Get the free New Account Agreement

Get, Create, Make and Sign new account agreement

Editing new account agreement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new account agreement

How to fill out new account agreement

Who needs new account agreement?

Understanding the New Account Agreement Form: A Comprehensive Guide

Understanding the new account agreement form

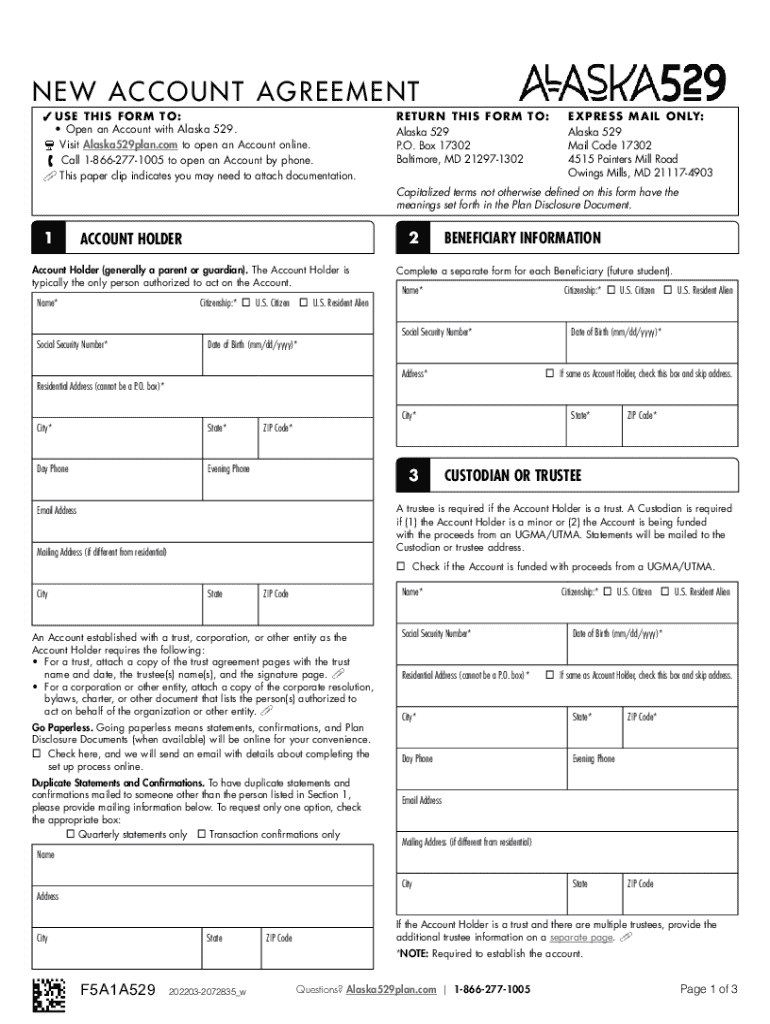

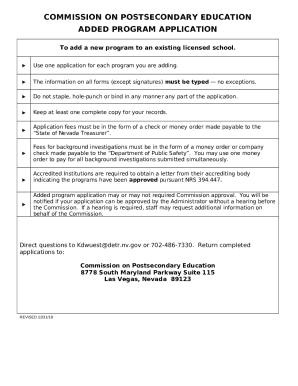

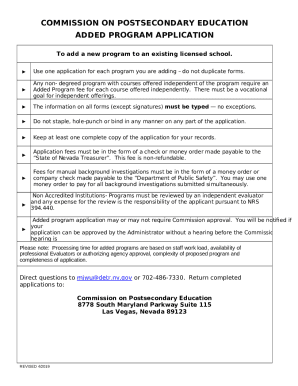

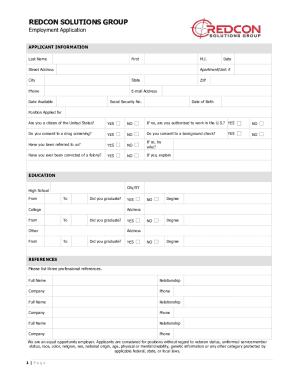

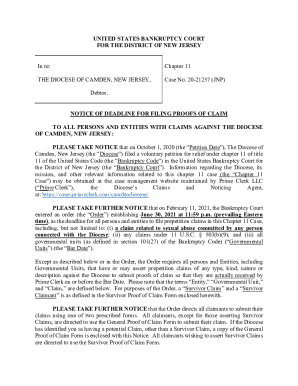

A new account agreement form is a contract between an account holder and a financial institution that outlines the terms and conditions of the account. Its primary purpose is to establish the responsibilities of both parties, providing essential information required for opening and maintaining an account. This agreement not only protects the institution's interests but also ensures that customers understand their rights and obligations.

Reviewing this agreement is crucial as it can prevent misunderstanding and potential disputes in the future. It is a vital document that dictates how you can use the account, what fees you might incur, and how to resolve issues. Common terms typically found in these agreements include details regarding transaction allowances, fee schedules, and conditions for account closure.

Key components of the new account agreement

When delving into a new account agreement form, understanding its key components will help users make informed decisions. The sections typically include detailed descriptions of account types, fees associated with maintaining the account, and guidelines on managing account balances.

Steps to fill out the new account agreement form

Filling out the new account agreement form correctly is vital to ensure a smooth account opening process. Gathering the required information beforehand can make the filling process more efficient and less stressful. Key documents often needed include personal identification and proof of income or employment.

Completing the form involves carefully filling out each section with accurate information, as common mistakes can lead to delays or account rejections. After completing the form, ensure you submit it through the accepted channels. Most institutions now allow online submissions, but you can also choose to do this in person or via mail.

Editing and modifying your account information

As life evolves, so too can your account needs; therefore, it's essential to know how to request changes to your account information. Updates might be necessary when you change your address, want to update beneficiary designations, or need to correct personal details.

While making these changes, it’s crucial to review privacy policies provided by the bank or financial institution to protect your personal information. They should have security measures in place to safeguard your data throughout this process.

E-signature and digital signing process

E-signing, or electronic signing, has become a standard method for signing documents like the new account agreement form. The legal validity of e-signatures enables users to complete their agreements quickly and securely, often from the comfort of their homes.

Utilizing e-signature streamlines the document management process, giving you the ability to sign from anywhere while enhancing the efficiency of your transactions.

Collaborating with others

In a team setting, managing account agreements can often require collaboration. Whether you are opening a joint account or involving multiple stakeholders, effective communication is vital. Teams can utilize tools like pdfFiller’s collaboration features to streamline this process.

Collaborating effectively leads to a well-understood and accurately completed agreement, preventing potential disputes later on.

Troubleshooting common issues

Sometimes, errors during the form-filling process can create challenges for new account holders. Common problems may include incorrect information, confusion regarding fees or terms, or difficulties with the submission process. Understanding how to troubleshoot these issues can help in resolving them quickly.

Addressing these concerns promptly not only prevents delays but also establishes a good relationship with your banking institution.

Understanding your rights and consent

When filling out a new account agreement form, it’s crucial to understand your rights regarding data use, consent, and communications you may receive post-agreement. For example, the Telephone Consumer Protection Act outlines regulations on how financial institutions can contact you.

Knowledge of your rights helps safeguard your information and ensure that you're not subjected to unsolicited contacts, enhancing your customer experience.

Additional support and contact information

For individuals needing assistance with their new account agreement form, finding appropriate support is essential. Most financial institutions provide various support channels, ensuring help is available when needed.

Familiarizing yourself with these support channels can be invaluable when navigating the agreement process and any questions that may arise.

Getting started with your account

After successfully completing your new account agreement form and having your account opened, the next step involves getting your account set up for daily use. This typically includes funding your account, setting up online access, and familiarizing yourself with the interface provided by your financial institution.

Being proactive now can facilitate smoother transactions in the future, helping you manage your financial activities more effectively.

Frequently asked questions about the new account agreement form

The new account agreement form may generate various inquiries, especially for first-time account holders. Understanding the common questions can diminish anxiety during the process.

Addressing these questions proactively can help individuals better understand their obligations and rights, ensuring a transparent and rewarding banking experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit new account agreement from Google Drive?

How do I execute new account agreement online?

How do I complete new account agreement on an iOS device?

What is new account agreement?

Who is required to file new account agreement?

How to fill out new account agreement?

What is the purpose of new account agreement?

What information must be reported on new account agreement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.