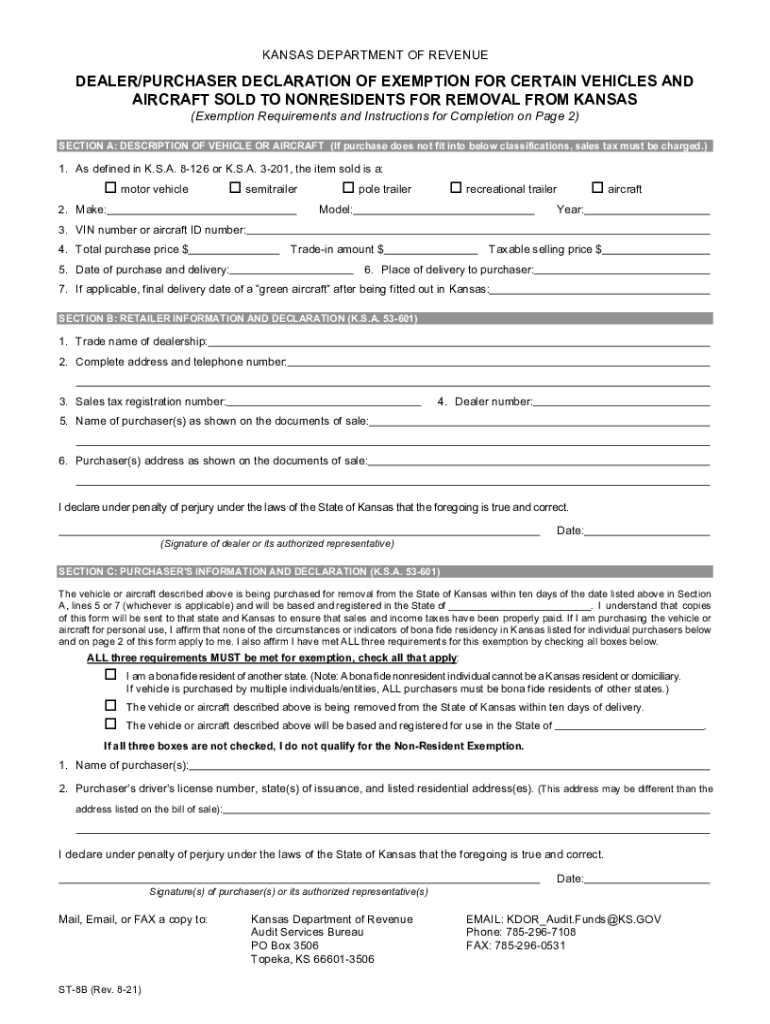

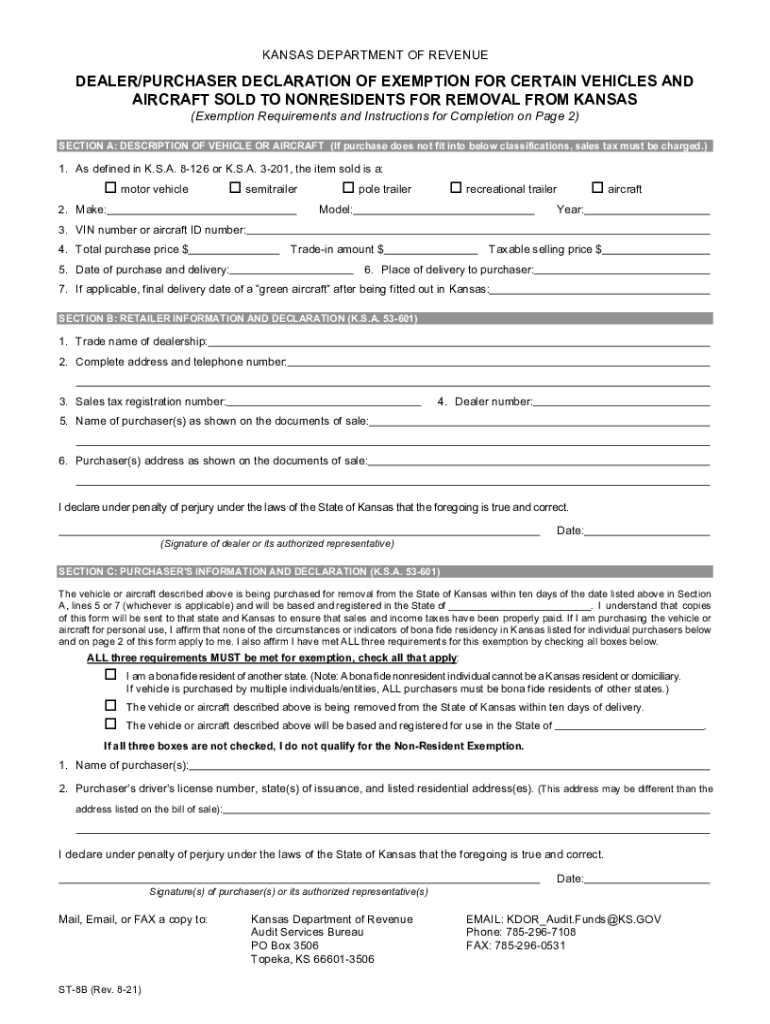

KANSAS DEPARTMENT OF REVENUEDEALER/PURCHASER DECLARATION OF EXEMPTION FOR CERTAIN VEHICLES AND

AIRCRAFT SOLD TO NONRESIDENTS FOR REMOVAL FROM KANSAS

(Exemption Requirements and Instructions for Completion

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KS DoR ST-8B

Edit your KS DoR ST-8B form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KS DoR ST-8B form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit KS DoR ST-8B online

Follow the steps below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit KS DoR ST-8B. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KS DoR ST-8B Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KS DoR ST-8B

How to fill out KS DoR ST-8B

01

Begin by accessing the KS DoR ST-8B form from the relevant government website or office.

02

Fill in your full legal name in the designated section.

03

Provide your current mailing address, ensuring it is accurate.

04

Enter your Social Security number or taxpayer identification number as requested.

05

Detail the specific reason for completing the form, following any guidelines provided.

06

Include any necessary supporting documentation to validate your claims.

07

Review all filled information for accuracy and completeness.

08

Sign and date the form in the appropriate section before submission.

Who needs KS DoR ST-8B?

01

Individuals or entities seeking to report or document certain transactions in Kansas.

02

Taxpayers who need to confirm compliance with state regulations.

03

Businesses that require formal documentation for state records.

Fill

form

: Try Risk Free

People Also Ask about

Do I need a sellers permit in Kansas?

Effective July 1st, 2021, Kansas has an economic nexus threshold of $100,000 in taxable sales in the current or prior calendar year. If you cross this threshold, you need to get a sales tax permit.

How do I get a Kansas sales tax certificate?

You will need to: Sign-in or register with the Kansas Department of Revenue Customer Service Center. Select one of the below exemption certificate types. Complete and submit an exemption certificate application.

Do I need a Kansas tax ID?

Kansas State Tax ID Number You'll need it if you're hiring employees in Kansas, if you're selling taxable goods and services in the state, or if you're going to owe excise taxes on regulated goods like alcohol or tobacco.

What is the best state to register an aircraft?

It's not uncommon nor is it illegal for an owner to set up an LLC to hold the title to an aircraft. In general – and not only for aircraft owners – the taxing structure in Delaware is one of the most favorable for small businesses and LLCs. Delaware is known as a very entrepreneur-friendly state.

How do I get a reseller certificate in Kansas?

The first step you need to take in order to get a resale certificate, is to apply for a Kansas Sales Tax Permit. This permit will furnish a business with a unique Kansas Sales Tax Registration Number, otherwise referred to as a Sales Tax ID number. Once you have that, you are eligible to issue a resale certificate.

What is the fly away rule?

Some states have a “fly-away” rule. In general, this means that an out-of-state buyer can come into their state and take possession as long as they immediately leave.

Does Kansas accept out of state resale certificates?

If the inventory item purchased by an out-of-state retailer is drop shipped to a Kansas location, the out-of-state retailer may provide to the third party vendor a Resale Exemption Certificate from any state, or the Multi-Jurisdiction Exemption Certificate showing registration for any state.

How do I get a Kansas tax ID number?

Kansas Withholding Account Number & Filing Frequency Register online as a new business. You will receive your Tax ID Number immediately after completing the registration online. After 3-5 business days, call the agency at (785) 368-8222 to receive your filing frequency.

How much is a seller's permit in Kansas?

There is no fee for the sales tax permit in Kansas. Other business registration fees may apply. Contact each state's individual department of revenue for more about registering your business. 5.

How do I get a Kansas sales tax license?

There are two ways to register for a Kansas sales tax permit, either by paper application or via the online website. We recommend submitting the application via the online website as it will generally be processed faster and you will receive confirmation upon submission.

How much does it cost to get a tax ID number in Kansas?

Plus, getting an EIN is free and takes just 10 minutes online.

What states are fly away states?

States Without Fly-Away Exemptions AlaskaDelawareHawaiiMarylandMassachusettsMississippiNevadaNew HampshireNew MexicoNorth DakotaOhioOregonSouth CarolinaVermontVirginia Jun 4, 2012

Is Kansas a fly away state?

Fly-aways are common, there's a fly away in Kansas, there are fly-aways in states like Florida, and many other states across the country.

What is a Fly Away exemption?

Basically, these exemptions mean that sales tax isn't charged on the sale provided the buyer flies the plane out of the state within a certain amount of time. Fly away exemptions are based on the idea that the buyer will take the airplane out of the state.

Do I need to register for sales tax in Kansas?

If you have sales tax nexus in Kansas, you're required to register with the Kansas DOR and to charge, collect, and remit the appropriate tax to the state.

Why do you need a reseller certificate?

A resale certificate is a signed document that indicates that the purchaser intends to resell the goods. It is usually provided by a retailer to a wholesale dealer. In addition, manufacturers issue resale certificates to suppliers of materials that become incorporated into the products they manufacture.

How do I get a tax ID for my business in Kansas?

If applying online isn't an option, you can also complete an EIN application by mail or fax by sending Form SS-4 to the IRS fax number 855-641-6935. You can even get an EIN over the phone if the company was formed outside the U.S. by calling 267-941-1099. If filing by phone, note that it isn't a toll-free number.

Do I need a tax ID to be a reseller?

If you have a business through which you are purchasing products for resale, you should have a reseller's permit, also known as a resale number, reseller's license, or sales tax identification number. This permit allows you to collect and remit sales tax to your state Department of Revenue.

Do I need a resale certificate in Kansas?

Kansas does not require registration with the state for a resale certificate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my KS DoR ST-8B directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your KS DoR ST-8B and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I edit KS DoR ST-8B from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including KS DoR ST-8B. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I edit KS DoR ST-8B straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing KS DoR ST-8B.

What is KS DoR ST-8B?

KS DoR ST-8B is a form used for reporting information related to tax obligations in the state of Kansas.

Who is required to file KS DoR ST-8B?

Entities conducting business activities in Kansas that are subject to state taxation are required to file KS DoR ST-8B.

How to fill out KS DoR ST-8B?

To fill out KS DoR ST-8B, provide accurate business information, financial details, and ensure all required sections are completed as per the form's instructions.

What is the purpose of KS DoR ST-8B?

The purpose of KS DoR ST-8B is to gather necessary tax information from businesses to ensure compliance with state tax laws.

What information must be reported on KS DoR ST-8B?

Information that must be reported includes business identification details, income, deductions, and other relevant financial data.

Fill out your KS DoR ST-8B online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KS DoR ST-8b is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.