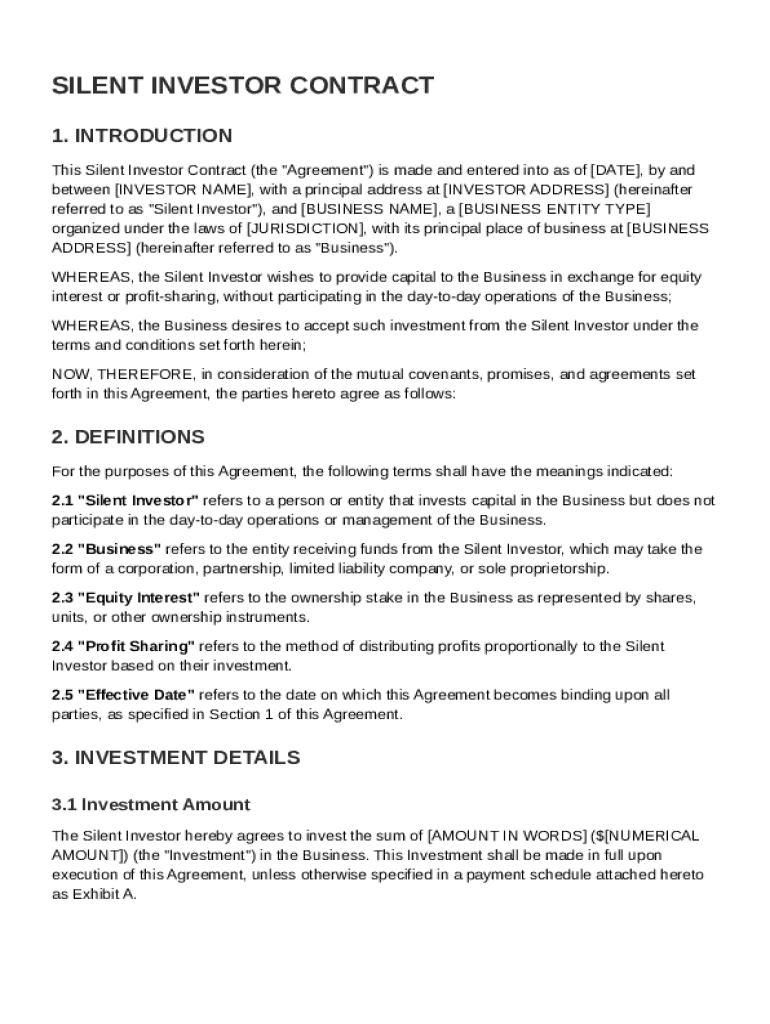

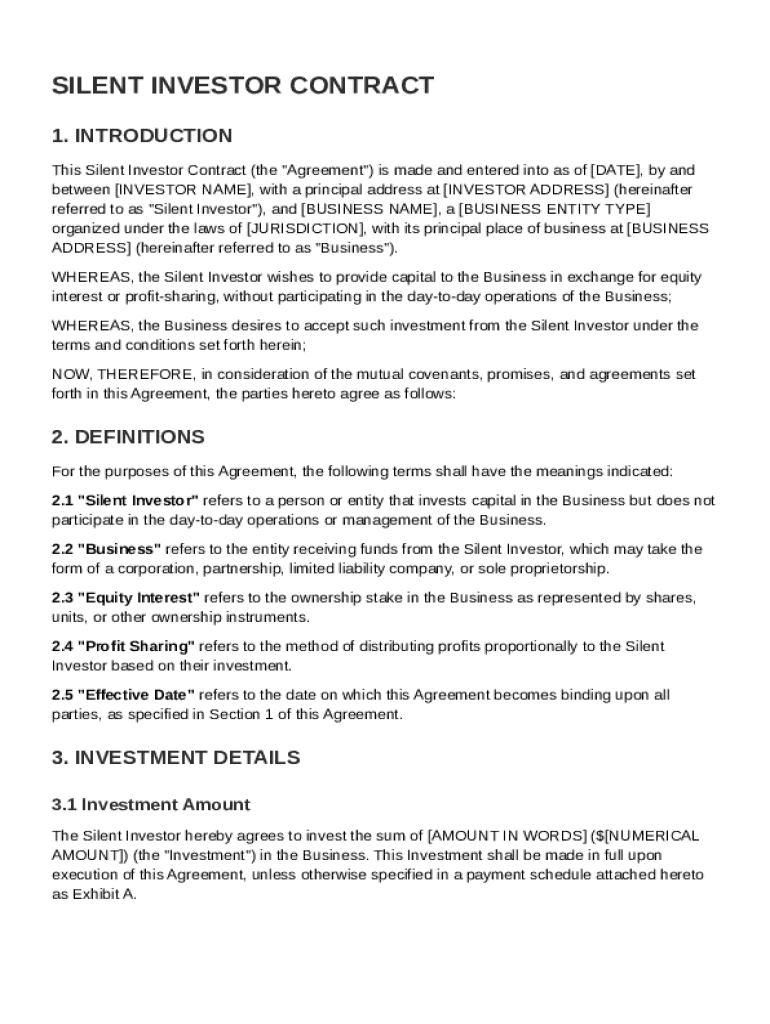

Silent Investor Contract Template free printable template

Show details

This document outlines the terms and conditions of an investment agreement between a Silent Investor and a Business, including investment details, rights, responsibilities, and confidentiality provisions.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Silent Investor Contract Template

A Silent Investor Contract Template is a legal document outlining the terms of investment and confidentiality between an investor and a business owner without active involvement in the business operations.

pdfFiller scores top ratings on review platforms

It was great!

Excellent and very easy

The last rep that helped me was the best tech support and customer service I have ever received - she was fantastic

Very user friendly

SO FAR SO GOOD

Easy to use

Who needs Silent Investor Contract Template?

Explore how professionals across industries use pdfFiller.

A comprehensive guide to using a silent investor contract template

Using a silent investor contract template can streamline your processes in securing investment for your business while defining the roles and responsibilities of the parties involved.

What is a silent investor contract?

A silent investor contract is a legal agreement between a business and an investor who provides capital without taking an active role in managing the business. These contracts are pivotal in business partnerships as they outline the terms of investment, the interests of the stakeholders, and ensure both parties understand their rights and responsibilities.

-

A silent investor is someone who invests in a business but does not partake in the daily operations, providing necessary capital in exchange for financial returns.

-

The contract protects both the business and the investor, clarifying expectations and preventing disputes over roles and profits.

-

Silent investors can provide valuable funds without intervening in the business, which allows entrepreneurs to maintain control over their operations.

Who are the key parties involved in the agreement?

Understanding who is involved in the silent investor agreement is essential for clarity and accountability. The key parties typically include the silent investor and the business owner(s).

-

This section should provide the investor's full name, address, and their entity type, such as an individual or corporate body.

-

Necessary information about the business includes its name, type of entity (LLC, corporation, etc.), jurisdiction, and address.

-

Clearly defining roles encourages accountability and sets the groundwork for cooperation, minimizing misunderstandings.

What are the objectives of the silent investor agreement?

The objectives of a silent investor agreement are crucial in determining the nature of the investment and the relationship between the investor and the business. This section should clearly delineate these objectives.

-

Identifying how the invested capital will support growth initiatives, operations, or other business needs can set a clearer path for use of funds.

-

Deciding whether the investor will receive equity in the business or a portion of the profits is essential for aligning interests.

-

Clarifying the level of involvement, if any, that the investor might have in decision-making helps to manage expectations.

How should investment details and terms be specified?

Investment details and terms lay the groundwork for the entire agreement. It is important to accurately specify each element of the investment.

-

Clearly denote how much is being invested (both in numbers and words) to avoid misunderstandings.

-

Include details about when payments will be made and any milestones linked to funding.

-

Outline how and when capital will be delivered, whether in lump sums or installments, to manage expectations effectively.

What is the profit and loss distribution mechanism?

Understanding how profits and losses are distributed is crucial for both parties in a silent investment agreement. This transparency is key to maintaining good relationships.

-

Clearly define the profit-sharing structure, ensuring that each party’s share aligns with their investment and roles.

-

Provide specific definitions for profit and loss to avoid ambiguity in the interpretation of financial results.

-

Discuss how future investment rounds will impact profit-sharing and equity interests may help in future negotiations.

How to manage decision-making authority and processes?

Clear decision-making authority within the agreement prevents confusion and conflict. Defining these processes is essential for smooth operations.

-

Define who has decision-making authority and at what levels, fostering clear responsibilities for governance.

-

Clearly state under which conditions silent investors may vote or participate in critical business decisions.

-

Establish systems for addressing and resolving disputes, whether through structured mediation or legal routes.

Why include confidentiality clauses and governing law?

Confidentiality clauses protect sensitive business information, especially vital in seamless business operations. Establishing governing law helps manage legal ramifications.

-

Investors need assurances that business insights remain confidential to protect competitive advantages.

-

Specifying acceptable jurisdictions for legal governance ensures all parties agree on legal frameworks.

-

Clearly stating penalties for breaching confidentiality can provide additional security for sensitive information.

How to manage and edit your silent investor contract?

Managing and editing your silent investor contract should be streamlined, and utilizing tools like pdfFiller can make this process significantly easier. Familiarizing yourself with how to effectively fill out these documents can save time.

-

Leverage pdfFiller for document creation and management to enhance efficiency and reduce errors in filing.

-

Follow the interactive guide on pdfFiller to ensure correct information is entered into the Silent Investor Contract.

-

Utilize eSigning options for convenience and make collaboration easier for all parties involved.

What are the dissolution and exit strategies for silent investors?

Establishing clear dissolution and exit strategies is important for a smooth exit process for silent investors, enabling them to withdraw from the agreement based on predetermined terms.

-

Define the exact circumstances under which the agreement may be deemed dissolved to avoid misunderstandings.

-

Articulate strategies that allow silent investors to exit the agreement while limiting their potential losses.

-

Include provisions for the transfer of equity interests to ensure a smooth transition for all parties involved.

How to fill out the Silent Investor Contract Template

-

1.Download the Silent Investor Contract Template from pdfFiller.

-

2.Open the PDF template in pdfFiller's editor.

-

3.Begin by entering the date at the top of the document.

-

4.Fill in the names and contact information of both the investor and the business owner in the designated fields.

-

5.Specify the investment amount and the terms of the investment in the relevant sections.

-

6.Outline any confidentiality agreements to protect the investor's anonymity and business information.

-

7.Include the duration of the agreement and any conditions for termination on the appropriate lines.

-

8.Review the agreement thoroughly for accuracy and completeness before signing.

-

9.Save the completed document and share it with the investor and relevant parties as necessary.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.