Last updated on Feb 17, 2026

Cash Receipt Contract Template free printable template

Show details

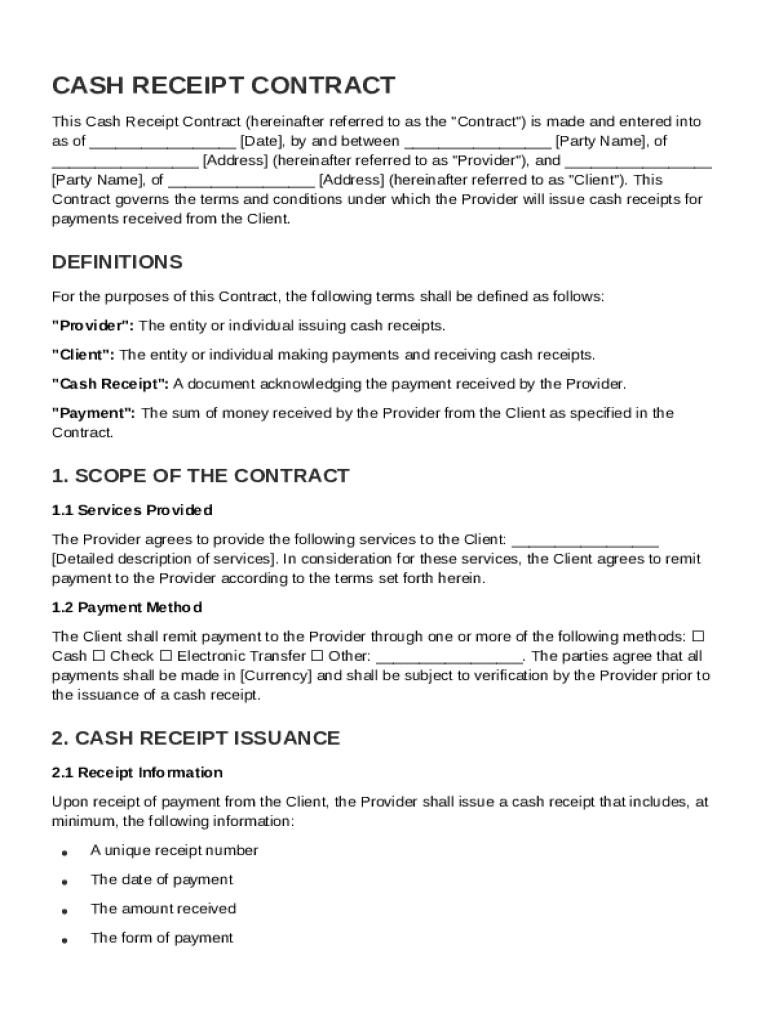

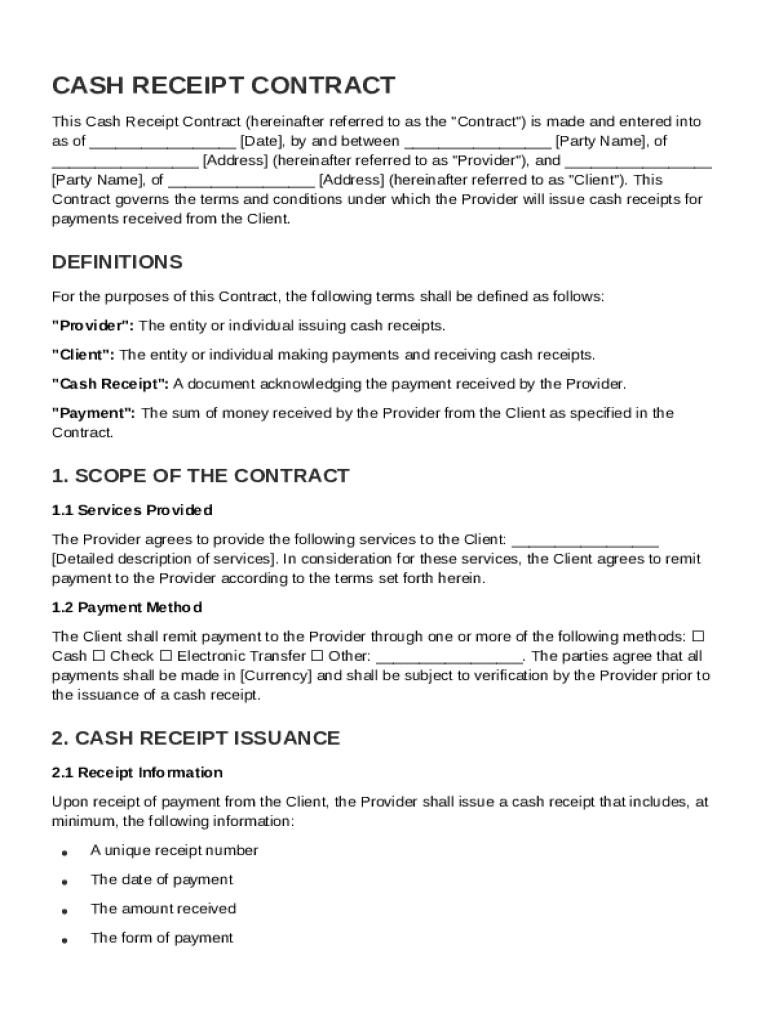

This document outlines the terms and conditions for issuing cash receipts between a Provider and a Client for payments received.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Cash Receipt Contract Template

A Cash Receipt Contract Template is a formal document used to acknowledge the receipt of cash for goods or services rendered.

pdfFiller scores top ratings on review platforms

I am not computer savy but your format…

I am not computer savy but your format was pretty easy to follow,

no complaints

no complaints. all good.

Great Program

Great Program

Initially was difficult but then manged…

Initially was difficult but then manged it

This has been a godsend!!!!

This has been a godsend!!!!

I had a refund issue and the team was…

I had a refund issue and the team was very reactive.

Problem solved in 5 minutes.

Shout out to Shaneen you are great.

Who needs Cash Receipt Contract Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Cash Receipt Contract Templates at pdfFiller

What is a cash receipt contract?

A cash receipt contract is a formal agreement outlining the transfer of funds from a client to a provider in exchange for goods or services. It serves not only as proof of payment but also as a record for future reference and legal purposes. Understanding this type of contract is crucial for both parties to ensure clarity and accountability.

-

A cash receipt contract documents a transaction where cash is exchanged, ensuring a mutual understanding of payment terms.

-

These contracts can have significant legal implications, protecting both parties in case of disputes.

-

Cash receipt contracts are often used in retail, service industries, and any other situation where immediate payment is made.

What are the essential components of a cash receipt contract?

A well-crafted cash receipt contract includes several key components that protect both the provider and the client. These elements are vital for establishing clarity in the terms of the transaction and ensuring a comprehensive understanding of obligations.

-

Clearly define terms such as Provider, Client, Cash Receipt, and Payment to avoid ambiguity.

-

Essential information like transaction amount, date, and descriptions of goods/services must be included.

-

The contract should be drafted clearly to explain all terms and conditions to prevent misunderstandings.

How do you fill out your cash receipt contract?

Filling out a cash receipt contract involves several steps that require attention to detail. By following a structured process, one can ensure all necessary information is correctly captured for the transaction.

-

Each section of the contract should be approached systematically, starting with the provider's information.

-

Adapt the template according to specific transaction details to maintain accuracy.

-

Referring to a sample cash receipt contract can provide clarity and simplify the process.

How can pdfFiller enhance your cash receipt contract management?

pdfFiller offers interactive tools that streamline the creation and management of cash receipt contracts. By leveraging these capabilities, users can edit, eSign, and collaborate effectively on their contracts.

-

Easily modify any part of your cash receipt contract using pdfFiller’s editing features.

-

pdfFiller facilitates signing and collaborative efforts, allowing multiple parties to engage with the document seamlessly.

-

Store and manage your completed documents securely within pdfFiller's cloud-based platform.

What are key considerations for payment methods and receipt issuance?

Understanding payment methods and the timeliness of receipt issuance is crucial for both parties in a cash transaction. This knowledge can promote trust and efficiency in business dealings.

-

Common payment forms include cash, check, and electronic transfers, each with its own pros and cons.

-

The receipt must include important details such as the transaction date, amount paid, and payment method.

-

Issuing the receipt promptly post-transaction reinforces good practice and accountability, ensuring both parties have confirmation.

What are alternatives to traditional cash receipt contracts?

In an increasingly digital world, exploring alternatives to cash receipt contracts is becoming more common. Several options can provide different benefits depending on the context of the transaction.

-

Different receipt types may be more suitable than standardized cash receipt contracts, depending on specific needs.

-

Alternative documentation options can be explored for more complex transactions or when a cash receipt does not suffice.

-

Switching to digital receipts via services like pdfFiller enhances convenience and accessibility while reducing physical paperwork.

How do digital receipts maximize efficiency?

Transitioning to digital receipts can significantly enhance efficiency in record-keeping and management. This shift offers many advantages that traditional paper records cannot match.

-

Digital receipts save physical space and are easier to search and manage compared to paper documents.

-

pdfFiller's features help speed up the receipt management process with interactive tools and storage options.

-

Implementing a structured approach when transitioning to digital solutions can help mitigate challenges and streamline the process.

How to fill out the Cash Receipt Contract Template

-

1.Open the Cash Receipt Contract Template on pdfFiller.

-

2.Enter the name of the recipient who received the cash in the designated field.

-

3.Fill in the date of the transaction, ensuring it aligns with the day the cash was received.

-

4.Specify the amount of cash received, using clear numerical formatting for easy understanding.

-

5.Describe the purpose of the payment, detailing the service or product associated with the cash receipt.

-

6.Add the name and signature of the payer, confirming the transaction and its validity.

-

7.Make sure to include the payment method (e.g., cash, check, etc.) in the appropriate section.

-

8.Review the completed template for accuracy, ensuring all fields are filled correctly before finalizing.

-

9.Save the document in your desired format (PDF or Word) for your records and provide a copy to the payer if necessary.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.