Last updated on Feb 17, 2026

Mortgage Contract Template free printable template

Show details

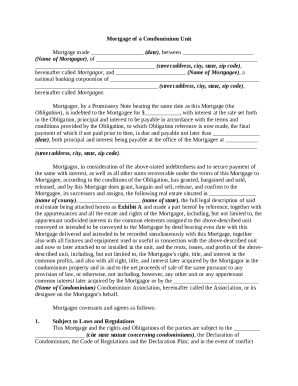

This document outlines the terms and conditions under which a mortgage is granted to a borrower (Mortgagor) by a lender (Mortgagee) for the purchase of real estate. It includes details about the loan

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Mortgage Contract Template

A Mortgage Contract Template is a legal document that outlines the terms and conditions of a loan secured by real estate.

pdfFiller scores top ratings on review platforms

The PDFfiller has greatly improved on my efficiency's.

PDFfiller is a good value application for PDF file editing, filling and file management. My limited use of the application so far leaves a lot of its functionality to be discovered. However, it is very user friendly and simple to work with.

i like that every thing is at your convenient and its easy to use.

It makes my documents needs very convenient.

It great it help me have all my document neatly done

Easy to use, got the job done, thank you

Who needs Mortgage Contract Template?

Explore how professionals across industries use pdfFiller.

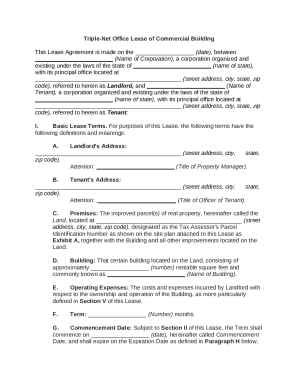

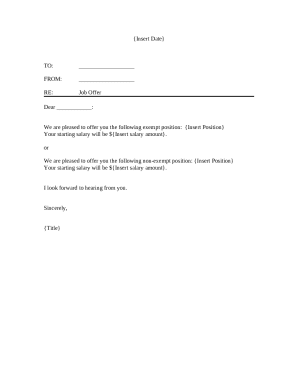

Mortgage contract template form guide

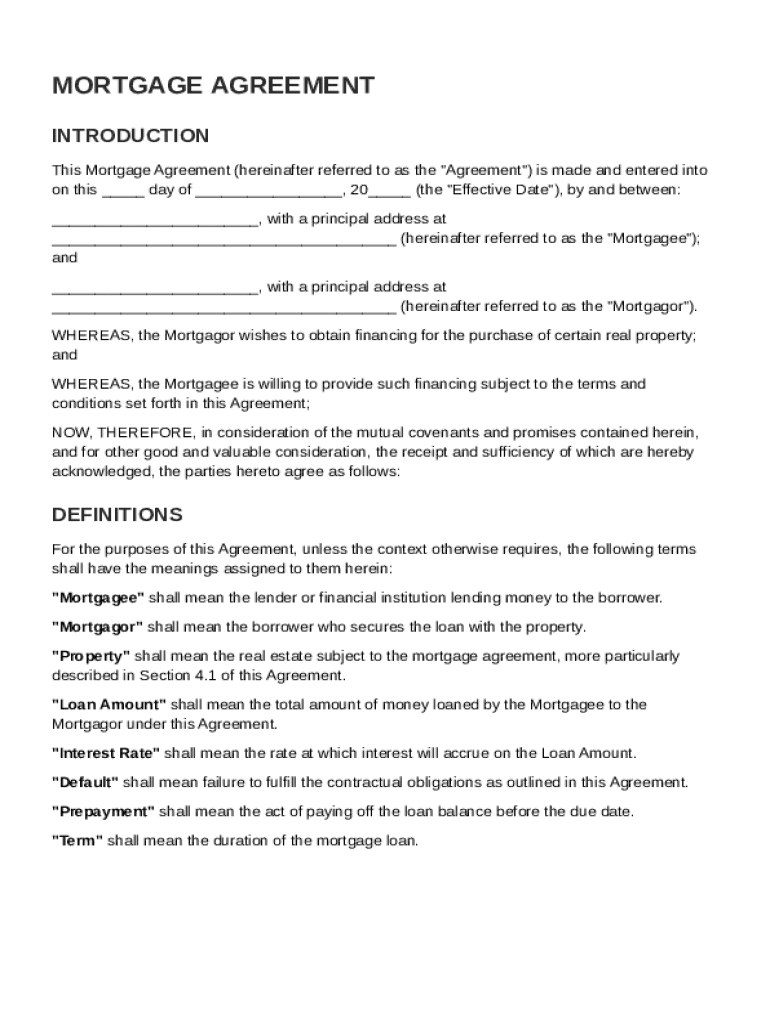

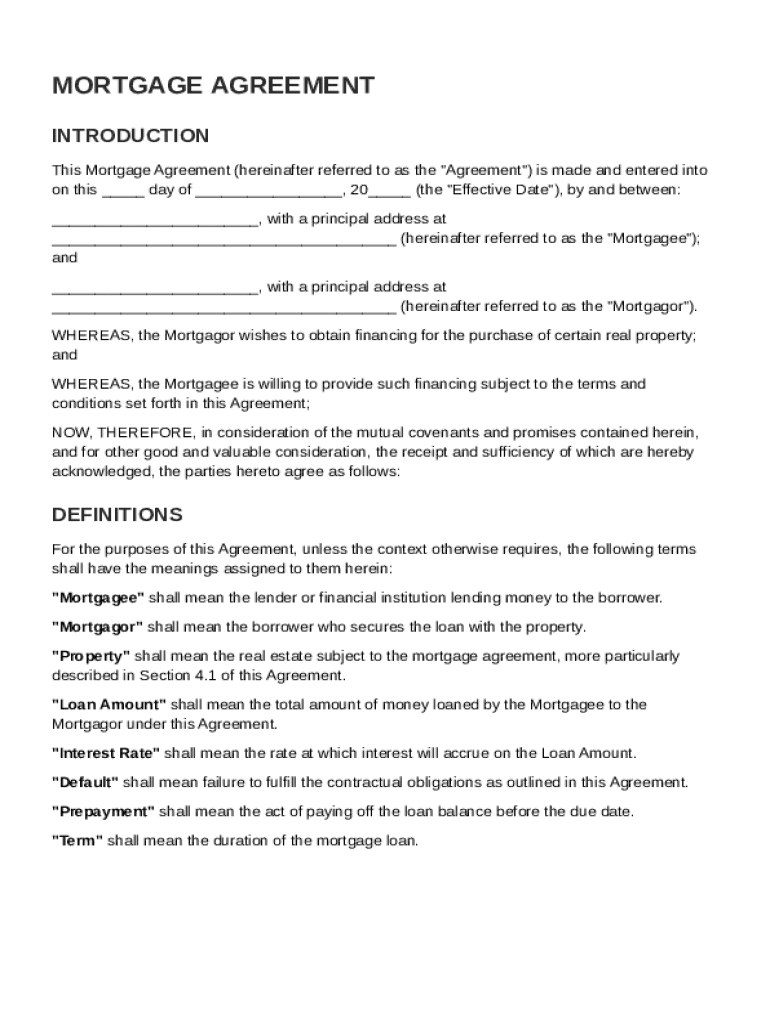

What is a mortgage agreement?

A mortgage agreement is a legal document that outlines the terms under which a borrower (mortgagor) agrees to repay a loan secured against a property. Understanding this agreement is crucial for securing loans as it protects both the lender (mortgagee) and the borrower. The document typically includes sections detailing the parties involved, the property being mortgaged, and any terms related to the loan.

-

It is a binding contract between a lender and a borrower to secure a loan against property.

-

It ensures that both parties are legally protected during the loan transaction.

-

Key components include the mortgagee (lender), mortgagor (borrower), and the property description.

-

Mortgage agreements are primarily used in home purchases, refinancing, and investment properties.

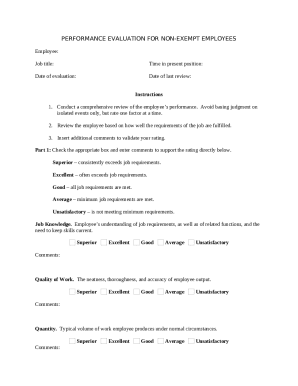

What are the key components of a mortgage contract?

A well-drafted mortgage contract will include several key components that directly affect the borrower's repayment obligations. Each part plays a crucial role in defining the rights and responsibilities of both the borrower and the lender.

-

Indicates when the mortgage contract becomes valid and enforceable.

-

Specifies the total sum being borrowed, which is critical for understanding repayments.

-

Describes whether the interest is fixed or variable, impacting the total loan cost.

-

Details the implications of missing payments and the conditions for paying off the loan early.

-

Refers to the duration of the mortgage and how it influences monthly payments.

How do you fill out your mortgage contract template?

Filling out your mortgage contract template can seem daunting, but following simple steps can ensure accuracy. Each detail provided in the contract must be precise to avoid future disputes.

-

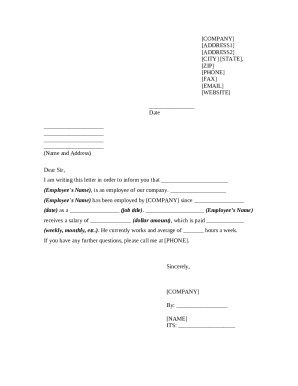

Fill out the names and information for both the mortgagee and mortgagor.

-

Include the full address and a brief description of the property being mortgaged.

-

Specify the loan amount and choose either a fixed or variable interest rate.

-

Outline any agreements concerning defaults and prepayment, including penalties or conditions.

What tools can you use to edit and sign your mortgage contract?

pdfFiller provides an interactive platform that simplifies the process of editing and signing mortgage contracts. Utilizing modern tools can enhance collaboration and efficiency, especially for teams.

-

Easily upload your mortgage contract template and make necessary modifications using pdfFiller.

-

Follow straightforward steps to add electronic signatures to your document.

-

Work with team members to edit and finalize the document using shared access.

-

Store your mortgage documents securely in the cloud for easy access and retrieval.

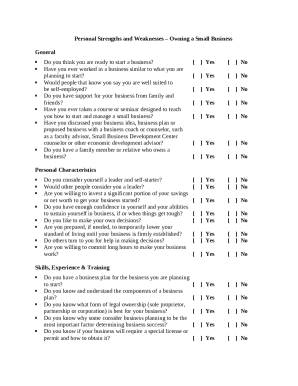

What legal considerations must be addressed in mortgage agreements?

It is vital to comply with regional laws when drafting mortgage agreements. Each state may have distinct regulations, and ensuring that your mortgage contract template meets local standards is critical to prevent legal issues.

-

Each jurisdiction has specific laws governing mortgage terms and validity.

-

Ensure your mortgage contract template adheres to both legal requirements and best practices.

-

Be aware of frequent mistakes that can lead to contract invalidation and learn how to avoid them.

-

Review considerations before making modifications to your established mortgage agreement.

What resources are available for effective mortgage management?

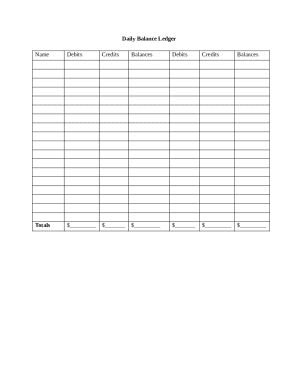

Managing your mortgage effectively requires the right tools and resources. Utilizing various instruments can help you stay organized and informed throughout the life of your loan.

-

Estimate your monthly payments and understand total costs based on your mortgage contract.

-

Evaluate different mortgage products to identify the best fit for your needs.

-

Learn how to communicate effectively with lenders and advisors for better negotiation outcomes.

-

Keep your mortgage documents organized and accessible to facilitate both future references and modifications.

How to fill out the Mortgage Contract Template

-

1.Download the Mortgage Contract Template from pdfFiller or upload your existing document to the platform.

-

2.Open the document in pdfFiller and review all sections to understand the required information.

-

3.Start by entering the borrower's information, including full name, contact details, and social security number.

-

4.Next, provide the lender's details, including the name of the lending institution and representative contact information.

-

5.Fill in the property details, including address, legal description, and current market value.

-

6.Specify the loan amount being borrowed and the interest rate, ensuring to check for fixed or variable rates.

-

7.Enter the terms of repayment, including the duration of the loan and monthly payment details.

-

8.Include any special conditions or clauses relevant to the agreement, such as escrow terms or prepayment penalties.

-

9.Review all entered information for accuracy and compliance with legal standards.

-

10.Save and print the completed Mortgage Contract Template for signatures from all parties involved.

How to create a simple mortgage?

Firstly, they are created by executing a mortgage deed, which outlines the terms and conditions of the mortgage agreement. Secondly, the mortgagee (lender) has the right to sell the property without the intervention of the court in case of default by the mortgagor (borrower).

How to write a simple loan contract?

What's in a Personal Loan Agreement? Identifications: The contract will need to list the names of all those involved and their addresses. Dates: There will need to be dates for when the contract goes into effect and any other important dates. Loan amount: This is the principal amount the borrower agrees to take out.

How do I write a letter for a mortgage?

How to Write a Letter of Explanation Choose a Business Letter Format. Write a Clear Subject Line. Explain Your Situation Clearly and Honestly. Provide Supporting Documents. Reaffirm Your Current Financial Stability. Thank the Lender for Their Consideration.

What is a mortgage loan contract?

A mortgage loan is a contract by which one party, the lender (usually a bank) transfers a fixed sum of money to the other party, the borrower, so that the latter can use it for a fixed period of time subject to payment of a fee represented by the interest.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.