Get the free Business Internet Banking Request Form

Get, Create, Make and Sign business internet banking request

How to edit business internet banking request online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business internet banking request

How to fill out business internet banking request

Who needs business internet banking request?

Business Internet Banking Request Form: How-to Guide

Understanding the business internet banking request form

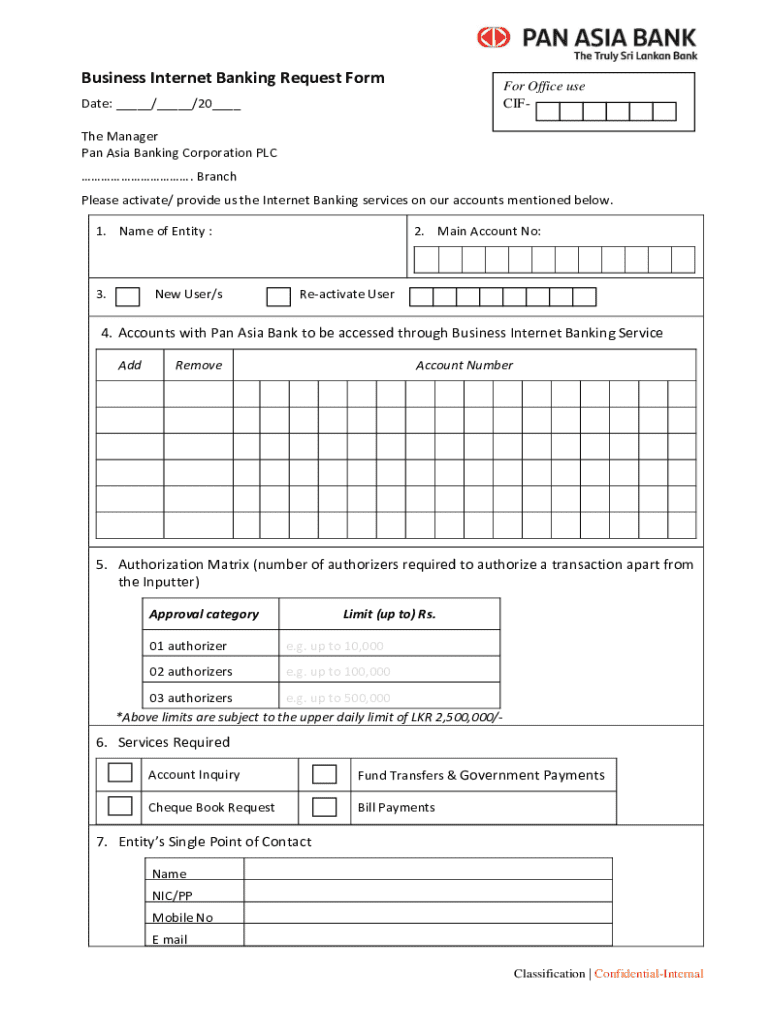

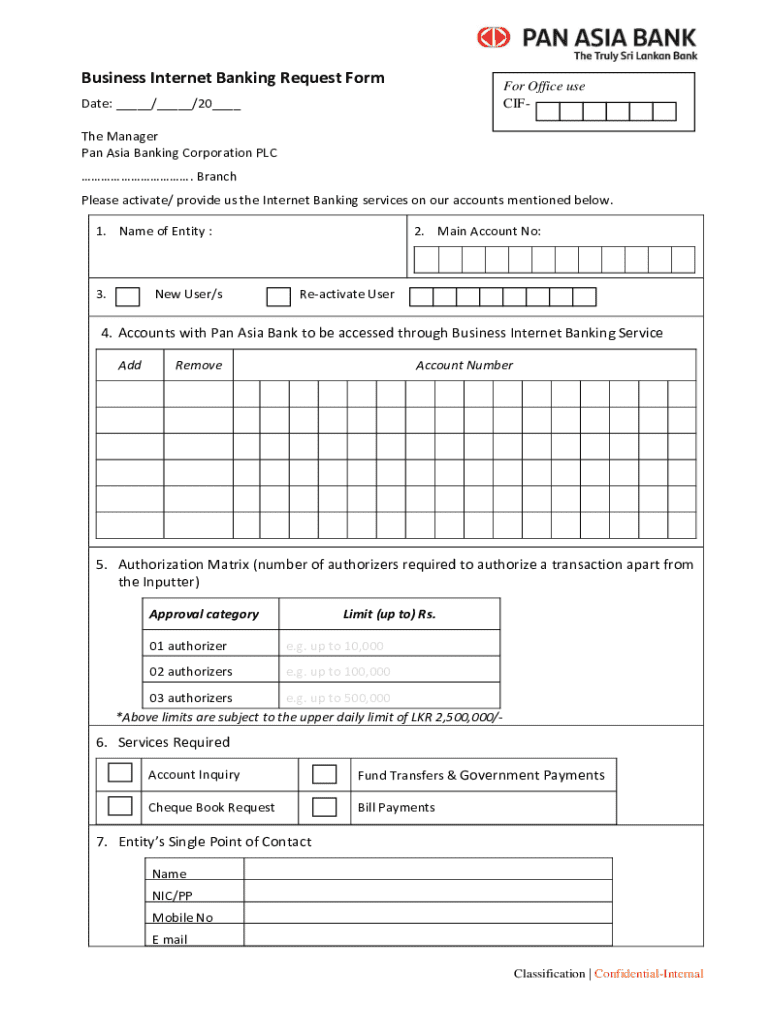

A Business Internet Banking Request Form is a crucial document that enables organizations to access and manage their banking needs online. This form allows businesses to initiate the enrollment or modification of their internet banking services, which are essential for effective financial management and operational efficiency. By utilizing this form, businesses can streamline their banking processes, ensuring quicker access to services such as fund transfers, account monitoring, and transaction history.

The importance of this form cannot be overstated. In an era where digital banking has become the norm, having the right tools at your disposal is vital. The Business Internet Banking Request Form not only facilitates access to banking services but also plays a significant role in maintaining accurate and organized financial records, aiding in compliance and audit requirements.

Who needs this form?

The target audience for the Business Internet Banking Request Form includes a wide range of stakeholders within an organization. This typically involves business owners, finance teams, and administrative personnel responsible for managing banking functions. Any entity that holds a business bank account and seeks to take advantage of digital banking services can benefit from this form.

Different types of businesses, from small startups to large corporations, utilize the Business Internet Banking Request Form. Small businesses often need to simplify their banking tasks, while larger organizations may require advanced features that come with corporate banking solutions. Regardless of size, the ability to access banking facilities digitally can greatly enhance operational capabilities.

Key features of the business internet banking request form

The Business Internet Banking Request Form is designed with several key features that cater to various banking needs. Understanding these components is critical for effective completion. Essential fields typically include business name, address, account number, and contact information. These details establish the identity of the business and its account association.

Optional fields may include specific banking preferences, like transaction limits or additional services desired. These could enhance the overall experience by tailoring service offerings to your business’s unique needs. It is advisable to review these optional fields carefully, as they may offer features that can significantly optimize your banking operations.

Understanding bank-specific variations

Different banks may have their own formats and requirements for the Business Internet Banking Request Form. Larger institutions might require additional verification steps or supplementary documents. It’s essential to consult your bank’s guidelines to ensure that the form is completed in accordance with their specific standards.

Take advantage of the benefits of online submission as well. Digital forms are typically processed much faster than their paper counterparts. Secure online submissions also minimize the risks associated with lost documents or identity theft. This leap in convenience and security has made online banking forms an increasingly preferred option for businesses.

Step-by-step instructions for filling out the form

Filling out the Business Internet Banking Request Form is a straightforward process when approached methodically. Start by gathering all necessary information that you will need to complete the form accurately.

Now, let’s walk through the steps for filling out the form effectively. First, start with the business information where you'll fill in your organization's name and address. Next, enter the details of the authorized signatories. These are the individuals granted permission to manage internet banking tasks. Following that, specify any banking preferences that align with your business operations. Finally, ensure that you take the time to review and double-check all entries for accuracy to prevent any potential errors.

Common pitfalls to avoid include overlooking optional fields that could enhance service usage or submitting incomplete signatures. Always ensure that every section relevant to your needs is addressed to avoid delays in processing.

Editing and managing your form online

Utilizing tools like pdfFiller to edit your Business Internet Banking Request Form provides a simple, intuitive method for managing documents online. By uploading your form to pdfFiller, you can edit fields and make necessary updates with ease. The interactive tools available allow you to modify text, rearrange the layout, and streamline the document to your satisfaction.

One of the standout features of pdfFiller is its collaborative capabilities. Multiple users can work on a single form simultaneously, making it ideal for team scenarios where several stakeholders might need to input data or feedback. This fosters a more inclusive environment for effective communication among team members and expedites the completion process.

When it comes to saving your edited form, pdfFiller offers various formats for download, including PDF and Word. Depending on your needs, you can choose the format that works best for you.

eSigning the business internet banking request form

eSignatures are increasingly important in document submission for businesses. With legal validation in many jurisdictions, eSignatures streamline the process of completing and sending official documents like the Business Internet Banking Request Form, allowing for a quick turnaround time.

Using pdfFiller, adding your signature digitally is a seamless process. You can either upload an image of your signature or create a new one directly within the platform. After adding your signature, it’s crucial to verify its placement to ensure it meets your bank's requirements.

Finalizing your eSignature can involve certain best practices such as ensuring your name is correctly displayed and that the signature field is clear of any overlaps with other text or graphics. Observing these details avoids the chance of your submission being rejected.

Submitting your form to the bank

After you have completed your Business Internet Banking Request Form and appended your eSignature, the next step is to submit it to the bank. It is important to keep various key points in mind to ensure a successful submission. Always double-check your form for accuracy and completeness to avoid common reasons for rejection.

After submission, tracking the status is vital. Most banks will provide email notifications or online portals to confirm that your submission was received. Follow up as necessary to ensure that your request is in process.

In case you face a rejection, it is often due to missing information or discrepancies in the details provided. Addressing these issues may involve providing additional documentation or clarifying misunderstandings directly with bank officials.

After submission: what to expect

Upon submission of your Business Internet Banking Request Form, be prepared for varying processing timelines depending on the bank. Typically, banks may take anywhere from a few hours to several days to process the requests. Knowing this timeline helps in planning your business's banking activities accordingly.

Keeping your banking information updated is another key aspect of managing your business finances effectively. Periodic checks on your banking details ensure that information remains accurate and compliant with any regulatory changes, helping to prevent any disruptions in your banking services.

Utilizing pdfFiller for ongoing document management

pdfFiller offers extensive features for continuous document management. Having a single, cloud-based platform for handling forms means that users can easily access, edit, and store all necessary documents without having to navigate multiple systems. This streamlined approach saves time and reduces confusion over document versions.

Security and compliance are paramount when managing financial documents. pdfFiller ensures your documents remain safe through encryption and secure cloud storage. Additionally, it complies with relevant regulatory standards, giving you peace of mind while managing sensitive information.

For those new to pdfFiller, the platform has an array of FAQ resources. These address common document management questions, allowing users to troubleshoot issues or find effective methods for utilizing the various features available.

User testimonials and success stories

Real-life examples illustrate the effectiveness of the Business Internet Banking Request Form when utilized through platforms like pdfFiller. Businesses across various sectors have shared their success stories, emphasizing how seamless document management has improved their banking experiences.

Customer feedback often highlights the ease of use and collaboration features provided by pdfFiller. Users appreciate the user-friendly interface and the efficiency gains that come from using an all-in-one document management solution.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send business internet banking request for eSignature?

Where do I find business internet banking request?

Can I edit business internet banking request on an Android device?

What is business internet banking request?

Who is required to file business internet banking request?

How to fill out business internet banking request?

What is the purpose of business internet banking request?

What information must be reported on business internet banking request?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.