Get the free Co-applicant Request Form

Get, Create, Make and Sign co-applicant request form

Editing co-applicant request form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out co-applicant request form

How to fill out co-applicant request form

Who needs co-applicant request form?

Comprehensive Guide to the Co-Applicant Request Form on pdfFiller

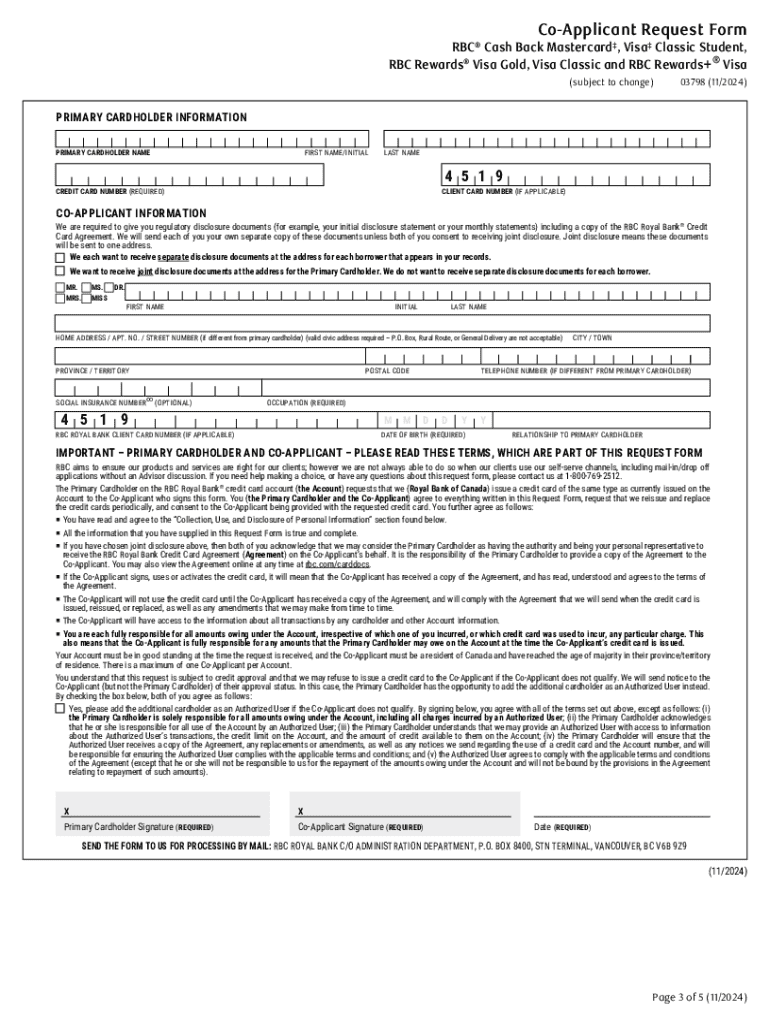

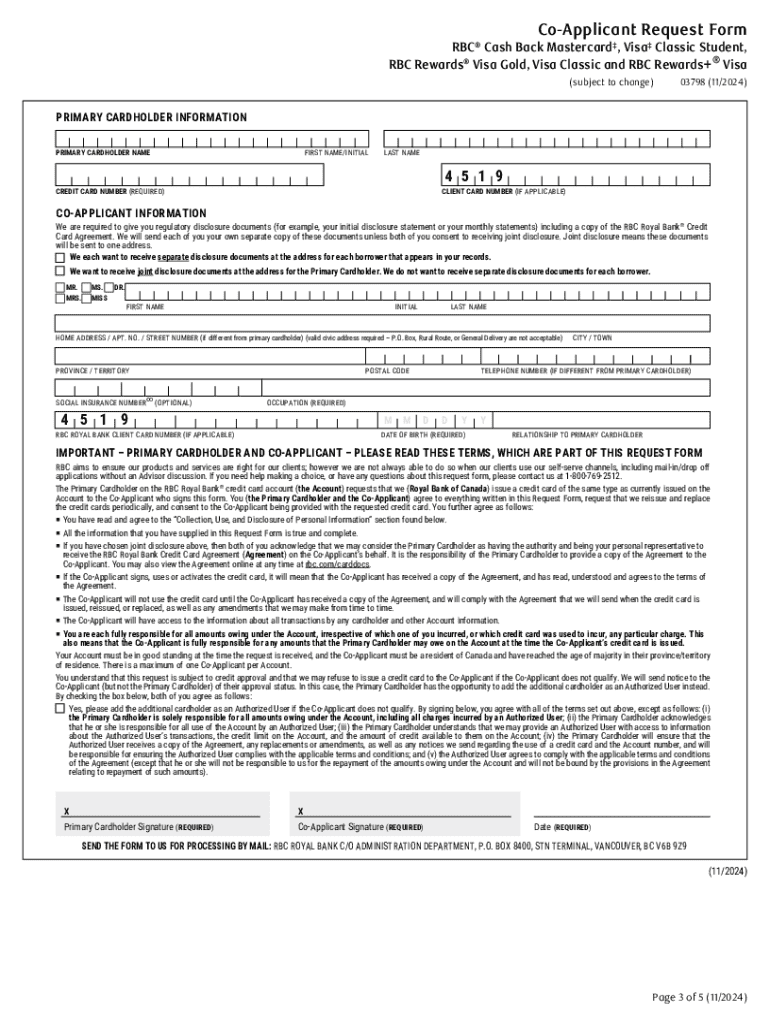

Understanding the co-applicant request form

A co-applicant request form is a critical document used in various financial transactions, particularly in loan and credit applications. Its primary purpose is to include another individual, known as a co-applicant, who will share the financial responsibility of the application. This form plays a vital role in demonstrating the combined income and creditworthiness of both applicants, which can significantly improve the chances of approval and potentially secure better loan terms.

Including a co-applicant in financial dealings not only amplifies borrowing power but also minimizes risks associated with default. Financial institutions often require a co-applicant to mitigate risks when lending substantial amounts of money. It paves the way for responsible shared financial commitments and can facilitate smoother transactions.

Who should use the co-applicant request form?

The co-applicant request form is particularly beneficial for several groups of individuals. First, those applying for loans or credit, such as mortgages, auto loans, or personal loans, should consider using a co-applicant to strengthen their application. By doing so, both applicants can leverage their combined financial strength to enhance their prospects.

Spouses or partners seeking shared financial responsibility are another group that can benefit significantly from this form. Together, they can apply for joint accounts or loans, demonstrating their shared commitment and financial stability. Additionally, teams collaborating on business accounts often need to include co-applicants to navigate the complexities of financing for joint ventures.

Key features of the co-applicant request form on pdfFiller

One of the standout features of the co-applicant request form on pdfFiller is its cloud-based accessibility. Users can edit and fill out forms from anywhere, simplifying the application process significantly. Whether you are at home, at work, or on the go, having the ability to access crucial documents becomes invaluable.

Another key feature is the user-friendly interface, designed to guide applicants through the process. This intuitive design helps prevent confusion, making it easier for users, regardless of their technical expertise. Additionally, the included eSignature capabilities allow users to sign documents securely without the hassle of printing and scanning, ensuring that everything stays organized in one place.

Step-by-step guide to completing the co-applicant request form

Completing the co-applicant request form can be a straightforward process when approached methodically. Initially, it is essential to prepare all necessary documents. Typical required information includes personal identification, financial statements, and credit history for both primary applicant and co-applicant. Common mistakes such as incomplete fields or mismatched information can lead to delays or denials, so preparation is crucial.

To access the form on pdfFiller, navigate to the pdfFiller dashboard. The dashboard provides a streamlined interface to quickly locate the co-applicant request form. Once accessed, you can fill out each section carefully. Key sections include personal information like names and addresses, financial information detailing income or existing debt, and co-applicant information to include the second party’s details.

After filling out the form, reviewing it becomes vital to double-check for errors. Pay attention to numbers and ensure that all required sections are completed. Once reviewed, you can save and submit the form directly through pdfFiller, making the process both efficient and hassle-free.

Interactive tools for enhancing your experience

pdfFiller offers a variety of interactive tools that enhance the user experience when completing the co-applicant request form. Utilizing templates is highly beneficial, ensuring accuracy and consistency across different applications. Templates not only save time but also help users avoid common errors by providing clear guidelines on what to include.

Real-time collaboration features enable teams to work together effectively on the same document, making it easier to manage joint financial applications. Tracking submission status and updates is another valuable feature, allowing users to stay informed about their application's progress. This eliminates the anxiety of uncertainty and offers peace of mind throughout the process.

FAQs about the co-applicant request form

When navigating the co-applicant request form, users often have questions pertaining to the application process. One common query is about the duration it takes for an application to be processed. Typically, this can range from a few days to a few weeks, depending on the lending institution’s policies and the complexity of the application.

Another frequent concern is what happens if a co-applicant doesn’t qualify. In such cases, it may be necessary to reassess the application, potentially adjusting the financial details or seeking a different co-applicant. Providing clear communication with lenders about the situation can also help identify alternative solutions.

Security and compliance considerations

When dealing with sensitive financial information, security and compliance should be top priorities. pdfFiller employs advanced security measures to protect personal information submitted through the co-applicant request form. Encryption standards are upheld to ensure that data remains confidential and secure throughout the application process.

Understanding privacy policies and data protection laws is crucial. By using pdfFiller, users can be assured that their information is handled in compliance with applicable regulations. This awareness helps users feel more confident in submitting their details, knowing that protective measures are in place.

Customer success stories

The co-applicant request form has been instrumental for numerous individuals and teams. A series of case studies illustrates successful applications, where clients shared their positive experiences of using pdfFiller. Testimonials highlight significant benefits such as quicker approvals, better loan terms, and easier document handling. These real-world accounts emphasize the effective role that this platform plays in navigating complex application processes.

By showcasing these success stories, potential users can envision the advantages of leveraging the co-applicant request form in their financial dealings. They serve as both motivation and reassurance that the process can lead to favorable outcomes when managed well.

Navigating future updates and changes

Staying informed about changes to the co-applicant request form and related processes is essential for users. pdfFiller periodically updates its templates and features to align with evolving industry standards and user needs. These updates may include adjustments in required information, formatting, and additional interactive features that further enhance user experience.

To access newly released templates and features, users are encouraged to regularly check the pdfFiller platform. Keeping abreast of updates not only streamlines future applications but also ensures that users are leveraging the best tools available at any given time, ultimately leading to more successful financial transactions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit co-applicant request form from Google Drive?

How can I edit co-applicant request form on a smartphone?

How do I complete co-applicant request form on an iOS device?

What is co-applicant request form?

Who is required to file co-applicant request form?

How to fill out co-applicant request form?

What is the purpose of co-applicant request form?

What information must be reported on co-applicant request form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.