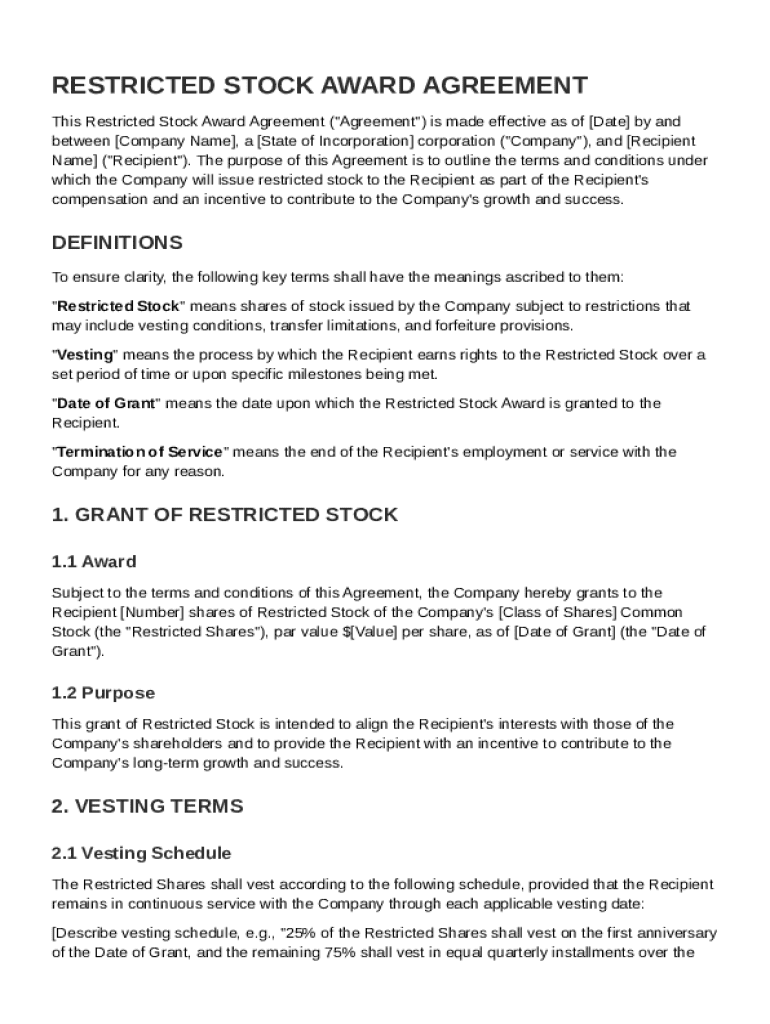

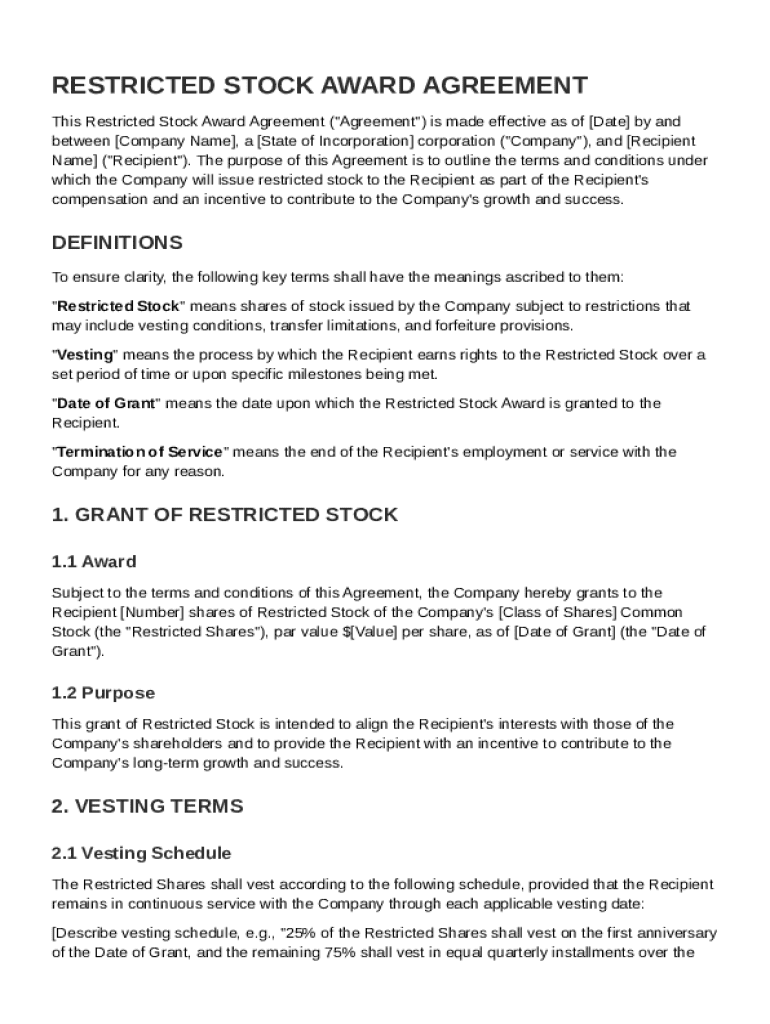

Restricted Stock Award Agreement Template free printable template

Show details

This document outlines the terms and conditions under which a company issues restricted stock as part of employee compensation, including definitions, grant details, vesting terms, restrictions, rights,

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Restricted Stock Award Agreement Template

A Restricted Stock Award Agreement Template is a legal document that outlines the terms and conditions under which stock is awarded to an employee or service provider, subject to certain restrictions.

pdfFiller scores top ratings on review platforms

A PDF Editor is awesome to have in your…

A PDF Editor is awesome to have in your productivity arsenal. It does what I need it to do for a low month to month price.

Easy to use had trouble printing

Easy to use had trouble printing, but found it.

love it

love it! It is very convenient and really makes things so easy for a person to get paperwork for appoints done before we even arrive for the appointment.

Beautiful

This program worked beautifully! Highly recommend!

PDFfiller is the best, hands down

I've used just about every PDF filling service I can find and although PDFfiller is on the pricey side, I've found them to be the best because of their drawing features, beautifully organized website on both desktop and mobile, and super fast customer support. If you need to fill out PDF's regularly, I'd say PDFfiller at $6 per month is easily worth the money.

PDF Filler Support

Used this company (PDFFiller) today and needed support assistance to clear up a situation on my account. The CUSTOMER SUPPORT TEAM were VERY helpful and corrected the issue immediately. Thank you for yourprofessionalism!!

Who needs Restricted Stock Award Agreement Template?

Explore how professionals across industries use pdfFiller.

Restricted Stock Award Agreement Template Guide

How do you understand restricted stock awards?

Restricted Stock Awards (RSAs) play a crucial role in employee compensation packages, offering employees financial incentives while aligning their interests with shareholders. These awards are often subject to vesting conditions, which means that the employee must meet certain requirements, such as continued employment, before they can fully own the shares. Additionally, RSAs typically come with transfer limitations and forfeiture provisions, protecting the company’s interests and incentivizing long-term performance.

-

Definition of Restricted Stock: RSAs are shares offered to employees that are subject to various conditions before they are fully owned by the employee.

-

Vesting Conditions: These are the terms that must be met, such as continued employment, to gain full ownership of the shares.

-

Transfer Limitations: Employees cannot sell or transfer their awarded shares until they meet specific criteria.

What are the key components of a restricted stock award agreement?

A well-structured Restricted Stock Award Agreement includes several key elements essential for clarity and compliance. These components are designed to outline the grant's particulars, including the date of grant, individual parties involved, and the overarching purpose of the award. Each part ensures that both the company and the recipient maintain transparency and alignment regarding the equity being awarded.

-

Date of Grant: This establishes when the shares are awarded and is critical for calculating vesting.

-

Parties Involved: Details on the company granting the award and the recipient, clarifying roles.

-

Purpose of the Grant: This helps ensure that employee interests align with shareholder interests.

How are the vesting terms explained?

The vesting schedule outlines the timeline for the employee to earn their shares fully. Different organizations may implement various vesting options, such as time-based, where shares vest incrementally over a set period, or milestone-based, where shares vest upon achieving specific performance targets. Understanding these terms is essential for both parties as they significantly affect the employee’s financial prospects and the company’s capabilities.

-

Vesting Schedule: This is a timeline that details when shares will be accessible to employees.

-

Vesting Options: Common options include time-based vesting, where shares vest over a timeline, and milestone-based vesting that occurs upon reaching set targets.

-

Continuous Service Requirement: Employees typically need to remain employed during the vesting period to earn their shares.

What are the step-by-step instructions for filling out the agreement?

Filling out a Restricted Stock Award Agreement requires attention to detail to ensure accuracy and compliance. Begin by clearly entering the company name and the state of incorporation, as these establish the legal framework. Next, specify the recipient's name and allocate the number of shares designated for them. It's also crucial to thoroughly specify any vesting periods or conditions aimed at aligning with company objectives.

-

Company Name and State: Accurate details are needed to validate the document legally.

-

Recipient Name and Share Allocations: Specify the designated shares accurately to avoid disputes.

-

Vesting Periods and Conditions: Clearly outline any conditions that must be met before shares can be fully owned.

How can interactive tools enhance document management?

Tools such as pdfFiller stand out in the realm of document management by allowing users to securely edit PDF forms while facilitating ease of collaboration. This ensures that teams can draft the agreement together, sharing valuable insights and making necessary amendments in real-time. Additionally, consider the advantages of different signature processes, as electronic signatures may offer efficiency and speed compared to traditional manual methods.

-

Editing PDF Forms: pdfFiller facilitates secure, efficient editing of documents.

-

Collaboration Features: Teams can work together on drafting agreements, enhancing communication.

-

Signing Processes: Evaluate electronic versus manual signatures to determine the most suitable method for your needs.

What compliance considerations should be included in your agreement?

It's critical to ensure that your Restricted Stock Award Agreement complies with state-specific regulations concerning stock awards. Additionally, understanding the tax implications related to RSAs is essential for both the company and the employee, as this can influence the overall financial outcome. Proper disclosures required under applicable laws must also be adhered to, mitigating any potential legal risks.

-

State-Specific Regulations: A grasp of local laws is crucial in drafting compliant agreements.

-

Tax Implications: Understanding the tax responsibilities associated with Restricted Stock can affect financial planning.

-

Legal Disclosures: Ensure that all mandatory disclosures are included to avoid legal complications.

What are the best practices for managing restricted stock awards?

Effective management of Restricted Stock Awards hinges on maintaining clear, accurate records of issued shares and ongoing vesting schedules. Companies should also adapt their agreements as necessary to reflect changes in corporate strategy or structure. Regular reviews with legal counsel are recommended to ensure that the terms of the agreement remain compliant with evolving regulations and best practices.

-

Record Keeping: Keeping detailed records helps prevent discrepancies and disputes.

-

Adapting Agreements: Regularly updating terms ensures that they remain relevant to corporate strategies.

-

Legal Reviews: Periodic checks with legal counsel help in identifying necessary adjustments to comply with laws.

How to fill out the Restricted Stock Award Agreement Template

-

1.Download the Restricted Stock Award Agreement Template from a reputable source.

-

2.Open the template in pdfFiller to begin the editing process.

-

3.Start by entering the name of the company at the top of the agreement.

-

4.Next, input the name of the employee receiving the stock grant.

-

5.Fill in the total number of shares being awarded to the recipient.

-

6.Specify the vesting schedule, including any performance milestones or periods before shares are fully owned by the employee.

-

7.Include details about the price of the shares, if applicable, and any applicable taxes or withholdings.

-

8.Review the terms of the agreement carefully to ensure accuracy, including any restrictions on transfer or sale of stocks.

-

9.Add signature lines for both the company representative and the employee, ensuring both parties will sign the document to make it legally binding.

-

10.Finally, save the completed document and distribute copies to all involved parties for their records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.