Petty Cash Agreement Template free printable template

Show details

This document outlines the policies and procedures for managing and using petty cash funds within an organization, ensuring accountability and proper utilization for minor business expenses.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

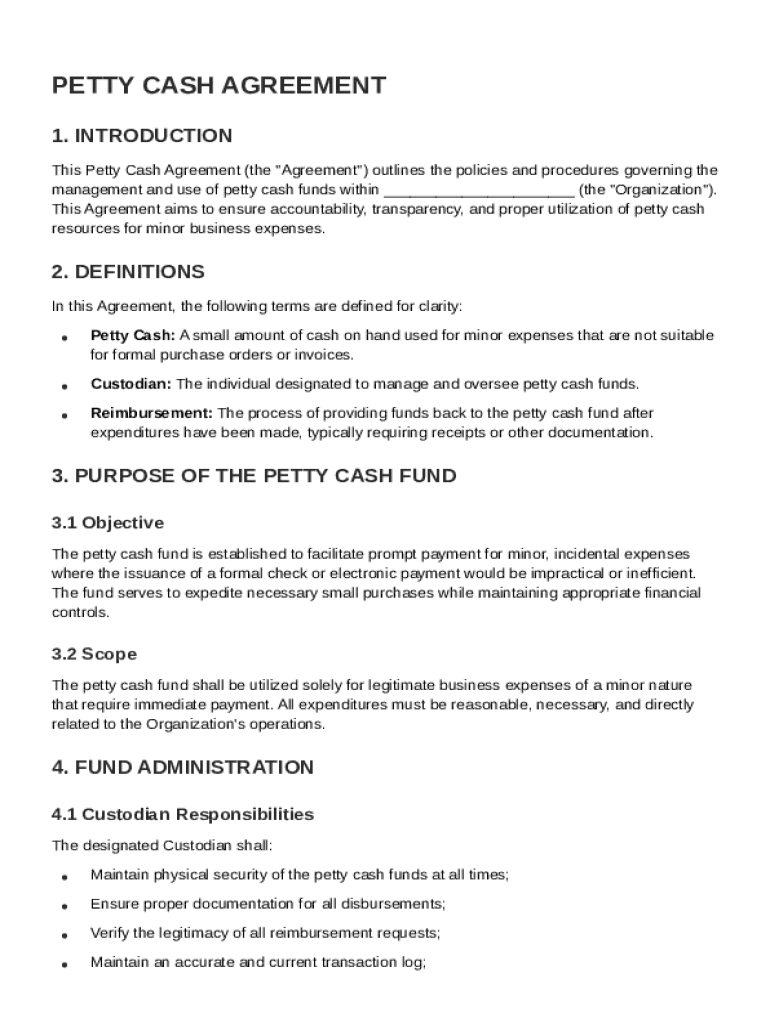

What is Petty Cash Agreement Template

A Petty Cash Agreement Template is a formal document outlining the rules and responsibilities for managing a petty cash fund within an organization.

pdfFiller scores top ratings on review platforms

Sometimes the user interface is difficult to operate. Otherwise, it works great.

I just stumbled upon this site and so far I am satisfied with the ease of use.

its awesome! makes sending forms so convenient

Customer support was very helpful not to mention 24/7. They were able to remotely take over my computer and trouble shoot all my problems.

Easy to use and is very intuitive form to fill out, save, print & email

GOOD FOR SOMEONE WHO HAD A BIG NEED FOR FILLING OUT DOCUMENT =S THRU THE YEAR

Who needs Petty Cash Agreement Template?

Explore how professionals across industries use pdfFiller.

Petty Cash Agreement Template

How to fill out a Petty Cash Agreement Template form

To fill out a Petty Cash Agreement Template form, begin by defining the purpose of the petty cash fund and identifying a custodian responsible for managing it. Specify the initial fund amount, allowable expenses, and the process for reimbursement. Lastly, ensure all relevant parties have access to the finalized form, providing electronic signatures where necessary.

Understanding the petty cash agreement

A petty cash agreement is crucial for managing minor expenses efficiently. Petty cash serves as a quick funding source for small, incidental costs that can arise daily in a business. Without a formal agreement, businesses risk mismanagement of funds and lack accountability in spending.

-

Petty cash is a small amount of cash kept on hand for minor expenditures, such as office supplies or employee reimbursements.

-

A formal petty cash agreement outlines the rules, limits, and responsibilities to prevent misuse and ensure transparency.

-

pdfFiller simplifies form management through its cloud-based platform, enabling easy editing, sharing, and signing of the petty cash agreement.

What are key definitions for effective management?

-

The custodian is responsible for the safekeeping and management of the petty cash fund, ensuring proper documentation of all transactions.

-

This process involves receiving funds back into the petty cash account once expenditures have been verified, thus maintaining the fund's integrity.

-

Utilizing pdfFiller tools to document transactions helps ensure accuracy and provides an audit trail for expenses carried out.

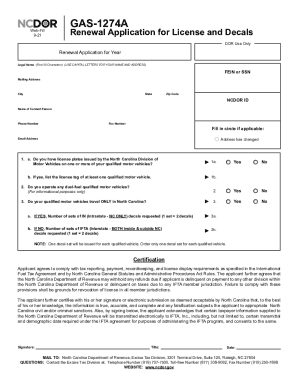

How to establish a petty cash fund?

Establishing a petty cash fund involves clear objectives for its usage, typically aimed at addressing minor but urgent payment needs. The fund should have a defined scope detailing what types of expenses are permissible to ensure proper usage.

-

Clear objectives help streamline minor payments, allowing businesses to remain agile in operations.

-

Defining allowed expenses is crucial to prevent abuse and maintain control over petty cash disbursements.

-

pdfFiller can assist in outlining how the petty cash will be distributed along with its limitations for a better overview.

What are the roles and responsibilities of the custodian?

-

The custodian must ensure that petty cash is stored securely to avoid theft or loss.

-

All transactions involving petty cash should be documented meticulously to maintain a clear financial record.

-

Custodians need to regularly reconcile the petty cash fund against receipts using pdfFiller to ensure accuracy.

-

Immediate reporting of discrepancies ensures transparency and accountability, which are essential for effective management.

How to manage fund amounts and adjustments?

Setting the initial petty cash fund amount requires careful consideration of operational needs. As business conditions change, the fund may need adjustments for optimal performance.

-

Determine an adequate initial amount for the petty cash fund that reflects typical expenses.

-

Fund amounts should be reviewed and adjusted periodically to align with business needs and activity levels.

-

Using pdfFiller allows easy documentation of any fund adjustments, fostering a clear record of changes.

What are best practices for effective petty cash management?

-

Staying organized with transaction logs is essential; leveraging tools like pdfFiller enhances tracking accuracy.

-

Categorizing and justifying petty cash expenses helps maintain oversight and control over fund usage.

-

Utilizing the features of pdfFiller enables better tracking and reporting of petty cash transactions, minimizing errors.

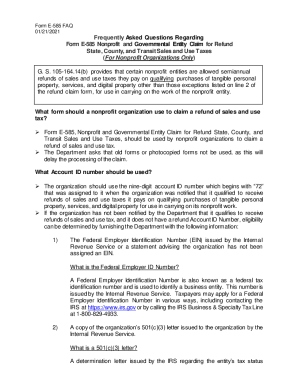

What legal and compliance considerations should you know?

Understanding local regulations regarding petty cash is fundamental. Compliance with these regulations not only fosters transparency but also promotes accountability in business finances.

-

Compliance requires an understanding of local laws governing petty cash management.

-

Regular reviews of expenditures and processes ensure adherence to legal standards.

-

pdfFiller supports compliance through streamlined documentation practices, ensuring all records are easily accessible.

How to finalize the petty cash agreement?

Finalizing the petty cash agreement involves a thorough review and obtaining necessary approvals from stakeholders. Utilizing pdfFiller allows for efficient electronic signatures and edits, making the process straightforward.

-

A comprehensive review ensures that all terms and conditions are clear to every party involved.

-

pdfFiller makes it easy to collect electronic signatures, streamlining the approval process.

-

Ensure that all team members involved have access to the finalized agreement for transparency.

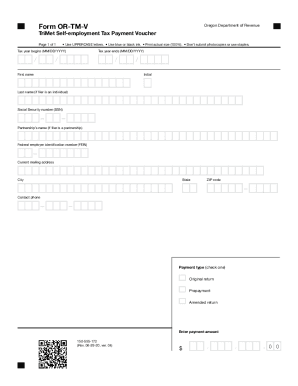

How to fill out the Petty Cash Agreement Template

-

1.Open the Petty Cash Agreement Template on pdfFiller.

-

2.Review the template sections to understand what information is required.

-

3.Fill in the organization’s name and address in the designated fields.

-

4.Enter details for the custodian of the petty cash, including their name and position.

-

5.Specify the total amount allocated for the petty cash fund.

-

6.Outline the purposes for which the petty cash may be used, such as small office supplies or incidentals.

-

7.Include the process for requesting and reporting expenditures made through petty cash.

-

8.Provide the signatures of the custodian and a supervisor to authorize the agreement.

-

9.Save the completed document in the desired format and share it with relevant parties.

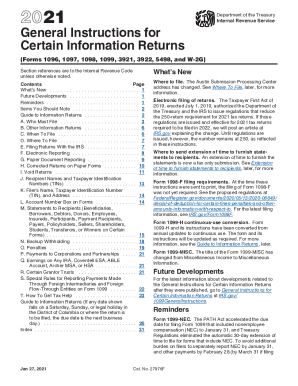

How to write a petty cash policy?

Clear and concise guidelines: Ensure your policy outlines the purpose of the petty cash fund, the staff members responsible, how expenses need to be recorded, and the approval process. Set spending limits: Make it clear how much every employee can spend from the fund and what they can use it for.

What is the petty cash arrangement?

How to Set Up a Petty Cash Management System? Step 1: Appoint a Petty Cash Custodian. Step 2: Establish Clear Policies and Controls. Step 3: Securing the Petty Cash Fund. Step 4: Recording Transactions and Keeping Receipts. Step 5: Replenishing the Fund.

How to make a petty cash form?

At a minimum, your petty cash sheet should include: Date: Record the date of each transaction. Description: Describe what the expense was for. Amount: Log the exact amount spent. Received By: Add a column to note who received the cash. Balance: Track how much cash remains in the petty cash fund.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.