Revolving Line of Credit Agreement Template free printable template

Show details

This document establishes terms for a revolving line of credit between a lender and borrower, including definitions, terms and conditions, borrowing procedures, and covenants.

We are not affiliated with any brand or entity on this form

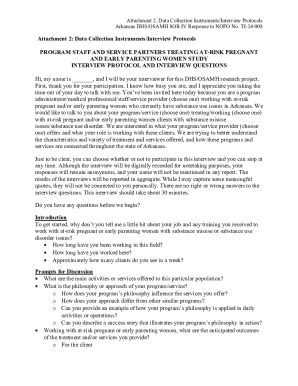

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Revolving Line of Credit Agreement Template

A Revolving Line of Credit Agreement Template is a financial document outlining the terms and conditions under which a lender provides a borrower with a line of credit that can be drawn upon and repaid repeatedly.

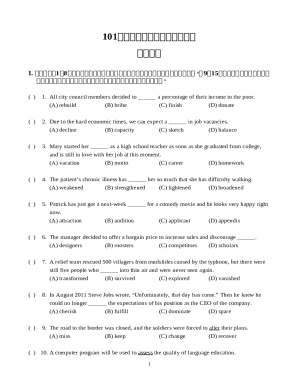

pdfFiller scores top ratings on review platforms

It has worked well so far. I did recommend a friend that was wondering if he should renew his docusign.

Find forms by description only. Has forms that my more expensive service does not offer.

Very nice software and editing capabilities

So far it is good. I use it for work schedules. Im very busy so havent had a lot of time to explore all the features. When i send my work from home to the work place; i find the security code a little annoying. Also when i purchased it i didnt receive a lower price as lead to believe. Although the price to continue useing it at renewal time wasnt bad.

It's been pretty easy and intuitive to use so far, thanks!

Muddling through it. Mostly have it figured out.

Who needs Revolving Line of Credit Agreement Template?

Explore how professionals across industries use pdfFiller.

Revolving line of credit agreement template insights and guidance

How to fill out a revolving line of credit agreement form

To fill out a revolving line of credit agreement form, start by defining the essential terms and conditions related to the credit limit, interest rate, and other critical variables. You can utilize tools like pdfFiller for seamless document management, allowing for easy customization, signing, and collaboration. Follow the structured sections of the agreement carefully to ensure clarity and compliance.

What is a revolving line of credit?

A revolving line of credit is a flexible financing option that allows borrowers to draw funds up to a specified credit limit. The benefit of this form of credit is its ability to provide financial support only when needed, and borrowers are only charged interest on the amount drawn, unlike a term loan where interest is based on the total loan amount. Typical uses include managing short-term expenses, bridging cash flow gaps, or unexpected financial needs.

-

Borrowers can draw and repay as necessary, up to the credit limit.

-

Interest is only charged on the drawn amount, not the entire credit limit.

-

Helps in managing cash flow by providing ready access to funds.

What are the core components of the agreement?

A revolving line of credit agreement must cover essential sections that define the framework of the borrowing arrangement. This typically includes definitions of key terms, the specific conditions under which credit is extended, and the rights and obligations of both the lender and borrower. Accurate representations of the 'Credit Limit', 'Interest Rate', 'Draw', and 'Maturity Date' are crucial to avoid disputes later.

-

Clearly outlines important terms that need to be understood by both parties.

-

Detailed descriptions of the loan structure, including interest calculations and payment schedules.

-

Specific stipulations that borrowers must meet in order to maintain access to the credit.

How is a credit facility established?

Establishing a revolving credit facility requires understanding the criteria for setting a credit limit that fits the borrower's financial situation. Lenders typically assess the borrower's creditworthiness and financial history to determine an appropriate limit, balancing risk and suitability. The availability period for borrowing is also defined and can impact a borrower’s access to funds, especially if the facility is set to expire.

-

Lenders evaluate the borrower's financial history and capacity to repay.

-

Based on borrower needs and lender policies, credit limits are established.

-

Borrowers must be aware that limitations on the borrowing period can affect cash flow.

What terms and conditions should be navigated?

Navigating the terms and conditions of a revolving line of credit helps borrowers manage their obligations and avoid unexpected charges. Key terms to be aware of include payment schedules, prepayment penalties, and conditions for cancellation. Negotiating favorable terms and understanding governing law can lead to a more manageable borrowing experience and foster a healthy relationship with the lender.

-

Know when payments are due and any associated fees to prevent defaults.

-

Finding mutually beneficial terms can enhance borrower-lender relations.

-

Understanding which jurisdiction's laws apply can assist in disputes.

How to customize your agreement with interactive tools?

Tools like pdfFiller enable users to customize their revolving line of credit agreements seamlessly. With step-by-step guides, users can easily edit, fill out, and sign documents online. The collaborative features provided by pdfFiller ensure that multiple stakeholders can draft and review the agreement, making it a preferred choice for both individuals and teams.

-

Users can efficiently modify terms and clauses in the agreement.

-

Securely sign documents without the need for physical copies.

-

Team members can work together on finalizing the document, streamlining the process.

What compliance requirements must be fulfilled?

Compliance with regional regulations is crucial for both lenders and borrowers. Each jurisdiction may have specific legal requirements that revolving credit agreements must adhere to, and understanding these can significantly affect the agreement's enforceability. Implementing best practices for compliance, from documentation to adhering to underwriting standards, ultimately protects all parties involved.

-

Different regions may have unique laws affecting credit agreements.

-

For instance, disclosures and fair lending practices are often mandatory.

-

Regular audits and legal consultations can prevent compliance issues.

What are expert tips for managing your agreement?

Effectively managing a revolving line of credit agreement is crucial for maintaining a good credit score and ensuring ongoing access to funds. Establishing a tracking system for borrowing and repayments can help retain awareness of financial health. Regular communication with your lender can also provide opportunities for improving terms and addressing any emerging issues in a timely fashion.

-

Implement systems to keep track of balances and due dates.

-

Know your payment obligations to avoid penalties and preserve credit.

-

Regular updates and communications can lead to better borrowing conditions.

How to fill out the Revolving Line of Credit Agreement Template

-

1.Start by downloading the Revolving Line of Credit Agreement Template from pdfFiller's website.

-

2.Open the template within the pdfFiller interface for editing.

-

3.Fill in the borrower’s details, including name, address, and contact information at the designated fields.

-

4.Enter the lender’s information in the appropriate sections, ensuring accuracy on both parties.

-

5.Specify the credit limit in the section provided, detailing the maximum amount available to the borrower.

-

6.Outline the interest rate and repayment terms, making sure to include any specifics regarding fees or penalties.

-

7.If applicable, add any collateral or security interests that may be necessary to secure the line of credit.

-

8.Review all entries for correctness, verifying dates and numerical figures.

-

9.Once all fields are completed, save the document and proceed to print or share as needed.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.