Get the free Private Pension Plan Bulletin

Get, Create, Make and Sign private pension plan bulletin

Editing private pension plan bulletin online

Uncompromising security for your PDF editing and eSignature needs

How to fill out private pension plan bulletin

How to fill out private pension plan bulletin

Who needs private pension plan bulletin?

Comprehensive guide to the private pension plan bulletin form

Understanding the private pension plan bulletin

Private pension plans serve as essential retirement provisions for many individuals, enabling them to save and invest funds which will provide income during retirement. A crucial aspect of these plans is the bulletin, which acts as a channel for communicating vital information to both beneficiaries and administrators. The importance of this bulletin cannot be overstated, as it ensures transparency, clarity, and adherence to legal requirements.

The bulletin provides information relating to benefits, contributions, changes in plan terms, and other pivotal updates. With regular updates, it keeps all stakeholders informed, ensuring they understand their rights and responsibilities. Thus, understanding the components of the bulletin is fundamental for anyone involved with a private pension plan.

Overview of the private pension plan bulletin form

The private pension plan bulletin form serves a multi-faceted purpose, primarily focusing on compliance with legal obligations and effectively communicating crucial information to beneficiaries and plan administrators. Filling out this form is not just a procedural formality but a significant step in the responsible management of pension plans. It highlights updates on funding status, benefit changes, and legal compliance, making it essential for all stakeholders involved.

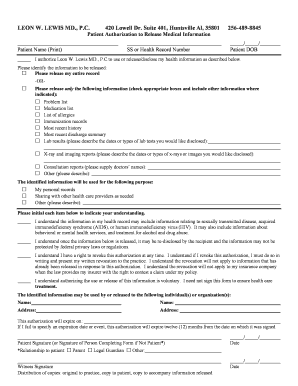

Eligibility for completion of the private pension plan bulletin form typically includes plan administrators, employers, and in some cases, beneficiaries themselves. It is crucial for individuals to understand who needs to fill it out and the situations that trigger the requirement for the form to ensure everyone’s awareness and adherence to stipulated timelines.

Steps to complete the private pension plan bulletin form

The first step in completing the private pension plan bulletin form involves collecting all necessary personal information. Individuals will need their name, address, contact information, and relevant pension plan details. Moreover, financial data such as contributions made, employer matches, and previous benefit amounts will also be needed. This comprehensive collection is vital to ensure accuracy and compliance with evolving regulations.

Once this information is gathered, the form must be filled out meticulously. Each section requires a detailed approach: Section 1 will request basic personal information and must be free from typos; Section 2 pertains to pension plan details, which necessitates careful input to avoid common pitfalls such as incorrect plan IDs or outdated benefit information; finally, Section 3 includes certifications and acknowledgments, reinforcing the responsibility and accuracy of the provided details.

Editing and managing the private pension plan bulletin form

Utilizing tools like pdfFiller can significantly enhance the editing and management process of the private pension plan bulletin form. These tools come equipped with features that allow users to edit PDF documents directly, collaborate with team members in real time, and apply templates that streamline form completion. This not only saves time but also reduces the margin of error.

To begin, accessing pdfFiller’s editing tools is straightforward. Users can upload the completed bulletin form or select from pre-existing templates. The auto-fill feature simplifies data entry, ensuring that less manual input is required, thereby minimizing errors. Collaboration functions allow multiple users to provide feedback or make changes without confusion, promoting a thorough review process before final submission.

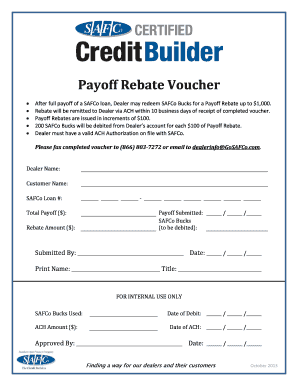

Signing the bulletin form

The importance of e-signatures in ensuring compliance with legal protocols cannot be understated when it comes to the private pension plan bulletin form. Making use of pdfFiller’s eSignature feature allows users to electronically sign documents securely. This process confirms the authenticity of the submission while streamlining timelines, eliminating the need for traditional paper signatures and physical document exchanges.

Signing electronically through pdfFiller is straightforward: users can click the 'Sign' button, choose to draw their signature, upload an image of their signature, or select a pre-made signature. This flexibility ensures that the process remains accessible, while also maintaining the legal validity required for submissions to regulatory bodies.

Submission and follow-up process

Once the private pension plan bulletin form is completed and signed, the next phase is submission. Various submission methods are available, including online platforms, postal mail, or even in-person delivery to relevant offices. Understanding the designated submission method is crucial, as it impacts how quickly the form can be processed and the subsequent actions required.

Post-submission, tracking the status of your form is equally important. This can often be done through online portals provided by the plan administrator or relevant government agencies. Maintaining a proactive approach ensures that any updates or requests for additional information are addressed promptly, thus preventing unnecessary delays.

Common issues and troubleshooting

While completing the private pension plan bulletin form might seem straightforward, there are several common issues that individuals may encounter. These can include missing information, incorrect details, and even issues with submission protocols. Addressing these problems promptly can save significant time and effort in the long run, ensuring compliance and avoiding penalties.

In cases of missing or incorrect information, the first step is to refer to the form instructions for guidance. Resources, including customer service from pdfFiller, can provide clarity and advice on resolving any issues. Understanding how to rectify these common pitfalls can help streamline the process and ultimately lead to successful document completion.

Best practices for using the private pension plan bulletin form

When utilizing the private pension plan bulletin form, certain best practices can enhance accuracy and compliance. Keeping abreast of evolving regulations is vital, as pension plan requirements can change. Regular reviews of the provided information can prevent issues that arise from outdated data, ensuring that all parties remain aligned with current regulations.

Moreover, leveraging pdfFiller's features for long-term document management can assist in maintaining compliance over time. Storing and organizing forms digitally allows for easier access when required, enabling proactive management of any necessary updates or filings.

Case studies and examples

Illustrative examples of completed private pension plan bulletin forms can highlight the critical importance of accurate filings. For instance, in a case where an individual accurately filled out their bulletin form, they experienced seamless communication with their pension plan administrator, allowing for timely access to benefits and updates. Conversely, another case where inaccuracies led to delays showcases the potential ramifications of errors in such filings.

Furthermore, testimonials from users who effectively utilized pdfFiller to manage their documents illustrate the platform’s impact on efficiency. Many have shared how the use of templates, editing tools, and real-time collaboration has made filling out and submitting forms an achievable task, thereby enhancing their document management strategy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send private pension plan bulletin to be eSigned by others?

How can I edit private pension plan bulletin on a smartphone?

How do I fill out private pension plan bulletin using my mobile device?

What is private pension plan bulletin?

Who is required to file private pension plan bulletin?

How to fill out private pension plan bulletin?

What is the purpose of private pension plan bulletin?

What information must be reported on private pension plan bulletin?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.