Risk Sharing Agreement Template free printable template

Show details

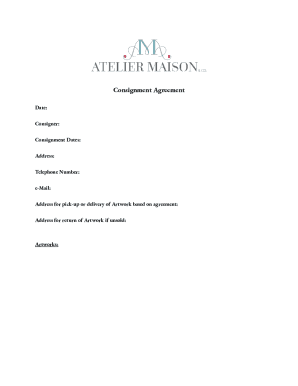

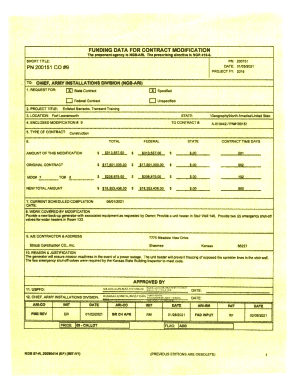

This document outlines the terms and conditions under which two parties agree to share risks associated with a project.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Risk Sharing Agreement Template

A Risk Sharing Agreement Template is a legal document that outlines the terms under which two or more parties agree to share the risks associated with a particular project or transaction.

pdfFiller scores top ratings on review platforms

Pro PDF editor

Good Performance from PDFfiller. I am satisfied with the result !!!

great!

is fantastic

REVIEW

Everything worked out fine.

great site

great site great site

VERY GOOD SOFT

Excellent customer service

Excellent customer service. The request was attended to at a very high speed and got it done. Kudos to the customer service team!

Who needs Risk Sharing Agreement Template?

Explore how professionals across industries use pdfFiller.

Risk Sharing Agreement Template Guide

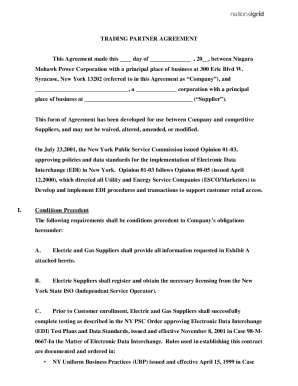

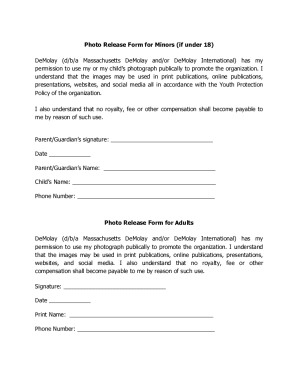

How to fill out a Risk Sharing Agreement Template form

To fill out a Risk Sharing Agreement Template form, start by clearly defining the parties involved, specifying the risks to be shared, and determining allocation methods. Ensure all terms are clearly understood, and use tools like pdfFiller for easy editing and collaboration. Complete the form with necessary eSignatures to finalize the agreement.

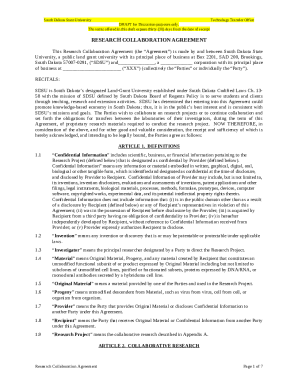

What are risk sharing agreements?

Risk sharing agreements are contracts wherein two or more parties agree to distribute potential risks associated with a specific project or operation. The purpose of these agreements is to minimize individual exposure to loss and enhance the prospects of collaboration. They are commonly used in sectors like insurance and finance, where risk is an inherent part of operations.

-

A risk-sharing agreement is a legal document that outlines how identified risks will be divided between parties.

-

Risk sharing can lead to lower premiums, collaborative solutions to issues, and improved project outcomes.

-

Risks can range from financial losses, operational mishaps, to legal liabilities.

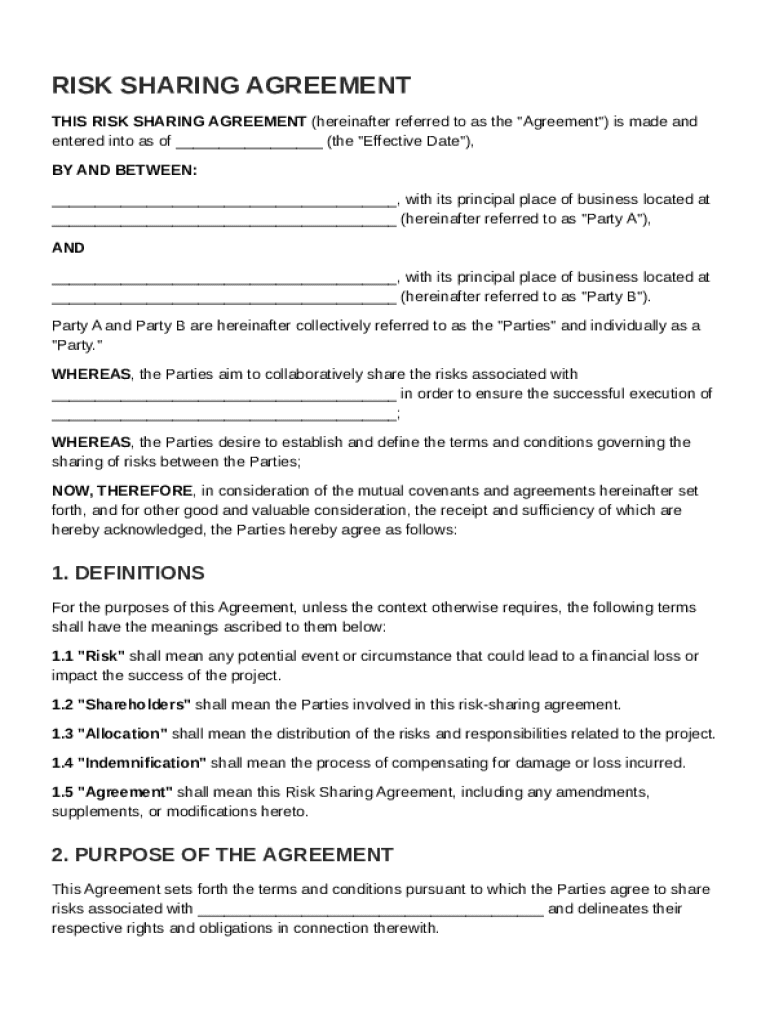

What are the key components of a risk sharing agreement?

A well-drafted risk sharing agreement includes several critical components to ensure clarity and enforceability. Identification of the parties involved lays the groundwork, while definitions of terms set the boundaries of understanding. Additionally, establishing clear goals and the scope of the agreement is paramount.

-

Clearly identify all parties to avoid confusion in obligations.

-

Terms such as 'Risk', 'Allocation', and 'Indemnification' must be defined to minimize ambiguity.

-

Specify the overarching goals and limits of the agreement to ensure all parties are aligned.

How to fill out the template step by step

Filling out the Risk Sharing Agreement Template should be methodical. You can start by entering pertinent party information, followed by defining the risks associated with the agreement. It's also essential to utilize the eSignature feature available on pdfFiller for a legally binding completion.

-

Fill in the names, addresses, and roles of each involved party.

-

Articulate the types of risks being shared and the extent of the agreement.

-

Utilize pdfFiller's eSignature tools to finalize the document digitally.

How to edit and customize your risk sharing agreement

Customization of your Risk Sharing Agreement is vital for meeting specific requirements or regulatory standards. pdfFiller offers a suite of editing tools that can help tailor your agreement to fit your particular needs, whether they are based on regional laws or specific business stipulations.

-

Leverage tools to edit text, add logos, or make changes to clauses.

-

Adjust the agreement according to unique project demands or legal requirements.

-

Utilize collaborative features in pdfFiller to get input from multiple stakeholders efficiently.

What common mistakes should be avoided?

Drafting risk-sharing agreements can often involve pitfalls that can lead to misunderstandings or disputes. Common mistakes include vague definitions, lack of clarity in terms, and insufficient legal review before signing. Avoiding these errors is critical to ensuring an effective agreement.

-

Ensure all terms are clearly defined to prevent misinterpretation.

-

Be explicit in the agreement to avoid future disputes due to ambiguity.

-

Conduct a thorough review to meet relevant legal standards before finalizing.

What legal considerations should you take into account?

Legal elements play a crucial role in the efficacy of a risk sharing agreement. It's essential to highlight significant terms and ensure legal review before signing to validate the contract. Compliance with industry norms and local regulations must also be considered to avoid any legal repercussions.

-

Include essential provisions like dispute resolution and governing law.

-

Seek expert legal advice to review terms ensuring compliance and enforceability.

-

Consider regional laws that may impact the agreement scope or requirements.

What features does pdfFiller provide for managing your agreement?

pdfFiller offers extensive features designed for managing risk sharing agreements efficiently. Its collaboration functionalities allow for seamless teamwork, while tracking changes helps in maintaining document integrity. Additionally, the platform's cloud storage facilitates easy management and access to your agreements.

-

Work together with team members or clients in real-time.

-

Monitor changes and edits made by different users in your agreement.

-

Securely store and access your agreements from any device.

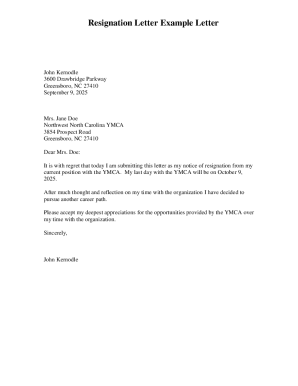

What final steps should be taken after drafting the risk sharing agreement?

After drafting your risk sharing agreement, it's vital to distribute the completed document to all parties involved. Organizing electronic copies for each stakeholder and setting reminders for regular reviews or renewals ensures that the agreement remains relevant and effective.

-

Share the finalized agreement promptly with all parties to avoid misunderstandings.

-

Maintain a clear filing system for easy reference in the future.

-

Establish a notification system for periodic reviews or necessary renewals.

How to fill out the Risk Sharing Agreement Template

-

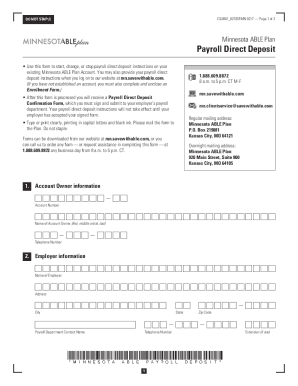

1.Download the Risk Sharing Agreement Template from pdfFiller.

-

2.Open the template in the pdfFiller editor.

-

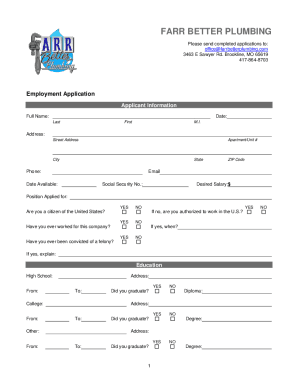

3.Begin by entering the names and contact information of all parties involved in the agreement in the designated fields.

-

4.Specify the project or transaction details being subjected to the risk-sharing agreement.

-

5.Outline the specific risks being shared and the responsibilities of each party regarding those risks.

-

6.Indicate how profits, losses, and liabilities will be allocated among the parties.

-

7.Include any terms related to dispute resolution and termination of the agreement.

-

8.Review the document for accuracy and completeness, ensuring that all necessary terms are included.

-

9.Sign the document electronically in pdfFiller, or prepare it for print if physical signatures are required.

-

10.Save and export the final version of the agreement for distribution to all parties involved.

What is a risk sharing agreement?

Risk-sharing contracts are agreements between parties that outline how risks and potential losses will be distributed among them.

What is a risk sharing arrangement?

An arrangement involving a provider, calling for payments to or from the provider where the payment is not related to a specific service performed by that provider, and the payment is contingent upon certain financial or operational goals being achieved.

What is an example of risk sharing?

What are examples of risk sharing? The most common example of risk sharing is when an individual or a business purchases insurance to help share financial risk like property damage.

What is the difference between risk sharing and risk transfer?

While the transfer of risk involves transferring risk to another individual or entity for a price, risk sharing involves sharing or dividing a common risk among two or more persons.

What is a risk sharing contract?

A risk sharing agreement is an insurance contract where the insurer and insured agree to share any financial risks associated with a particular event. Risk sharing agreements are typically used when one party cannot afford to insure themselves against all of the possible risks they face.

What is the difference between MOU and data sharing agreement?

Data Sharing Agreement (DSA) While the MOU is a broad document that names the purpose, partners, and guiding principles of a data integration effort, the DSA includes the specific terms and conditions that govern how specific data are transferred, stored, and managed when shared and integrated within the IDS.

How to write an information sharing agreement?

Your agreement should set out the types of data you are intending to share. This is sometimes known as a data specification. This may need to be detailed, because in some cases it will be appropriate to share only certain information held in a file about an individual, omitting other, more sensitive, material.

How to make a written agreement template?

How to draft a contract in 13 simple steps Start with a contract template. Understand the purpose and requirements. Identify all parties involved. Outline key terms and conditions. Define deliverables and milestones. Establish payment terms. Add termination conditions. Incorporate dispute resolution.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.