Last updated on Feb 17, 2026

Borrow Contract Template free printable template

Show details

This document outlines the terms and conditions for borrowing items or money between a Lender and a Borrower, including definitions, loan details, repayment terms, and responsibilities of both parties.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Borrow Contract Template

A Borrow Contract Template is a legally binding document establishing the terms and conditions under which one party borrows money or assets from another party.

pdfFiller scores top ratings on review platforms

I really like the application a lot. I am finding the fact that you do not have a field value setting which comes in handy for allowing a Check Mark to have a Value and Calculate costs based on Check Marks or Drop Down Menus. I also would love a copy and paste a single field, this comes in handy for repetitive drop down menus. Prepopulating a field from an earlier field value would be great in helping people not have to enter same information more than once.

makes life much easier when I can type information into forms

Today is first time using, so far so good!

Have been able to add signatures change dates and update pertinent information on the documents. Have not used extensively, but have been able to do everything I wanted so far. Good product!

Small business owner, impulse bought PDF filler in a time crunch, would like to learn more so as to reconcile the purchase

THIS FORM MADE THE PROCESS EASY TO FOLLOW. I WILL USE IT AGAIN.

Who needs Borrow Contract Template?

Explore how professionals across industries use pdfFiller.

Borrow Contract Template Guide

How to efficiently fill out a Borrow Contract Template form?

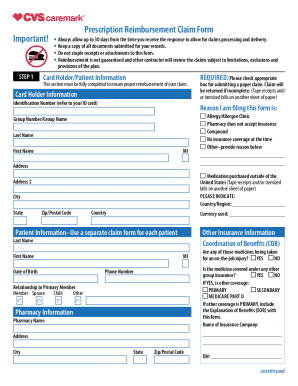

Filling out a Borrow Contract Template begins with clearly defining the roles of the lender and borrower, alongside crucial terms like loan amount and repayment structure. Start by gathering all necessary information, such as financial details and personal data, to ensure accuracy. Leverage digital platforms like pdfFiller to edit, sign, and manage your document seamlessly.

What are Borrow Contracts?

A Borrow Contract serves as a formal agreement outlining the terms of a loan between a lender and a borrower. The purpose of this contract is to ensure that both parties are on the same page regarding the loan details, which enhances trust and accountability. Borrow Contracts differ significantly from verbal agreements, as they provide legal protection and a clear reference for the terms agreed upon.

-

A Borrow Contract defines the expectations of both the lender and borrower, outlining responsibilities and minimizing the risk of disputes.

-

A written agreement serves as a legal document that can be presented in court if necessary, ensuring obligations are met.

-

Unlike verbal agreements, Borrow Contracts create a physical record that is harder to contest; they specify terms in writing, enhancing clarity.

What are the key components of a Borrow Contract?

Understanding the main elements of a Borrow Contract is critical for both parties involved. These components dictate how the loan is structured and repaid, ensuring clarity and minimizing misunderstandings.

-

The lender is the party providing the funds, while the borrower is responsible for repayment. Understanding these roles is essential to establish clear responsibilities.

-

It is vital to specify the total amount borrowed, ensuring both parties agree on what is being lent.

-

The contract should clarify if the interest is fixed or variable, along with how it will be calculated.

-

Setting an agreed-upon due date for payments helps both parties stay accountable to the established repayment schedule.

How do you define terms in your Borrow Contract?

Clear definitions in your Borrow Contract prevent confusion and disagreements later. While terms may seem basic, their implications can be vast if not articulated properly.

-

Everyone involved should understand terms like 'Lender' and 'Borrower', which designate responsibilities and expectations.

-

Using exact wording helps mitigate risks associated with misinterpretation, which can lead to disputes.

-

Key financial details such as 'Interest Rate' and 'Due Date' must be discussed thoroughly to ensure mutual understanding.

What is included in a Detailed Loan Information Section?

The Detailed Loan Information Section provides specifics about the loan, its conditions, and its value, enhancing transparency.

-

Clearly define the items or services being loaned, including details about their condition and any accompanying warranties.

-

Provide loan amounts in both numeric and written formats to prevent discrepancies.

-

Incorporating specific starting and ending dates for the loan term establishes clear time frames for obligations.

How to establish repayment terms?

Creating a mutually agreeable repayment schedule is essential for maintaining a good lender-borrower relationship. This process includes outlining how the payments will be made, their frequency, and the total amount.

-

Both parties should agree on a schedule that accommodates their financial situations.

-

Options may include weekly, bi-weekly, or monthly payments, and should be chosen based on what works best for both.

-

Determine payment sizes that are manageable for the borrower and fair for the lender to maintain trust.

How can you utilize pdfFiller for your Borrow Contract?

Utilizing platforms like pdfFiller simplifies the process of managing Borrow Contracts. This cloud-based solution supports remote collaboration and makes document management effortless.

-

Users can easily find and edit the Borrow Contract Template by navigating the intuitive interface on pdfFiller.

-

Both lenders and borrowers can work together in real-time, ensuring that both parties are constantly informed and involved.

-

Its built-in eSignature feature allows users to sign documents online, streamlining the finalization process.

What is the comparative analysis with other documents?

An understanding of how Borrow Contracts differ from other financial documents can clarify their unique benefits.

-

While both serve as loan management tools, a Loan Agreement typically contains more detailed provisions than a Promissory Note.

-

These agreements are typically more formal and detailed, involving larger amounts and specific business risks.

-

An I Owe You note is less formal and may not hold up as well legally, while a Borrow Contract provides clear terms and conditions.

How to fill out the Borrow Contract Template

-

1.Download the Borrow Contract Template from pdfFiller.

-

2.Open the template in the pdfFiller editor.

-

3.Fill in the borrower's information, including their full name and address.

-

4.Enter the lender's details, ensuring to include their name and contact information.

-

5.Specify the amount being borrowed in the designated field.

-

6.Set a clear repayment schedule by outlining payment dates and amounts.

-

7.Include any applicable interest rates or fees associated with the loan in their respective sections.

-

8.Outline the terms of the loan, including usage of the borrowed amount and any collateral if applicable.

-

9.Review all the filled information for accuracy and completeness.

-

10.Save the document and either print it or send it electronically to the other party for signing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.