Get the free Broker Shield Insurance Program

Get, Create, Make and Sign broker shield insurance program

Editing broker shield insurance program online

Uncompromising security for your PDF editing and eSignature needs

How to fill out broker shield insurance program

How to fill out broker shield insurance program

Who needs broker shield insurance program?

Comprehensive Guide to the Broker Shield Insurance Program Form

Overview of the Broker Shield Insurance Program

The Broker Shield Insurance Program is designed specifically for freight brokers, providing them with essential insurance coverage tailored to their unique operational needs. This program plays a crucial role in protecting brokers against various risks such as client disputes, cargo loss, and regulatory liabilities. Successfully navigating the complexities of logistics and transportation often requires brokers to have solid insurance coverage, making the Broker Shield Insurance Program a vital tool in ensuring business stability.

Freight brokers handle intricate logistics and are exposed to numerous risks in their daily operations. With a comprehensive insurance program, they not only protect themselves against unforeseen liabilities but also enhance credibility and trust with clients. The key benefits of the Broker Shield Insurance Program include tailored coverage options, competitive pricing, and access to professional advice to help mitigate risks.

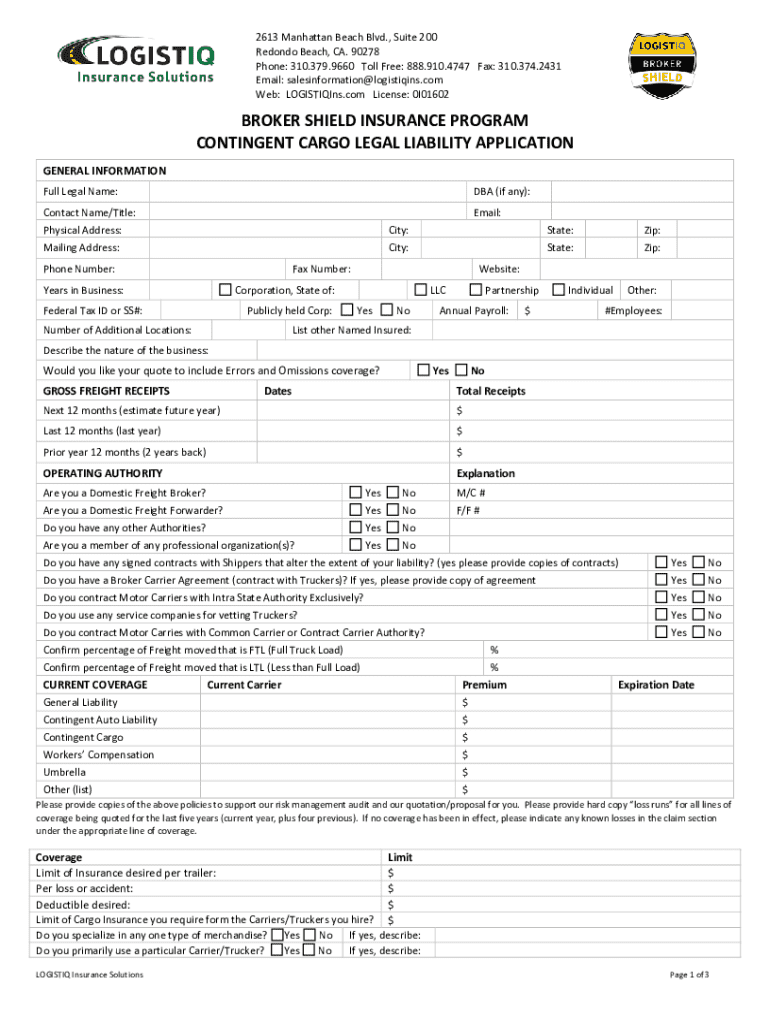

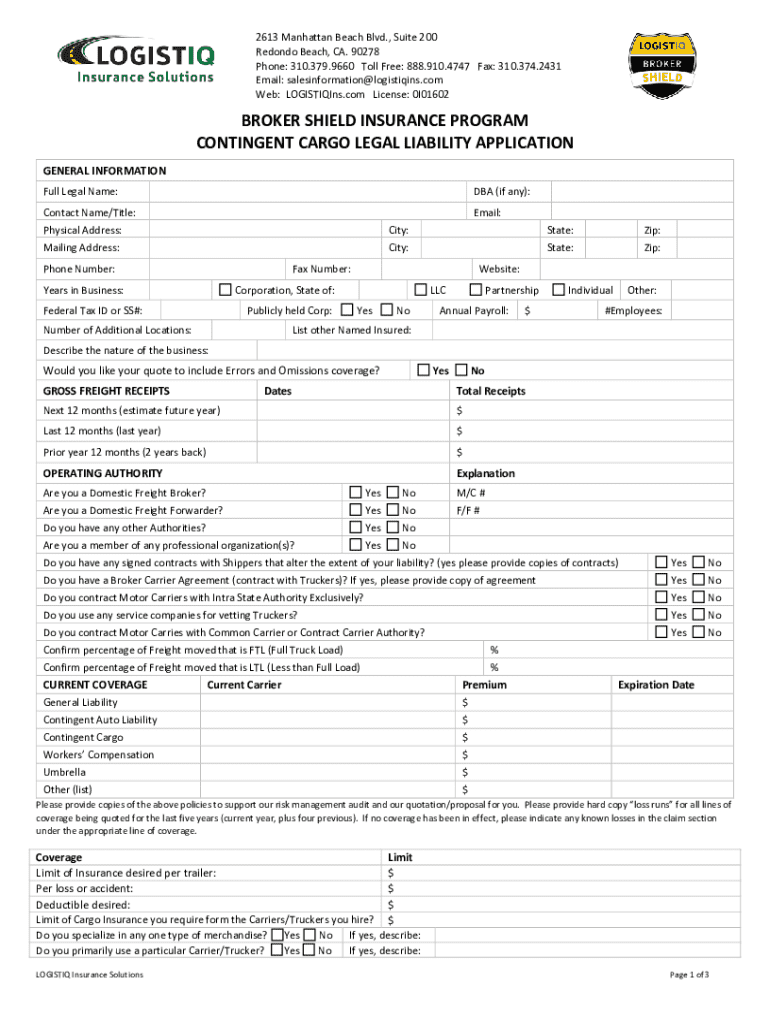

What you need before filling out the form

Before you begin filling out the Broker Shield Insurance Program form, it’s crucial to gather all necessary information and documents. Being prepared will streamline your application process significantly. First and foremost, ensure you have your business details readily available, including your company name, address, and contact information. Secondly, familiarize yourself with your operational details, such as the types of goods transported, the volume of clients serviced, and the specific routes taken.

In addition to business and operational details, you'll also need to provide financial information. Be prepared to list your annual revenue and any existing insurance coverage you may have. Collect both physical and digital documents where applicable, as this will facilitate easier access and submission later on.

Step-by-step instructions for completing the Broker Shield Insurance Program form

Filling out the Broker Shield Insurance Program form is a crucial step towards securing the right coverage. Start by accessing the form, which can easily be found on pdfFiller’s platform. To locate the form, visit the pdfFiller website and use the search function or navigate to templates specifically designed for insurance applications.

Once you have the form open, begin filling it out section by section. The first section covers your basic information, including your business name and address. The second section pertains to your coverage needs, where you’ll indicate the types of coverage you are seeking. Next is the risk assessment section, which evaluates your industry risks. Finally, explore additional coverage options available to enhance your policy.

After completing the form, it is vital to review all your information carefully. Double-check the entered data and ensure there are no discrepancies. Pay attention to details, as even minor errors can lead to complications in processing your application. Once you’re confident in the accuracy of your form, you are ready to submit it. You can submit electronically through pdfFiller, or alternatively, you can choose to fax or mail the form to the appropriate contact point.

Interactive tools to enhance your application experience

pdfFiller offers an array of interactive tools that make filling out the Broker Shield Insurance Program form not only straightforward but also efficient. Among these, you will find editing features that allow you to highlight key sections, add comments, and even digitally sign documents. These features can significantly aid in ensuring clarity and accessibility of information.

Additionally, you can collaborate with team members during the form-filling process using pdfFiller’s sharing options. This collaborative approach can help you gather feedback and insights, ensuring that the form accurately reflects your needs. The built-in eSign capabilities also expedite the signing process, leading to quicker approval of your coverage.

Managing your Broker Shield Insurance Program form

After submitting your application form, managing it effectively is key to a seamless insurance experience. pdfFiller enables you to save and edit your application even after submission. This flexibility can be particularly helpful if you need to make adjustments or correct information after initially filling out the form.

In the event that your form encounters errors or is rejected, it's important to understand common pitfalls and how to avoid them. Review the guidelines provided with the Broker Shield Insurance Program form for specific common areas where applicants may lead to issues. Tracking your application’s progress through pdfFiller is easy, providing you with updates and notifications on your application status.

Understanding coverage options available with Broker Shield

The Broker Shield Insurance Program offers a variety of coverage options tailored to the specific risks faced by freight brokers. General liability insurance is essential for protecting against third-party claims, while property insurance covers physical assets. Errors and omissions coverage is equally critical for protecting against claims that arise from mistakes in service delivery.

When selecting coverage options, factors such as business size, types of goods transported, and client volume play a significant role. It's advisable to assess your needs carefully and choose coverage that aligns with your operational reality. Smaller brokers may require different coverage than larger firms, making personalized recommendations vital.

Frequently asked questions (FAQs)

Navigating the complexities of the Broker Shield Insurance Program can raise numerous questions. Common concerns often revolve around the limits of your coverage, exclusions, and the steps to follow if you want to modify your policy. It’s essential to communicate directly with your insurance provider most familiar with your specific situation, as they can provide tailored advice and clarify any uncertainties.

For personalized inquiries, be sure to contact support directly through either the pdfFiller platform or directly through your insurance provider’s contact channels. They are equipped to address your concerns and guide you efficiently.

Resources for further learning

To enhance your understanding of freight broker insurance, several educational materials are readily available. You can access articles and blog posts focused on various aspects of freight broker insurance, including best practices and case studies. Additionally, pdfFiller offers video tutorials and webinars designed to help users comprehend the nuances of filling out insurance forms effectively.

Engaging with community forums can also be beneficial; there, you will connect with fellow freight brokers who share experiences and insights. Furthermore, don't overlook the value of accessing sample forms and templates, as these can serve as effective references while you navigate your own application.

Testimonials and success stories

Real-life experiences from users of the Broker Shield Insurance Program can offer valuable insights into its effectiveness. Many freight brokers have shared their success stories, highlighting how this program addressed their insurance needs efficiently. Users consistently report positive experiences with the application process through pdfFiller, noting the ease of navigation and comprehensive support offered.

These testimonials often emphasize the importance of having adequate insurance in place for maintaining business sustainability and promoting growth. By ensuring that their coverage aligns with their operational needs, freight brokers can focus on enhancing service delivery without worrying about unanticipated liabilities.

Glossary of key terms

Understanding insurance terminology is vital for effectively navigating the Broker Shield Insurance Program. By familiarizing yourself with key terms, you can enhance your comprehension of coverage options and policy requirements. For instance, 'coverage' refers to the protection offered by your insurance policy, while 'deductibles' indicate the amount you must pay out of pocket before your coverage kicks in. 'Endorsements' are amendments to your policy that can alter the coverage you receive or adjust the agreement terms.

Staying updated on insurance regulations

Remaining informed about insurance regulations is essential for freight brokers to ensure compliance and adapt to changes in industry standards. One of the best ways to stay updated is by following reliable sources focused on freight broker insurance and industry regulations. Industry associations often publish newsletters that highlight new policies, regulatory updates, and key market trends.

Engaging with professional organizations can also support your growth; participating in forums and attending webinars provides opportunities to share insights with peers and get updates on best practices within the freight brokerage field. By establishing a network, you acquire valuable information and can adapt to the evolving landscape of freight insurance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit broker shield insurance program in Chrome?

Can I create an electronic signature for the broker shield insurance program in Chrome?

How can I edit broker shield insurance program on a smartphone?

What is broker shield insurance program?

Who is required to file broker shield insurance program?

How to fill out broker shield insurance program?

What is the purpose of broker shield insurance program?

What information must be reported on broker shield insurance program?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.