Last updated on Feb 17, 2026

Money Between Friends Contract Template free printable template

Show details

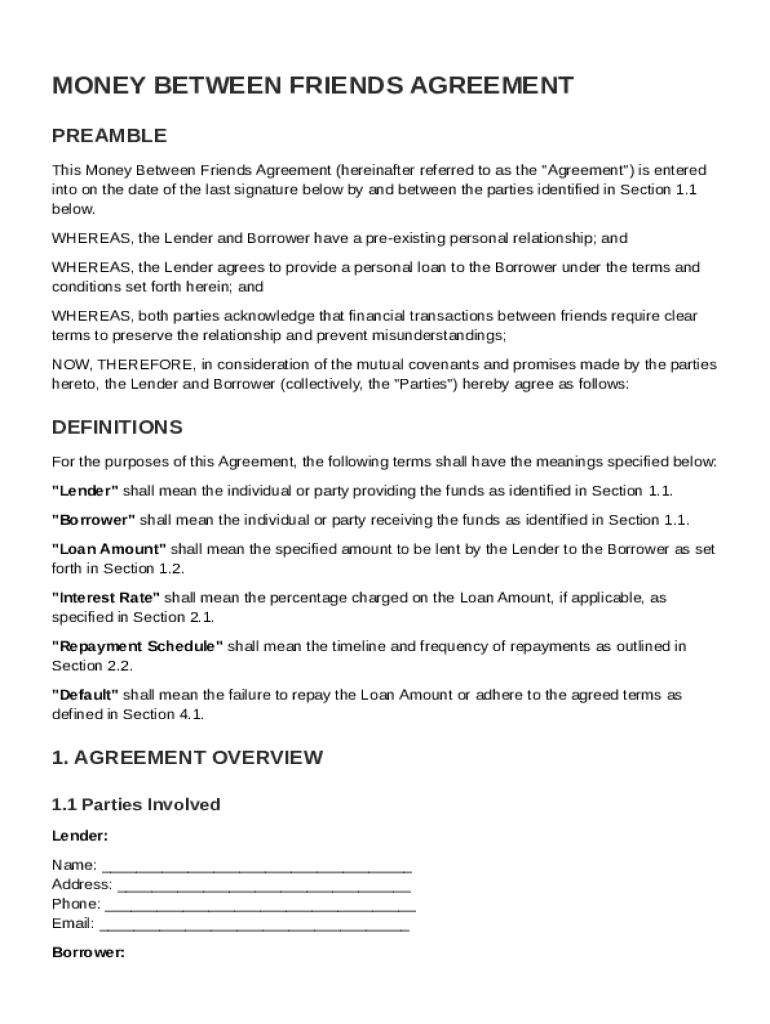

This document outlines the terms of a personal loan agreement between a lender and a borrower who are friends, aiming to clarify the financial transaction to preserve their relationship.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Money Between Friends Contract Template

A Money Between Friends Contract Template is a legal document that outlines the terms of a loan agreement between friends, including the amount, repayment schedule, and any interest rates.

pdfFiller scores top ratings on review platforms

very intuitive and has everything I need so far

good

lots of useful options easy to use

love it

So far so good.

user friendly and useful

Who needs Money Between Friends Contract Template?

Explore how professionals across industries use pdfFiller.

How to create a Money Between Friends contract template form

How can you benefit from a Money Between Friends contract?

Creating a Money Between Friends contract template form can help define the terms of your loan agreement, ensuring clarity for both parties. A well-structured agreement lays the groundwork for understanding and can safeguard relationships when money is exchanged among friends or family. It’s essential to have a clear written agreement to prevent misunderstandings down the line.

-

Using a contract template provides clear terms regarding the loan amount, interest rates, and repayment schedules. This transparency helps prevent future disputes.

-

A signed agreement offers some legal protection by documenting the loan, essential in case of defaults or disagreements.

-

Having an upfront agreement allows friends to voice their expectations and concerns, thus helping to maintain personal relationships even during financial exchanges.

What are the key definitions and parties involved?

Defining key terms in the agreement is crucial for both parties. The involved parties typically include the Lender, who provides the money, and the Borrower, who receives the funds. Establishing these definitions upfront helps avoid confusion later.

-

The person or entity who lends money.

-

The individual or party who is borrowing the money.

-

The total sum of money that is being borrowed.

-

The percentage added to the loan amount, which the Borrower agrees to pay back in addition to the principal.

-

A timeline outlining how and when the Borrower will repay the loan.

-

Failure to adhere to the terms of the agreement, particularly related to repayment.

How do you define the loan amount and interest rates?

Clearly specifying the loan amount is essential for any Money Between Friends agreement. You must also decide whether interest will be applied and at what rate. Sometimes friends choose to waive interest entirely to keep things simple and maintain goodwill.

-

Clearly state how much money is lent in the agreement.

-

Define whether interest will apply, the percentage rate, and how it compounds if applicable.

-

Discuss the factors that influence your decision on interest, including duration, relationship dynamics, and financial necessities.

How do you structure the repayment schedule?

Establishing a repayment schedule ensures both the Lender and Borrower understand the timeline for repaying the loan. It’s vital to detail whether repayments will be made weekly, bi-weekly, or monthly and to set specific deadlines for clarity.

-

Choose a repayment frequency that suits both parties—monthly or bi-weekly schedules are common.

-

Set precise due dates for each payment to facilitate accountability.

-

Use templates to visualize the repayment schedule, making it easier for all parties to understand their obligations.

What happens if the Borrower defaults on the agreement?

Defining what constitutes default and outlining possible consequences in the agreement can help prepare both parties for inevitable challenges. Defaulting can strain friendships, but it’s important to approach any situation thoughtfully.

-

Clarify under what circumstances a default occurs, often linked to missed payments.

-

Discuss potential repercussions, including fees, additional interest, or relationship impact.

-

Offer solutions for resolution, such as renegotiating terms or extending payment deadlines.

How to preserve relationships during the loan process?

Maintaining open lines of communication is crucial when lending money to friends or family. Setting clear expectations upfront can minimize stress during repayment and help prevent misunderstandings.

-

Encourage open discussions about the loan and any potential issues that arise.

-

Both parties should clarify their responsibilities and outcomes to avoid misunderstandings.

-

Establish boundaries around financial discussions and maintain a level of grace throughout the period.

What are the legal and tax implications of family loans?

Even informal loans between family and friends can have legal and tax implications. It’s essential to document the agreement properly and understand the local laws surrounding personal lending to avoid complications.

-

Discuss potential gift tax obligations that may arise from forgiving unpaid loans.

-

Understand any local requirements for documenting these loans, as any formalities can protect both parties.

-

Ensure your agreement complies with regional regulations to avoid legal challenges.

What are the alternatives to personal loans?

Before lending money to friends, explore alternative financial options. Formal loans or credit products may provide better safeguards, but they come with their own pros and cons that can affect relationships.

-

Consider bank loans or credit that formalize the process. They often come with more rigorous terms.

-

Analyze credit cards or personal loans as alternatives that don’t affect personal relationships.

-

Understand how these alternatives could influence your friendship differently from a personal loan.

How to use pdfFiller for your Money Between Friends agreement?

pdfFiller makes creating a Money Between Friends contract template form easy. It allows users to edit, eSign, and manage agreements all in one convenient location, offering modern solutions to traditional document handling.

-

Use pdfFiller’s intuitive interface to customize your loan agreement according to your unique needs.

-

Digitally sign your agreement and share it securely with your friend or family member.

-

Enjoy the benefits of a cloud-based document system, allowing access from anywhere and collaboration with ease.

How to fill out the Money Between Friends Contract Template

-

1.Start by downloading the Money Between Friends Contract Template from pdfFiller.

-

2.Open the document in pdfFiller and review the template structure.

-

3.Fill in the names and contact information of both the lender and the borrower at the designated sections.

-

4.Specify the loan amount clearly to avoid ambiguities.

-

5.Determine and input the repayment terms, including the schedule and any interest rates if applicable.

-

6.Review the terms and check for completeness to ensure mutual agreement.

-

7.Consider adding any additional clauses relevant to the specific situation.

-

8.Proofread the document for accuracy and clarity.

-

9.Sign the contract electronically or print it for both parties to sign.

-

10.Save a copy for personal records and ensure both parties receive a copy of the signed agreement.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.