Get the free Form 990

Get, Create, Make and Sign form 990

Editing form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990 Form: A Comprehensive How-To Guide

Understanding Form 990: Overview and Importance

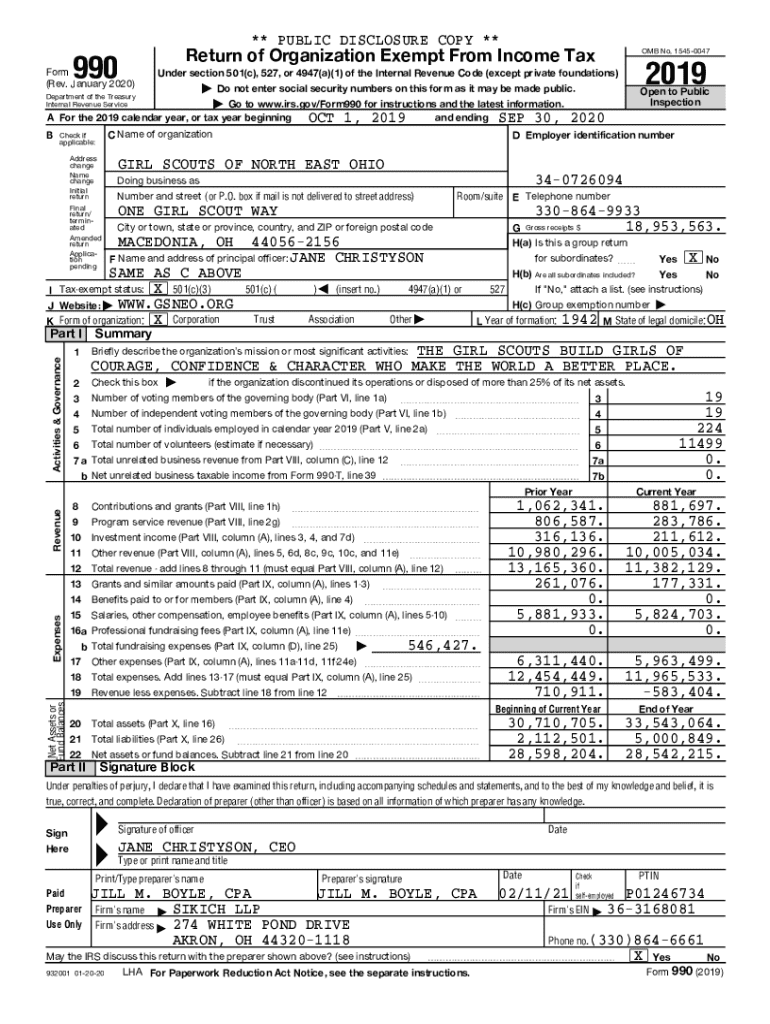

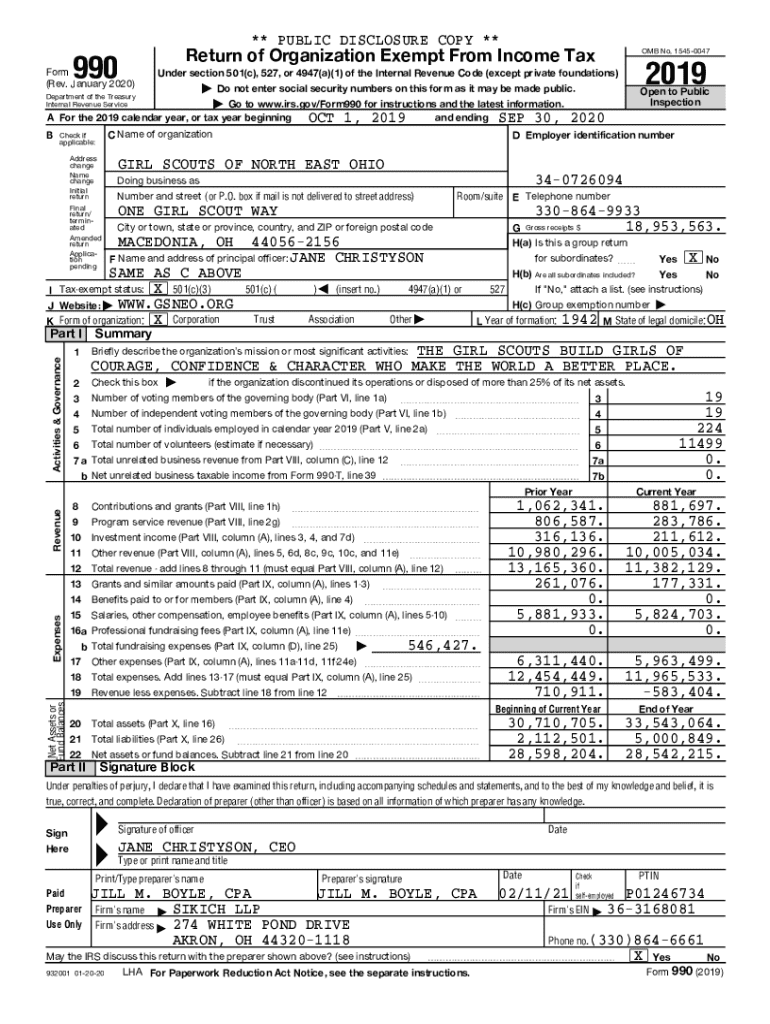

Form 990 is a crucial document that the IRS requires nonprofit organizations to file annually. This form provides details about a nonprofit's mission, programs, and finances, making it an essential tool for transparency and accountability in the nonprofit sector.

The primary purpose of Form 990 is to ensure that nonprofits operate effectively and within their financial means while providing valuable information to the public about their operations and impact. By analyzing this form, stakeholders can gauge how funds are used, evaluate the financial health of the organization, and understand the organization's governance structure.

Navigating the different variants of Form 990

Not all nonprofits are required to file the same version of Form 990. There are three primary variants: Form 990, Form 990-EZ, and Form 990-N, each designed to suit the needs of different organizational sizes.

Form 990 is detailed, requiring extensive financial data and narratives about programs. In contrast, Form 990-EZ offers a simplified version suitable for smaller organizations with gross receipts under $200,000 and total assets below $500,000. For very small nonprofits with gross receipts below $50,000, Form 990-N—the e-Postcard—can be filed, simplifying the process even further.

Filing requirements: Who must submit Form 990?

The IRS mandates that most nonprofits, including charitable organizations, private foundations, and social welfare organizations, file Form 990. However, certain organizations, such as churches and governmental entities, are exempt from this requirement.

Organizations must consider income thresholds when determining which form to file. For example, anyone earning over $200,000 per year must file Form 990, while organizations earning below the threshold might be able to file the 990-EZ or the 990-N.

Filing modalities: Step-by-step guide to submission

Preparing to file Form 990 requires gathering essential information—this includes your nonprofit's financial statements, governance structure, and detailed program descriptions. A meticulous approach to data collection can alleviate potential filing headaches later.

pdfFiller provides an excellent platform for creating and submitting Form 990. With its robust editing features, users can easily input financial data, attach supporting documentation, and utilize its eSigning capabilities for swift approval from board members or stakeholders.

Detailed breakdown of Form 990 sections

Form 990 consists of multiple sections essential for a comprehensive assessment of an organization. These cover identification details, financial statements, governance practices, and descriptions of program services.

Key components include the organization's name, the revenue sources, expenses, total assets, and liabilities. Governance practices outline how the board manages resources, and program service accomplishments highlight the impact and effectiveness of the organization's service delivery.

Understanding IRS compliance and penalties

Timeliness and accuracy in completing Form 990 are not just bureaucratic necessities; they carry significant implications for IRS compliance. Nonprofits that fail to meet these standards may face penalties that could impact their operational budget and reputation.

Penalties for not filing Form 990 can include monetary fines and potential loss of tax-exempt status. Organizations that consistently fail to file may have their IRS exemptions revoked, limiting their ability to raise funds and serve their communities.

Public inspection regulations: What you need to know

According to IRS regulations, Form 990 must be made publicly available. Organizations must retain copies that individuals can view upon request, ensuring that there is transparency in operations.

Interacting with Form 990 allows potential donors, grant-making bodies, and regulatory authorities to assess the nonprofit's operations and accountability. Public inspection also empowers stakeholders by enabling informed decisions regarding charitable contributions.

How to read and interpret Form 990

Understanding Form 990 comes down to recognizing key financial data. Organizations can analyze revenue sources against expenditures to gauge efficiency and effectiveness.

Key metrics include the ratio of program service expenses to total expenses—a hallmark for assessing effectiveness. When comparing Form 990s across organizations, users should identify consistent revenue sources and program impacts to paint a clearer picture of the nonprofit landscape.

History of Form 990 and its impact on nonprofits

Since its introduction in 1942, Form 990 has undergone significant changes to adapt to evolving nonprofit needs and regulatory standards. Amendments, particularly following the Taxpayer Bill of Rights, have improved the focus on accountability.

Recent legislative changes have tightened requirements, ensuring that nonprofits can be held accountable for their operations. This evolution signifies a commitment to enhancing transparency and giving stakeholders critical insights into nonprofit performance.

Interactive tools and resources: Enhancing your filing experience

Utilizing pdfFiller enhances the Form 990 filing experience through advanced interactive tools. Features like collaboration tools allow team members to work together in real-time, ensuring that all inputs are cohesive and correct before submission.

The platform provides access to various templates, enabling users to download and customize them according to their needs. These resources can expedite the filing process while ensuring all necessary documentation is complete, reducing the risk of errors.

Fiduciary responsibilities for nonprofit executives

Nonprofit executives face significant fiduciary responsibilities when completing Form 990. Proper due diligence is crucial to ensure all information reported is accurate and comprehensive.

Adhering to best practices in reporting includes involving board members in the preparation process, ensuring all financial statements align with internal records, and being transparent about organizational challenges and successes.

Common questions and comments: Clarifying misconceptions

Many nonprofits encounter confusion regarding Form 990, particularly around filing frequency, reporting requirements, and transparency expectations. A common misconception is that all nonprofit organizations must submit the same version of the form.

Understanding the specific version required based on size and income can help avoid compliance penalties. Additionally, some executives believe that limited communication about Form 990 is acceptable; however, proactive sharing of information fosters greater trust and accountability.

Finding more resources on Form 990

Numerous resources are available to assist nonprofit organizations in understanding and completing Form 990. The IRS provides official guidelines and updates, alongside advocacy organizations that offer tips and best practices for filing.

pdfFiller serves as an invaluable tool by offering templates and comprehensive documentation features to streamline the filing process. Utilizing these resources can greatly enhance the quality and accuracy of completed Form 990 submissions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 990 directly from Gmail?

How can I get form 990?

How do I execute form 990 online?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.