Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990 Form - How-to Guide Long-Read

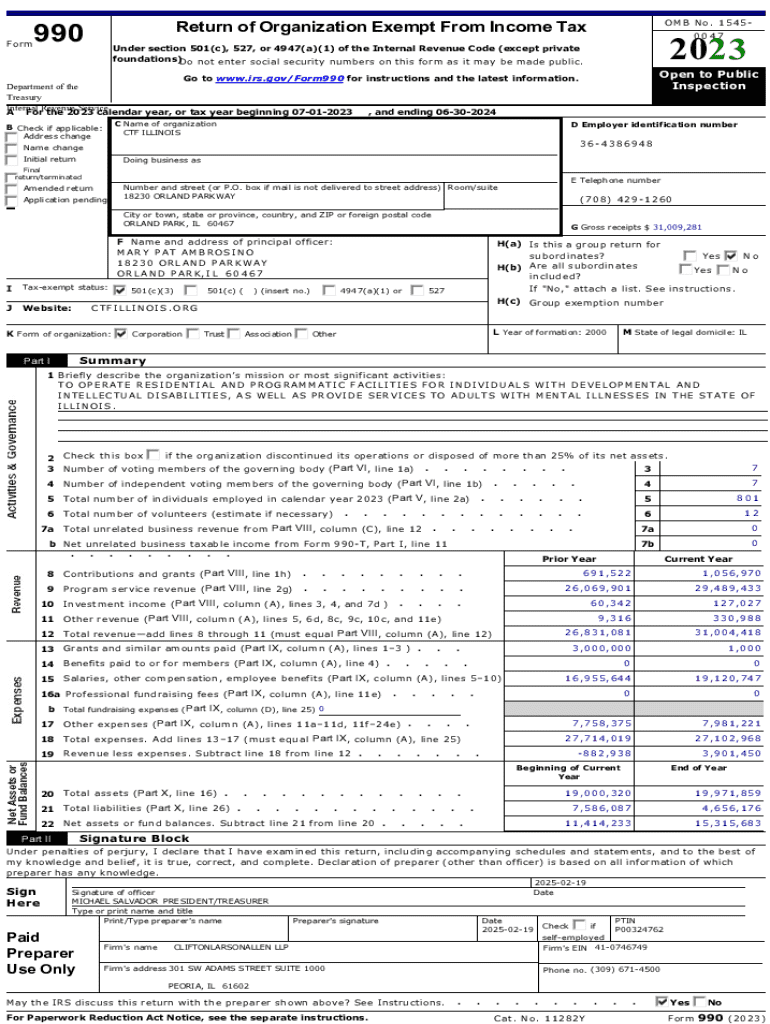

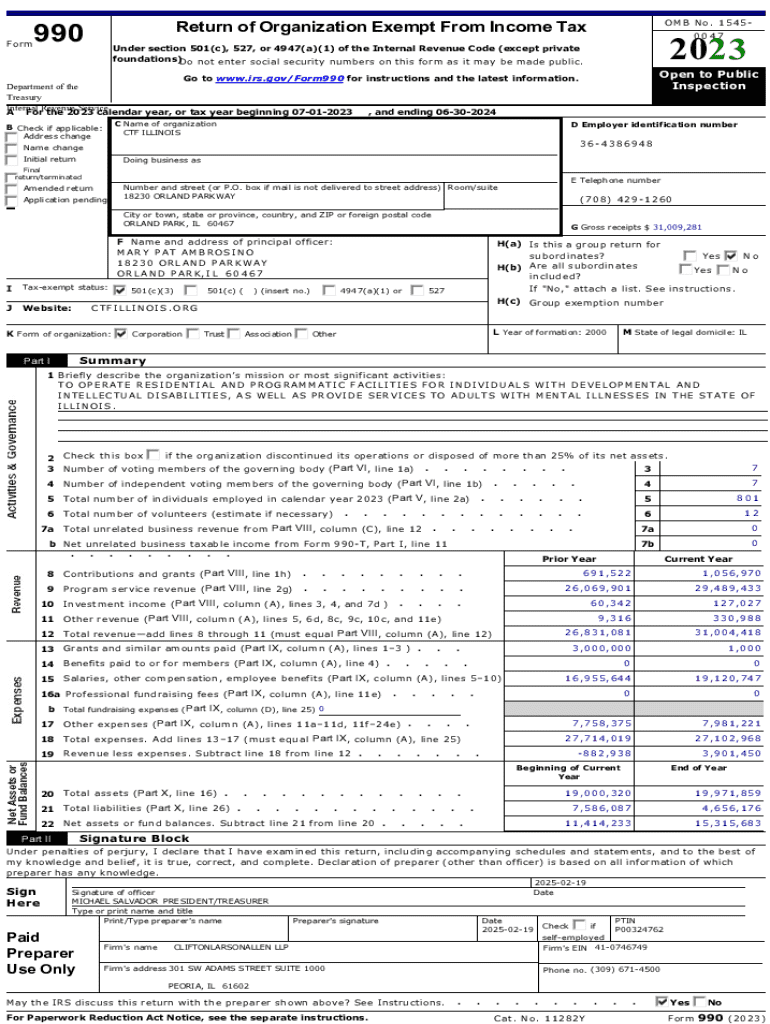

Understanding the Form 990

The Form 990, also known as the 'Return of Organization Exempt From Income Tax,' is a crucial document that provides the IRS and the public with a comprehensive overview of a nonprofit organization’s financial situation. Its main purpose is to ensure transparency and accountability in the nonprofit sector, helping organizations uphold their tax-exempt statuses while disclosing necessary financial information.

For nonprofit organizations, the Form 990 is not just a tax requirement; it serves as a valuable tool for management and accountability. By carefully analyzing this form, organizations can identify financial trends and make informed decisions to improve operations, fundraising, and impact.

Types of organizations required to file

Various types of nonprofit organizations are required to file the Form 990. Primarily, these include charitable organizations under section 501(c)(3), which are typically eligible for federal tax exemptions. Other categories include 501(c)(4) social welfare organizations and 501(c)(6) trade associations. Depending on their size and revenue, the specific form they need (990, 990-EZ, or 990-N) may vary.

Detailed breakdown of the Form 990

The Form 990 is divided into multiple sections, each requiring specific financial data. Significant sections include details about revenue, expenses, and net assets. Each component gives the IRS and stakeholders insight into the financial health and operational efficiency of the nonprofit. Understanding these sections in detail can help organizations present their financial story effectively.

Key line items include total revenue from donations, grants, and program services; total functional expenses comprising program, management, and fundraising costs; and net assets reflecting the organization's fiscal position. Accurate reporting of these figures is essential for compliance and accountability.

Variants of the Form 990

There are three primary variants of the Form 990 depending on the organization's size and revenue. The full Form 990 is required for larger organizations, while smaller nonprofits may opt to file Form 990-EZ, a streamlined version. The smallest organizations, often with gross receipts under $50,000, can utilize Form 990-N, also known as the e-Postcard.

Filing requirements and processes

Determining who must file the Form 990 is essential for compliance. Typically, all nonprofit organizations claiming tax exemption must file annually. The specific filing thresholds vary based on revenue and type of organization, with different deadlines according to fiscal year-end.

Most organizations must file within five and a half months after the end of their fiscal year, with options for extensions available. Adhering to these timelines prevents penalties and ensures that information remains current.

Filing modalities

Nonprofits have the option to file their Form 990 both electronically or via paper submission. While electronic filing is preferred and often faster, organizations should assess their capabilities and resources when choosing a filing method. Utilizing tools such as pdfFiller can streamline this process, providing templates and editing functionalities to ensure accuracy.

Compliance and penalties

To avoid penalties, nonprofits should be mindful of common filing mistakes when submitting the Form 990. Misreporting figures, neglecting to sign the form, or missing deadlines can lead to delays or even fines. Remaining meticulous throughout the reporting process ensures compliance and protects the organization’s reputation.

Penalties vary based on the severity and timing of the violation, with potential fines for late submissions ranging from $20 to $100 per day for publicly supported organizations. Understanding these consequences reinforces the importance of timely compliance.

Common filing mistakes to avoid

Public access and inspection regulations

Importantly, Form 990 ensures transparency by mandating that its details are publicly accessible. This transparency allows individuals to scrutinize nonprofit operations, promoting accountability. The IRS and many states require that Form 990 is disclosed in a manner accessible to donors and the general public, fostering trust within the community.

You can typically find a specific organization’s Form 990 on the IRS website or platforms dedicated to nonprofit data. This invaluable resource serves as a key factor for donors and researchers alike when evaluating a nonprofit's effectiveness and integrity.

Role of Form 990 in charity evaluation research

Navigating the Form 990

Completing the Form 990 can be daunting. Step-by-step instructions significantly ease the process. For beginning users, understanding each section is vital. The organization can start with identifying revenue streams, documenting expenses meticulously, and then detailing net assets for clarity.

For best practices, ensure each entry corresponds with actual financial records. Always consult with a tax professional if there are questions regarding specific entries or compliance requirements. This approach safeguards against misreporting and reflects positively on the organization’s reputation.

How to read and interpret the Form 990

Interpreting the completed Form 990 is just as critical as its preparation. Stakeholders should pay close attention to any deviations from previous years to gauge financial trends. This analysis can highlight potential areas for improvement, guide strategic planning, and inform discussions with donors.

Tools and resources for Form 990 management

Utilizing tools can simplify Form 990 management significantly. Platforms like pdfFiller offer numerous benefits for nonprofits, such as the ability to edit, collaborate, and eSign documents all in one cloud-based service. This functionality enables teams to work together seamlessly, ensuring accuracy and timeliness in filing.

Tools like interactive calculators and submission trackers further enhance compliance, helping organizations stay organized and informed regarding deadlines and documentation requirements.

Using pdfFiller for Form 990

Historical context and analysis

Form 990 has evolved significantly since its introduction, adapting to changing regulatory frameworks and organizational needs. Originally created to ensure accountability in the nonprofit sector, the form has undergone numerous revisions that reflect the growing complexities and transparency demands of this sector.

By examining these regulatory changes and the responses from the nonprofit sector, stakeholders can gain insight into the financial health of organizations over time. Trends identified in Form 990 data can serve as indicators of broader societal changes and funding shifts.

How the form reflects financial health of nonprofits

Frequently asked questions about Form 990

Many nonprofits have questions about the intricacies of Form 990, reflecting a wide range of concerns in the sector. Common inquiries often relate to categories of organizations required to file, filing deadlines, and potential penalties associated with non-compliance. Addressing these confusions can significantly enhance understanding and encourage timely filing.

Organizations can also benefit from resources provided by the IRS and other nonprofit support organizations that offer guidance on compliance and effective filing.

Clarifying common confusions

Engaging with your Form 990

Active engagement with the Form 990 starts with a strong data collection strategy. Best practices should include frequent audits of financial records and ensuring transparency in reporting processes. Accurate data collection simplifies the form-filling process while enhancing the overall quality of submissions.

Furthermore, organizations should find ways to utilize insights from their Forms 990 in communicating with stakeholders. By highlighting financial health and organizational impact through this document, nonprofits can engage donors and enhance trust within their communities.

Collecting data for your Form 990

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 990 from Google Drive?

How do I complete form 990 on an iOS device?

Can I edit form 990 on an Android device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.