Get the free Form No. 10ac

Get, Create, Make and Sign form no 10ac

Editing form no 10ac online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form no 10ac

How to fill out form no 10ac

Who needs form no 10ac?

Form No. 10AC: A Comprehensive Guide for Charitable and Religious Organizations

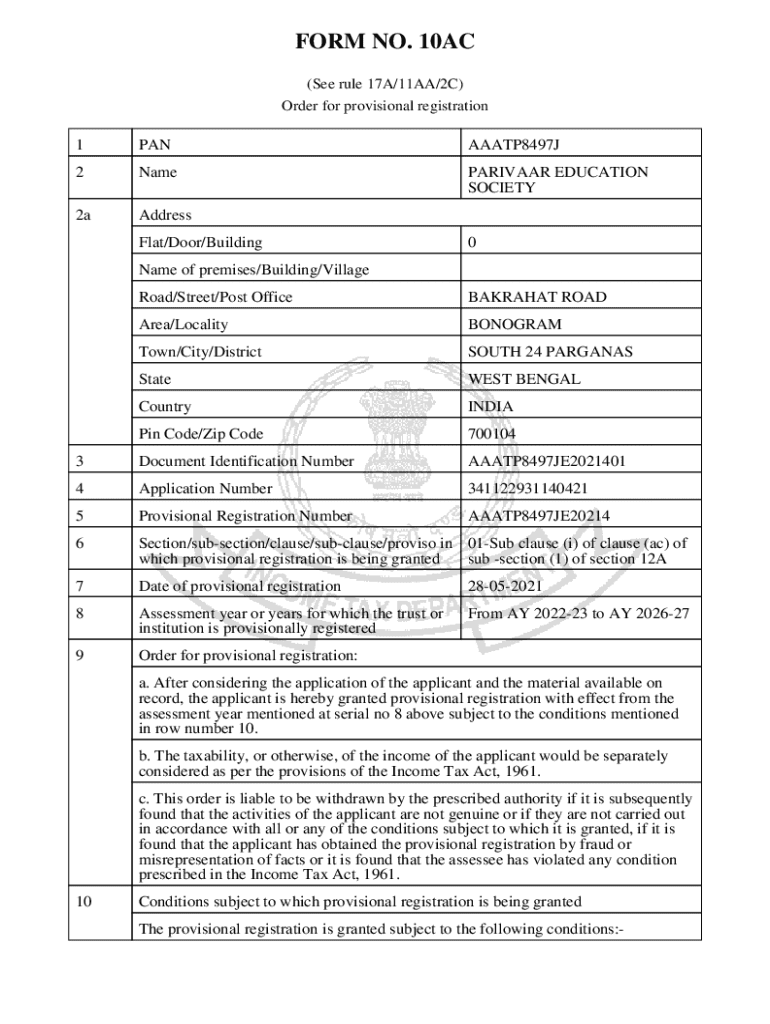

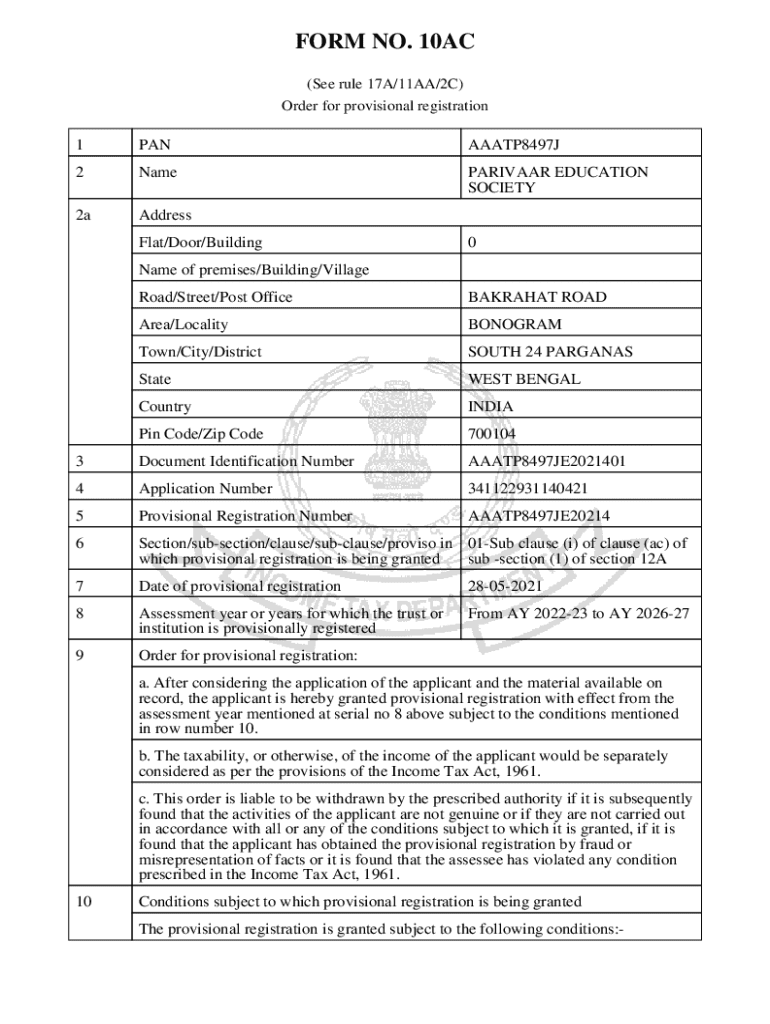

Understanding Form No. 10AC

Form No. 10AC serves a pivotal role in the registration of charitable and religious trusts in India. Its primary function is to facilitate the recognition of these organizations for tax exemptions under Section 80G of the Income Tax Act. With this form, organizations can ensure they are officially recognized as charitable entities, which opens the door to receiving donations while granting donors the ability to claim tax deductions.

The importance of Form No. 10AC cannot be overstated. It not only establishes a framework for operational transparency and legitimacy but also connects the donor community with organizations that drive social change. Many organizations rely on donations to fund their initiatives, thus making the acceptance of tax-deductible donations essential for their sustainability.

Eligibility criteria for applying for Form No. 10AC

The eligibility criteria for applying for Form No. 10AC is primarily aimed at charitable institutions, religious trusts, societies, and non-profit organizations. To be eligible, organizations must demonstrate that they operate for charitable purposes as outlined in the Indian Income Tax Act.

Key benefits of filing Form No. 10AC

Filing Form No. 10AC yields significant advantages for organizations involved in charitable activities. One of the most crucial benefits is the tax exemption status granted to eligible organizations. This status allows non-profits to retain more of their funds, thereby enabling them to allocate resources efficiently.

Detailed application process of Form No. 10AC

Filling out Form No. 10AC requires careful attention to detail. The application process begins by collecting all necessary basic information, including the organization's name, address, and objectives. The form typically asks for particulars regarding the organization’s activities and its governing bodies.

The online submission process for Form No. 10AC is user-friendly, with a dedicated portal available on the Income Tax Department’s website. Applicants can upload their forms along with supporting documents electronically, streamlining the submission process. It’s also advisable to keep a copy of all submitted documents for future reference.

Common mistakes to avoid when filling out Form No. 10AC

When applying for Form No. 10AC, organizations must ensure that they avoid common pitfalls that could lead to rejection of their application. Incomplete information is one of the leading causes for delays; therefore, double-checking entries is essential.

Timeline and procedures of issuance by income tax authorities

The timeline for processing Form No. 10AC varies based on the efficiency of income tax authorities and the completeness of the application. Typically, applicants can expect a processing time ranging from two weeks to several months, depending on the workload of the department.

After submission, the applicant will receive an acknowledgment number, which can be used to track the status of the application. Upon successful approval, the organization will be issued a registration number, enabling it to operate as a formally recognized charitable entity.

Maintaining compliance post-submission

Once Form No. 10AC is submitted and approved, organizations must ensure compliance with its provisions to maintain their tax-exempt status. Form No. 10AC is typically valid for five years, after which renewal is required. Adhering to compliance requirements is crucial for preserving their tax advantage.

Rectification and amendment processes

If there are errors found post-submission, organizations have the opportunity to rectify them. The process for making amendments to an already submitted Form No. 10AC generally requires filing a specific request along with justification for the changes needed.

Frequently asked questions about Form No. 10AC

As organizations navigate the complexities of Form No. 10AC, they often have queries. For instance, one common question pertains to the deadline for submission; organizations are encouraged to submit their application as early as possible, especially if they are looking to qualify for 80G approval. Organizations also frequently ask what to do if they miss the submission deadline: in this case, they should consult a tax advisor for possible retrospective application options.

Recent updates and clarifications regarding Form No. 10AC

Among the notable updates regarding Form No. 10AC is the Finance Act, 2022, which introduced certain amendments focused on refining eligibility and procedural guidelines for organizations seeking tax exemptions. This law aims to eliminate ambiguities and enhance efficiency in processing these forms.

Additionally, the Central Board of Direct Taxes (CBDT) has issued clarifications aimed at addressing common uncertainties organizations face. These updates emphasize compliance and streamline the processes involved in applying for Form No. 10AC, making it increasingly essential for organizations to stay informed about any changes in tax law.

Impact of Form No. 10AC on tax exemption status

The registration obtained through Form No. 10AC significantly impacts an organization's tax-exempt status. By complying with the provisions of the form, organizations maintain eligibility for tax benefits under various sections of the Income Tax Act, such as Sections 12A and 80G.

Related topics and further readings

For organizations seeking a deeper understanding of their operational landscape, familiarity with sections such as 12A, 80G, 10(23C), and 35 of the Income Tax Act is crucial. These sections outline the eligibility, benefits, and obligations tied to charitable organizations. Furthermore, insights into government policies impacting charitable institutions provide a framework within which these entities operate, ensuring compliance with laws while maximizing their social impact.

Utilizing pdfFiller for Form No. 10AC

pdfFiller emerges as a powerful tool for individuals and teams working on Form No. 10AC. Its intuitive interface aids in seamless editing, ensuring all required fields are correctly filled out. Collaborators can easily review and sign documents in a secure environment, which is especially useful when multiple stakeholders are involved in the application process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form no 10ac without leaving Google Drive?

How do I edit form no 10ac online?

How do I complete form no 10ac on an iOS device?

What is form no 10ac?

Who is required to file form no 10ac?

How to fill out form no 10ac?

What is the purpose of form no 10ac?

What information must be reported on form no 10ac?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.