Money Borrow Contract Template free printable template

Show details

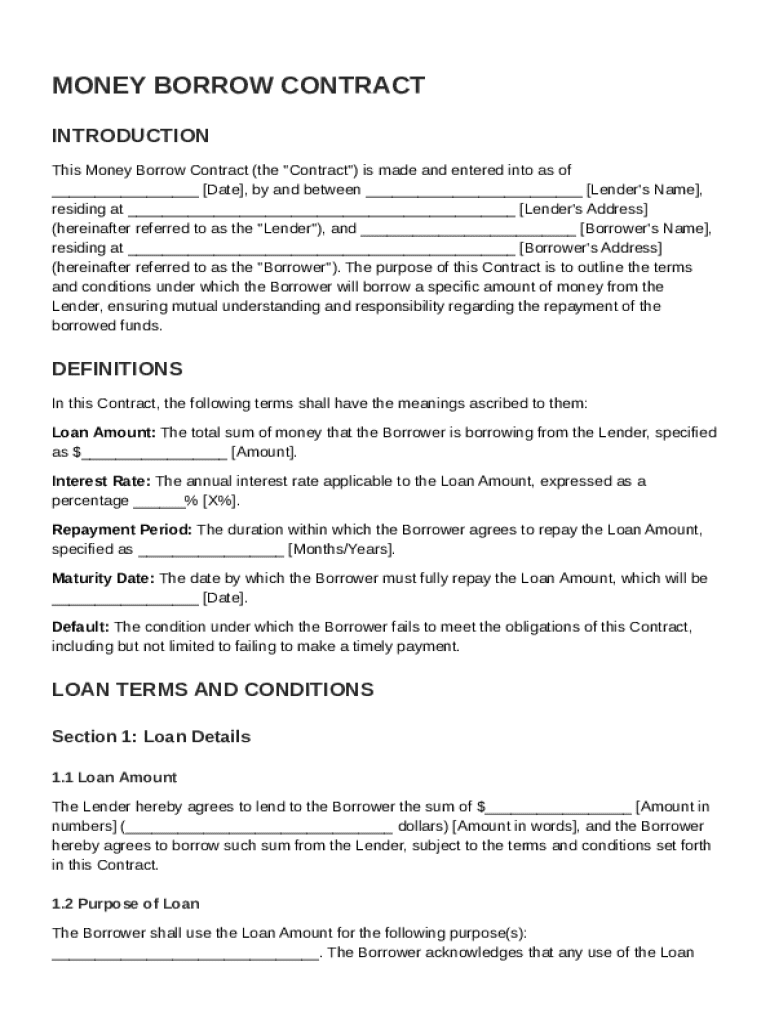

This document outlines the terms and conditions under which a borrower can borrow money from a lender, including details on loan amounts, interest rates, repayment terms, and default provisions.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Money Borrow Contract Template

A Money Borrow Contract Template is a legal document outlining the terms and conditions of a loan agreement between a borrower and a lender.

pdfFiller scores top ratings on review platforms

Simple and TIME SAVING. Allows me to easily create professional proposals, estimates and contracts.

I liked the arrows indicating next steps to fill out.

I HAD NO CHOICE BUT TO USE IT TO PRINT A PASSPORT APP.

I LOVE PDFfiller! I prepare a lot of documents, and this makes everything so much faster and easier.

FINDING NEW THINGS I CAN DO EVERY DAY. WOULD LIKE TO SEE MORE HELP / TROUBLESHOOTING GUIDES OR A VIDEO TUTORIAL SHOWING THE DIFFERENT PROCESSES YOU CAN DO WITH PDFFILLER.

All of my experiences by way of the help line has been professional and satisfying. The Reps are all pleasant and extremely helpful. I am a very satisfied customer, Thank you!

Who needs Money Borrow Contract Template?

Explore how professionals across industries use pdfFiller.

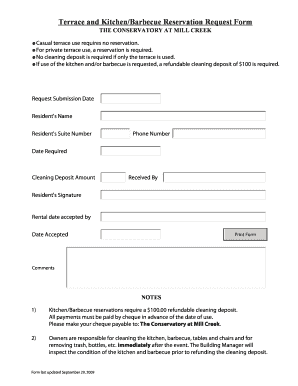

Money Borrow Contract Template Guide

A Money Borrow Contract Template form is essential for both lenders and borrowers to establish clear terms for loans. This guide will help you navigate through the process of creating, editing, and managing such a contract using pdfFiller.

Understanding the importance of a Money Borrow Contract

-

A Money Borrow Contract clearly outlines the responsibilities and rights of both parties, ensuring there is no ambiguity in the relationship.

-

By detailing repayment structure, terms, and timelines, the contract minimizes the chances of conflicts due to misunderstandings later on.

-

Having a written document makes the agreement legally binding, providing a fallback in case of disputes.

What are the essential components of a Money Borrow Contract?

-

This sets the timeline for the loan and serves as a reference point.

-

Includes the lender's contact information for easy reference.

-

The borrower's information adds accountability and can be critical for legal purposes.

-

Clearly listing the loan amount reduces ambiguity regarding the principal debt.

-

Transparency in how interest will be calculated is vital for borrower protection.

-

It defines the loan duration, helping both parties understand repayment expectations.

-

This outlines what happens if the borrower fails to meet payment obligations.

How to analyze loan terms and conditions in your contract?

-

Clearly state the loan amount both numerically and in text to avoid any possible future disputes.

-

Specifying what the loan can be used for aids in clarity and can make enforcement simpler.

-

Explaining the default consequences protects lenders and clarifies risks for borrowers.

-

Allowing for potential adjustments helps accommodate unforeseen circumstances for the borrower.

What are step-by-step instructions for completing your Money Borrow Contract using pdfFiller?

-

Start by locating the template in the pdfFiller library for easy customization.

-

Enter the borrower and lender's information accurately to ensure the contract is valid.

-

pdfFiller offers tools that help you tweak loan quantities, terms, and conditions to fit specific needs.

-

Once complete, utilize the eSigning feature to finalize the contract easily.

Are there examples of completed Money Borrow Contracts?

-

Review several templates tailored for various borrowing scenarios.

-

Understanding how to navigate through the nitty-gritty details can simplify contract adherence.

-

Visual aids can help demonstrate how all the various terms operate cohesively.

What are the common pitfalls to avoid when drafting a Money Borrow Contract?

-

Not having this outlined can lead to misunderstandings and delays in repayment.

-

If the purpose is unclear, it can create issues in enforceability and agreement adherence.

-

It's critical to ensure both parties understand what will happen in the case of default.

-

Ensure that calculations are unambiguous to prevent disputes about financial obligations.

How does pdfFiller simplify document management for your Money Borrow Contract?

-

This convenience means you can work on your contract from any device with internet access.

-

More than one user can interact with the document, allowing for seamless teamwork.

-

Utilizing pdfFiller’s eSigning ensures that all agreements are legally enforceable and secure.

In conclusion, a Money Borrow Contract Template form is crucial for defining the terms of financial agreements. By following this guide and utilizing pdfFiller's tools, individuals and teams can create comprehensive and legally sound contracts effortlessly.

How to fill out the Money Borrow Contract Template

-

1.Download the Money Borrow Contract Template from PDFfiller.

-

2.Open the document in PDFfiller's editing interface.

-

3.Start by entering the date of the agreement at the top of the document.

-

4.Fill in the full name and contact details of the borrower followed by the lender's information.

-

5.Specify the loan amount clearly in both numeral and written form.

-

6.Set the repayment terms, including interest rate, payment schedule, and payment methods.

-

7.Include the duration for which the loan will be active.

-

8.If applicable, define any collateral that secures the loan.

-

9.Review the terms for both parties and ensure that they are mutually agreed upon.

-

10.Once all fields are filled, double-check the details for accuracy.

-

11.Sign the document digitally and save it, or print it for physical signatures.

How to write a contract agreement for borrowing money?

To draft a Loan Agreement, you should include the following: The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

How do you write a note to borrow money?

What do I need to write a promissory note? Names and contact information of the borrower and lender. Include their full legal names, addresses, and contact numbers — include any co-signers if applicable. Loan details. Collateral (if applicable) Consequences of default. Governing law. Signatures.

What is the agreement to borrow money?

The Lender agrees to lend to the Borrower and the Borrower agrees to borrow from the Lender for the purposes specified in Article 2 hereof and on the terms and conditions contained herein, a sum not exceeding Rs. __/-_ (Rupees __ only). The said sum is hereinafter referred to as “the Loan”.

Can I loan someone money with a contract?

It is wise to draw up and sign a loan contract regardless of your relationship with the lender. This protects both parties in case of a disagreement. A loan agreement between two individuals is more simplistic but similar to a standard bank promissory note.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.