Get the free Campaign Finance Receipts & Expenditures Report

Get, Create, Make and Sign campaign finance receipts expenditures

How to edit campaign finance receipts expenditures online

Uncompromising security for your PDF editing and eSignature needs

How to fill out campaign finance receipts expenditures

How to fill out campaign finance receipts expenditures

Who needs campaign finance receipts expenditures?

A comprehensive guide to campaign finance receipts expenditures form

Understanding campaign finance forms

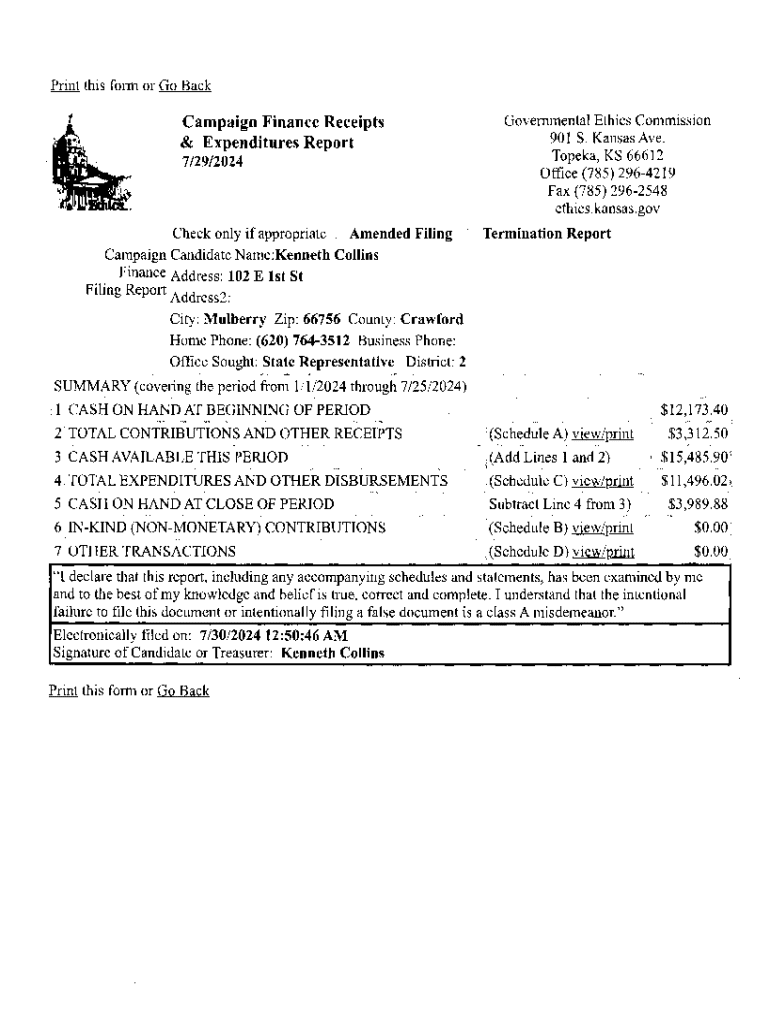

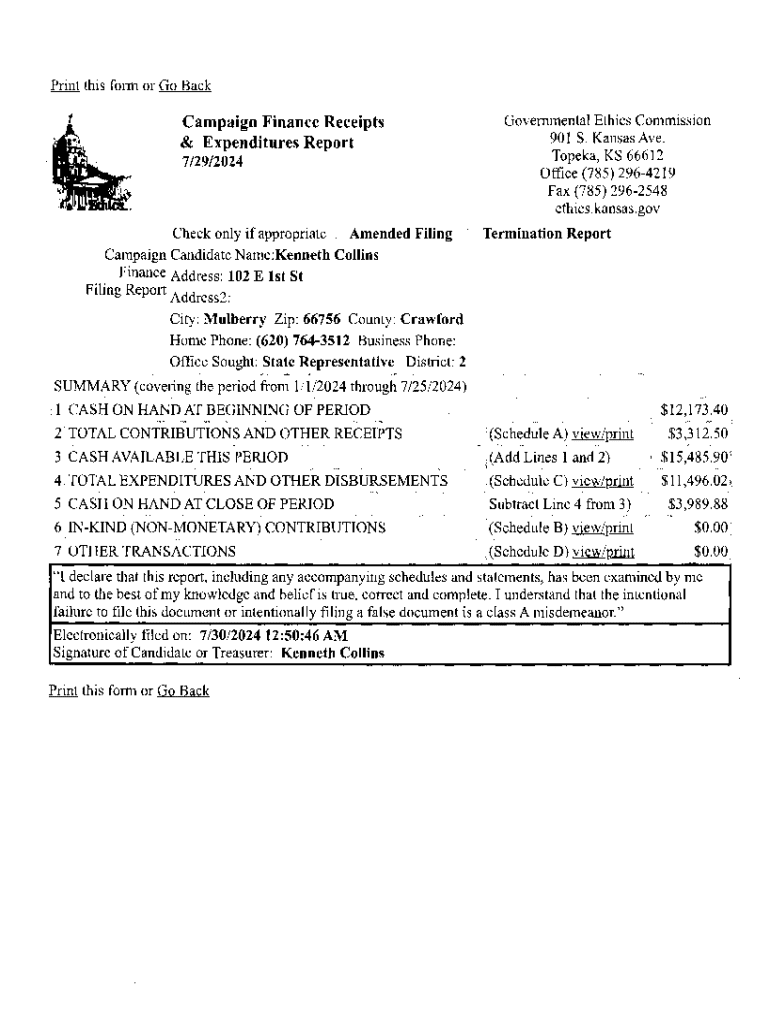

Campaign finance receipts expenditures forms are crucial documents used by political candidates and committees to report contributions (receipts) and their expenditures. These forms help ensure transparency in political funding, allowing both the public and regulatory bodies to track where money is coming from and how it is being spent. By keeping accurate records through these forms, candidates can maintain compliance with legal obligations, thereby fostering trust and accountability in the electoral process.

The significance of these forms extends beyond mere compliance; they embody the spirit of democratic engagement. Politicians relying on funding from donors are accountable to the electorate, making it imperative to disclose financial transactions. This openness helps to mitigate corruption and allows voters to make informed decisions based on the relationships candidates have with financial contributors.

Key terminology

Understanding key terms associated with campaign finance can simplify the process of completing these forms. Here’s a quick glossary:

Components of the campaign finance receipts expenditures form

The campaign finance receipts expenditures form breaks down into two main sections: receipts and expenditures. Each component serves a unique purpose but is essential for a comprehensive view of a campaign's financial landscape.

Receipt section

The receipt section focuses on documenting all contributions received. This includes direct monetary donations, loans, and in-kind contributions, which can encompass anything from free advertising to furnished office space. Accurately reporting these contributions is paramount because they provide insights into the campaign's funding sources.

Monetary donations should be recorded with the following details: donor's name, address, occupation, employer, and the amount contributed. For in-kind donations, it’s essential to provide a description of the service or item, along with its fair market value, to ensure proper valuation in reporting.

Expenditure section

The expenditure section outlines how the campaign spends its funds. This section should classify expenses into different categories like advertising, event hosting, payroll, and administrative costs. Each category needs detailed documentation to comply with regulations and to maintain financial integrity.

When reporting expenditures, it is crucial to include the date of the expense, a brief description, and the amount spent. Gathering receipts and invoices related to each expenditure can support your records and help prevent discrepancies during audits.

Step-by-step guide to completing the form

Filling out the campaign finance receipts expenditures form may seem overwhelming at first, but breaking it down into manageable steps can simplify the process significantly.

Gathering necessary information

Before starting the form, compile the necessary documentation. This includes detailed lists of all donors, invoices for expenditures, and any receipts from in-kind contributions. Organizing this information beforehand can speed up the completion process and reduce mistakes.

Filling out the receipt section

When filling out the receipt section, pay close attention to each field. Common pitfalls include incomplete donor information and inaccuracies in reported amounts. Use a checklist to ensure all required fields are filled correctly before submission.

Filling out the expenditure section

For the expenditure section, categorize expenses accurately and provide specific details for each entry. Example entries can help clarify the type of information required, such as: 'Radio Ad – XYZ Radio Station – $500'. Providing clear examples will also make it easier to review your expenses before submitting the form.

Key regulations and compliance requirements

Compliance with campaign finance regulations is non-negotiable for candidates and political committees. Understanding these regulations is crucial for accurately completing campaign finance receipts expenditures forms. The rules governing these forms can vary significantly between federal and state levels.

Federal and state regulations

At the federal level, the Federal Election Commission (FEC) regulates campaign finance, imposing strict limits on individual contributions and requiring comprehensive reporting. State regulations, however, can differ widely in terms of contribution limits, reporting frequency, and disclosure requirements. Researching your specific state regulations is crucial to ensure compliance.

Reporting deadlines

Campaigns typically have specific deadlines for submitting their campaign finance receipts expenditures forms. Failing to meet these deadlines can result in fines or other penalties, which can harm both the candidate’s financial standing and public image. Mark your calendar with these important dates to avoid last-minute scrambling and ensure timely submissions.

Managing campaign finance documentation

Effective management of campaign finance documentation is vital not only for transparency but also for logistical efficiency during campaign operations. Maintaining organized records can simplify compliance and make any future audits significantly easier.

Tips for organizing financial records

Consider creating a structured filing system both digitally and physically. Here are some suggested methods:

Whether opting for physical or digital filing, ensure that everything is accessible and up-to-date, especially before major reporting deadlines.

Utilizing pdfFiller for document management

pdfFiller provides an effective platform for managing your campaign finance receipts expenditures forms. With its user-friendly features, users can upload, edit, and esign documents seamlessly. This eliminates the hassle of manual signatures and helps manage document versions effectively.

By leveraging pdfFiller, campaign teams can ensure that all contributors have access to the necessary documents while maintaining a clear audit trail.

Frequently asked questions (FAQs)

When filling out campaign finance receipts expenditures forms, many individuals encounter common queries. Understanding these issues can streamline your process.

Common queries about campaign finance forms

One significant concern revolves around what constitutes a legitimate contribution. Many candidates wonder if they must report smaller contributions or donations made from friends and family. The short answer is that all contributions exceeding your state’s reporting threshold need to be documented. Consulting your state’s campaign finance law is advisable for clarity.

Troubleshooting issues

Common errors during the filing process can include neglecting to disclose in-kind donations or miscalculating total contributions. To rectify such issues, double-check all entries against your supporting documentation. If problems persist, numerous resources are available online, including state election offices or compliance specialists.

Interactive tools for campaign finance management

Utilizing interactive tools can make it much easier to manage campaign finance documentation. When technology is integrated effectively into your data management practices, it helps streamline processes and reduce human error.

Tools provided by pdfFiller

pdfFiller offers a suite of interactive forms and templates tailored for campaign finance management. These templates ensure consistency and accuracy across your reporting, providing built-in calculations for totals to eliminate manual errors.

Best practices for collaborative document management

Collaboration is vital when managing campaign finances, especially in larger teams. Strategies for effective collaboration include:

Implementing these best practices not only enhances efficiency but also improves compliance by reducing the potential for errors that may arise from miscommunication.

Staying updated with campaign finance changes

Staying informed about changes in campaign finance regulations is imperative for candidates. Campaign finance laws are subject to change, and failing to adapt could lead to compliance issues and fines.

Monitoring legislative changes

Numerous resources exist for tracking updates in campaign finance law. Websites of election commissions often provide a wealth of recent changes and amendments. Utilizing tools like email alerts from state election offices can further enhance your awareness.

Adapting to new requirements

When new regulations come into effect, adjusting your internal processes is essential for compliance. This may involve additional training for staff, revising documentation practices, and utilizing updated forms through platforms like pdfFiller to ensure that all reporting meets current standards.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete campaign finance receipts expenditures online?

How do I edit campaign finance receipts expenditures online?

How do I edit campaign finance receipts expenditures straight from my smartphone?

What is campaign finance receipts expenditures?

Who is required to file campaign finance receipts expenditures?

How to fill out campaign finance receipts expenditures?

What is the purpose of campaign finance receipts expenditures?

What information must be reported on campaign finance receipts expenditures?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.