Get the free Business Remote Deposit Application and Maintenance Form

Get, Create, Make and Sign business remote deposit application

Editing business remote deposit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business remote deposit application

How to fill out business remote deposit application

Who needs business remote deposit application?

A Comprehensive Guide to the Business Remote Deposit Application Form

Understanding business remote deposit

Business remote deposit services allow companies to deposit checks electronically from any location. This technology has streamlined the traditional method of depositing physical checks, providing businesses with a faster, more efficient alternative. By simply scanning a check and uploading it via a secure application, businesses can deposit funds without having to visit a bank branch.

The convenience offered by business remote deposit not only enhances operational efficiency but also improves cash flow management. Companies can process checks anytime and anywhere, reducing the time it takes for funds to become available. This capability is particularly beneficial for businesses with multiple locations or remote teams.

Key features of the business remote deposit application

A solid business remote deposit application comes with several key features designed to make the user experience seamless and secure. One of the most significant aspects is its user-friendly interface, allowing users to navigate the application effortlessly. The design minimizes complexity, ensuring that users can deposit checks without extensive training.

Moreover, security measures such as data encryption are paramount to safeguard sensitive information during the deposit process. The application often accommodates multiple users, enabling team collaboration for larger organizations. Additionally, compatibility with various devices—namely smartphones, tablets, and computers—means users can manage deposits on the go, enhancing flexibility.

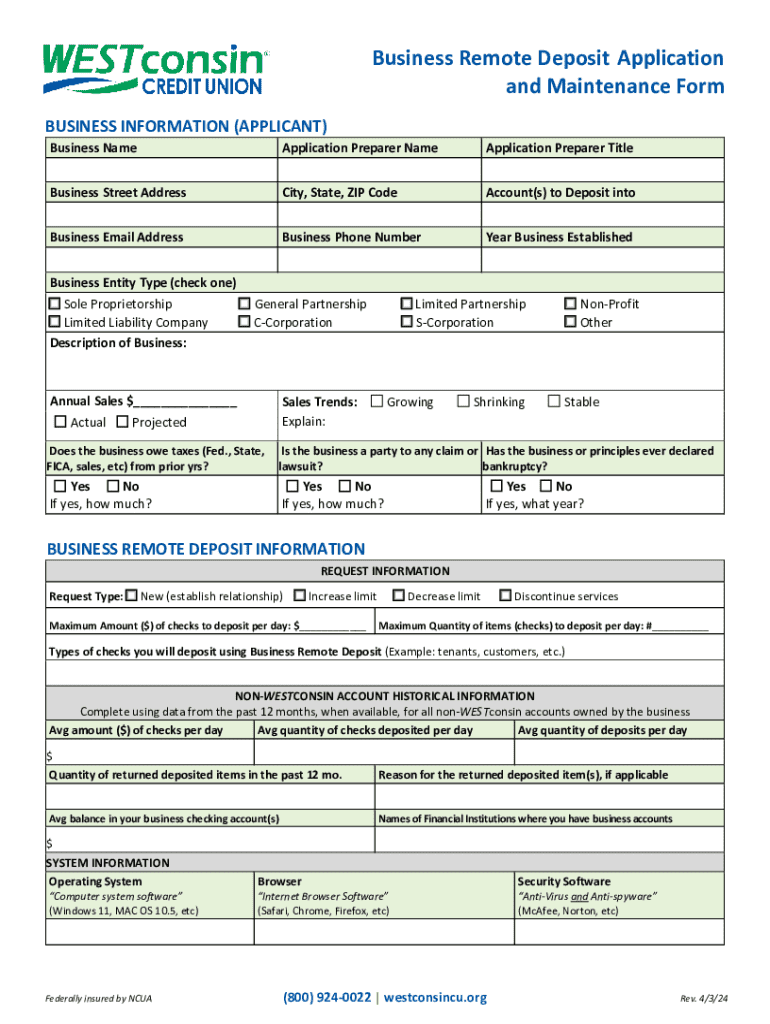

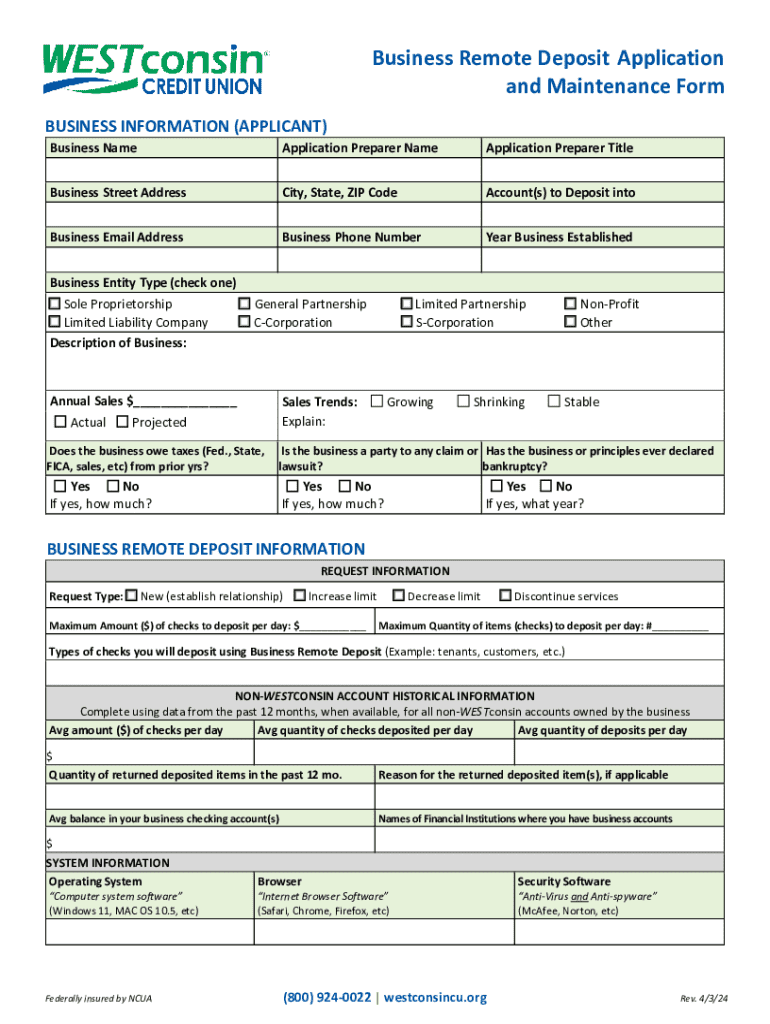

Getting started: business remote deposit application form

Before filling out the business remote deposit application form, businesses need to ensure they meet specific eligibility requirements. These may include having an active business bank account, a valid tax ID, and operating within certain banking regulations. It's essential to check with your financial institution for any additional requirements.

Accessing the application form typically involves visiting your bank's website or utilizing a document management platform like pdfFiller. Upon navigating to the remote deposit section, you will find the application form available for download or online completion. Make sure to have the necessary information on hand, covering two primary areas: business details and banking information.

How to fill out the business remote deposit application form

Completing the business remote deposit application form is a straightforward process when approached step-by-step. First, ensure you navigate to the correct remote deposit application page on pdfFiller. Here’s how to fill out the form:

Interactive tools for enhancing your experience

pdfFiller offers a suite of interactive tools designed to enhance your experience when using the business remote deposit application. Leveraging its editing features can streamline your documentation process. Adding electronic signatures is a simple task, allowing for immediate validation of documents.

Furthermore, the platform facilitates collaboration with team members in real-time, making it easy to review and finalize paperwork together. Utilizing templates can also expedite processing, allowing businesses to save time and minimize errors by starting with pre-developed forms tailored to their operations.

Common challenges and solutions

While using the business remote deposit application form, users may face several challenges. One common issue involves encountering errors during submission. If this happens, double-check that all required fields are filled in correctly and that identification documents are properly attached. Should problems persist, do not hesitate to contact customer support for assistance.

Another crucial aspect is ensuring the accuracy of submitted documents. Small mistakes can lead to delays or rejections. It is recommended to have another team member review the form or adopt checklists to ensure all information is correct before submission.

FAQs on business remote deposit

Regarding the business remote deposit application form, many questions crop up related to functionality and operational aspects. One frequent inquiry is how businesses can enroll in the remote deposit service. Typically, enrollment begins after filling out the application form and successful submission to the designated bank.

Other common questions include inquiries about associated fees, endorsement practices for electronic submissions, transaction limits, and post-submission actions. Addressing these FAQs can provide clarity and encourage efficient use of the remote deposit feature.

Maximizing the benefits of business remote deposit

To leverage the full potential of the business remote deposit, it’s vital to implement best practices for check management. Efficient tracking of deposits not only enhances transparency but also aids in cash flow management. Integrating the remote deposit system with existing accounting systems can significantly streamline operations, facilitating better budget forecasting and financial monitoring.

To further optimize operations, consider regularly reviewing transaction limits and trends to make informed decisions on access and security measures. These steps ensure the remote deposit service aligns with broader business goals and enhances operational efficiency.

Support and assistance

Accessing efficient support is crucial for resolving issues with the business remote deposit application form. pdfFiller offers dedicated customer support that can guide users through the process, whether it’s a technical question or help with form completion. Users can reach out via dedicated communication channels specified on the website.

In addition to direct support, several resources like user guides, FAQs, and informative articles are available to assist users in getting familiar with both the application form and the remote deposit service. Utilizing these resources can empower users to maximize their use of the platform.

Getting the most out of your document management

Lastly, utilizing pdfFiller’s additional features can greatly enhance document management for businesses. Beyond remote deposit capabilities, pdfFiller offers tools for editing, signing, and collaborating on PDFs, making it a comprehensive solution for document workflows.

Incorporating these tools not only streamlines the deposit process but also contributes to broader operational improvements, ensuring businesses remain agile and responsive to market demands. Continuous updates in remote deposit technology mean that businesses using pdfFiller can adapt quickly and benefit from evolving features and functionalities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in business remote deposit application without leaving Chrome?

How can I edit business remote deposit application on a smartphone?

How do I edit business remote deposit application on an iOS device?

What is business remote deposit application?

Who is required to file business remote deposit application?

How to fill out business remote deposit application?

What is the purpose of business remote deposit application?

What information must be reported on business remote deposit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.