Personal Payment Contract Template free printable template

Show details

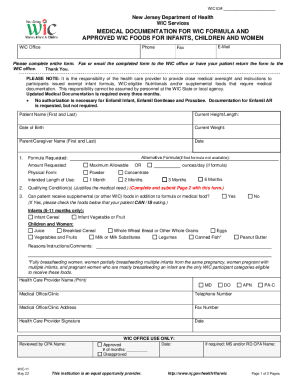

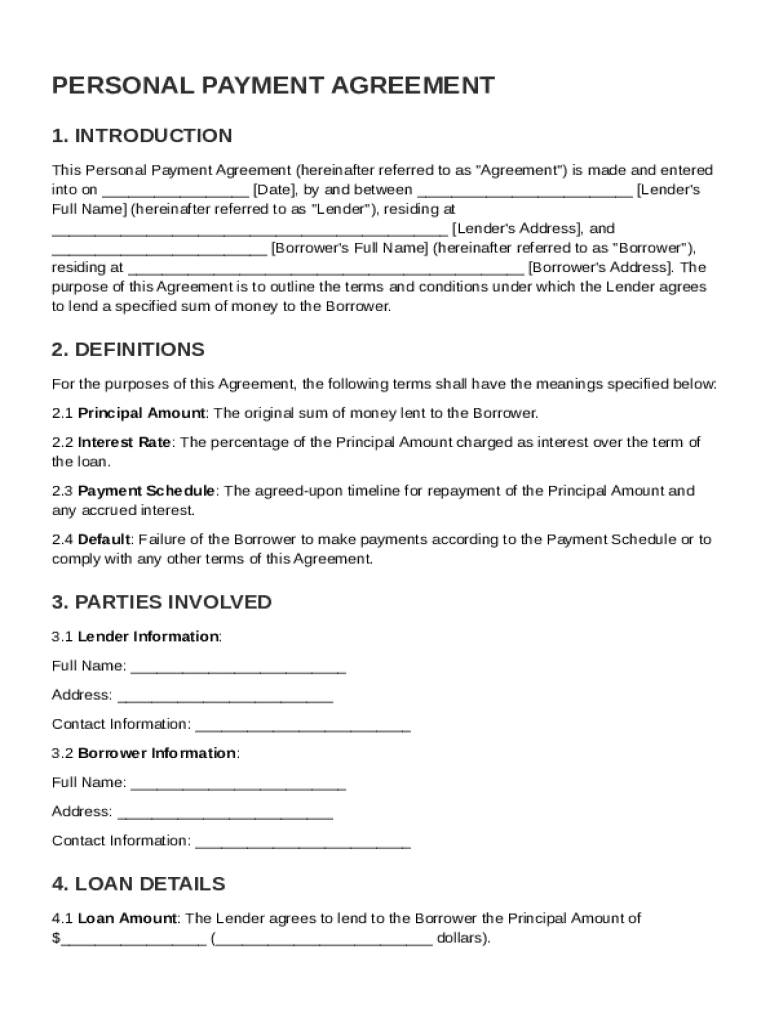

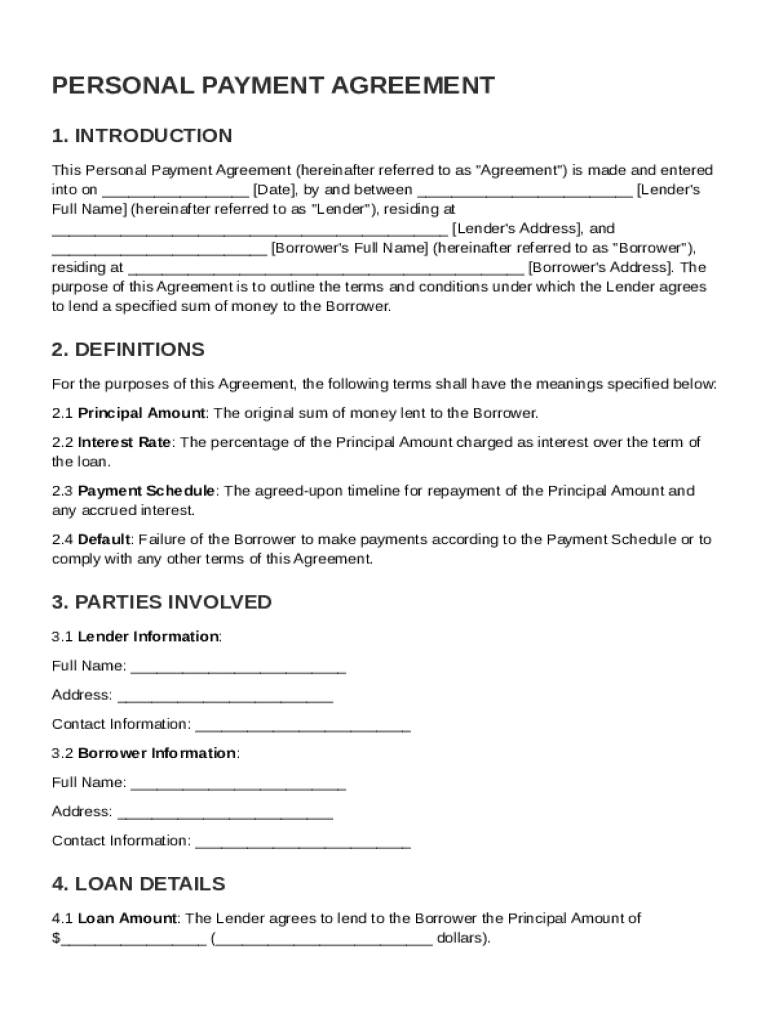

This document outlines the terms and conditions under which a lender agrees to loan a specified sum of money to a borrower, including details on repayment and default.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Personal Payment Contract Template

A Personal Payment Contract Template is a legal document that outlines the terms and conditions of a loan or payment agreement between two parties.

pdfFiller scores top ratings on review platforms

Perfect

This was the easiest software to use. Perfect!! Very impressed! A lot better than microsoft office

*** was very helpful in retreiving my lost infor and reconnecting me to my "filler" account. He was friendly informative and thorough. Great job many Thanks!

Really helpful my day to day work environment

It has been easy to learn and very smooth. Another of your competitors was really expensive and their app did not work as well as yours.

I love the editing features, and the tool seems very easy to navigate

easy to operate

Who needs Personal Payment Contract Template?

Explore how professionals across industries use pdfFiller.

Personal Payment Contract Template Guide

Creating a Personal Payment Contract Template involves understanding various components to ensure all parties agree on the terms of the transaction. This guide outlines everything you need to know about crafting a comprehensive payment agreement, including essential elements, how to provide accurate information, and the legal stipulations that must be included.

If you're looking to establish a well-documented personal payment agreement, you'll want to focus on accurately defining the roles of the lender and borrower, the amount being borrowed, and any interest fees that may apply.

-

Understand the template sections and fields you need to complete.

What are personal payment agreements?

A Personal Payment Agreement is a formal document that outlines the terms between a lender and a borrower regarding a loan. It ensures clarity and legality, serving as a safeguard for both parties involved in the financial arrangement.

Written contracts reduce misunderstandings and disputes over repayment terms. They are particularly important in scenarios such as family loans, informal lending, or business ventures where clear intentions need to be documented.

What essential components should include in my personal payment contract?

-

Clearly state the names and contact details of both the lender and borrower.

-

Specify the total amount borrowed and the interest rate applicable to the loan.

-

Outline how often payments will be made, and when they are due.

-

Description of what will happen if payments are missed and the potential for requiring full repayment.

-

Include clauses that protect both parties from prior claims or misunderstandings associated with the debt.

How do provide accurate information in my payment agreement?

-

Collect and accurately fill in the names, addresses, and contact details of both parties.

-

Calculate the total amount needed and decide on a reasonable interest rate based on industry standards.

-

Outline the specific reasons for the loan to enhance accountability and understanding.

How can create a payment schedule that works?

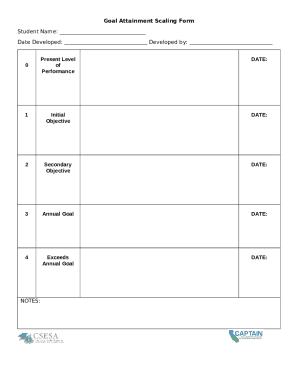

Setting a practical payment schedule is vital for ensuring that payments are manageable for the borrower and predictable for the lender. It allows both parties to prepare financially for scheduled payments.

-

Decide whether payments will be made weekly, monthly, or in a single lump sum.

-

Clearly outline when the first payment is due and when the final payment will occur.

-

Ensure borrowers understand how much they will repay in total, factoring both principal and interest.

What payment methods are acceptable?

-

Discuss different methods such as checks, bank transfers, or digital platforms like PayPal.

-

Include details about how payments will be recorded within the agreement.

-

Emphasize the necessity of both parties keeping track of payments to avoid disputes.

How can pdfFiller assist in my personal payment agreement?

pdfFiller offers an array of tools that make filling out your Personal Payment Contract Template easy. Users can leverage pdfFiller's editing capabilities and eSigning features to finalize documents.

-

Edit your contract in real-time and use electronic signatures to validate the document.

-

Work together with other team members to create comprehensive payment agreements seamlessly.

-

Store your agreements securely in the cloud for easy access from anywhere.

What compliance and legal considerations should keep in mind?

Awareness of compliance requirements by region is crucial when drafting your Personal Payment Contract Template. Compliance involves ensuring your agreement meets local laws and regulations, which can vary significantly.

-

Investigate the local laws that affect lending and borrowing agreements.

-

Ensure that the terms outlined are enforceable and recognized by law.

-

Incorporate suggested provisions to enhance the enforceability of the agreement.

How do finalize and manage my payment agreement?

Before signing, both parties should review the Personal Payment Contract Template thoroughly to confirm accuracy and understanding. Regular monitoring of payment status is essential to stay on top of repayments.

-

Carefully vet the agreement for any potential discrepancies or unclear clauses.

-

Keep the document updated and ensure all agreed changes are documented.

-

Discuss the protocols to follow if either party faces issues meeting the payment obligations.

How to fill out the Personal Payment Contract Template

-

1.Download the Personal Payment Contract Template from pdfFiller.

-

2.Open the template in pdfFiller's editor.

-

3.Begin by filling in the names and addresses of both the lender and borrower in the designated fields.

-

4.Specify the total amount being loaned or the service being paid for clearly in the amount field.

-

5.Outline the interest rate and specify if applicable; fill out the terms field with precise repayment details.

-

6.Indicate the payment schedule including due dates and method of payment, ensuring all parties agree to these terms.

-

7.Include any additional terms such as late fees, collateral or conditions for early repayment if necessary.

-

8.Review the completed document for accuracy and both parties’ consent to the terms outlined.

-

9.Once finalized, save the document and send it for electronic signatures if needed using pdfFiller's e-signature feature.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.