Get the free Notification of Bequest Intention Form

Get, Create, Make and Sign notification of bequest intention

How to edit notification of bequest intention online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notification of bequest intention

How to fill out notification of bequest intention

Who needs notification of bequest intention?

Understanding the Notification of Bequest Intention Form

Understanding the notification of bequest intention

A notification of bequest intention form is a document that outlines a donor's wishes to leave a portion of their estate to a designated charity or organization after their passing. By completing this form, individuals can express their commitment to support a cause they care about, turning their philanthropic aspirations into reality. Notifying organizations of these intentions is crucial as it allows charities to plan their finances and future projects accordingly. It also fosters a deeper relationship between the donor and the organization, reinforcing the impact of their intended gift.

The act of bequesting is more than a legal transaction; it's a personal expression of legacy. By formally documenting this intention, individuals ensure that their values and philanthropic aspirations live on, impacting future generations. In addition to fulfilling personal values, this notification can bolster fundraising efforts for organizations, allowing them to confidently allocate resources based on projected future support.

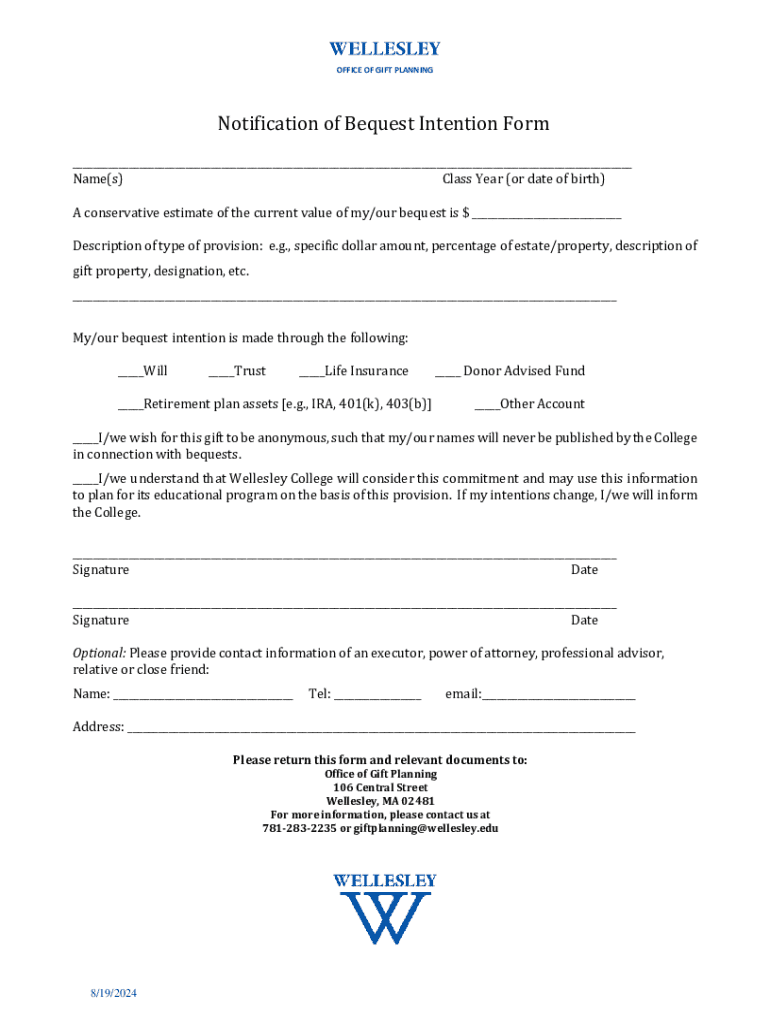

Key components of the notification of bequest intention form

The notification of bequest intention form comprises several essential elements. It starts with the personal identification details of the donor, including name, address, and contact information, ensuring the organization can connect with them regarding their bequest or any related matters. Additionally, the form requires detailed information about the charity or organization that is set to receive the bequest, ensuring clarity and transparency.

Most critically, donors must provide a description of the bequest itself. This can range from specific assets, such as real estate or financial accounts, to a percentage of the donor’s total estate. Detailed descriptions help prevent misunderstandings and ensure the organization knows what to expect. The form must also be signed and dated by the donor, as this adds a legal dimension to the notification, confirming the donor's intentions and making the document valid.

How to fill out the notification of bequest intention form

Filling out the notification of bequest intention form is a straightforward process that can be accomplished in a few simple steps. Step one involves gathering required information, which includes personal financial details and the charity's information. It's essential to have the correct contact details, including the charity's name and mailing address, readily available.

Next, you’ll proceed to complete the form. Each section should be filled in carefully; pay close attention to the descriptions required for your bequest. Step three is to review the entries for accuracy. Double-checking ensures that all information is correct, thus avoiding potential legal complications. Step four involves signing and dating the form in the designated areas, affirming your intentions and securing your commitment.

Common mistakes to avoid include listing errors, such as typos in names or addresses, missing vital information, and forgetting to sign the form. Each of these oversights can delay or complicate the processing of your bequest intention.

Editing and customizing the notification of bequest intention form

To ensure that your notification of bequest intention form meets your specific needs, pdfFiller offers a range of tools for editing the document. You can customize the form by adding or modifying fields to capture all necessary information effectively. Accessing these features is simple: just upload your form to pdfFiller, and use the intuitive editing tools to make your changes.

Once you complete the necessary edits, it’s vital to save and store your form securely. pdfFiller allows you to save documents in the cloud, providing easy access from any device. Regularly backing up important documents is a recommended practice to ensure that your wishes are preserved and accessible when needed.

Signing and submitting the notification of bequest intention form

Once you have filled out and reviewed your notification of bequest intention form, the next step is to sign it. Utilizing pdfFiller’s eSignature features allows you to sign documents electronically, providing a quick and efficient method compared to traditional signing. Electronic signatures are legally recognized and can expedite the process considerably.

After signing, there are several options for submitting the form. You can submit it online directly through the charity’s portal or send it via postal mail. For those who prefer face-to-face interactions, in-person delivery can also be arranged. Once submitted, it’s wise to follow up with the organization to confirm they received your notification, reinforcing your commitment and allowing you to receive any acknowledgments from them.

Frequently asked questions about bequest intention forms

Understanding who should fill out the notification of bequest intention form is key for potential donors. Generally, any individual who wishes to leave a bequest to a charity is eligible to complete the form. This document is typically filled out by those preparing their estate plans and looking to ensure their philanthropic goals are honored.

After submission, the processing timeline can vary depending on the organization’s procedures. It’s important to know that you can make changes to your notification after submission if needed. Many organizations have policies in place for updating bequest intentions, ensuring that your wishes always reflect your current intentions.

Additional considerations for bequest planning

When planning for a bequest, it’s crucial to consider the legal and tax implications associated with estate giving. Understanding estate laws can be complex, but many find that bequests can offer tax benefits to the donor’s estate, which may ease the financial burden on heirs. Consulting with a financial advisor or estate planner can provide valuable insights into how best to structure your intentions.

Another key aspect of bequest planning is selecting the right organization to benefit from your generosity. Take the time to research charities that align with your values and passions. Investigating an organization's legitimacy, financial health, and community impact is essential to ensure your donation makes a meaningful difference.

Personal stories and testimonials

Hearing from individuals who have completed the notification of bequest intention form can provide encouragement and inspiration. Many donors share feelings of satisfaction and fulfillment after formally expressing their intentions, feeling a sense of peace knowing they can contribute to a cause they believe in even after their passing.

Charities also benefit remarkably from knowing the intentions of their donors. Numerous organizations cite the positive impact bequest intentions have on their funding models, allowing them to plan long-term projects with a solid foundation of promise backed by donor commitments.

Staying connected with your chosen organization

After submitting your notification of bequest intention form, staying in touch with the organization can be valuable. Regular communication can enhance your connection with them and provide updates on how your intended gift will be utilized. Many organizations invite donors to participate in special events, allowing for closer ties and fostering a sense of community.

There are also opportunities for donors to collaborate or get involved beyond financial gifts. Volunteering or participating in initiatives can provide a deeper insight into the organization's mission and work, reinforcing your decision to support them.

To learn more or get help

Should you have any questions regarding the notification of bequest intention form, pdfFiller’s support channels are readily available. Their customer support team can assist with any inquiries you may have, helping you navigate the form with ease. Furthermore, pdfFiller provides access to additional forms and templates that can support your estate planning needs.

To expand your knowledge, consider looking into related documents available on pdfFiller, which can provide further insight into effective bequest planning and additional steps in establishing your philanthropic legacy.

Engaging with relevant news and updates

Staying informed about changes in estate planning laws and philanthropy trends is vital. Engaging with newsletters and updates related to these topics can equip you with knowledge and insights to enhance your giving strategy. Signing up for updates from pdfFiller can ensure you receive the latest information that could affect your bequest intentions.

Additionally, involvement can expand beyond bequest giving. Many organizations offer volunteer opportunities that can provide meaningful engagement, aligning your actions with your values while making a difference in the community.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in notification of bequest intention?

Can I create an electronic signature for signing my notification of bequest intention in Gmail?

Can I edit notification of bequest intention on an iOS device?

What is notification of bequest intention?

Who is required to file notification of bequest intention?

How to fill out notification of bequest intention?

What is the purpose of notification of bequest intention?

What information must be reported on notification of bequest intention?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.