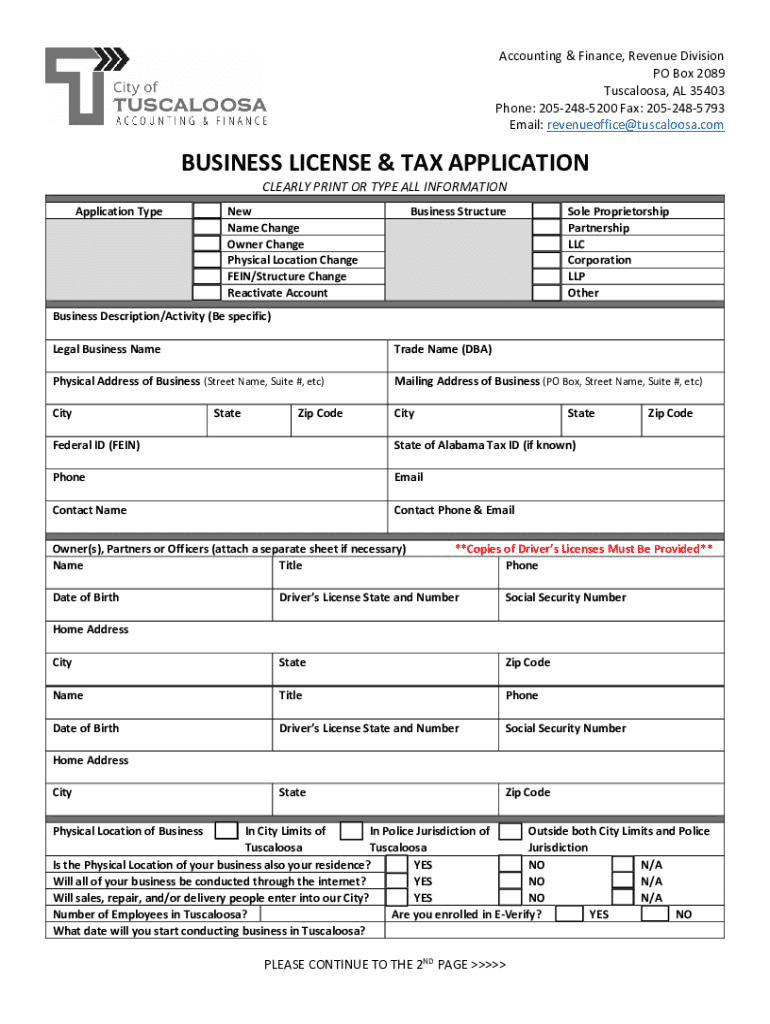

Get the free Business License & Tax Application - Tuscaloosa, AL

Get, Create, Make and Sign business license tax application

Editing business license tax application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business license tax application

How to fill out business license tax application

Who needs business license tax application?

The Comprehensive Guide to Business License Tax Application Forms

Understanding business license tax requirements

A business license tax is a fee levied by local or state governments to authorize businesses to operate within a specific jurisdiction. This tax varies by location and business type, reflecting the regulatory environment that businesses must navigate to remain compliant. Obtaining a business license is crucial for legitimate operations, as it legitimizes your business and allows you to legally conduct your activities.

The significance of acquiring a business license goes beyond merely adhering to legal standards. It serves as a safeguard against penalties, fines, or even closure due to non-compliance. Each business license usually comes with specific compliance and legal obligations that vary based on the industry, ensuring that businesses operate in accordance with local laws and regulations.

Who needs a business license?

Not all businesses require a business license, but many do. Generally, any business that engages in trade, provides services, or operates in a retail capacity will need a license. This includes categories such as retail establishments—grocery stores, clothing shops, and online retailers—as these businesses interact directly with consumers and must be regulated.

Service providers like plumbers, electricians, beauty salons, and contractors also need licenses to ensure that they meet industry standards. Home-based businesses, including consulting firms and crafts selling on platforms like Etsy, might also require licensing depending on the local regulations. Freelancers and independent contractors typically need licenses as well, particularly if they operate under a business name. Non-profit organizations and peddlers or solicitors also face similar licensing requirements, ensuring compliance with local regulations.

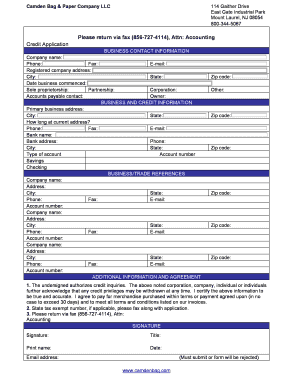

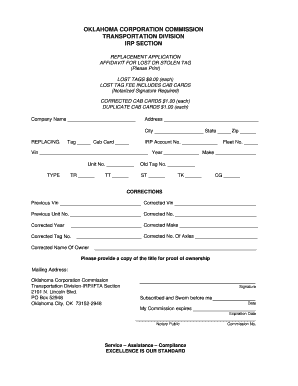

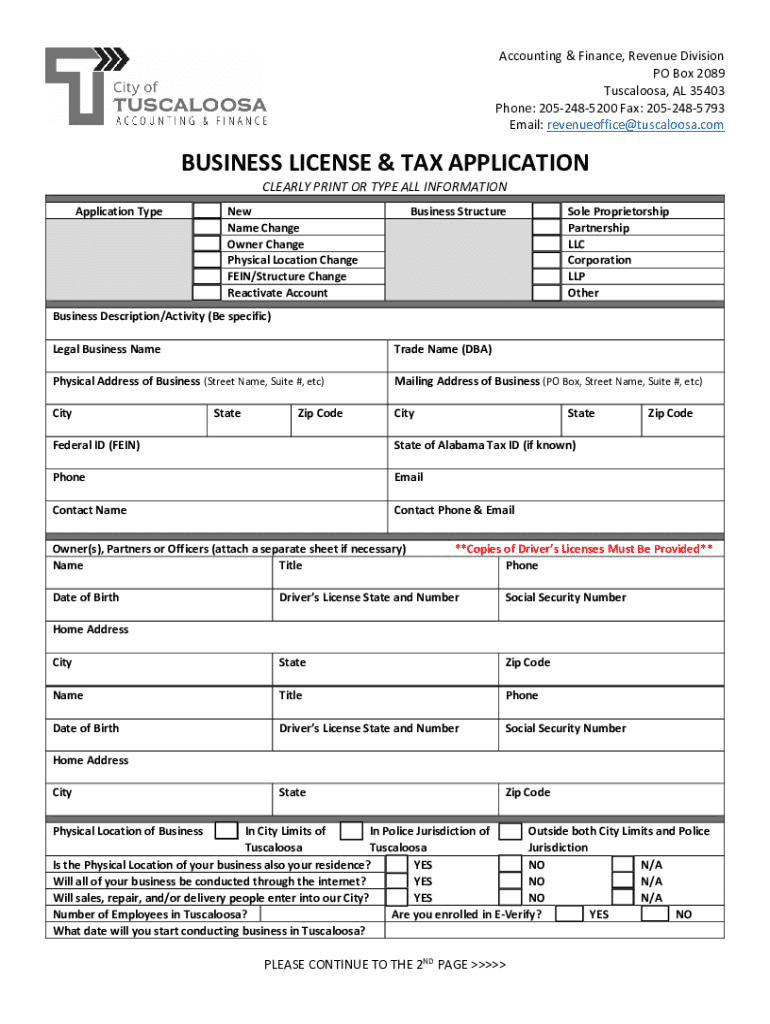

Preparing to apply for a business license tax

Before you fill out a business license tax application form, it’s essential to gather all necessary documents. Businesses typically must provide identification, such as a driver’s license, as well as business entity documentation. This could include an LLC formation document or a partnership agreement depending on your business structure.

Understanding the associated fee structures is crucial. Business license fees can vary considerably; some locations offer flat rates, while others base fees on gross receipts or revenue. Be prepared to consider mandatory disclosures, including verifying compliance with the Americans with Disabilities Act (ADA) and ensuring proper contractor verification if applicable.

Step-by-step application process

Accessing the business license tax application form is often the first step in the application process. This form can typically be found on local government websites or through dedicated platforms like pdfFiller, which provides comprehensive tools for form management. Make sure to follow the instructions for filling out the application carefully, as accurate information is critical.

When you begin filling out the application, focus on specific sections such as business information, ownership, management details, and tax identification. Each section is required to provide a complete profile of your business. Once you have completed your information, it’s vital to review and edit your application before submission. pdfFiller’s interactive tools allow for easy adjustments and efficient submission of your documents.

Post-submission steps

After submitting your business license tax application form, there are several key steps to anticipate. Typically, processing times depend on local regulations—ranging from a few days to several weeks. It's crucial to track your application and stay informed regarding notifications from local agencies, as any additional information required could delay approval.

Once your application is approved, don't overlook the actions required afterward. Displaying your business license prominently at your business location is generally required. Additionally, businesses must keep track of when renewals or amendments are necessary, as licenses often come with expiration dates or require updates based on changes in business structure or address.

Common challenges and solutions

Filing for a business license can have its share of challenges, leading many to question specific aspects of the process. Common inquiries include whether a business license needs to be renewed, what happens if a business relocates, or whether a business license can be transferred to a new owner. It's crucial to understand that most business licenses require periodic renewals based on local regulations, and any change in location may require a new application.

Should you encounter issues during the application, accessing resources and contacting support can streamline trouble resolution. Many local governments offer dedicated contacts for business licensing inquiries, and platforms like pdfFiller provide customer support and additional resources for assistance.

Additional considerations

Specialized business types, including those operating coin-operated machines and maintenance service providers, often face additional licensing requirements. For example, businesses that manage vending machines may need to acquire specific permits related to health and safety, while maintenance services may require additional local ordinances to be followed.

Non-profit organizations can also qualify for tax exemptions, but this often requires documentation and a specific application process. Understanding these nuances is vital for ensuring compliance and maximizing potential benefits available for each business type.

Engaging with resources and tools

Utilizing platforms like pdfFiller allows users to access significant document management tools to simplify the business license tax application process. This platform enables users to edit PDFs, eSign, collaborate with team members, and manage their documents efficiently—making it easier to navigate complex licensing requirements.

Moreover, pdfFiller offers help and support features that ensure users can resolve issues as they arise. Whether you need assistance editing your form or understanding the specifics of compliance, the community and customer service resources provide a solid support network.

Explore related licenses and regulations

As you embark on applying for a business license tax, it's beneficial to familiarize yourself with other associated licenses relevant to your business type. Different regulatory bodies entail various licensing requirements based on tax type, which can often intersect with city or state regulations.

Resources are available to help navigate licensing across different states and cities, providing vital information about updates to regulations. Staying informed can assist in compliance and operational success as your business grows.

Contact and support options

Effective communication and support avenues are vital when navigating the business license tax application process. Customer service channels and help centers provide essential resources for addressing specific concerns and inquiries that arise during the application journey.

Engaging with community resources can further augment your understanding and awareness of local regulations. Whether you're reaching out for specific inquiries or seeking general guidance, these resources play a critical role in ensuring smooth processing of your business license tax application.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in business license tax application?

How do I make edits in business license tax application without leaving Chrome?

How do I complete business license tax application on an Android device?

What is business license tax application?

Who is required to file business license tax application?

How to fill out business license tax application?

What is the purpose of business license tax application?

What information must be reported on business license tax application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.