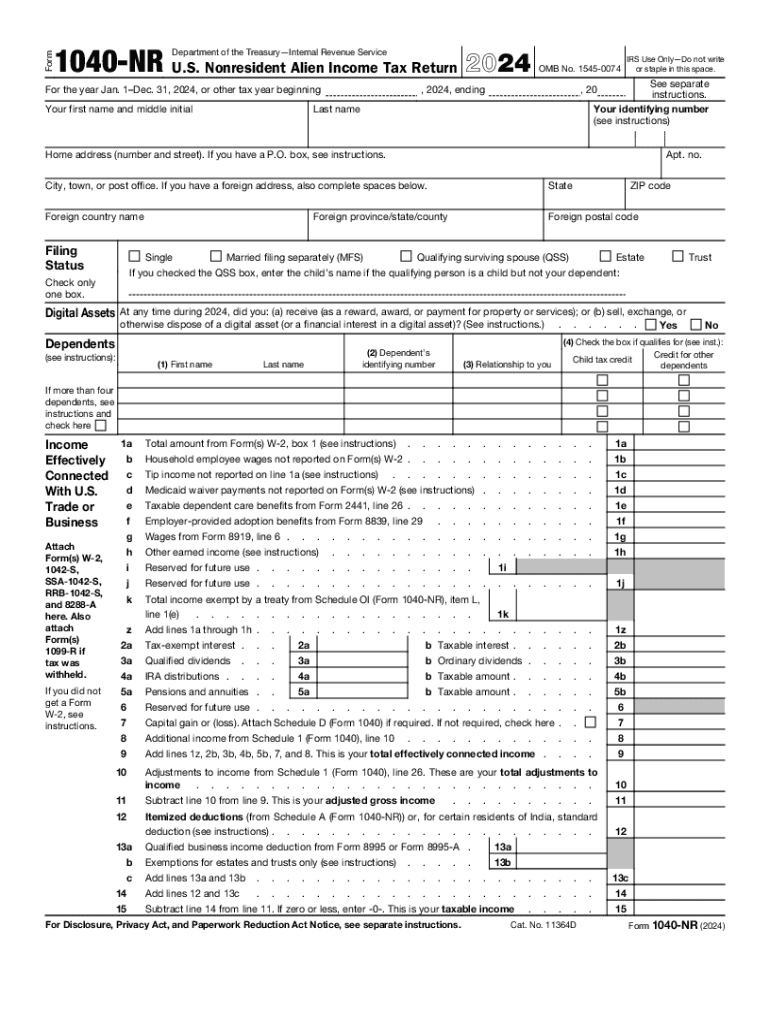

IRS 1040-NR 2024 free printable template

Instructions and Help about IRS 1040-NR

How to edit IRS 1040-NR

How to fill out IRS 1040-NR

Latest updates to IRS 1040-NR

About IRS 1040-NR 2024 previous version

What is IRS 1040-NR?

Who needs the form?

Components of the form

What payments and purchases are reported?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

How many copies of the form should I complete?

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1040-NR

How can I correct mistakes on my IRS 1040-NR after filing?

To correct mistakes on your IRS 1040-NR, you must file Form 1040-X, the Amended U.S. Individual Income Tax Return. It’s essential to clearly indicate the changes and provide supporting documentation. After filing, the IRS typically takes up to 16 weeks to process your amendment.

How can I verify if my IRS 1040-NR has been received and processed?

You can check the status of your IRS 1040-NR online using the IRS 'Where's My Refund?' tool, if you expect a refund. For non-refundable filings, you can call the IRS for updates. Ensure you have your details on hand, such as your Social Security number and filing status.

What should I do if I receive an IRS notice regarding my 1040-NR?

If you receive a notice from the IRS about your 1040-NR, read it carefully to understand the issue. Follow the instructions provided, which may involve supplying additional information or correcting errors. Always keep records of the correspondence you send back to the IRS.

What common errors should I watch out for while filing my IRS 1040-NR?

When filing your IRS 1040-NR, be cautious of common errors such as mismatched Social Security numbers, incorrect bank account details for direct deposit, or missing signatures. Double-check all figures and ensure you’ve reported all necessary income to avoid processing delays.

Is e-filing my IRS 1040-NR safe and what should I know about technical requirements?

E-filing your IRS 1040-NR is generally safe when using IRS-approved software. Ensure your device's operating system and web browser are up-to-date for compatibility. Use a secure internet connection, and always double-check your entries before submission for a smooth filing experience.

See what our users say