Form 990: Comprehensive Guide to Understanding and Completing Your Form

Overview of Form 990

IRS Form 990 serves as a crucial document for tax-exempt organizations, providing essential financial information to the IRS and the public. This form is designed to ensure transparency within the nonprofit sector, making it a key resource for accountability and governance.

Definition: Form 990 is an annual information return that most tax-exempt organizations must file with the IRS.

Purpose: The form’s primary goal is to report financial status, governance, and activities to maintain compliance with federal regulations.

Importance: By filing Form 990, nonprofits can demonstrate their commitment to transparency and build public trust, which is essential for attracting funding and support.

Understanding the structure of Form 990

Form 990 is structured into multiple sections, each serving a distinct purpose. Understanding these sections will help organizations complete the form accurately and fulfill their reporting requirements.

Core Sections: The form includes sections for revenue, expenses, net assets, and disclosures about governance and performance.

Schedules: Additional schedules may be required to provide detailed information concerning specific activities or financial transactions.

Variants: Be aware of variants such as Form 990-EZ, which is a simplified version for smaller organizations, and Form 990-N, a postcard version for organizations with gross receipts under $50,000.

Filing requirements for Form 990

Not every nonprofit is obligated to file Form 990. Different types of organizations have varied requirements based on their size, revenue, and specific designation under the IRS structure.

Mandatory Filing: Most tax-exempt organizations that earn more than $200,000 in gross receipts or have assets exceeding $500,000 must file.

Exceptions: Churches, integrated auxiliaries, and certain public charities are among those exempt from filing requirements.

Deadlines: Organizations must file Form 990 by the 15th day of the fifth month following the end of their fiscal year. Organizations that miss this deadline face penalties.

Penalties for non-compliance

Failing to file Form 990 on time can lead to significant penalties and jeopardize a nonprofit's tax-exempt status. Understanding these consequences is critical for organizational leaders.

Financial Penalties: Noncompliance can incur automatic fines. For late submissions, the IRS imposes a penalty of $20 per day, up to a maximum of $10,000.

Losing Exempt Status: Repeated failures to file may result in revocation of tax-exempt status, complicating financial operations and funding.

Reinstatement Challenges: Reinstating tax-exempt status involves additional paperwork and can entail significant delays.

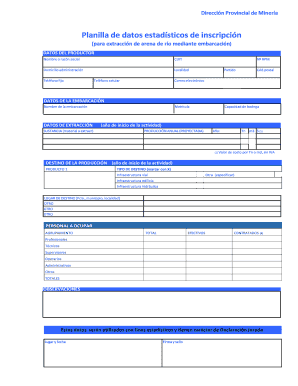

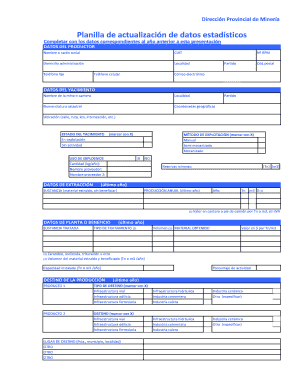

Preparing to fill out Form 990

Preparation is key when it comes to filing Form 990. Ensuring all necessary documentation is gathered can streamline the process and lead to greater accuracy.

Financial Documentation: Gather your nonprofit’s financial statements, including balance sheets and income statements.

Supporting Records: Collect documentation related to contributions, grants, and operational expenses for thorough reporting.

Checklist: Create a checklist of all data required for each section, including prior year’s Form 990 if available, to ensure completeness.

Step-by-step guide to completing Form 990

Completing Form 990 can appear daunting, but following a methodical approach can simplify the process.

Data Entry: Start by filling in general information such as the organization’s name, address, and EIN at the top of the form.

Schedule Title: Complete the core schedules; ensure financial data correlates with recorded amounts in your books.

Review: Before submission, verify accuracy of all calculations and disclosures to minimize corrections post-filing.

Public inspection regulations

Form 990 is not just a filing requirement; it also plays a significant role in ensuring public access to information about nonprofit organizations.

Legal Access: Organizations must make Form 990 available for public inspection for a minimum of three years following the filing.

Online Resources: Websites like Guidestar and the IRS offer free access to Form 990, making it easier for the public to research and assess nonprofits.

Transparency: Public availability of Form 990 fosters trust and accountability within the nonprofit realm, reinforcing donor confidence.

Analyzing Form 990 for charitable evaluation

Form 990 serves as an important resource for potential donors and researchers evaluating the effectiveness and financial health of nonprofit organizations.

Financial Health Metrics: Analysts can gauge an organization’s financial health, including revenue trends, expense allocation, and liquid assets.

Performance Indicators: Metrics disclosed in Form 990 can help assess a nonprofit's operational effectiveness and impact in the community.

Evaluation Tools: Platforms like Charity Navigator utilize data from Form 990 to provide overall ratings of nonprofits based on financial health.

Historical context of Form 990

Understanding the historical context of Form 990 provides insight into its evolution and current importance within the nonprofit sector.

Evolution: Introduced in 1942, Form 990 has evolved in structure and requirements to enhance compliance and transparency.

Accountability: The development of Form 990 reflects increasing demands for nonprofit accountability and donor transparency over the decades.

Outcome: As a standardized reporting tool, Form 990 has become a foundational document for nonprofit governance and public trust.

Alternative filing modalities and digital solutions

With technological advancements, e-filing forms like Form 990 have become a more efficient option for nonprofit organizations.

E-filing Benefits: Electronic submissions allow for faster processing, reduced paperwork, and lower chances of errors.

Integration with Online Platforms: Utilizing platforms like pdfFiller simplifies Form 990 management, enabling users to edit and collaborate in real-time.

Document Management: The ease of managing documents digitally streamlines organizational work and supports timely compliance.

Fiduciary responsibilities and reporting

Board members have a fundamental role in overseeing the organization’s financial status and compliance with Form 990 requirements.

Board Oversight: Beyond Form 990, board members should ensure overall financial health through regular reviews of financial statements and budgets.

Risk Mitigation: Accurate reporting can help prevent financial mismanagement, ensuring that funds are used effectively to advance the organization’s mission.

Collective Governance: Engaging in thorough compliance and reporting practices bolsters both board effectiveness and organizational integrity.

FAQs about Form 990

Understanding the intricacies of Form 990 can be daunting; however, addressing common questions can demystify the filing process for many.

Common Concerns: Potential filers often worry about penalties for late submissions, and whether they truly need to file.

Resources for Guidance: The IRS website offers detailed instructions and FAQs for non-profits, ensuring users have access to reliable information.

Support Services: Engaging with a professional service can provide additional guidance and peace of mind in the filing process.

Related forms and documentation

In the realm of nonprofit administration, several forms supplement Form 990, each tailored for specific reporting needs.

Form 1023: This is the application form for tax-exempt status and must be filed before Form 990.

Form 990-T: This form is required if your nonprofit engages in unrelated business income, ensuring proper tax reporting.

Ongoing Compliance: Nonprofits should actively maintain compliance with all IRS requirements, utilizing resources to track submissions.

Conclusion: Empowering your nonprofit through knowledge

Understanding Form 990 is essential for the responsible governance of nonprofit organizations. Knowledge of this form not only facilitates compliance but also empowers organizations to leverage financial documentation effectively for growth.

Documentation Usage: Utilize Form 990 as a tool for reflection and future planning, positioning your organization for sustained success.

Continuous Learning: Engaging with resources like pdfFiller can provide additional support, fostering a culture of ongoing compliance and improvement.

Community Building: By maintaining transparency and accurate reporting through Form 990, organizations enhance community trust and donor engagement.