Get the free Legacy Giving Intent Form

Get, Create, Make and Sign legacy giving intent form

Editing legacy giving intent form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out legacy giving intent form

How to fill out legacy giving intent form

Who needs legacy giving intent form?

Legacy Giving Intent Form: A Comprehensive Guide

Understanding legacy giving

Legacy giving refers to the practice of donating assets or funds to nonprofits or charitable organizations through bequests, trusts, or other means, typically upon one’s passing. This form of giving enables individuals to leave a lasting impact, ensuring their values and priorities continue to resonate within the community long after they are gone.

The importance of legacy giving lies in its ability to support vital causes while providing donors with the satisfaction of contributing to a brighter future. It is a powerful way to ensure that one’s passions and beliefs are honored through financial support, advancing the missions of the organizations they care about.

Despite its benefits, several myths persist about legacy giving. Some individuals believe that only the wealthy can make substantial gifts, or that planning a legacy gift is too complicated and time-consuming. However, legacy giving can be accessible to anyone, providing options that align with individual financial situations and philanthropic goals.

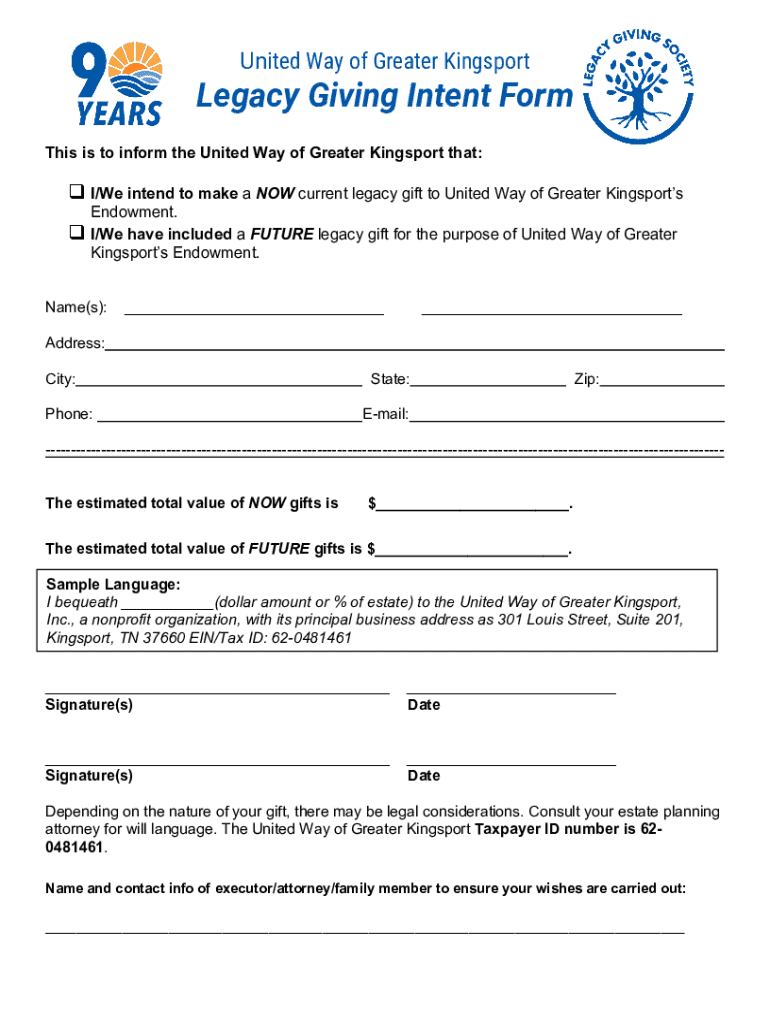

The purpose of the legacy giving intent form

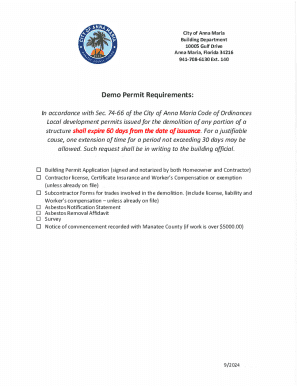

Filling out a legacy giving intent form is a crucial step for any donor wishing to formalize their intentions. This document communicates a donor's commitment to contribute through bequests or other means, outlining specific details that guide organizations in using those gifts effectively.

Key benefits for donors include clarifying their charitable intentions and ensuring that their wishes are honored. Additionally, specifying a legacy gift allows organizations to plan and allocate resources more effectively. From a legal and financial perspective, legacy gifts can also provide various tax benefits, allowing donors to maximize the impact of their generosity.

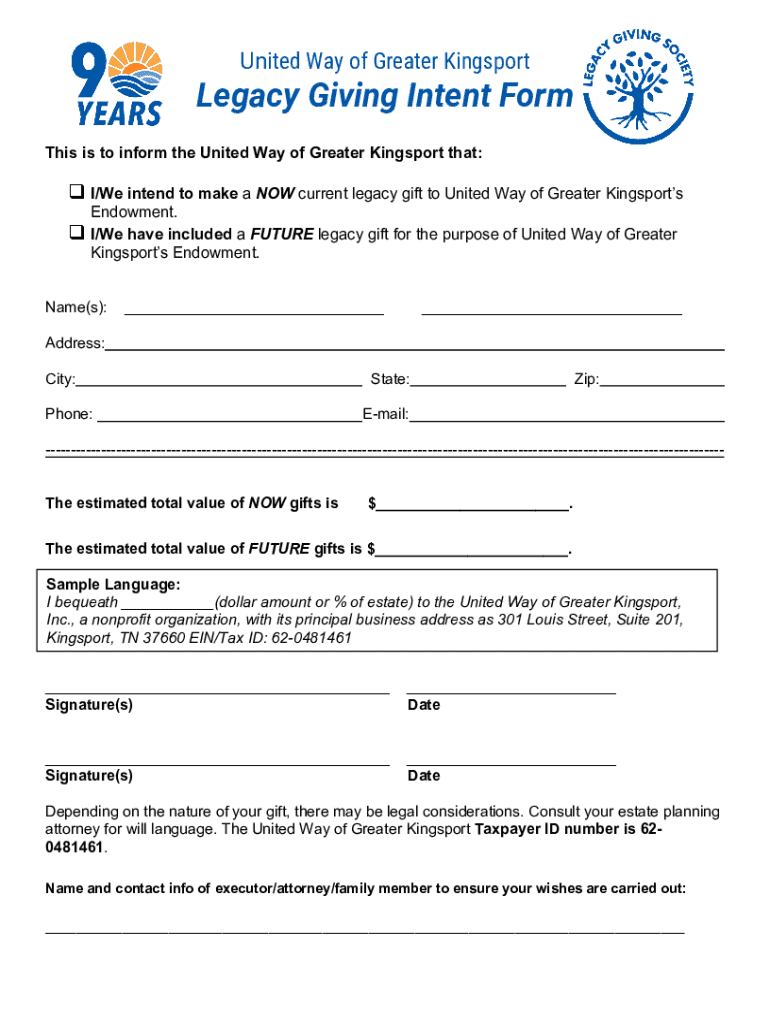

Navigating the legacy giving intent form

The legacy giving intent form is designed to be straightforward, with clear sections to guide donors through the process. Understanding the layout can help streamline the filling-out process and ensure that all necessary information is provided.

Key sections of the form typically include areas for personal information, gift details, and specific designations for the funds. These elements are critical in communicating exactly how the donor wishes their contribution to be managed.

Step-by-step instructions for filling out the form

Filling out the legacy giving intent form can seem daunting. However, following a structured approach takes away the guesswork and simplifies the process significantly. Here’s a detailed, step-by-step guide to assist you.

Step 1: Provide personal information

In this section, you'll need to provide basic personal details such as your full name, contact information, and address. Required fields must be filled out for the form to be processed, while optional fields allow you to add additional context.

Step 2: Select the type of gift

You can choose different forms of legacy gifts, including bequests, which are gifts made through a will, charitable gift annuities that provide income during your lifetime, or various types of trusts. Selecting the gift type allows you to tailor your contributions to meet your financial and philanthropic goals.

Step 3: Specify your intentions

This is where the heart of your legacy giving lies. Include a legacy statement that outlines your motivations and the impact you'd like your gift to have. Additionally, specifying a beneficiary is crucial to ensure that your chosen legacy aligns with your intentions.

Step 4: Additional information

Donors are often encouraged to provide insight into their motivations for giving and any additional context that can help the organization better understand their wishes. Sharing your story can create a more personalized connection between you and the organization.

Tips for completing the legacy giving intent form effectively

To ensure your legacy giving intent form is completed accurately and conveys your wishes effectively, consider the following tips. Accuracy is paramount; double-check all entries for typos or omissions that could lead to misunderstandings down the line.

Additionally, common mistakes such as providing outdated contact information or failing to specify a beneficiary can complicate the legacy giving process. Ensuring that all details and designations are clearly outlined can save time and effort in the future.

After submission: what happens next?

Once you've submitted your legacy giving intent form, the organization will begin processing it. This step usually includes verifying the details and ensuring all necessary documentation is in order to fulfill your intentions.

Most organizations will confirm receipt of your form and may follow up with additional questions to clarify your intentions. Staying engaged with the organization can help ensure that any changes you might want to make in the future are accommodated.

Frequently asked questions (FAQs)

Legacy giving can raise various questions among potential donors. Some common inquiries include how to begin the process, what types of gifts can be made, and the impact of legacy giving on one’s financial status. Clarifying these concerns can enhance understanding and motivate individuals to contribute.

FAQs specific to the intent form

Donors may also have questions specific to the legacy giving intent form. For instance, how personal information is handled, what types of gifts are acceptable, or the process for updating intentions after the form has been submitted. Providing clear and concise answers can alleviate concerns and encourage participation.

Personalizing your legacy giving experience

Every legacy gift tells a unique story. You can personalize your legacy giving experience by detailing how your contributions will make an impact. Engaging with organizations on tailored projects allows you to connect deeply with the cause you support.

Many legacy donors find fulfillment in sharing their stories. By participating in community events or writing about their motivations, they inspire others to consider similar generosity. It creates a tapestry of shared values that strengthens community bonds.

Engaging with our organization

Staying informed about legacy giving initiatives is vital for ongoing donor engagement. Organizations often send newsletters or updates about the impact of gifts, future plans, and current projects. This keeps donors connected and can provide new motivation for future giving.

If you want more personalized engagement, many organizations invite donors to share their legacy stories or participate in focus groups to discuss future initiatives. Opportunities for interaction can deepen your relationship with the community and enhance your giving experience.

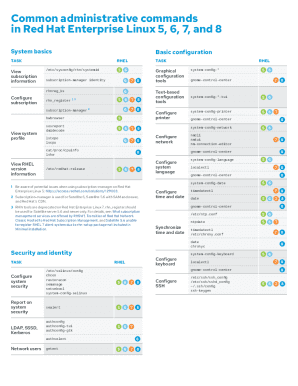

Tools and resources for legacy giving

For those looking to dive deeper into legacy giving, numerous resources are available. Online tools and documents can help streamline the process from understanding the impact of legacy giving to filling out the legacy giving intent form.

Utilizing platforms like pdfFiller can enhance your experience, providing digital tools to fill, edit, and manage documents seamlessly. Its capabilities align perfectly with ensuring your legacy intentions are documented and communicated without hassle.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get legacy giving intent form?

Can I sign the legacy giving intent form electronically in Chrome?

Can I create an electronic signature for signing my legacy giving intent form in Gmail?

What is legacy giving intent form?

Who is required to file legacy giving intent form?

How to fill out legacy giving intent form?

What is the purpose of legacy giving intent form?

What information must be reported on legacy giving intent form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.