SBA Loan Authorization and Agreement Template free printable template

Show details

This document establishes the terms and conditions governing the loan provided to the Borrower by Lender, detailing obligations, rights, and responsibilities of both parties in accordance with SBA

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is SBA Loan Authorization and Agreement Template

The SBA Loan Authorization and Agreement Template is a document that outlines the terms and conditions of a loan provided by the Small Business Administration (SBA).

pdfFiller scores top ratings on review platforms

Program easy to use and the support is easy to access with fast response!

I really enjoy that you can take care of all my document needs on this one site

great. easy to use. convenient. would recommend.

Thanks for the help, PDF filler was easy to use.

I LOVE IT ALREADY...MAKES LIFE SO MUCH EASIER.

I do like this helper. Easy to use. I will try this tool for a couple of months.

Who needs SBA Loan Authorization and Agreement Template?

Explore how professionals across industries use pdfFiller.

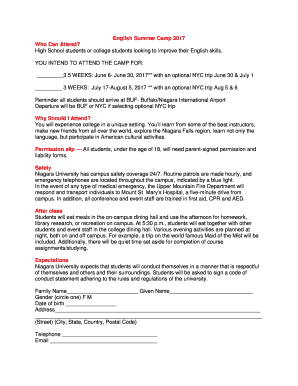

How to fill out an SBA Loan Authorization and Agreement Template form

What is an SBA Loan Authorization and Agreement?

An SBA Loan Authorization and Agreement is a formal document that connects borrowers and lenders within the framework of Small Business Administration (SBA) loans. It outlines the terms and conditions agreed upon by both parties, facilitating a mutual understanding of all parties' obligations. This agreement is crucial for ensuring that the loan process goes smoothly and that all legal and financial responsibilities are clear.

-

It defines the legal framework for lending backed by the SBA, providing security for both borrower and lender.

-

It ensures clarity on loan terms, conditions, and expected behaviors, majorly reducing uncertainties.

-

Familiarizing oneself with the agreement and its components is vital for successful loan acquisition.

Who are the key participants in the Agreement?

The main participants in the SBA Loan Authorization Agreement are the borrower and the lender. Each party plays a vital role in the success of the loan process.

-

The borrower is primarily responsible for repaying the loan according to the specified terms.

-

Lenders are responsible for providing the funds and ensuring compliance with SBA rules.

-

Clear roles help prevent misunderstandings and ensure the loan proceeds as planned.

What are the core components of the Loan Agreement?

Each loan agreement consists of several essential components that detail the specifics of the loan terms. Understanding these components is crucial for both parties involved.

-

The loan amount includes not only the principal sum but also terms that define payment structure.

-

The loan term specifies the duration within which the loan must be repaid.

-

The interest rate affects the total cost of the loan and can vary based on the lender's conditions.

-

Collateral provides security to the lender in case the borrower defaults on repayment.

How to ensure compliance with loan purpose?

Using SBA loan proceeds correctly is imperative for ensuring compliance and avoiding potential issues. Misuse can lead to severe ramifications.

-

Funds must be used for business purposes aligned with SBA regulations, such as purchasing equipment or real estate.

-

Misleading use of funds can lead to loan default, legal action, or loss of government backing.

-

Any intended changes to loan use must be documented and approved by the lender.

How to complete the Agreement step by step?

Completing the SBA Loan Authorization and Agreement requires careful attention to detail and understanding of the provided fields.

-

Follow the outlined steps meticulously to ensure all necessary information is filled correctly.

-

Ensure all sections are accurate, as errors can lead to processing delays or rejections.

-

pdfFiller offers intuitive tools for easy editing, collaboration, and eSignature.

What interactive tools aid in document management?

Efficient document management can enhance the entire loan process, and pdfFiller excels in providing necessary resources.

-

The platform allows multiple parties to sign documents electronically, saving time and enhancing convenience.

-

Users can easily share documents for collaborative input, ensuring all voices are heard.

-

Post-signature management tools help store, access, and track changes to the document.

What variations exist in the SBA Loan Authorization Agreement?

Understanding the different SBA loan agreements is essential, as each comes with unique stipulations and focuses.

-

Each type of SBA loan serves different business needs, and it’s crucial to select the right one.

-

SBA loans may have varied guidelines and requirements based on state and regional regulations.

-

pdfFiller provides a searchable database of forms tailored to specific loan types.

What final steps should be expected post-agreement?

Understanding the loan agreement's aftermath is crucial for maintaining compliance and ensuring proper follow-through.

-

You'll begin the repayment process, which is crucial for maintaining a good relationship with the lender.

-

Failure to adhere can result in penalties or even a default status on the loan.

-

Maintaining regular communication helps keep all parties informed and engaged throughout the loan's life.

How to fill out the SBA Loan Authorization and Agreement Template

-

1.Download the SBA Loan Authorization and Agreement Template from a reliable source or pdfFiller.

-

2.Open the PDF in pdfFiller to begin editing.

-

3.Start by entering the borrower’s name and contact information in the designated fields.

-

4.Fill in the loan amount and the purpose of the loan as specified in the agreement section.

-

5.Complete the repayment terms, including the interest rate and payment schedule, according to the loan details.

-

6.Provide information on any collateral required by the SBA or financial institution.

-

7.Review the section detailing the fees associated with the loan, ensuring accuracy.

-

8.Fill out any personal or business guarantees requested in the template.

-

9.Double-check all information for accuracy and completeness before signing.

-

10.Once completed, save the document in pdfFiller and optionally share it with relevant parties for review or approval.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.