Get the free Form N-csrs

Get, Create, Make and Sign form n-csrs

How to edit form n-csrs online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form n-csrs

How to fill out form n-csrs

Who needs form n-csrs?

Understanding Form N-CSRS: A Comprehensive Guide

Understanding Form N-CSRS: A Comprehensive Overview

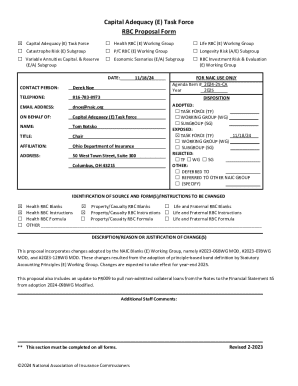

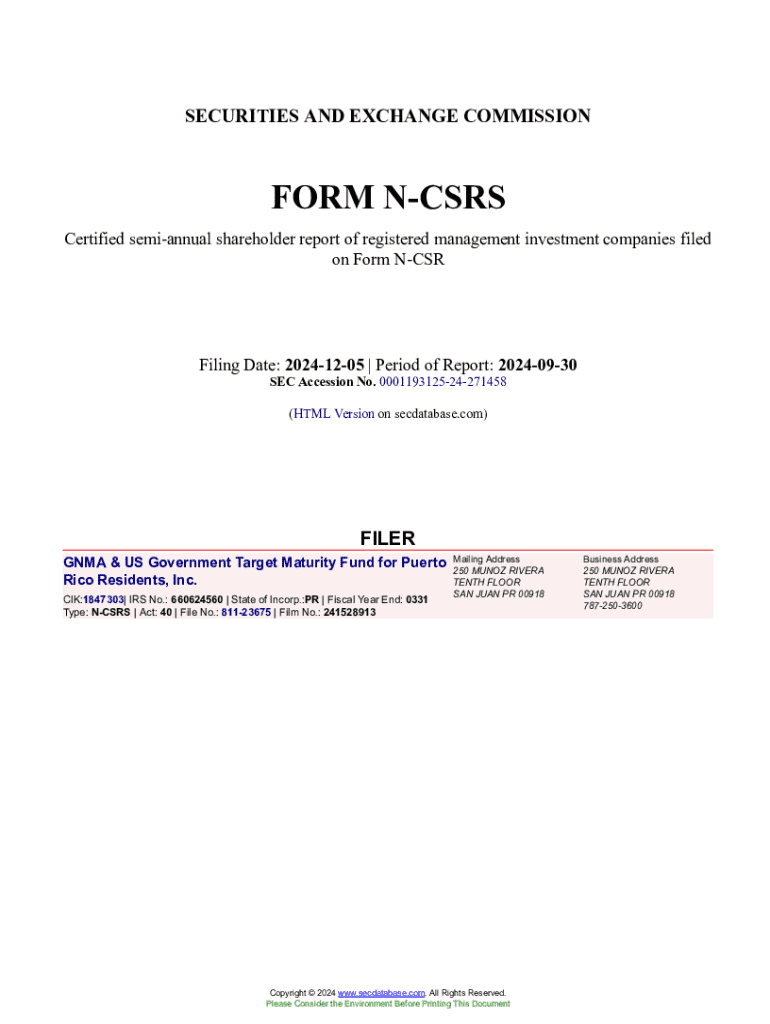

Form N-CSRS is a crucial document for mutual funds and investment companies in the United States. It encompasses essential disclosures related to the operational and financial status of registered management investment companies. The key purpose of Form N-CSRS is to provide investors with vital information regarding mutual fund operations, ensuring transparency and accountability in the investment landscape.

One of the primary functions of Form N-CSRS is to report annual disclosures, offering insights into the fund's performance, fees, and governance structure. Its compliance is vital in fostering investor confidence and upholding the integrity of investment markets.

The legal framework surrounding Form N-CSRS

Form N-CSRS is governed by a robust regulatory framework that involves several key bodies, primarily the U.S. Securities and Exchange Commission (SEC). The legal requirements governing this form arose from the Investment Company Act, which mandates transparency in financial reporting. Compliance is not optional, as it ensures that companies meet established guidelines and keep shareholders informed.

Failure to comply with Form N-CSRS regulations can lead to severe implications, such as fines, penalties, or even revocation of registration. Moreover, inaccurate reporting can mislead investors, impacting their decisions and exposing the firm to legal liabilities. Understanding the timeline for compliance, including deadlines for submission, is critical for avoiding these risks.

Filling out Form N-CSRS: Step-by-Step Instructions

Before beginning the process of filling out Form N-CSRS, it’s essential to gather all required documents and information, which include financial statements and company identification details. Establishing a pdfFiller account can substantially simplify the editing and management of the form, making it readily accessible from anywhere.

Completing Form N-CSRS involves several key sections. Starting with Section A, you will need to provide basic company information such as the name, address, and contact details. Section B focuses on financial disclosures, including performance data and fee structures. Section C is dedicated to shareholder communications, ensuring that investors receive timely updates, whereas Section D covers reports and various performance metrics essential for investor evaluation.

Editing and managing your Form N-CSRS

pdfFiller provides powerful tools for managing your Form N-CSRS. With interactive tools, you can easily edit forms, add annotations, and rectify any inaccuracies without hassle. Features like importing, merging, and exporting documents are designed to ensure that all files related to your submission are well-organized and easily accessible.

The collaboration features of pdfFiller allow team members to review and edit documents collectively. By inviting colleagues to comment and make changes, you streamline the review process and minimize the risk of errors. Tracking changes is essential for maintaining versions and ensuring that every modification is accounted for.

eSigning your Form N-CSRS

eSigning your Form N-CSRS is a critical step in the filing process. Within pdfFiller, creating an eSignature is straightforward and can be done in a few clicks. Validating your signature is equally important, as it confirms that the form meets legal standards for compliance. This step not only streamlines the submission process but also ensures that your filing will not face delays due to signature-related discrepancies.

Legal implications of having a signed document are substantial; unsigned forms may lead to regulatory issues and delay the acceptance of your submission. Leveraging the convenience of eSigning through pdfFiller can help maintain compliance and ensure that your documents are processed efficiently.

Submission process: What to do once your form is ready

Once your Form N-CSRS is complete and eSigned, the next step is submission. It’s vital to ensure that you know where and how to submit your completed form. Typically, this will involve electronic submission through the SEC's EDGAR system, and you may be required to include additional documentation, such as an index of the submitted information.

After submission, tracking its progress is essential. You can confirm receipt through the SEC portal, and it might be beneficial to monitor for any communications regarding potential follow-up requirements or requests for additional information.

Resources for further assistance

Navigating the complexities of Form N-CSRS and ensuring compliance can be challenging. pdfFiller’s support services are available to assist with any document-related queries. Whether you have questions regarding the fulfillment of specific requirements or about utilizing the platform’s extensive toolset, reaching out to customer support can provide clarity.

In addition, accessing the EDGAR knowledge base can enhance your understanding of regulatory compliance. This resource offers updated information regarding SEC guidelines, best practices, and educational links relevant to filing requirements, providing a valuable asset for mutual funds and investment companies.

Related forms and solutions by pdfFiller

Form N-CSRS is part of a greater framework of essential forms required by mutual funds and investment companies. Understanding how it relates to other crucial forms, such as N-CSR, is vital for compliance and reporting. This knowledge allows companies to see the bigger picture of their reporting obligations and how various forms interconnect.

Beyond just Form N-CSRS, pdfFiller offers additional integrated solutions designed for document management in financial services. These solutions include custom forms, automation packages, and collaborative tools tailored to the specific needs of investment entities, enhancing efficiency and accuracy in form management.

Key takeaways and final thoughts

Successfully managing Form N-CSRS involves understanding its complexities and leveraging the right tools for effective completion and submission. Best practices include thorough preparation, careful review of each section, and maintaining clear communication with team members involved in the process.

By utilizing pdfFiller’s comprehensive platform, you enhance efficiency in document management, making the overall process of preparing, editing, and submitting Form N-CSRS as seamless and compliant as possible. As compliance standards evolve, staying informed and using the right resources will become increasingly essential in the investment landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form n-csrs without leaving Google Drive?

How can I send form n-csrs to be eSigned by others?

How do I execute form n-csrs online?

What is form n-csrs?

Who is required to file form n-csrs?

How to fill out form n-csrs?

What is the purpose of form n-csrs?

What information must be reported on form n-csrs?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.