Small Personal Loan Contract Template free printable template

Show details

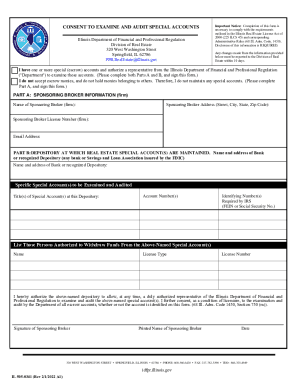

This document outlines the terms and conditions regarding a personal loan provided by the Lender to the Borrower, including loan amount, interest rate, repayment terms, and default consequences.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Small Personal Loan Contract Template

A Small Personal Loan Contract Template is a legal document outlining the terms and conditions of a personal loan between a lender and a borrower.

pdfFiller scores top ratings on review platforms

A little tough to regenerate the template. Not that user-friendly

It would be a 5 if I could open multiple docs for editing and switch from one to the other rather than closing one to open another.

Where to find spell check. Difficulty inserting or changing words.

i had to prepare a 991 with short timeline. PDF saved my jo

it was user friendly and I had no issue what so ever.

First time using but so far so good. Hopefully will work with all my PDF documents.

Who needs Small Personal Loan Contract Template?

Explore how professionals across industries use pdfFiller.

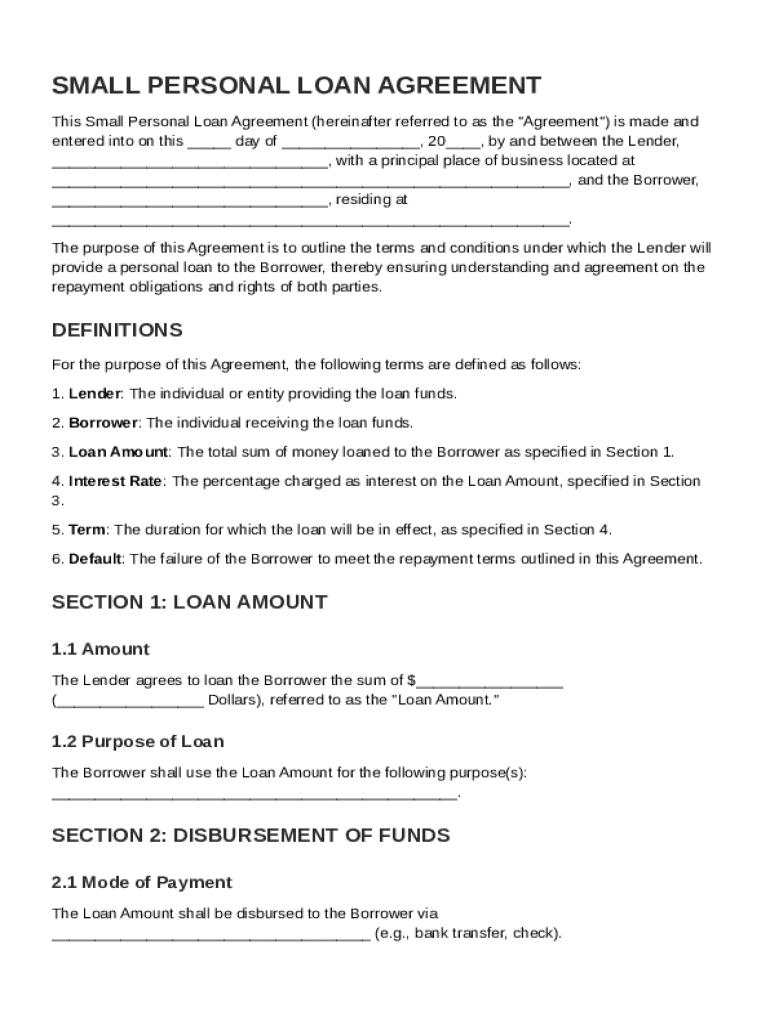

Small Personal Loan Contract Template Guide

Filling out a Small Personal Loan Contract Template is straightforward if you follow these key steps and understand the essential components. This guide will help you complete the form accurately to ensure all aspects of the loan are covered.

What is the purpose of a small personal loan agreement?

The primary purpose of a Small Personal Loan Agreement is to outline the terms and conditions of a loan between a lender and a borrower. Individuals usually need this agreement when they seek to borrow money for personal expenses like medical bills, education, or home improvements. Clarity within this agreement helps both parties understand their obligations and minimizes potential disputes.

Who are the key parties involved in the agreement?

-

The lender provides the funds and is typically a bank, credit union, or individual. They hold the right to receive repayments as agreed upon.

-

The borrower receives the loan and commits to pay it back with interest. Clear identification and contact information for both parties are vital to prevent misunderstandings.

What are the essential components of the loan agreement?

A comprehensive loan agreement must include critical sections such as Loan Amount, Interest Rate, and Term. Each component plays a significant role in determining how much the borrower will receive, the cost of borrowing, and the duration of repayment. Mutual stipulations within these sections provide further clarity and ensure that both parties have agreed on all terms.

How do you break down the loan amount section?

-

Begin by assessing your financial needs and amounts that can realistically be repaid. A thorough analysis helps avoid borrowing more than necessary.

-

Clearly state what the loan will be used for—whether for debt consolidation, home renovation, or another purpose. This transparency helps in loan approval.

-

Be cautious of over-borrowing or misrepresenting the intended use; these can lead to financial strain or legal repercussions.

What is the process for disbursement of loan funds?

Disbursal entails transferring the approved loan amount to the borrower. Common options include bank transfers or checks. Timing is crucial; funds should be disbursed promptly once all conditions have been met.

How are interest rates and payment schedules determined?

-

Interest rates can be either fixed or variable and are calculated on the loan amount over time. Understanding these rates is essential to budgeting repayments.

-

Loan agreements may feature either simple or compound interest, each affecting overall repayment differently.

-

These can vary; common options include monthly or quarterly payments. Making prompt payments helps maintain good credit.

How do you establish the term of the loan?

Setting the loan duration depends on various factors such as the amount borrowed and ability to repay. Loan terms typically range from a few months to several years. Upon maturity, the borrower should be aware of options, such as renewing the loan.

What happens in case of default?

-

A loan is considered in default when the borrower fails to fulfill the repayment terms, leading to legal consequences.

-

Lenders have rights to pursue repayments through legal means, and may even reclaim collateral.

-

Both parties should seek amicable resolutions; alternatives include renegotiating terms to avoid further complications.

How to fill out the small personal loan agreement template?

Filling out the Small Personal Loan Agreement Template can be achieved by following a step-by-step approach. Maintaining accurate information is crucial to ensuring all necessary details are covered. Common mistakes include using outdated contact information or neglecting to read the entire contract before signing.

How can pdfFiller help manage this agreement?

pdfFiller empowers users to seamlessly edit PDFs and eSign documents from a single, cloud-based platform. Featuring interactive tools, it enhances collaboration by allowing multiple parties to work on a document simultaneously while ensuring that all inputs are saved automatically.

What compliance considerations are relevant?

-

Understanding local regulations concerning personal loans helps in crafting an agreement that adheres to the law.

-

These laws safeguard borrowers from unfair practices in the lending process and should be reviewed.

-

Consulting with legal professionals can help clarify obligations and protect rights when drafting agreements.

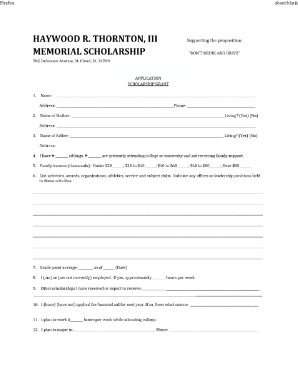

How to fill out the Small Personal Loan Contract Template

-

1.Open the Small Personal Loan Contract Template on pdfFiller.

-

2.Begin by entering the names of the lender and borrower at the top of the document.

-

3.Fill in the loan amount that the borrower is requesting in the designated section.

-

4.Specify the interest rate applicable to the loan in the relevant field.

-

5.Enter the repayment terms, including the duration and payment schedule (monthly, bi-weekly, etc.).

-

6.Detail any late payment penalties or fees to ensure both parties are informed.

-

7.Include any additional clauses relevant to the loan, such as collateral or prepayment options.

-

8.Review all entered information for accuracy and completeness.

-

9.Sign the document at the bottom, and have the other party sign as well, if required.

-

10.Save the completed contract and consider sharing it with both parties for their records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.