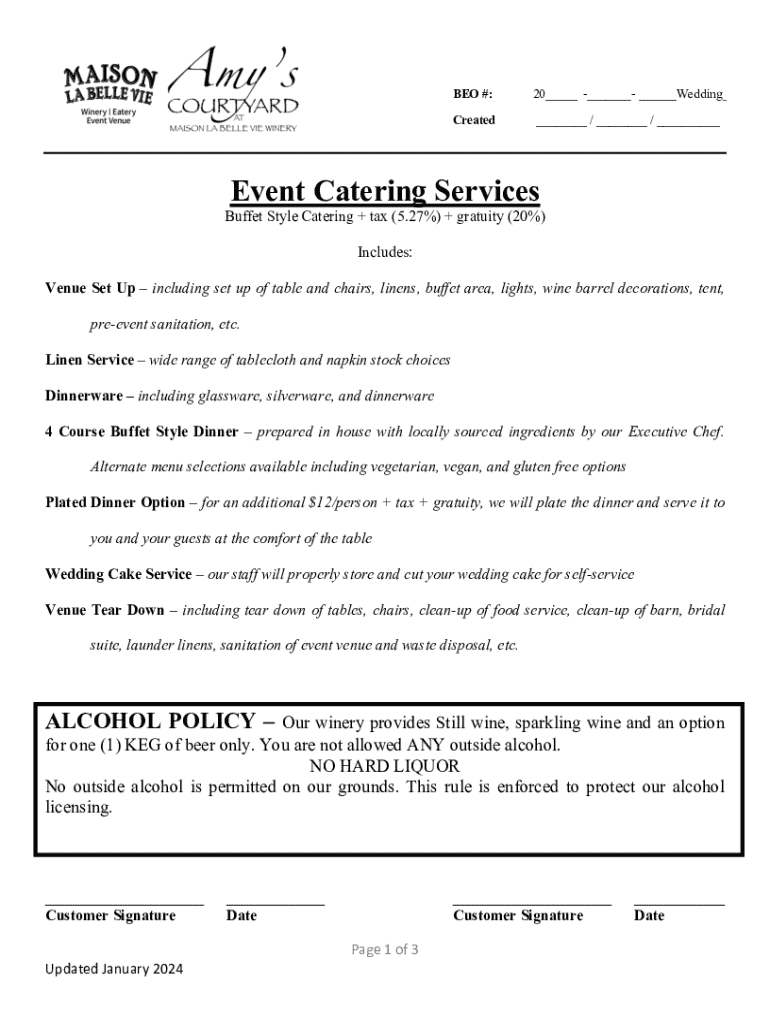

Get the free Buffet Style Catering + tax (5

Get, Create, Make and Sign buffet style catering tax

How to edit buffet style catering tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out buffet style catering tax

How to fill out buffet style catering tax

Who needs buffet style catering tax?

Buffet Style Catering Tax Form: A Comprehensive Guide for Caterers

Understanding the buffet style catering tax form

The buffet style catering tax form is a dedicated document that catering professionals must complete to comply with tax regulations. This form is pivotal in capturing all necessary financial details related to buffet-style events, which can include weddings, corporate gatherings, or other large functions. Accurate documentation not only ensures that tax obligations are met but also minimizes the risk of audits and penalties.

For caterers and restaurant owners, using the buffet style catering tax form is essential for reflecting the income generated from catering services. Event planners and coordinators also need this form as it serves as a financial auditor tool that tracks expenses versus profits. This document facilitates the proper classification of revenue and deductions that are specific to buffet-style catering.

Key tax obligations for buffet style catering

Understanding tax obligations is crucial for every catering business. Buffet-style catering often entails both sales tax on services offered and the need to report all income generated from these events accurately. Depending on the jurisdiction, sales tax may vary, which means consulting local regulations to stay compliant is essential.

Common tax deductions specific to the catering industry are vital for optimizing tax returns. Deductible expenses include costs associated with food, labor, and equipment rentals, such as tables, chairs, and serving utensils. Maintaining accurate records is imperative to validate these deductions, and digital tools can significantly assist in managing these details efficiently.

Step-by-step guide to completing the buffet style catering tax form

Completing the buffet style catering tax form begins with gathering essential information. Caterers should compile all necessary documentation, including income statements, receipts for expenses, and client contracts. These items will help ensure that the tax form accurately reflects the business's financial position.

When filling out the buffet style catering tax form, it's critical to break down income and expenses into clear categories. The form typically includes sections for gross income, deductible expenses, and net income. Common pitfalls include neglecting to report all income or incorrectly categorizing expenses. To avoid errors, implement a double-checking system or use checklists that reference each section of the form.

Tips for managing your catering tax forms efficiently

Staying organized is paramount in managing catering tax forms effectively. Implementing best practices for record-keeping can greatly simplify the process. Use digital tools for tracking finances and expenses, ensuring that every receipt and invoice is documented properly. Systems like spreadsheets or financial software can streamline this effort, allowing for greater efficiency.

Utilizing pdfFiller for document management can enhance the efficiency of filling out tax forms. This cloud-based platform allows you to edit PDFs easily and eSign documents, making it a flexible option for busy caterers. With features that support collaboration with financial advisors or accountants, pdfFiller helps ensure that your tax forms are accurate and submitted on time.

Troubleshooting common issues related to buffet style catering taxes

Despite thorough preparation, caterers may encounter issues related to their tax forms. Common questions include what to do if a deduction is missed. It’s vital to consult with a tax professional for advice on how to amend your filing and claim forgotten deductions where possible. If facing an audit, keep calm and organize all relevant documentation. Navigating an audit is easier with proper records.

For further assistance, reach out to the IRS for guidance or consult state tax agencies relevant to your operating location. Engaging with catering tax professionals can also alleviate the stress of dealing with complicated tax regulations and ensure full compliance.

Leveraging technology for catering tax management

The advancement of cloud-based solutions has transformed how catering businesses handle tax documentation. Tools like pdfFiller offer significant advantages, such as secure online editing and storage of important tax forms. This not only saves time but also reduces the risk of losing critical documents that play a role in tax compliance.

Interactive tools, including tax calculators and document templates specific to the catering industry, can simplify the tax management process further. Entrepreneurs can access these resources through their preferred platforms, making it a breeze to calculate obligations or fill forms accurately while collaborating with team members efficiently.

Case studies of successful buffet style catering tax management

Several caterers have successfully managed their tax forms through diligent practices. One notable example is a mid-sized catering company that adopted systematic tracking software, which allowed them to categorize expenses meticulously. As a result, they were able to leverage their deductions effectively, resulting in significant tax savings.

Feedback from catering professionals highlights the effectiveness of using tools like pdfFiller in managing their documents. They often share testimonials that underscore the ease of use, the clarity it brings to complex paperwork, and how it significantly streamlines their tax filing processes.

The future of catering tax management

Looking ahead, catering tax regulations might evolve to become more intricate, particularly as digital transactions become prevalent. Upcoming changes in tax laws could affect the buffet-style catering sector directly, emphasizing the necessity for businesses to stay informed and prepared. Utilizing software solutions alongside professional guidance will be essential in maintaining compliance.

Embracing technology is no longer optional; it’s a requirement for catering businesses aiming to thrive in this changing landscape. By adapting to new systems and integrating advanced document management platforms like pdfFiller, caterers can work more efficiently and even anticipate future challenges, harnessing digital transformation within their operations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the buffet style catering tax in Chrome?

How can I edit buffet style catering tax on a smartphone?

How can I fill out buffet style catering tax on an iOS device?

What is buffet style catering tax?

Who is required to file buffet style catering tax?

How to fill out buffet style catering tax?

What is the purpose of buffet style catering tax?

What information must be reported on buffet style catering tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.