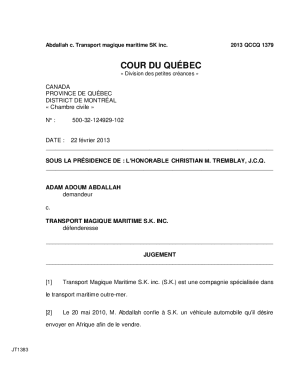

Get the free Check# Date Name GrossPay City State Zip drct-dpst 1/24 ...

Get, Create, Make and Sign check date name grosspay

Editing check date name grosspay online

Uncompromising security for your PDF editing and eSignature needs

How to fill out check date name grosspay

How to fill out check date name grosspay

Who needs check date name grosspay?

A comprehensive guide to the check date name gross pay form

Understanding the check date name gross pay form

The check date name gross pay form is a crucial document in payroll management, capturing vital information about employee compensation. This form acts as a record of the check date, employee name, and gross pay, allowing businesses to track payroll expenses accurately. Understanding and utilizing this form effectively can streamline financial tracking for both individuals and businesses.

Incorporating the check date name gross pay form into regular payroll processes is essential. It ensures compliance with financial regulations and simplifies record-keeping, enabling businesses to maintain a well-organized payroll system that can quickly adapt to audits and reviews.

Components of the check date name gross pay form

To effectively use the check date name gross pay form, it is important to understand its components. The essential elements include:

Additionally, there are other important elements like deductions, net pay, and year-to-date totals, which provide more context and clarity on the payroll process. Deductions usually include taxes, benefits, and other withholdings that affect the employee's take-home pay.

How to fill out the check date name gross pay form

Filling out the check date name gross pay form correctly is essential for ensuring accurate payroll processing. Here is a step-by-step guide to help you:

Accuracy is key. Double-checking numbers and dates protects against payroll discrepancies. Collaborating and confirming details with employees can further enhance the accuracy of the final figures.

Common mistakes to avoid when using the check date name gross pay form

While using the check date name gross pay form, several common pitfalls can impede payroll accuracy. For instance, failing to include necessary information like the check date or employee name can cause delays in payroll processing.

Taking proactive measures to mitigate these mistakes can streamline payroll operations significantly.

Best practices for maintaining check date name gross pay records

Maintaining an organized record of check date name gross pay forms is key to an efficient payroll mechanism. Here are some best practices to consider:

Consistent organization of payroll records not only assists in efficient processing but also in compliance with labor laws.

Frequency of use and tailoring to business needs

The check date name gross pay form's usage can vary widely between businesses of different sizes. Small businesses may employ this form less frequently, whereas larger companies rely on it routinely to manage payroll.

By customizing and frequently revisiting the check date name gross pay form, businesses can enhance their payroll efficiency.

The role of technology in managing check date name gross pay forms

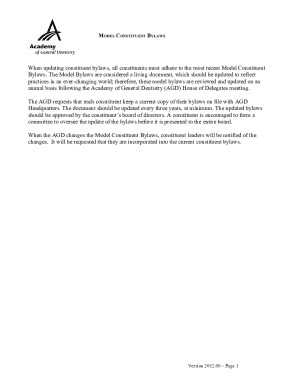

Technology has revolutionized payroll management, including the check date name gross pay form. pdfFiller provides valuable tools to simplify document management by allowing users to fill out, edit, and manage forms effectively from a cloud-based platform.

Leveraging technology enhances accuracy and efficiency in managing payroll documents, including the check date name gross pay form.

Frequently asked questions (FAQ)

To further clarify the use of the check date name gross pay form, here are some frequently asked questions:

Addressing these questions can help employees and employers navigate payroll processes more smoothly.

Enhance your payroll process with tools and automation

Embracing tools and automation can greatly improve the payroll process associated with the check date name gross pay form. Services such as integrated payroll software allow for seamless processing, while online calculators can assist in accurately calculating gross pay.

By leveraging technology and automation, organizations can enhance efficiency and ensure precision in their payroll process.

Resources for further learning

Learning more about payroll management can enhance your understanding and application of the check date name gross pay form. Consider participating in webinars or workshops that cover best practices in payroll.

Investing time in learning about payroll accuracy and management resources will pay off in the long run.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the check date name grosspay electronically in Chrome?

Can I create an eSignature for the check date name grosspay in Gmail?

How do I fill out check date name grosspay using my mobile device?

What is check date name grosspay?

Who is required to file check date name grosspay?

How to fill out check date name grosspay?

What is the purpose of check date name grosspay?

What information must be reported on check date name grosspay?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.