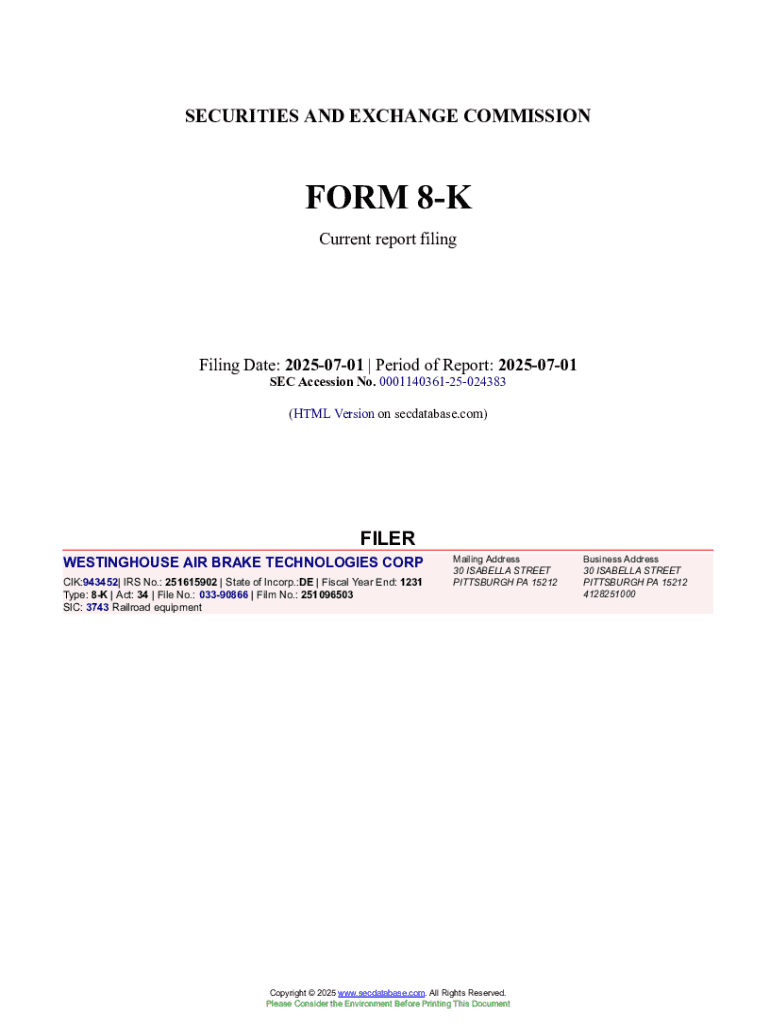

Get the free Form 8-k

Get, Create, Make and Sign form 8-k

Editing form 8-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-k

How to fill out form 8-k

Who needs form 8-k?

Understanding Form 8-K: A Comprehensive Guide

Understanding Form 8-K

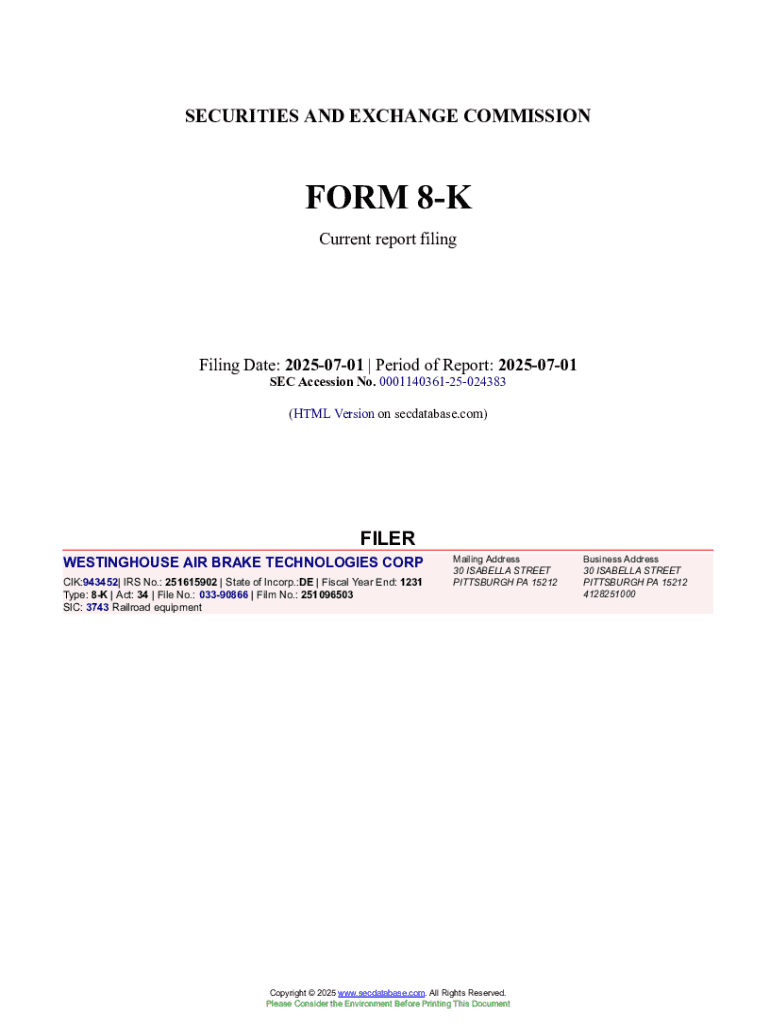

Form 8-K, also known as the current report, is a critical disclosure document required by the U.S. Securities and Exchange Commission (SEC) for publicly traded companies. This form serves to inform shareholders and the public about significant events that occur between the regular quarterly (10-Q) and annual (10-K) filings. As it provides an instantaneous account of important corporate changes, Form 8-K plays a vital role in corporate reporting.

The significance of Form 8-K cannot be overstated, as it ensures that stakeholders remain informed about developments that could impact a company’s financial condition or share price. Unlike forms 10-K and 10-Q, which provide a comprehensive overview of a company’s financial status over a set period, Form 8-K is event-driven and filed promptly following key developments. This distinction underscores its importance in maintaining transparency and facilitating timely communication.

When is Form 8-K required?

Form 8-K must be filed when specific triggering events occur. Some of the major corporate events include:

Companies are required to file Form 8-K within four business days of the occurrence of the event. This quick turnaround helps ensure that all stakeholders have timely access to critical information.

Key components of Form 8-K

Form 8-K has a standardized structure that makes it easier for investors and analysts to locate pertinent information. The form consists of various sections, identified by unique item numbers. A few critical item numbers include:

Each of these items requires specific disclosures, and it is crucial for companies to provide accurate and comprehensive information. Failing to disclose relevant details can lead to regulatory penalties and loss of investor trust.

Reading and analyzing Form 8-K

Interpreting the information contained in a Form 8-K requires familiarity with legal and financial terminology. Investors should look for key indicators that suggest how the corporate events may affect the company’s value and stability. For example, a change in executive leadership may signal a new strategic direction, while the announcement of a merger could represent growth opportunities or incite concerns about integration risks.

It's important for investors to be aware of potential red flags. This could include vague disclosures, repetitive issues, or a lack of transparency regarding significant events. By being analytical and questioning the implications of what is disclosed, investors can make more informed decisions.

Historical context of Form 8-K

Form 8-K has evolved since its inception as part of regulatory frameworks aimed at enhancing market transparency. The implementation of this form was a response to severe corporate scandals that highlighted the need for prompt disclosure of material events. Historical case studies illustrate how some landmark Form 8-K filings have influenced market reactions.

For instance, significant announcements regarding mergers or executive departures have frequently led to drastic fluctuations in stock prices. These filings provide priceless insight into how investor sentiment and market behaviors are interlinked with corporate disclosures, reshaping the importance of Form 8-K in contemporary finance.

Industry-specific considerations

The specifics of Form 8-K filings can vary widely across industries. For instance, tech companies might report different types of material events compared to those in finance or healthcare. The ever-evolving landscape of technology may lead to rapid changes in leadership or product launches, necessitating unique disclosures.

Conversely, the finance sector may focus more on regulatory compliance and legal matters, leading to different reporting challenges. These industry-specific nuances highlight the importance of tailoring disclosures to ensure compliance and clarity.

Benefits of Form 8-K for stakeholders

Form 8-K enhances transparency and accountability within corporations, thereby benefiting various stakeholders. It ensures that shareholders are promptly informed about significant events that may affect their investments. A well-constructed Form 8-K reassures investors of the company's commitment to transparency.

For potential investors, timely and accurate disclosures facilitate informed decision-making. Form 8-K acts as a key resource for understanding company strategies, financial health, and risks, instilling greater confidence in corporate governance and investor relations.

FAQs about Form 8-K

Many companies and investors often have questions regarding the filing procedures and content of Form 8-K. Common inquiries include what constitutes a material event, how long businesses have to file after an event occurs, and how to interpret technical jargon used in the document.

It is advised that companies develop a clear protocol for stakeholder communication after filing Form 8-K. Ensuring clarity in language and transparency in intent can help mitigate misunderstandings and foster a positive dialogue with shareholders.

Tools and resources for managing Form 8-K filings

pdfFiller provides an accessible solution for individuals and teams looking to manage Form 8-K filings effectively. With interactive tools designed for completing, editing, and signing Form 8-K documents, pdfFiller empowers users to maintain compliance effortlessly.

Users can take advantage of features that simplify document management by providing templates and guided assistance to ensure that all necessary disclosures are included. This facilitates smoother filing processes and minimizes the risk of errors.

Staying updated on Form 8-K filings

Monitoring recent Form 8-K submissions is crucial for investors who wish to stay informed about their investments. Numerous resources allow stakeholders to track filings in real-time, ensuring they receive timely updates on any significant corporate events.

By subscribing to financial news feeds, utilizing SEC databases, and monitoring corporate websites, investors can stay ahead of the curve. This proactive approach allows informed decision-making and enhances an investor's ability to respond to market changes effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form 8-k?

How do I complete form 8-k on an iOS device?

How do I fill out form 8-k on an Android device?

What is form 8-k?

Who is required to file form 8-k?

How to fill out form 8-k?

What is the purpose of form 8-k?

What information must be reported on form 8-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.