Car Loan Contract Template free printable template

Show details

This document outlines the terms and conditions of a loan provided by a lender to a borrower for the purpose of purchasing a vehicle.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Car Loan Contract Template

A Car Loan Contract Template is a legal document detailing the terms and conditions under which a borrower agrees to repay a loan for purchasing a vehicle.

pdfFiller scores top ratings on review platforms

Great in filling out forms.

Great in filling out forms.

very helpful tools

very helpful tools

EASY USE

EASY USE AND FRIENDLY WINDOWS

fantastic

PDF filter is fantastic , I dont have to print and scan , just sighn all doc here

I am not great with technology

I am not great with technology, and I found this program very easy to use. I am so grateful that you had the ordinary person in mind when establishing "pdf Filler."

good

Very good application

Who needs Car Loan Contract Template?

Explore how professionals across industries use pdfFiller.

Car Loan Contract Template form

Filling out a Car Loan Contract Template form involves understanding various components of the agreement, such as defining loan terms, setting payment schedules, and the rights of each party. This guide provides you with insights into each section of the contract and how to effectively manage the document using pdfFiller.

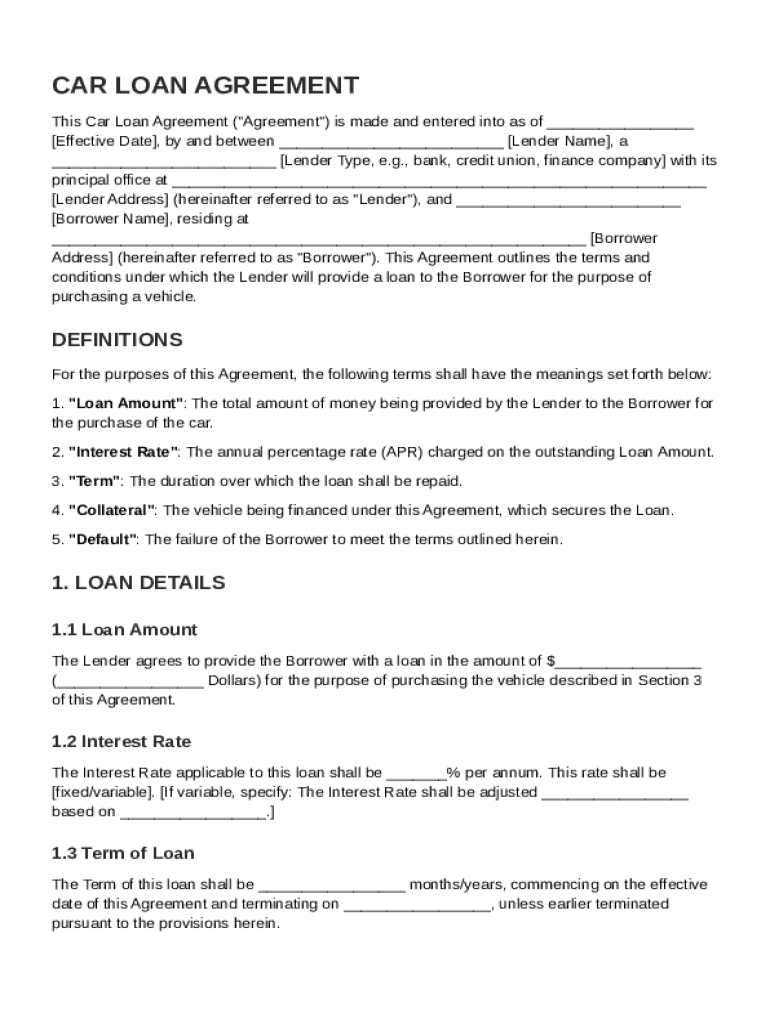

What is a Car Loan Agreement?

A Car Loan Agreement is a legally binding contract between a lender and a borrower concerning the loan amount for purchasing a vehicle. It is crucial to have this formal agreement in place to protect the rights of both parties and to outline the responsibilities and terms associated with the loan.

-

The financial institution or individual providing the loan.

-

The individual or entity seeking the funds to buy the vehicle.

What are the key terms of a Car Loan Agreement?

-

This is the total sum of money needed to purchase the vehicle.

-

The annual percentage rate (APR) that determines how much you will pay extra for borrowing the money.

-

This refers to the duration you have to repay the loan, often expressed in months or years.

-

The vehicle serves as collateral, meaning the lender can claim it if the borrower fails to repay the loan.

-

Failure to meet the terms of the agreement can lead to serious consequences, including the loss of the vehicle.

How do you break down your loan details?

-

Clearly state the loan amount needed and ensure you validate this with the lender.

-

Understand the difference between fixed and variable rates to make an informed choice. Fixed rates stay the same, while variable rates can fluctuate.

-

Determine the right loan duration based on your financial situation and how quickly you can repay.

-

Calculate your monthly payments based on the total loan amount, interest rate, and duration.

What are the payment terms to consider?

-

It’s important to compute an accurate monthly amount to avoid difficulties in meeting payment deadlines.

-

Establish a payment schedule that aligns with your financial planning.

-

Missing payments can lead to late fees, and in severe cases, repossession of the vehicle.

How can you utilize pdfFiller for Car Loan Agreements?

-

Easily upload your Car Loan Contract Template to pdfFiller to begin editing or signing.

-

Adjust fields and sections within the document to ensure all information is accurate and complete.

-

Conveniently sign agreements digitally, avoiding delays associated with traditional signing.

-

Share the document for collaborative reviews, ensuring all parties are on the same page.

Where can find sample Car Loan Agreements?

-

Review examples to understand the structure and necessary elements of a solid Car Loan Agreement.

-

Analyze how agreements may differ across various lenders to find the best fit for you.

-

Learn how to adapt your contract based on specific lender requirements for a smoother process.

What legal considerations should you be aware of?

-

Become familiar with laws governing car loans in your state to avoid pitfalls.

-

Understand your rights under car loan agreements to ensure fair treatment throughout the loan process.

-

Always document any additional agreements or amendments to the original loan terms in writing.

How to fill out the Car Loan Contract Template

-

1.Access pdfFiller and upload the Car Loan Contract Template.

-

2.Begin by entering the borrower’s full name in the designated field.

-

3.Fill in the lender’s name and contact details next.

-

4.Specify the total loan amount being borrowed for the vehicle purchase.

-

5.Indicate the interest rate and loan term (in months or years).

-

6.Provide a detailed description of the vehicle including make, model, year, and VIN.

-

7.Outline the payment schedule, including due dates and amounts.

-

8.Include any additional terms such as late fees, early repayment penalties, and insurance requirements.

-

9.Review the entire document for accuracy and completeness before signing.

-

10.Save and download the completed contract for your records.

How to create a loan contract?

There are 10 basic provisions that should be in a loan agreement. Identity of the parties. The names of the lender and borrower need to be stated. Date of the agreement. Interest rate. Repayment terms. Default provisions. Signatures. Choice of law. Severability.

How to write a borrow money letter?

To improve the chances of loan approval, consider loan guidelines carefully, detail the reasons for the loan, attach supporting documentation, outline the requested loan amount and repayment plan, and maintain a polite, professional tone throughout the letter.

How do I write a personal loan contract agreement?

Preparing to Draft Your Personal Loan Agreement Gather Essential Information. Consult Legal and Financial Experts. Identifying the Parties Involved. Determining the Loan Amount and Purpose. Loan Purpose. Setting the Interest Rate and Repayment Terms. Default and Late Payment Penalties. Modifying and Terminating the Agreement.

Does a loan agreement need to be witnessed in the UK?

Witnesses aren't legally required when signing a loan agreement. However, either party may want to record a witness to prove the validity of the document should it ever be disputed.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.