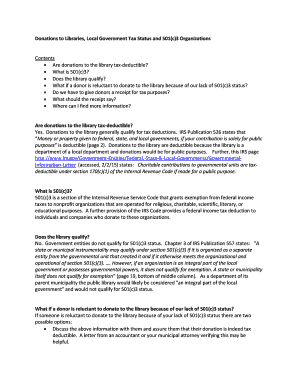

Get the free 990

Get, Create, Make and Sign 990

Editing 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 990

How to fill out 990

Who needs 990?

Comprehensive Guide to Completing the 990 Form

Understanding Form 990

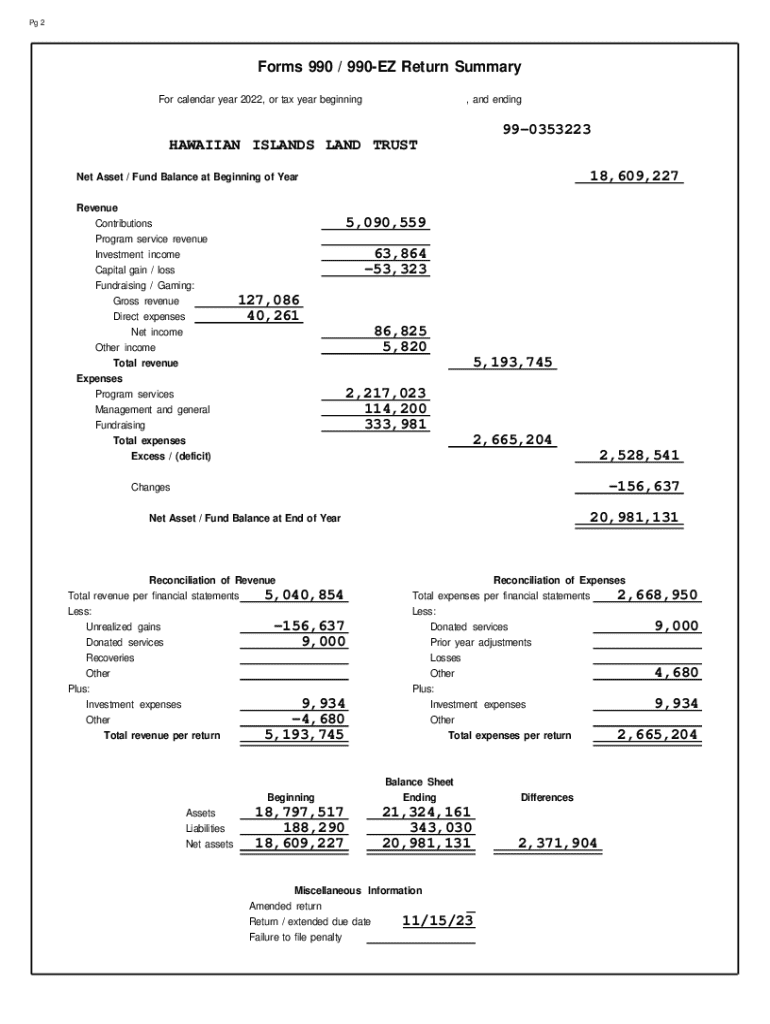

Form 990 serves as the annual reporting return for tax-exempt organizations in the United States. Its primary purpose is to provide the IRS and the public with a clear view of an organization’s financial activities, governance, and compliance with tax requirements. Nonprofits rely on this form not only to maintain their tax-exempt status but also to demonstrate transparency and accountability to donors and stakeholders.

The importance of Form 990 cannot be overstated; it serves as a crucial tool for fundraising, allowing organizations to showcase their impact and financial health to potential donors. Historically, this form has evolved to include broader reporting requirements and greater detail about nonprofits’ activities and finances, helping to create a transparent environment.

Key components of Form 990

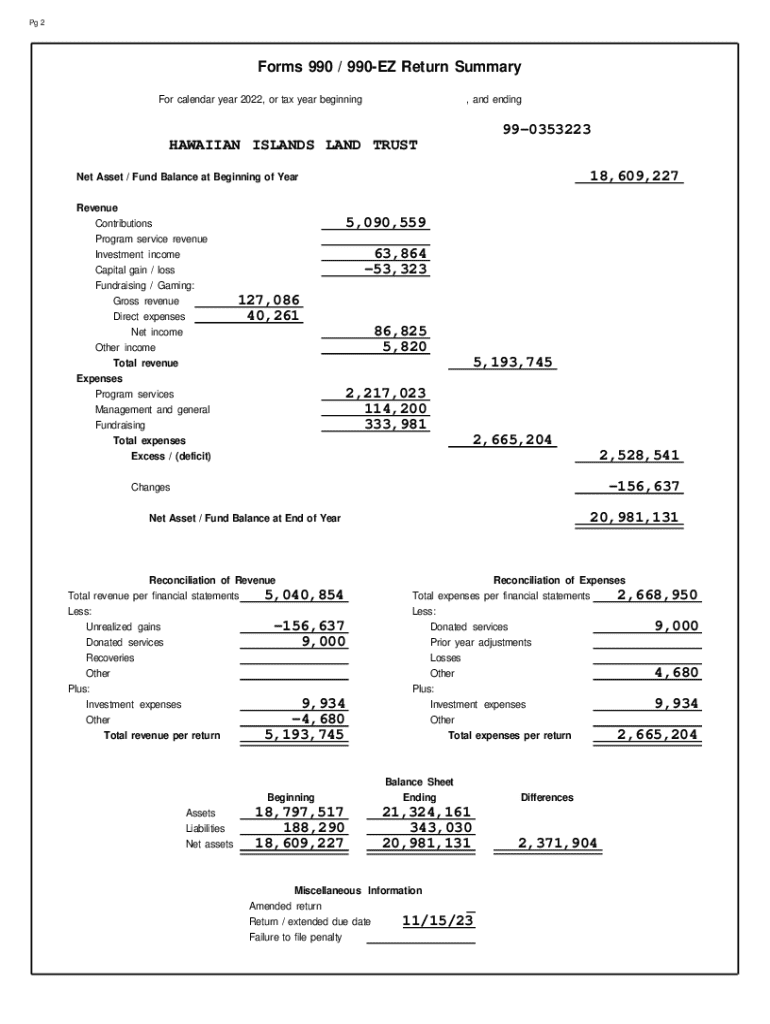

Understanding the structure of Form 990 is essential for accurate completion. The form is divided into several sections, including the Summary, which provides a snapshot of essential information, and Governance, which outlines the organization’s board and leadership practices. Financial statements reveal income, expenses, and assets, while specific schedules offer detailed insights into contributions, lobbying activities, and more.

The important schedules, such as Schedule A, B, and C, each serve distinct purposes that organizations must carefully consider. For example, Schedule A assesses a nonprofit’s public charity status, focusing on its public support, and Schedule B lists significant contributors, which fosters donor transparency and trust.

Filing requirements

Nonprofits must understand who is required to file Form 990. Generally, organizations that are tax-exempt and meet certain income thresholds must file annually. Specifically, any organization with gross receipts over $50,000 is required to submit some version of Form 990, while those with under that amount can file the simpler 990-N. Furthermore, the filing requirements can also be affected by the type of organization, such as whether it is a public charity or a private foundation.

Filing deadlines typically fall on the 15th day of the 5th month after the organization’s fiscal year ends. For example, if the fiscal year ends on December 31, the form is due on May 15 of the following year. Extensions can be requested using Form 8868, but organizations must keep in mind that simply filing an extension does not extend the time for payment of any tax liability.

Completing the Form 990

Completing Form 990 requires meticulous attention to detail. A section-by-section approach can streamline the process. Start with the Summary section, which sets the stage by providing a broad overview of the organization’s mission, programs, and financial information. From there, navigate through the Governance section to detail leadership roles and board meeting records.

Special care should be taken with financial entries; these figures must reflect the organization’s actual income and expenses. Common mistakes include misreporting income, failing to include all required schedules, or neglecting to provide details about governance. Regularly reviewing a checklist of frequent errors can help organizations minimize mistakes.

Digital tools for efficient filing

Utilizing modern technology can greatly simplify the process of completing Form 990. Platforms like pdfFiller provide an easy-to-use interface for editing PDFs, eSigning documents, and collaborating among team members. This cloud-based solution allows for real-time updates and reduces the likelihood of errors, as all versions of the document are stored securely online.

Collaborative features enable teams to work together efficiently, making it easy to share comments and revisions. Moreover, document management features help in keeping filed forms organized, ensuring that users can revisit previous years’ filings quickly and easily.

Understanding compliance and penalties

Understanding compliance is vital for avoiding penalties associated with Form 990. If an organization files late or submits incorrect information, the IRS may impose financial penalties. For instance, organizations that fail to file altogether for three consecutive years risk automatic revocation of their tax-exempt status, which can have severe implications.

Furthermore, Form 990s are publicly accessible, promoting transparency and lawful practice. Members of the public, including potential donors, can inspect these forms, so maintaining accuracy is essential for upholding an organization’s reputation.

Analyzing Form 990 data

Form 990 serves as a rich information source for evaluating nonprofit organizations. Stakeholders can leverage data from the form to assess the financial stability, program effectiveness, and governance practices of charities. For instance, potential donors often review Form 990 filings to inform their giving decisions.

Additionally, annual IRS data aggregations provide insights into overall sector trends, revealing how nonprofits manage finances, solicitation strategies, and operational practices. Proper analysis of this data can help inform best practices within the nonprofit sector.

Recommendations for specialized assistance

For nonprofits, navigating the complexities of Form 990 can sometimes necessitate bringing in a nonprofit tax professional. Recognizing when expert assistance is needed is crucial; organizations may face intricate financial situations, reporting requirements, or unique circumstances affecting their filings.

When selecting a Consultant, organizations should consider factors such as experience in nonprofit tax law, familiarity with the specific industry, and capability to provide ongoing support. Individuals and teams can ensure they find a qualified professional who can meet their specific needs.

Additional support and resources

Accessing sample IRS Form 990s and templates can greatly aid organizations in understanding the expectations and structure of the form. Websites often provide downloadable resources, showcasing previous filings which can serve as invaluable guides.

In addition, various third-party organizations offer support, either through consultations, workshops, or informational resources. These platforms can help nonprofits understand not only how to fill out Form 990 but also why each component is important for their overall compliance and reputation.

Preparing for future filings

Maintaining accurate records throughout the year can significantly ease the filing process for Form 990. Regular tracking of financial activities, including revenues and expenses, will provide reliable data to report during the annual filing. It’s crucial for organizations to stay organized and proactive, preventing the last-minute rush that can often lead to errors.

Additionally, organizing donor information is essential to ensure accuracy in reporting. Establishing a systematic approach to documentation can streamline the process of collecting and verifying contributions. Setting up an annual filing calendar can aid nonprofits in anticipating deadlines, thus facilitating timely submissions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the 990 electronically in Chrome?

How do I fill out 990 using my mobile device?

How do I complete 990 on an Android device?

What is 990?

Who is required to file 990?

How to fill out 990?

What is the purpose of 990?

What information must be reported on 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.