KS DoR ST-8B 2014 free printable template

Show details

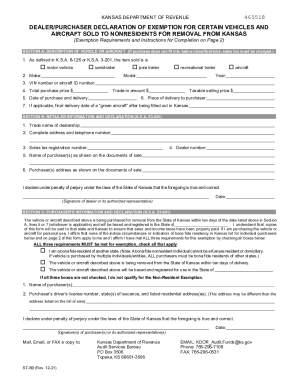

KANSAS DEPARTMENT OF REVENUE DEALER/PURCHASER DECLARATION OF EXEMPTION FOR CERTAIN VEHICLES AND AIRCRAFT SOLD TO NONRESIDENTS FOR REMOVAL FROM KANSAS (Exemption Requirements and Instructions for Completion

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KS DoR ST-8B

Edit your KS DoR ST-8B form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KS DoR ST-8B form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing KS DoR ST-8B online

Follow the guidelines below to use a professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit KS DoR ST-8B. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KS DoR ST-8B Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KS DoR ST-8B

How to fill out KS DoR ST-8B

01

Obtain the KS DoR ST-8B form from the Kansas Department of Revenue website or local office.

02

Review the instructions provided with the form to understand what information is required.

03

Fill in your personal details, including name, address, and social security number.

04

Provide the details of the tax period for which you are filing.

05

List any income and deductions relevant to your tax situation.

06

Calculate the total amount owed or refund due based on the information you provided.

07

Sign and date the form to certify that all information is accurate to the best of your knowledge.

08

Submit the completed form via mail or electronically as specified in the instructions.

Who needs KS DoR ST-8B?

01

Individuals or businesses located in Kansas who need to report changes in their tax situations.

02

Taxpayers who have experienced life changes, such as marriage, divorce, or relocation.

03

Those who are required to update their tax information to comply with Kansas tax laws.

Fill

form

: Try Risk Free

People Also Ask about

Do I need a sellers permit in Kansas?

Effective July 1st, 2021, Kansas has an economic nexus threshold of $100,000 in taxable sales in the current or prior calendar year. If you cross this threshold, you need to get a sales tax permit.

How do I get a Kansas sales tax certificate?

You will need to: Sign-in or register with the Kansas Department of Revenue Customer Service Center. Select one of the below exemption certificate types. Complete and submit an exemption certificate application.

Do I need a Kansas tax ID?

Kansas State Tax ID Number You'll need it if you're hiring employees in Kansas, if you're selling taxable goods and services in the state, or if you're going to owe excise taxes on regulated goods like alcohol or tobacco.

What is the best state to register an aircraft?

It's not uncommon nor is it illegal for an owner to set up an LLC to hold the title to an aircraft. In general – and not only for aircraft owners – the taxing structure in Delaware is one of the most favorable for small businesses and LLCs. Delaware is known as a very entrepreneur-friendly state.

How do I get a reseller certificate in Kansas?

The first step you need to take in order to get a resale certificate, is to apply for a Kansas Sales Tax Permit. This permit will furnish a business with a unique Kansas Sales Tax Registration Number, otherwise referred to as a Sales Tax ID number. Once you have that, you are eligible to issue a resale certificate.

What is the fly away rule?

Some states have a “fly-away” rule. In general, this means that an out-of-state buyer can come into their state and take possession as long as they immediately leave.

Does Kansas accept out of state resale certificates?

If the inventory item purchased by an out-of-state retailer is drop shipped to a Kansas location, the out-of-state retailer may provide to the third party vendor a Resale Exemption Certificate from any state, or the Multi-Jurisdiction Exemption Certificate showing registration for any state.

How do I get a Kansas tax ID number?

Kansas Withholding Account Number & Filing Frequency Register online as a new business. You will receive your Tax ID Number immediately after completing the registration online. After 3-5 business days, call the agency at (785) 368-8222 to receive your filing frequency.

How much is a seller's permit in Kansas?

There is no fee for the sales tax permit in Kansas. Other business registration fees may apply. Contact each state's individual department of revenue for more about registering your business. 5.

How do I get a Kansas sales tax license?

There are two ways to register for a Kansas sales tax permit, either by paper application or via the online website. We recommend submitting the application via the online website as it will generally be processed faster and you will receive confirmation upon submission.

How much does it cost to get a tax ID number in Kansas?

Plus, getting an EIN is free and takes just 10 minutes online.

What states are fly away states?

States Without Fly-Away Exemptions AlaskaDelawareHawaiiMarylandMassachusettsMississippiNevadaNew HampshireNew MexicoNorth DakotaOhioOregonSouth CarolinaVermontVirginia Jun 4, 2012

Is Kansas a fly away state?

Fly-aways are common, there's a fly away in Kansas, there are fly-aways in states like Florida, and many other states across the country.

What is a Fly Away exemption?

Basically, these exemptions mean that sales tax isn't charged on the sale provided the buyer flies the plane out of the state within a certain amount of time. Fly away exemptions are based on the idea that the buyer will take the airplane out of the state.

Do I need to register for sales tax in Kansas?

If you have sales tax nexus in Kansas, you're required to register with the Kansas DOR and to charge, collect, and remit the appropriate tax to the state.

Why do you need a reseller certificate?

A resale certificate is a signed document that indicates that the purchaser intends to resell the goods. It is usually provided by a retailer to a wholesale dealer. In addition, manufacturers issue resale certificates to suppliers of materials that become incorporated into the products they manufacture.

How do I get a tax ID for my business in Kansas?

If applying online isn't an option, you can also complete an EIN application by mail or fax by sending Form SS-4 to the IRS fax number 855-641-6935. You can even get an EIN over the phone if the company was formed outside the U.S. by calling 267-941-1099. If filing by phone, note that it isn't a toll-free number.

Do I need a tax ID to be a reseller?

If you have a business through which you are purchasing products for resale, you should have a reseller's permit, also known as a resale number, reseller's license, or sales tax identification number. This permit allows you to collect and remit sales tax to your state Department of Revenue.

Do I need a resale certificate in Kansas?

Kansas does not require registration with the state for a resale certificate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my KS DoR ST-8B directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your KS DoR ST-8B as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I make changes in KS DoR ST-8B?

The editing procedure is simple with pdfFiller. Open your KS DoR ST-8B in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How can I edit KS DoR ST-8B on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing KS DoR ST-8B right away.

What is KS DoR ST-8B?

KS DoR ST-8B is a specific tax form used in Kansas for reporting certain business taxes and information related to the Department of Revenue.

Who is required to file KS DoR ST-8B?

Businesses that operate in Kansas and meet specific criteria set by the Kansas Department of Revenue are required to file KS DoR ST-8B.

How to fill out KS DoR ST-8B?

To fill out KS DoR ST-8B, you need to provide business identification information, transaction details pertaining to sales and use taxes, and any other required financial data as specified in the form's instructions.

What is the purpose of KS DoR ST-8B?

The purpose of KS DoR ST-8B is to ensure compliance with Kansas tax laws by providing the state with necessary information regarding sales and use taxes.

What information must be reported on KS DoR ST-8B?

The information that must be reported on KS DoR ST-8B includes sales and use tax collections, deductions, exemptions, and any other relevant financial transactions and business information as required by the form.

Fill out your KS DoR ST-8B online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KS DoR ST-8b is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.