Last updated on Feb 17, 2026

Cosigner Contract Template free printable template

Show details

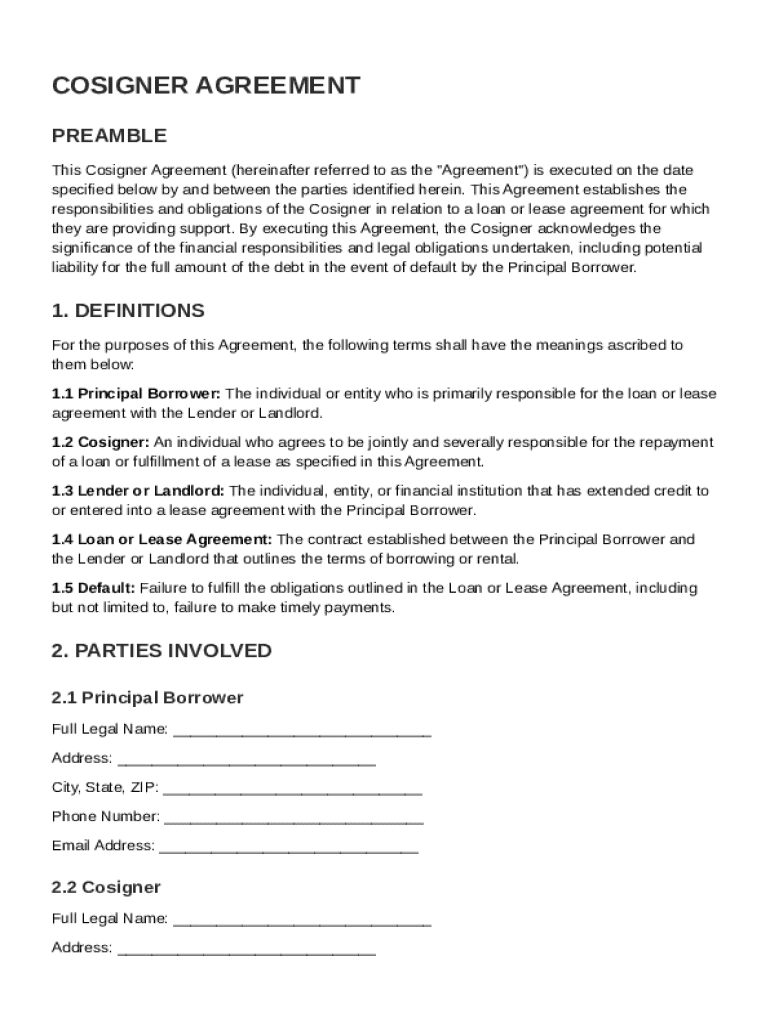

This document outlines the responsibilities and obligations of a Cosigner in relation to a loan or lease agreement, including potential financial liabilities in case of default by the Principal Borrower.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Cosigner Contract Template

A Cosigner Contract Template is a legal document that outlines the responsibilities and obligations of a cosigner when agreeing to guarantee a loan or lease.

pdfFiller scores top ratings on review platforms

I'm still learning but based on what I've seen so far it's great!

I like the forms but a little hard for scrolling and saving!

My handwriting is terrible. PDFfiller is a God-send

Service is great customer support is even better!

it's great just needs better ways on how to use

EASY EXCEPT FOR DATE FILLING,FORM WOULD GO AWAY BEFORE COMPLETE

Who needs Cosigner Contract Template?

Explore how professionals across industries use pdfFiller.

Co-Signer Contract Template Guide

How to fill out a Co-Signer Contract Template form

To successfully fill out a Co-Signer Contract Template, you need to gather all necessary information from both the principal borrower and the co-signer. Be sure to fill in the required personal details accurately and review the document for any common errors before submission.

Understanding the co-signer agreement

A co-signer agreement is a legally binding document that guarantees the obligations of the borrower. It is essential to know the differences between a principal borrower and a co-signer, as the latter shares the financial responsibility for the loan.

-

Definition: A co-signer agreement holds both parties accountable for loan repayment.

-

Roles: The principal borrower directly receives the loan, while the co-signer backs the borrower's obligation.

-

Implications: Co-signers must be aware of their liability, as defaulting borrowers can affect their credit.

What are the key components of the co-signer agreement?

Each co-signer agreement features specific sections critical for legal clarity. Understanding these components helps ensure a legally binding contract.

-

This section establishes the parties involved and the date of the agreement.

-

Key terms like 'principal borrower' and 'co-signer' should be clearly defined.

-

Include all required personal information for both the borrower and the co-signer, ensuring accuracy.

How can you fill out the co-signer agreement correctly?

Filling out the agreement requires precise attention to detail. Following a step-by-step guide can prevent common mistakes.

-

Gather all necessary details from both parties before starting.

-

Follow a structured format to input personal information.

-

Review the document thoroughly for accuracy and clarity.

-

Avoid common errors such as incorrect dates or misspellings.

How to manage the co-signing process?

Once the co-signer agreement is in place, managing it is crucial for compliance and updates. This process can be simplified with the right tools.

-

Editing the agreement as necessary to reflect any changes.

-

Utilizing pdfFiller tools for collaboration and document adjustments.

-

Signing electronically to ensure compliance with legal standards.

What legal considerations and compliance should you be aware of?

Understanding legal implications is vital when entering a co-signer agreement. Compliance requirements may vary based on jurisdiction.

-

Research the compliance requirements specific to your region.

-

Be aware of potential liabilities, as misunderstanding can lead to financial repercussions.

-

Implement best practices to ensure the legal validity of the agreement.

Where to find additional resources and support?

Additional resources can further enhance your understanding of co-signer agreements. Legal advice and support can be vital.

-

Links to related documents that may complement the co-signer agreement.

-

Obtaining legal advice may provide clarity on specific regulations in your area.

-

Accessing customer support through pdfFiller for assistance in document management.

How to fill out the Cosigner Contract Template

-

1.Obtain the Cosigner Contract Template from a reliable source such as pdfFiller.

-

2.Open the template on pdfFiller to start filling it out.

-

3.Begin by entering the names of the primary borrower and the cosigner in the designated fields.

-

4.Fill in the loan or lease amount in the appropriate section, specifying details such as interest rates if relevant.

-

5.Include the duration of the loan or lease agreement clearly, ensuring all parties understand the timeline.

-

6.Provide any necessary personal information for both borrower and cosigner, including addresses and Social Security numbers where applicable.

-

7.Review all filled information for accuracy, ensuring no details are missing or incorrect.

-

8.If required, add any additional clauses or conditions that may be specific to the loan or lease agreement.

-

9.Once completed, save the document and share it with all parties for their review and signature.

-

10.Print and sign the document where indicated, and ensure that both the borrower and the cosigner retain copies for their records.

How do you write a cosigner agreement?

The undersigned, for the consideration of the execution of a Rental Agreement and for other valuable consideration, the receipt of which is hereby acknowledged, hereby guarantee(s) that the resident will pay all rent due and will perform all of the terms and conditions of the resident's part to be performed under the

What is the co signer clause?

Cosigners agree to be financially responsible if the tenant fails to pay the rent or any other amount owed to you under the terms of the lease or rental agreement. You may add a cosigner to an existing lease or rental agreement, or include the cosigner when you enter into the rental.

What is the difference between a guarantor and a cosigner?

Guarantors vs Cosigners: Key Differences Guarantor: Only responsible for rent payments if the tenant fails to pay. Cosigner: Shares full responsibility for rent and any lease-related obligations from the start.

What is an example of a co signer?

The most common example is a parent co-signing for their child's first apartment since the child has no rental history. Other examples include co-signing an apartment for a significant other who doesn't live with you or for an unemployed family member.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.