Get the free Cigarette Tax Stamp Purchase Order - cfo dc

Get, Create, Make and Sign cigarette tax stamp purchase

How to edit cigarette tax stamp purchase online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cigarette tax stamp purchase

How to fill out cigarette tax stamp purchase

Who needs cigarette tax stamp purchase?

Cigarette Tax Stamp Purchase Form: A Comprehensive Guide

Understanding cigarette tax stamps

Cigarette tax stamps are essential markers used by state and federal governments to indicate that the appropriate taxes on tobacco products have been paid. These stamps serve multiple purposes, including helping authorities monitor and enforce compliance with tax regulations, preventing tax evasion, and ensuring that consumers are paying the legally mandated taxes on their purchases. In essence, they act as proof of tax payment, making it easier for regulatory bodies to track and collect revenues.

The significance of these stamps extends beyond compliance; they also help regulate the tobacco market, providing a clear indication of legal sales. In cases where retailers do not possess the necessary tax stamps, they may face substantial penalties or even legal ramifications for their actions. Thus, understanding the role of cigarette tax stamps is crucial for those involved in tobacco sales, whether as manufacturers, distributors, or retailers.

Navigating the cigarette tax stamp purchase process

Acquiring cigarette tax stamps necessitates that applicants meet specific eligibility criteria. Generally, any individual or business dealing with the distribution or sale of tobacco products can apply for tax stamps. However, it's essential for applicants to provide appropriate documentation to verify their business operations and compliance with local laws. Typical documents include business licenses, tax identification numbers, and sometimes proof of previous tax payments.

When applying for tax stamps, applicants have the choice between online and paper forms. Utilizing pdfFiller's platform enables an efficient online application process, streamlining your experience and minimizing potential errors. The digital format is not only user-friendly but also offers real-time validation, ensuring that your submissions are accurate before sending them off.

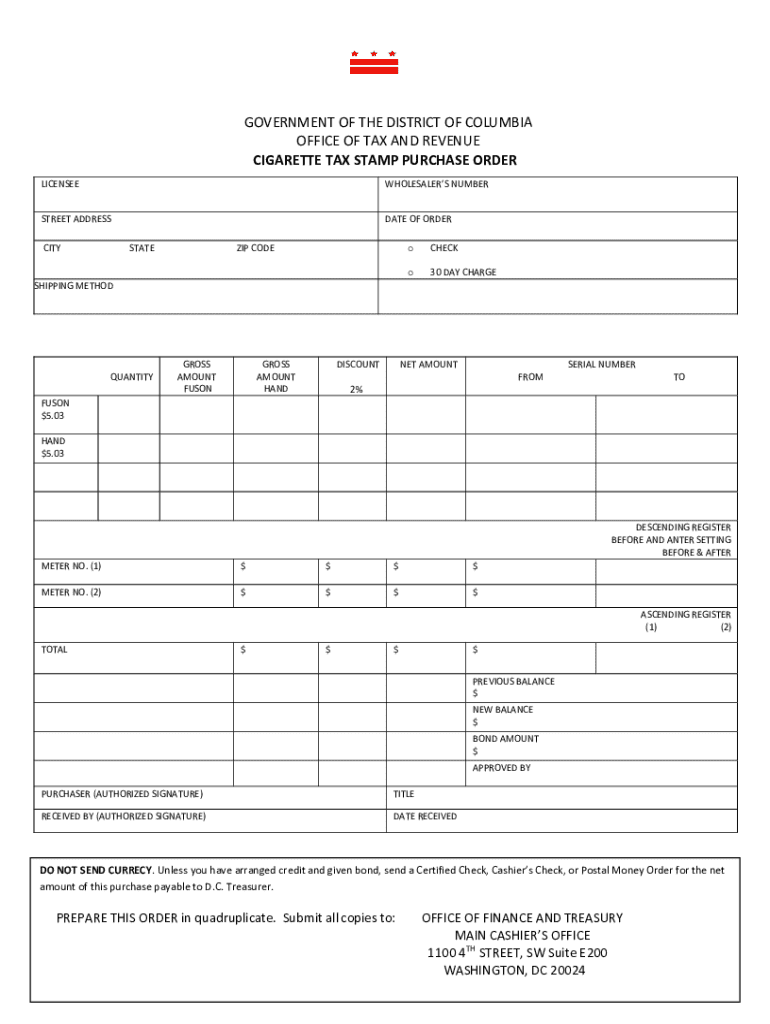

Step-by-step guide to completing the cigarette tax stamp purchase form

To begin, locate the official cigarette tax stamp purchase form. This can usually be found on your local tax authority's website or directly through pdfFiller's extensive database. Tip: Use the search feature within pdfFiller to quickly find the right form without sifting through numerous documents.

Filling out the form accurately is crucial to avoid delays. Essential sections to complete include your name, business name, and contact information. You’ll also need to specify the quantity and type of stamps you are requesting, as well as include payment information. Error avoidance is key here, and ensuring all information is complete and accurate will facilitate a smooth processing experience.

Utilizing pdfFiller's features for an efficient purchase experience

pdfFiller empowers users to enhance their document editing and signing experience significantly. Within the platform, you can edit and customize your cigarette tax stamp purchase form effortlessly. Features such as text boxes, highlighting, and annotation tools allow you to ensure clarity and precision in your submissions.

Utilizing eSignatures can significantly expedite the verification and approval process of your documents. Moreover, pdfFiller's collaboration capabilities enable multiple stakeholders to work on the form simultaneously, perfect for businesses that require input from various team members. This encourages a seamless workflow and reduces the chances of miscommunication.

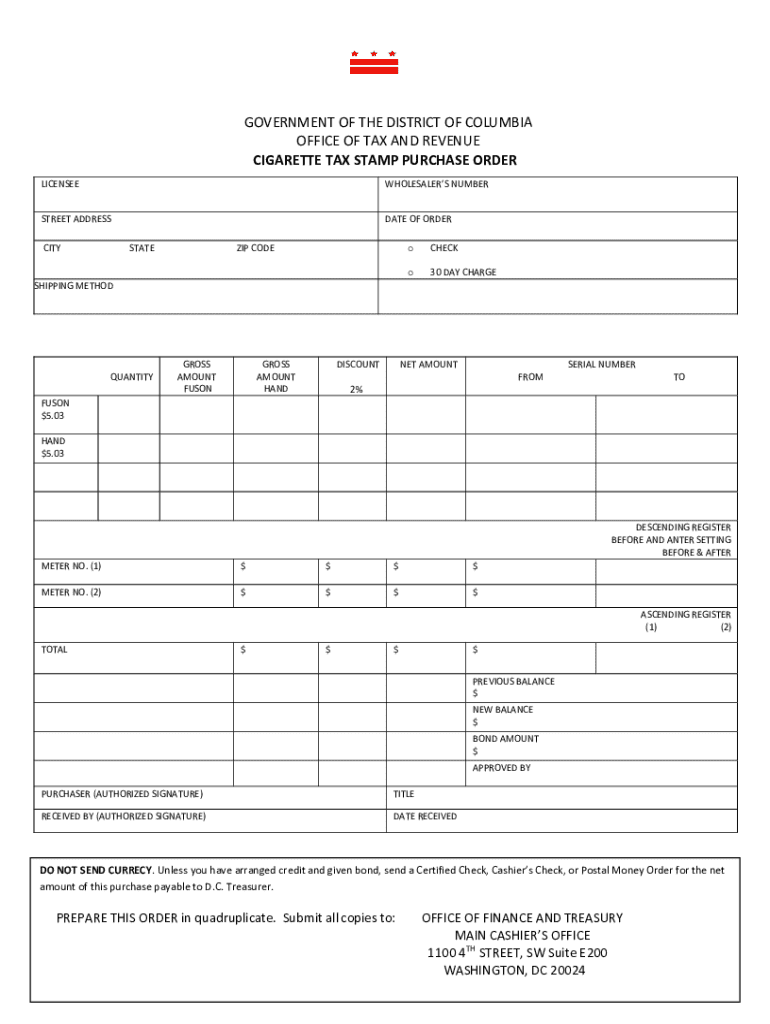

Managing your submission and tracking progress

After filling out the cigarette tax stamp purchase form, understanding the submission process is key. Options typically include electronic submission via email or direct upload on the state's tax authority portal. Regardless of the method you choose, always confirm that you receive a submission receipt as proof of your application.

Tracking the application status can generally be done via the same portal you used for submission or through customer service provided by the tax authority. It's important to stay aware of processing times, which can vary from state to state, and follow up if necessary to ensure your application is on track.

Cost considerations and fees

Acquiring cigarette tax stamps involves certain costs, which can vary based on location and the quantity of stamps requested. Typically, the fees are calculated based on the number of stamps and the predetermined state tax rates. It's crucial to be aware of these costs so that you can plan your budget accordingly.

Payment methods may include credit cards, electronic transfers, or checks, with options available via pdfFiller for seamless payment processing. Additionally, understanding potential penalties for non-compliance, such as the absence of required stamps, can help mitigate risks and ensure complete compliance with regulations.

FAQs about cigarette tax stamp purchases

When engaging in the process of purchasing cigarette tax stamps, many applicants have questions and concerns. One frequently asked question pertains to the next steps if your application is rejected. Typically, applicants should review the reasons for rejection, correct any issues, and resubmit as promptly as possible.

Another common concern is whether an application can be amended after submission. Generally, it's advisable to consult with the issuing authority for guidance on how to correct or amend your application effectively.

Regulatory compliance and staying informed

Compliance with both state and federal regulations concerning cigarette tax stamps is crucial for any tobacco distributor or retailer. Regulations often change, affecting both tax rates and compliance procedures. To remain compliant, it's essential to stay updated by regularly consulting the official state tax websites and resources regarding tobacco regulations.

Additionally, utilizing platforms like pdfFiller helps in maintaining compliance because it provides templates and forms that are up-to-date with current laws. Staying proactive about changes in legislation will save you both time and potential legal issues in the future.

Final tips for a smooth experience

Navigating the cigarette tax stamp purchase process can be seamless with a few best practices. Start with thorough preparation by ensuring all documentation is in order and double-checking your application for completeness. Utilizing pdfFiller's capabilities throughout this process can save time and minimize errors.

Additionally, don’t hesitate to seek guidance from customer service or your tax authority if you encounter any uncertainties. Keeping communication open with stakeholders, and ensuring transparency within your team will lead to smoother operations as you navigate this process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find cigarette tax stamp purchase?

Can I create an eSignature for the cigarette tax stamp purchase in Gmail?

How do I complete cigarette tax stamp purchase on an iOS device?

What is cigarette tax stamp purchase?

Who is required to file cigarette tax stamp purchase?

How to fill out cigarette tax stamp purchase?

What is the purpose of cigarette tax stamp purchase?

What information must be reported on cigarette tax stamp purchase?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.